Answered step by step

Verified Expert Solution

Question

1 Approved Answer

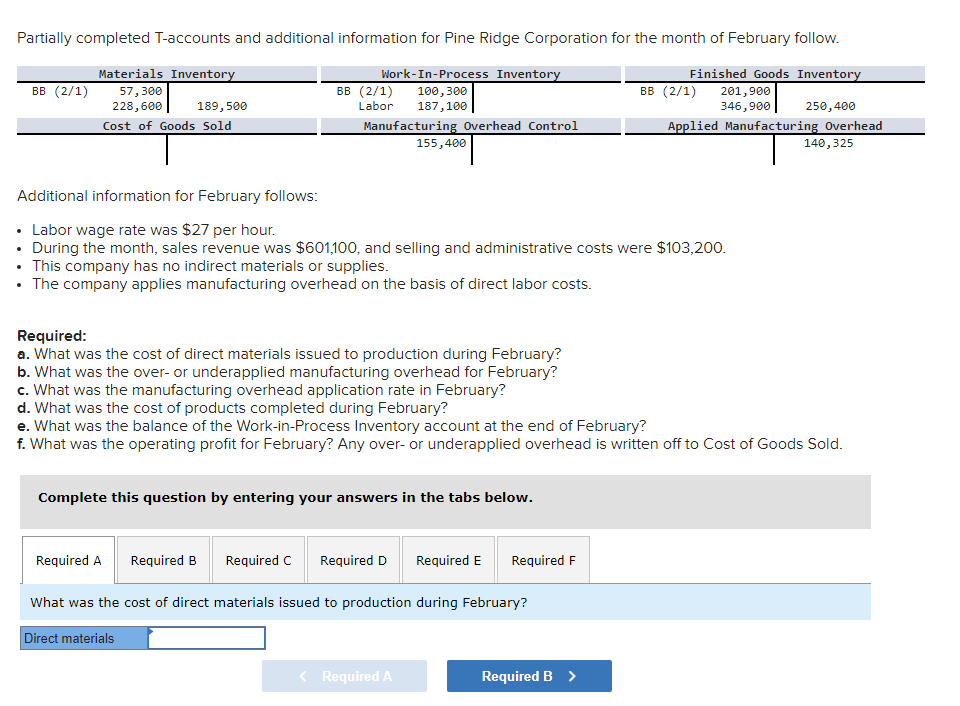

