Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bazz Lightyear Bhd. (hereinafter referred to as BIB) is an unlisted public company. It was incorporated in Malaysia in 2018 having a paid-up capital

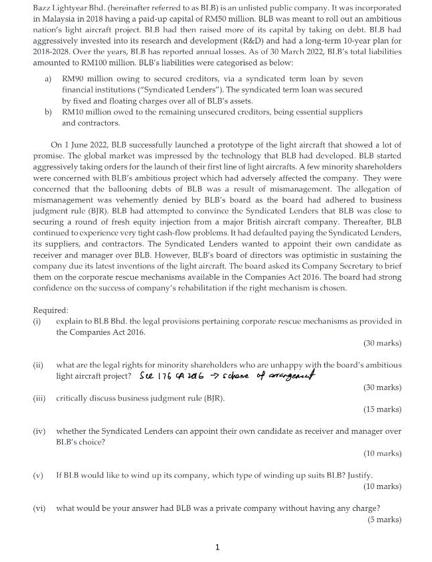

Bazz Lightyear Bhd. (hereinafter referred to as BIB) is an unlisted public company. It was incorporated in Malaysia in 2018 having a paid-up capital of RM50 million. BLB was meant to roll out an ambitious nation's light aircraft project. BIB had then raised more of its capital by taking on debt. Bl.B had aggressively invested into its research and development (R&D) and had a long-term 10-year plan for 2018-2028. Over the years, BLB has reported annual losses. As of 30 March 2022, BL.B's total liabilities amounted to RM100 million. BLB's habilities were categorised as below: a) RM90 million owing to secured creditors, via a syndicated term loan by seven financial institutions ("Syndicated Lenders"). The syndicated term loan was secured by fixed and floating charges over all of BLB's assets. b) RM10 million owed to the remaining unsecured creditors, being essential suppliers and contractors. On 1 June 2022, BLB successfully launched a prototype of the light aircraft that showed a lot of promise. The global market was impressed by the technology that BLB had developed. BLB started aggressively taking orders for the launch of their first line of light aircrafts. A few minority shareholders were concerned with BLB's ambitious project which had adversely affected the company. They were concerned that the ballooning debts of BLB was a result of mismanagement. The allegation of mismanagement was vehemently denied by BLB's board as the board had adhered to business judgment rule (BIR), BLB had attempted to convince the Syndicated Lenders that BLB was close to securing a round of fresh equity injection from a major British aircraft company. Thereafter, BLB continued to experience very tight cash-flow problems. It had defaulted paying the Syndicated Lenders, its suppliers, and contractors. The Syndicated Lenders wanted to appoint their own candidate as receiver and manager over BLB. However, BLB's board of directors was optimistic in sustaining the company due its latest inventions of the light aircraft. The board asked its Company Secretary to brief them on the corporate rescue mechanisms available in the Companies Act 2016. The board had strong confidence on the success of company's rehabilitation if the right mechanism is chosen Required: (0) explain to BLB Bhd. the legal provisions pertaining corporate rescue mechanisms as provided in the Companies Act 2016. (30 marks) (ii) what are the legal rights for minority shareholders who are unhappy with the board's ambitious light aircraft project? See 176 CA 2016 - scheme of arrangement (ii) critically discuss business judgment rule (BIR). (30 marks) (15 marks) (iv) whether the Syndicated Lenders can appoint their own candidate as receiver and manager over BI.B's choice? (10 marks) (v) If BLB would like to wind up its company, which type of winding up suits BIB? Justify (10 marks) 1 (vi) what would be your answer had BLB was a private company without having any charge? (5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started