Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Baton Rouge Inc., located in Germany is involved in the production of motor bikes and currently exports these products to India. The company must import

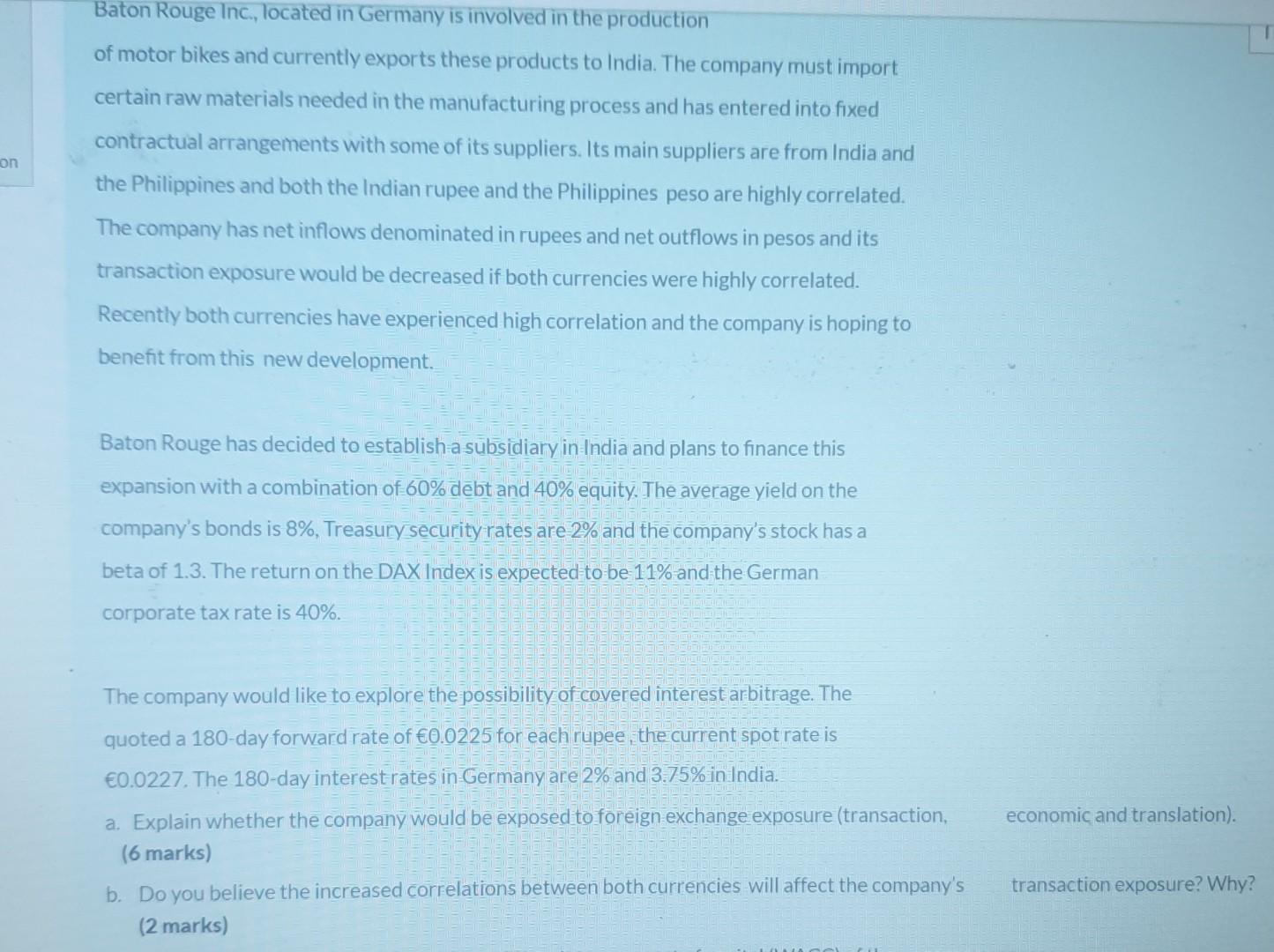

Baton Rouge Inc., located in Germany is involved in the production of motor bikes and currently exports these products to India. The company must import certain raw materials needed in the manufacturing process and has entered into fixed contractual arrangements with some of its suppliers. Its main suppliers are from India and the Philippines and both the Indian rupee and the Philippines peso are highly correlated. The company has net inflows denominated in rupees and net outflows in pesos and its transaction exposure would be decreased if both currencies were highly correlated. Recently both currencies have experienced high correlation and the company is hoping to benefit from this new development. Baton Rouge has decided to establisha sbsidiary in India and plans to finance this expansion with a combination of 60% debt and 40% equity. The average yield on the company's bonds is 8%, Treasury security rates are 2% and the company's stock has a beta of 1.3. The return on the DAX Index is expected to be 11% and the German corporate tax rate is 40%. The company would like to explore the possibility of covered interest arbitrage. The quoted a 180-day forward rate of 0.0225 for each rupee, the current spot rate is 0.0227. The 180-day interestrates in-Germany are 2% and 3.75% in India. a. Explain whether the company would be exposed to foreign exchange exposure (transaction, economic and translation). (6 marks) b. Do you believe the increased correlations between both currencies will affect the company's transaction exposure? Why? (2 marks) Baton Rouge Inc., located in Germany is involved in the production of motor bikes and currently exports these products to India. The company must import certain raw materials needed in the manufacturing process and has entered into fixed contractual arrangements with some of its suppliers. Its main suppliers are from India and the Philippines and both the Indian rupee and the Philippines peso are highly correlated. The company has net inflows denominated in rupees and net outflows in pesos and its transaction exposure would be decreased if both currencies were highly correlated. Recently both currencies have experienced high correlation and the company is hoping to benefit from this new development. Baton Rouge has decided to establisha sbsidiary in India and plans to finance this expansion with a combination of 60% debt and 40% equity. The average yield on the company's bonds is 8%, Treasury security rates are 2% and the company's stock has a beta of 1.3. The return on the DAX Index is expected to be 11% and the German corporate tax rate is 40%. The company would like to explore the possibility of covered interest arbitrage. The quoted a 180-day forward rate of 0.0225 for each rupee, the current spot rate is 0.0227. The 180-day interestrates in-Germany are 2% and 3.75% in India. a. Explain whether the company would be exposed to foreign exchange exposure (transaction, economic and translation). (6 marks) b. Do you believe the increased correlations between both currencies will affect the company's transaction exposure? Why? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started