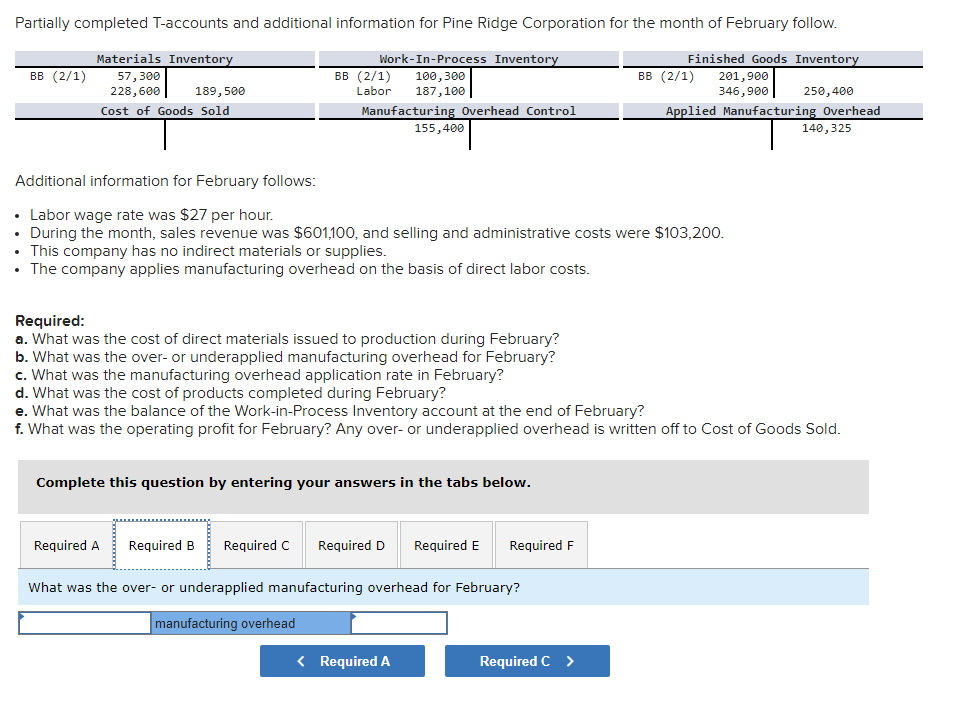

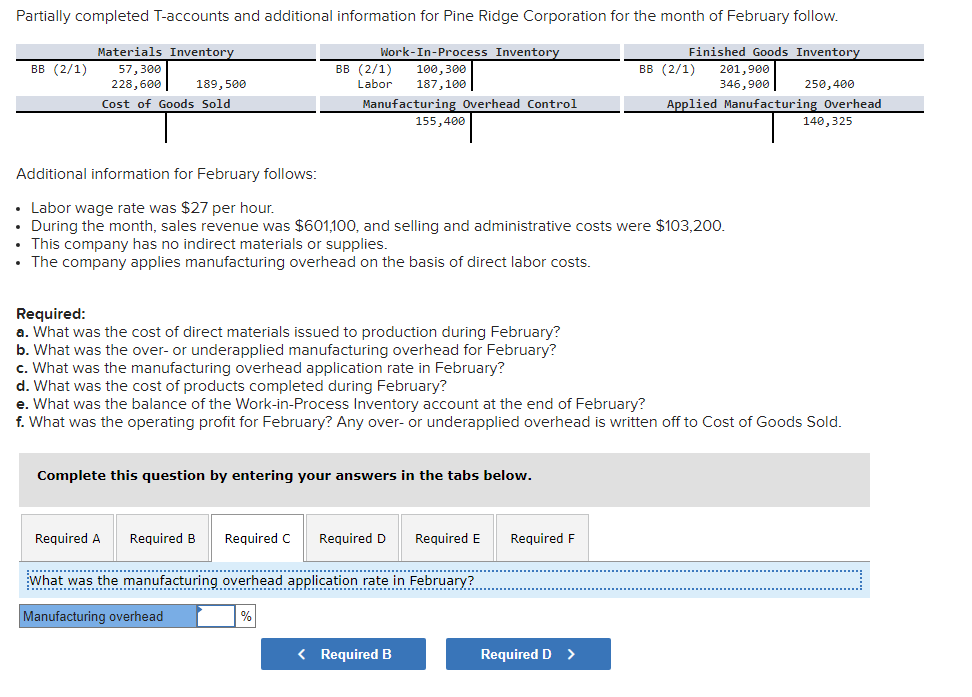

