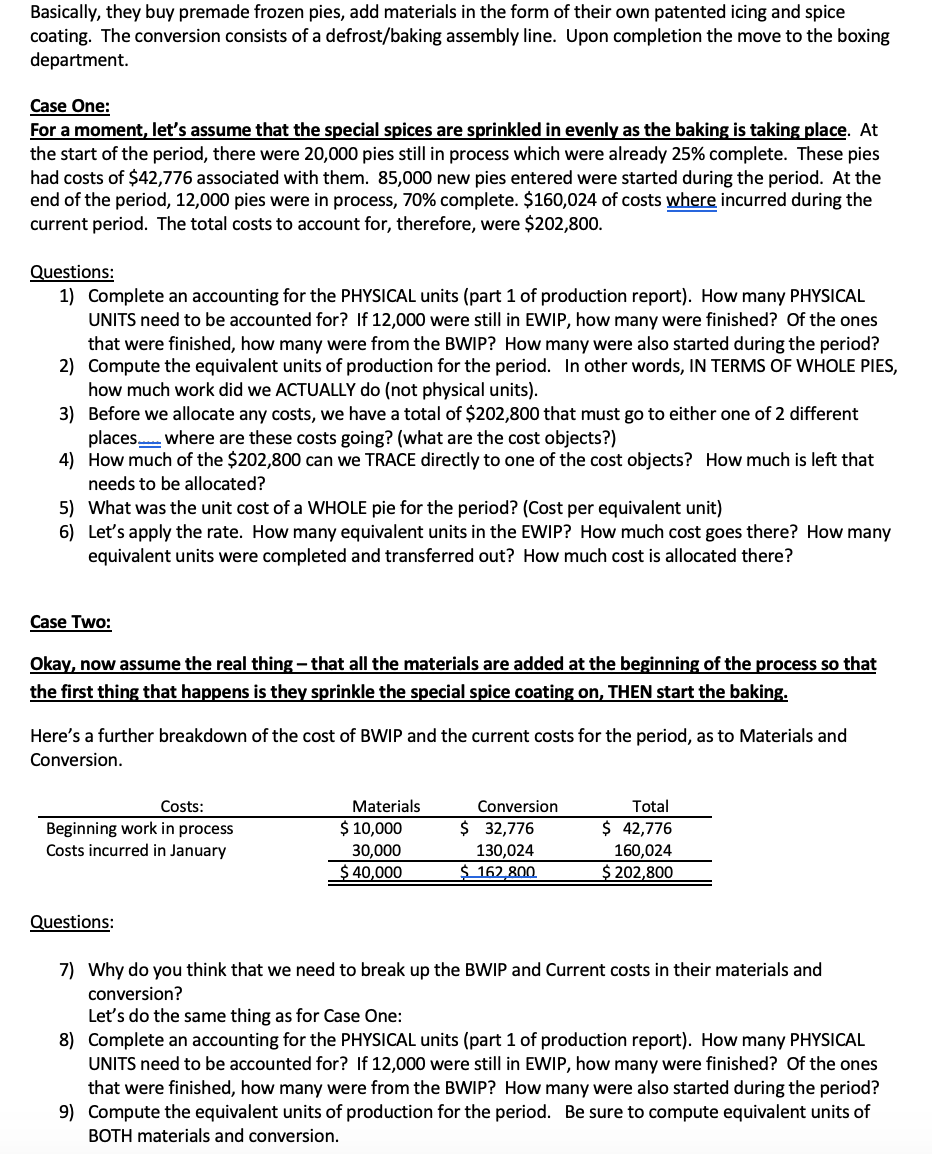

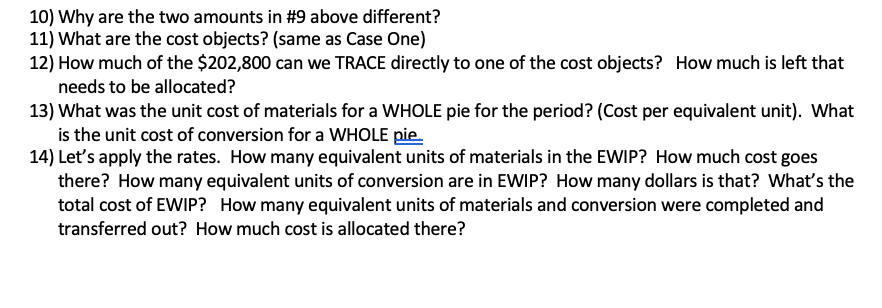

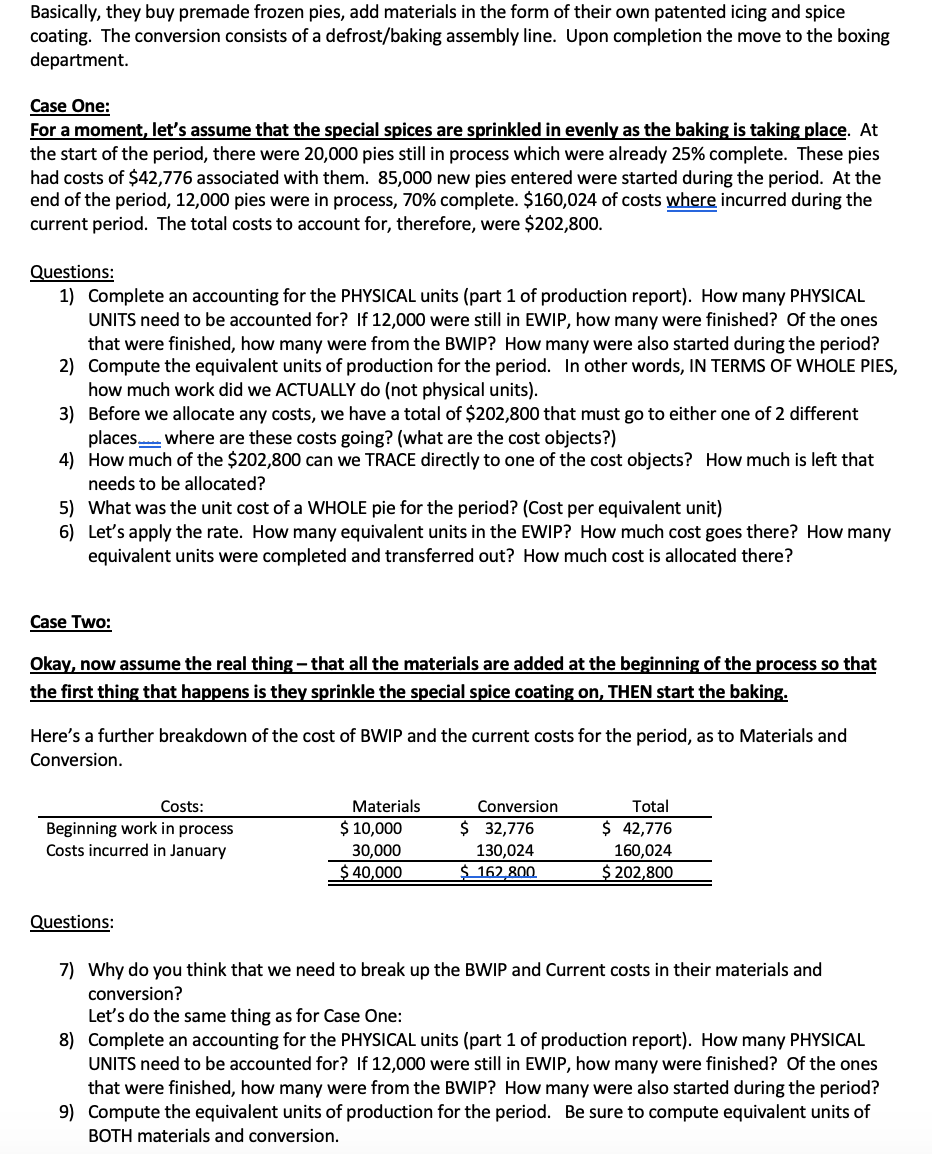

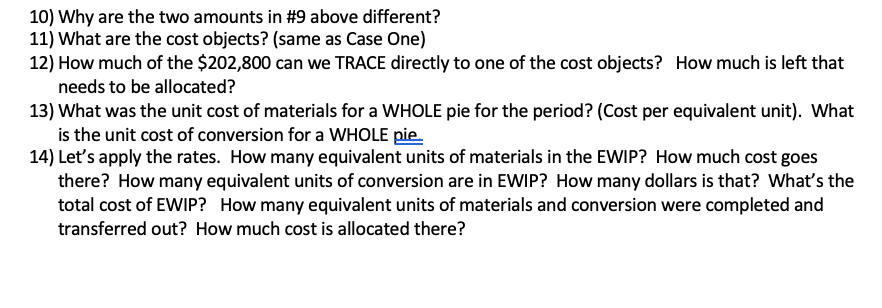

Basically, they buy premade frozen pies, add materials in the form of their own patented icing and spice coating. The conversion consists of a defrost/baking assembly line. Upon completion the move to the boxing department. Case One: For a moment, let's assume that the special spices are sprinkled in evenly as the baking is taking place. At the start of the period, there were 20,000 pies still in process which were already 25% complete. These pies had costs of $42,776 associated with them. 85,000 new pies entered were started during the period. At the end of the period, 12,000 pies were in process, 70% complete. $160,024 of costs where incurred during the current period. The total costs to account for, therefore, were $202,800. Questions: 1) Complete an accounting for the PHYSICAL units (part 1 of production report). How many PHYSICAL UNITS need to be accounted for? If 12,000 were still in EWIP, how many were finished? Of the ones that were finished, how many were from the BWIP? How many were also started during the period? 2) Compute the equivalent units of production for the period. In other words, IN TERMS OF WHOLE PIES, how much work did we ACTUALLY do (not physical units). 3) Before we allocate any costs, we have a total of $202,800 that must go to either one of 2 different places...where are these costs going? (what are the cost objects?) 4) How much of the $202,800 can we TRACE directly to one of the cost objects? How much is left that needs to be allocated? 5) What was the unit cost of a WHOLE pie for the period? (Cost per equivalent unit) 6) Let's apply the rate. How many equivalent units in the EWIP? How much cost goes there? How many equivalent units were completed and transferred out? How much cost is allocated there? Case Two: Okay, now assume the real thing - that all the materials are added at the beginning of the process so that the first thing that happens is they sprinkle the special spice coating on, THEN start the baking. Here's a further breakdown of the cost of BWIP and the current costs for the period, as to Materials and Conversion. Costs: Beginning work in process Costs incurred in January Materials $ 10,000 30,000 $ 40,000 Conversion $ 32,776 130,024 $ 162,800 Total $ 42,776 160,024 $ 202,800 