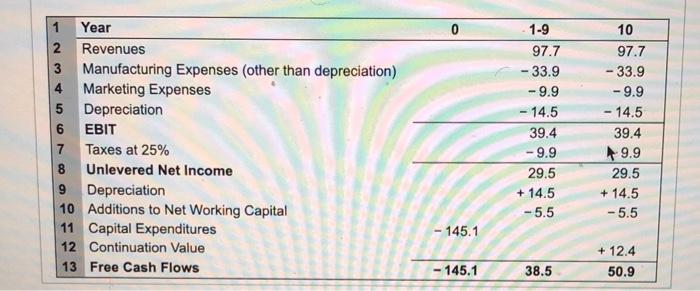

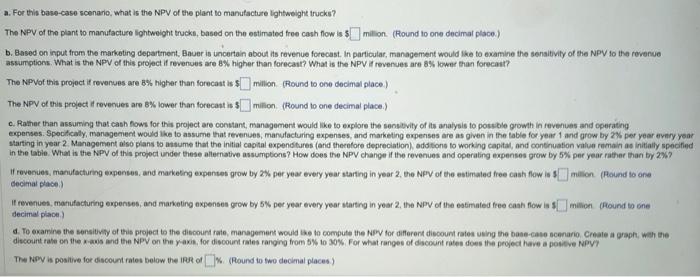

Baver industries is an astomobile manufacturer. Management is currently evaluating a proposal to buld a plant that will manutacture lightiseight trucks. Bsuer plans to use a cost of capieal of 12.1% to evaluate this project. Based on exiensive research, it has propared the incremental treo cash flow projections ahown in the following table (h milions of dollars): a. For this base-case scenano, what is the NPV of the plant to manutacture lightweight trucks? b. Based on input trom the marketing department, Baver is uncertain about its revenve forecant. In particular, manapement would ake to axamine the sanativily of the NPV to the fovenue assumptions. What is the NPV of this project if revenues are 8% higher than forecast? What is the NPV if revenues are 8% lower than forocaut? c. Rather than assuming that cash flows for this project are constant, management would like to explore the sansitivity of its analysis to possible growh in revenies and operating experses Specifically, management would like to atsume that revenuns, manulacturhg expenses, and mocketing expenses are as given in the tabie for year 1 and grow by 2% per year every year startirg in year 2. Management aiso plans to assume that the inital capital expenditure (and enerefore degrediabon), additions to working captal, and continuaton value remain as initialy tpecified in the table. What is the NPV of this project under these alernative assumgtions? How does the NPV change if the revenues and operating expenses grow by STW per year rather than by 2\$S? d. To examine the sensitivity of thil project to the discount rate, mansaement would like to compute the NPP for diflerent fiscount rates. Create a graph, with the dacount rate on the rakis and the NPV on the y-axis, for discount rates ranging from SW to 30%. For what ranges of discount rates does the project have a positive NPPV? a. For this base-case scenario, what is the NPV of the plant to manutacture lightweight trucks? The NPV of the plant to manufacture lightweight trucki, based on the estimated free cash flow is 5 million. (Round to one decimal place.) b. Based on input from the marketing department, Bauer is uncertain about its revenue forecast. In paricular, management would like to examine the sensitivily of the NPV to the revenue assumptions. What is the NPV of this project if revenoes are 8% higher than forecant? What is the NPV it revenues are 8% lowert than forecant? The NeVof this projoct if revenues are B\% higher than forecast is s. million. (RRound to one decimal place) The NPV of this project if revenues are BW lower than forecast is 4 millon. (Round to one decimal place.) c. Rather than assuming that cash fows for this project are constant, management would like to explore the sensitily of its analysis to possiole growh in revenues and operating expenses. Spooficaly, manegemient would like to assume that revenises, manulacturing expenses, and marketing expenses are as given in the table for year 1 and grow by 2% per year eviry yeor starting in year 2. Management also plans to antume that the initial capial expenotures (and thecofore depreciation) addtone to working capital, and continuation vilue remain as initially speofied in the table. Whan is the NPV of this propect under these allemative assumptons? How does the NPV change if the revenues and operaling expenses grow by 5 . per year rather than by 2% ? If revenues, manufacturing expenses, and marketing expenses grow by 2% per year every year starting in year 2 , fe NFV of the estimaled free cash flow is 3 decimai place.) If revenues, manufacturing expenses, and marketing axpenses grow by 5% pec year every year starthg in yoar 2 , the NPV of the estimated free caak flow is 1 million (fhound to one decimal place.) discourt rate on the x-aws and the NPV on the y-axis, for discoumt rales ranging from 5% to 30% For what ranges of dicount rates does the peoject have a posicve NPY? The RoY is positive for discount rates below the IRR of 6. (Round to two decimal places)