Question

Bayside hospital is projecting that their supplies to finish out this year at $12,000,000. If they anticipate a 4% inflation and a 2% volume growth,

Bayside hospital is projecting that their supplies to finish out this year at $12,000,000. If they anticipate a 4% inflation and a 2% volume growth, what would their budgeted supplies be at?

Dr. Smith is meeting with his accountant about this 2012 budget. Currently his rent costs him $4,000 per month. He does anticipate a 5% volume growth next year, but no need for additional space. He is in the 3rd year of a 5 year lease agreement that calls for a 2% annual escalation in his rent. Based on the information given, what would you project Dr. Smith's 2012 budget be for his rent?

You are the lab director for a large hospital. Currently you spend $10 per patient day for lab supplies. You anticipate that you will experience a 2% inflation for your costs next year. The hospital is projected to finish the current year with 10,000 discharges and a length of stay of 5 days. What is your current projected cost?

You anticipate that you will experience a 2% inflation for your daily costs next year. You also anticipate a 5% discharge growth and a reduction in ALOS from 5.0 to 4.5 days. Based on the new information, what would you project your next year budget to be? (Hint: Calculate your new total patient days and new per day cost first).

You are given the following information:

A.Current 9 month supply cost is $8,000.

B.Volume Growth next year is 4%

C.Expected supplyinflation next year is 5%

What is your current year project and next year supply budget?

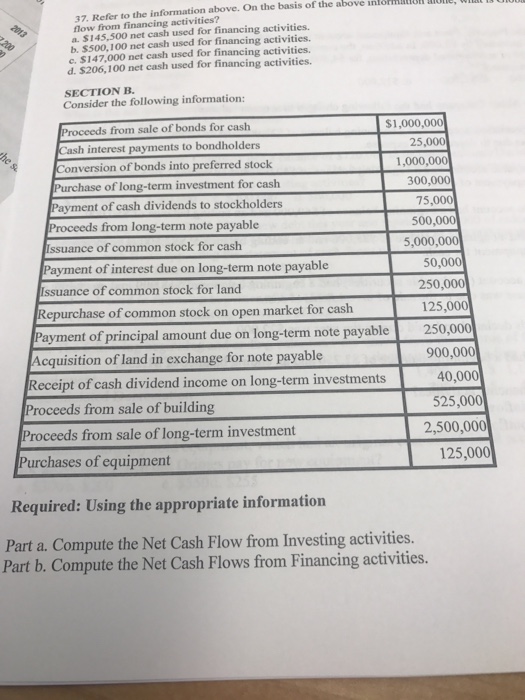

2013 7,200 the s 37. Refer to the information above. On the basis of the above informill flow from financing activities? a. $145,500 net cash used for financing activities. b. $500,100 net cash used for financing activities. c. $147,000 net cash used for financing activities. d. $206,100 net cash used for financing activities. SECTION B. Consider the following information: Proceeds from sale of bonds for cash Cash interest payments to bondholders Conversion of bonds into preferred stock Purchase of long-term investment for cash Payment of cash dividends to stockholders Proceeds from long-term note payable Issuance of common stock for cash Payment of interest due on long-term note payable Issuance of common stock for land Repurchase of common stock on open market for cash Payment of principal amount due on long-term note payable Acquisition of land in exchange for note payable Receipt of cash dividend income on long-term investments Proceeds from sale of building Proceeds from sale of long-term investment Purchases of equipment $1,000,000 25,000 1,000,000 300,000 75,000 500,000 5,000,000 50,000 250,000 125,000 250,000 900,000 40,000 525,000 2,500,000 125,000 aonic, LEGA Required: Using the appropriate information Part a. Compute the Net Cash Flow from Investing activities. Part b. Compute the Net Cash Flows from Financing activities.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Part a Net Cash Flow from Investing Activities Proceeds from sale of longterm investment 2500000 Pur...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started