Questions: 7) Why do you think that we need to break up the BWIP and Current costs in their materials and conversion? Let's do the same thing as for Case One: 8) Complete an accounting for the PHYSICAL units (part 1 of production report). How many PHYSICAL UNITS need to be accounted for? If 12,000 were still in EWIP, how many were finished? Of the ones that were finished, how many were from the BWIP? How many were also started during the period? 9) Compute the equivalent units of production for the period. Be sure to compute equivalent units of BOTH materials and conversion. 10) Why are the two amounts in #9 above different? 11) What are the cost objects? (same as Case One) 12) How much of the $202,800 can we TRACE directly to one of the cost objects? How much is left that needs to be allocated? 13) What was the unit cost of materials for a WHOLE pie for the period? (Cost per equivalent unit). What is the unit cost of conversion for a WHOLE pie. 14) Let's apply the rates. How many equivalent units of materials in the EWIP? How much cost goes there? How many equivalent units of conversion are in EWIP? How many dollars is that? What's the total cost of EWIP? How many equivalent units of materials and conversion were completed and transferred out? How much cost is allocated there? Basically, they buy premade frozen pies, add materials in the form of their own patented icing and spice coating. The conversion consists of a defrost/baking assembly line. Upon completion the move to the boxing department. Case One: For a moment, let's assume that the special spices are sprinkled in evenly as the baking is taking place. At the start of the period, there were 20,000 pies still in process which were already 25% complete. These pies had costs of $42,776 associated with them. 85,000 new pies entered were started during the period. At the end of the period, 12,000 pies were in process, 70% complete. $160,024 of costs where incurred during the current period. The total costs to account for, therefore, were $202,800. Questions: 1) Complete an accounting for the PHYSICAL units (part 1 of production report). How many PHYSICAL UNITS need to be accounted for? If 12,000 were still in EWIP, how many were finished? Of the ones that were finished, how many were from the BWIP? How many were also started during the period? 2) Compute the equivalent units of production for the period. In other words, IN TERMS OF WHOLE PIES, how much work did we ACTUALLY do (not physical units). 