Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Basis period Advanced taxation B. Umart Sdn Bhd has been in retail business since 2000. The accounts were closed on 30 June annually. During board

Basis period Advanced taxation

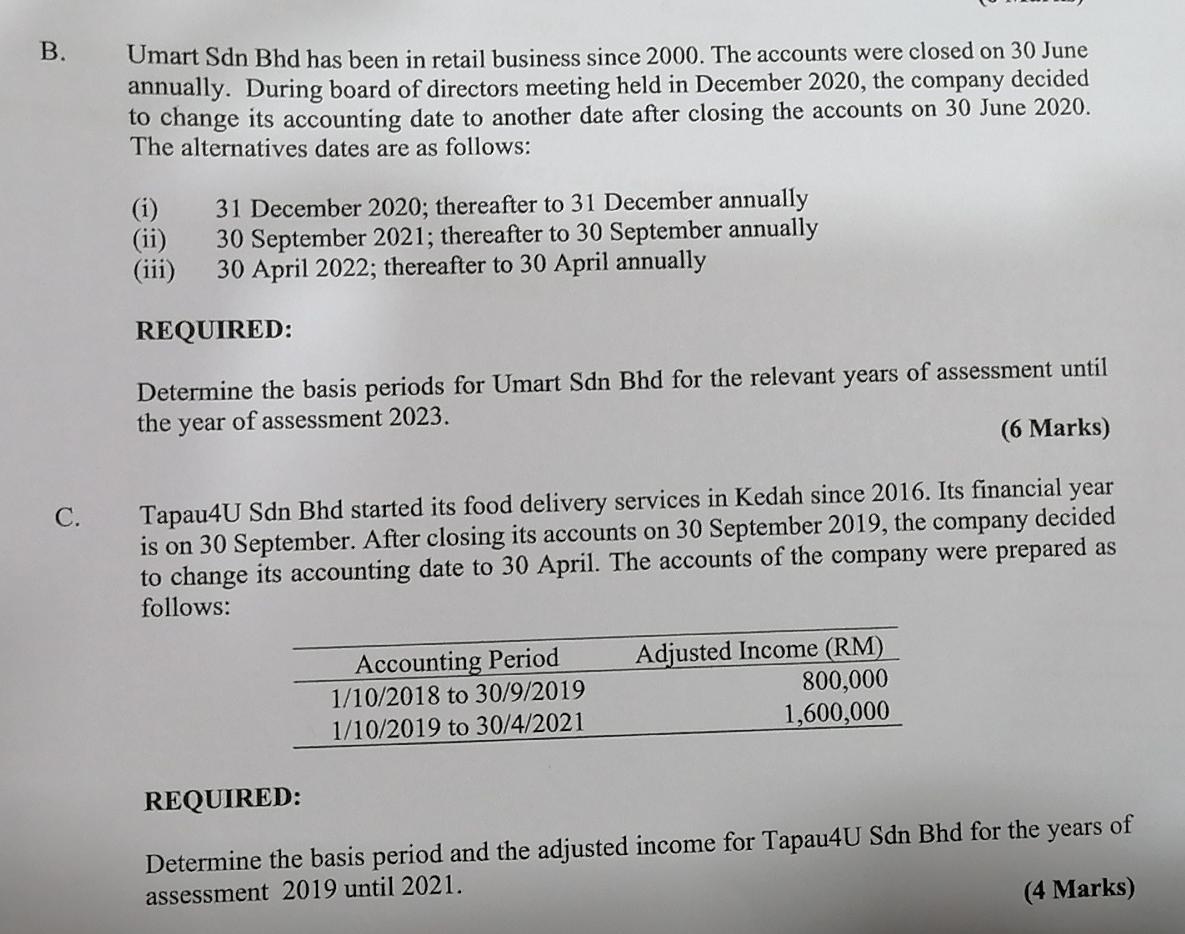

B. Umart Sdn Bhd has been in retail business since 2000. The accounts were closed on 30 June annually. During board of directors meeting held in December 2020, the company decided to change its accounting date to another date after closing the accounts on 30 June 2020. The alternatives dates are as follows: 31 December 2020; thereafter to 31 December annually 30 September 2021; thereafter to 30 September annually 30 April 2022; thereafter to 30 April annually (iii) REQUIRED: Determine the basis periods for Umart Sdn Bhd for the relevant years of assessment until the year of assessment 2023. (6 Marks) C. Tapau4U Sdn Bhd started its food delivery services in Kedah since 2016. Its financial year is on 30 September. After closing its accounts on 30 September 2019, the company decided to change its accounting date to 30 April. The accounts of the company were prepared as follows: Accounting Period 1/10/2018 to 30/9/2019 1/10/2019 to 30/4/2021 Adjusted Income (RM) 800,000 1,600,000 REQUIRED: Determine the basis period and the adjusted income for Tapau4U Sdn Bhd for the years of assessment 2019 until 2021. (4 Marks) B. Umart Sdn Bhd has been in retail business since 2000. The accounts were closed on 30 June annually. During board of directors meeting held in December 2020, the company decided to change its accounting date to another date after closing the accounts on 30 June 2020. The alternatives dates are as follows: 31 December 2020; thereafter to 31 December annually 30 September 2021; thereafter to 30 September annually 30 April 2022; thereafter to 30 April annually (iii) REQUIRED: Determine the basis periods for Umart Sdn Bhd for the relevant years of assessment until the year of assessment 2023. (6 Marks) C. Tapau4U Sdn Bhd started its food delivery services in Kedah since 2016. Its financial year is on 30 September. After closing its accounts on 30 September 2019, the company decided to change its accounting date to 30 April. The accounts of the company were prepared as follows: Accounting Period 1/10/2018 to 30/9/2019 1/10/2019 to 30/4/2021 Adjusted Income (RM) 800,000 1,600,000 REQUIRED: Determine the basis period and the adjusted income for Tapau4U Sdn Bhd for the years of assessment 2019 until 2021. (4 Marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started