Answered step by step

Verified Expert Solution

Question

1 Approved Answer

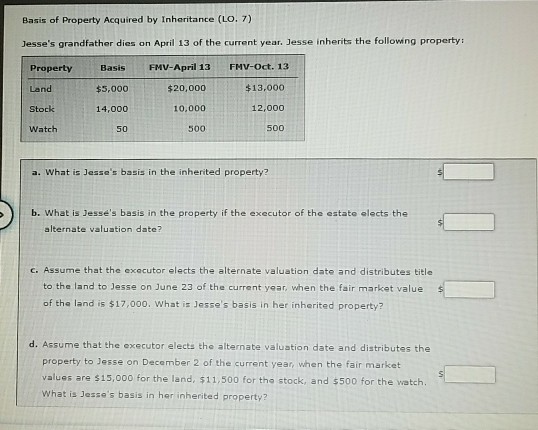

Basis of Property Acquired by Inheritance (LO. 7) Jesse's grandfather dies on April 13 of the current year. Jesse inherits the followng property: Basis FMV-April

Basis of Property Acquired by Inheritance (LO. 7) Jesse's grandfather dies on April 13 of the current year. Jesse inherits the followng property: Basis FMV-April 13 FMV-Oct. 13 Property Land Stock Watch $5,000 14,000 50 $20,000 10.000 500 $13.000 12,000 500 a. What is Jesse's basis in the inherited property? b. What is Jesse's basis in the property if the executor of the estate elects the alternate valuation date? c. Assume that the exacutor elects the alternate valuation date and distributes title to the land to Jesse on June 23 of the current year, when the fair market value of the land is $17,000. What is Jesse's basis in her inherited property? d. Assume that the executor elects the alternate valuation date and distributes the property to Jesse on December 2 of the cu values are $15,000 for the land, $11,500 for the stock, and $500 for the watch. What is Jesse's basis in her inherited property? rrent year, when the fair market

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started