3) Before we allocate any costs, we have a total of $202,800 that must go to either one of 2 different places...where are these costs going? (what are the cost objects?) 4) How much of the $202,800 can we TRACE directly to one of the cost objects? How much is left that needs to be allocated? 5) What was the unit cost of a WHOLE pie for the period? (Cost per equivalent unit) 6) Let's apply the rate. How many equivalent units in the EWIP? How much cost goes there? How many equivalent units were completed and transferred out? How much cost is allocated there? Case Two: Okay, now assume the real thing - that all the materials are added at the beginning of the process so that the first thing that happens is they sprinkle the special spice coating on, THEN start the baking. Here's a further breakdown of the cost of BWIP and the current costs for the period, as to Materials and Conversion. Costs: Beginning work in process Costs incurred in January Materials $ 10,000 30,000 $ 40,000 Conversion $ 32,776 130,024 $ 162,800 Total $ 42,776 160,024 $ 202,800 Questions: 7) Why do you think that we need to break up the BWIP and Current costs in their materials and conversion? Let's do the same thing as for Case One: 8) Complete an accounting for the PHYSICAL units (part 1 of production report). How many PHYSICAL UNITS need to be accounted for? If 12,000 were still in EWIP, how many were finished? Of the ones that were finished, how many were from the BWIP? How many were also started during the period? 9) Compute the equivalent units of production for the period. Be sure to compute equivalent units of BOTH materials and conversion. 10) Why are the two amounts in #9 above different? 11) What are the cost objects? (same as Case One) 12) How much of the $202,800 can we TRACE directly to one of the cost objects? How much is left that needs to be allocated? 13) What was the unit cost of materials for a WHOLE pie for the period? (Cost per equivalent unit). What is the unit cost of conversion for a WHOLE pie. 14) Let's apply the rates. How many equivalent units of materials in the EWIP? How much cost goes there? How many equivalent units of conversion are in EWIP? How many dollars is that? What's the total cost of EWIP? How many equivalent units of materials and conversion were completed and transferred out? How much cost is allocated there