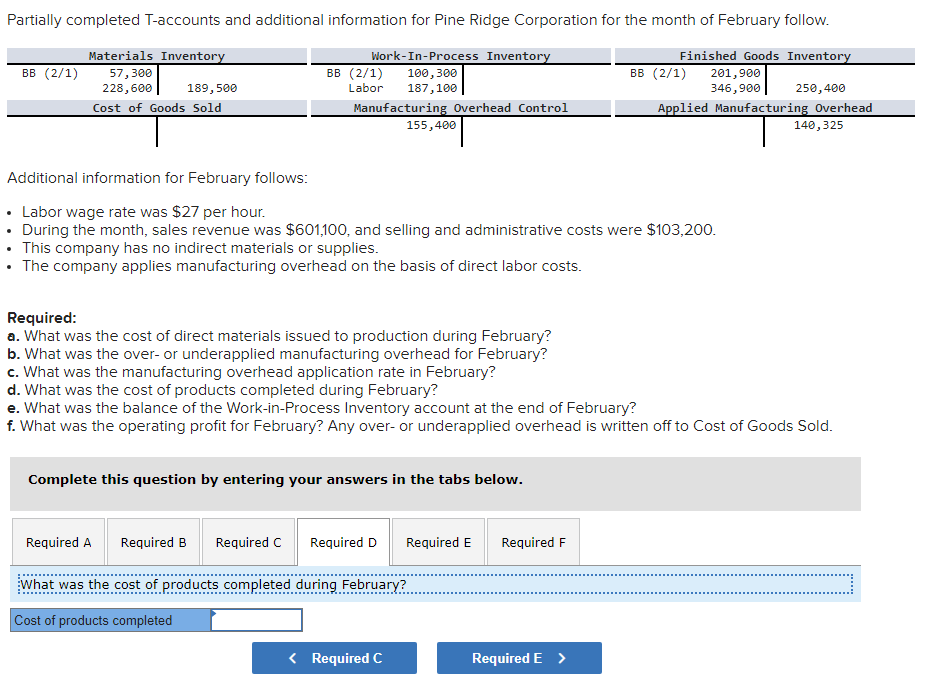

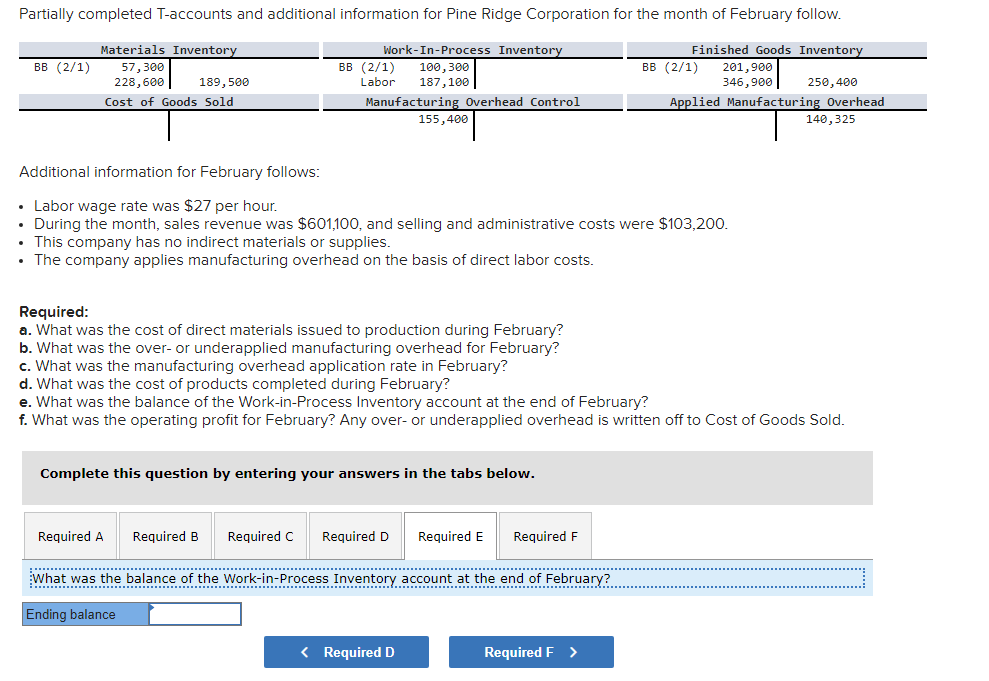

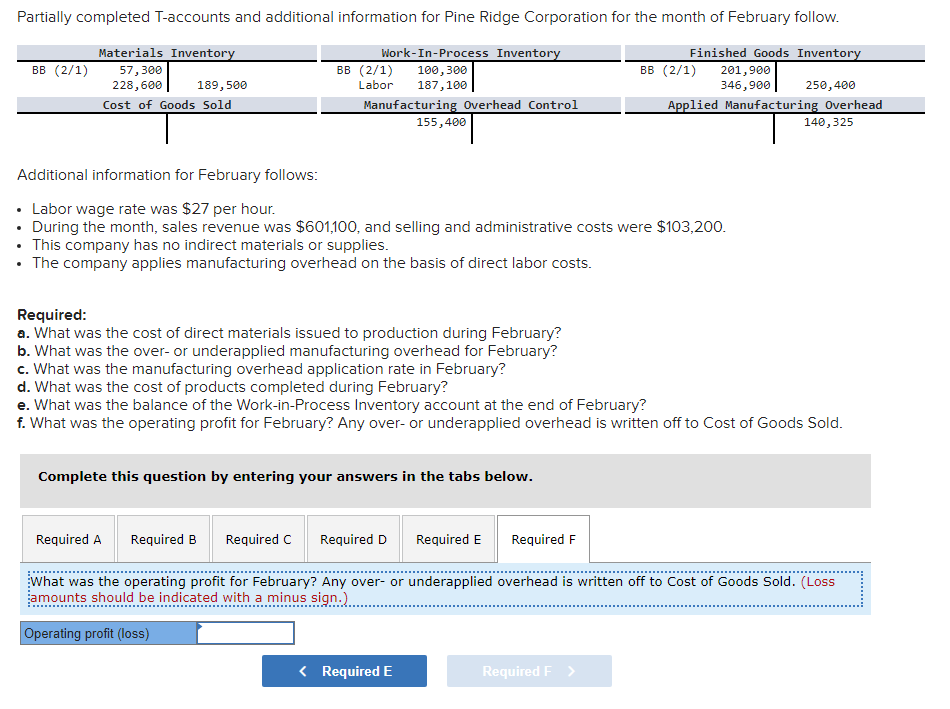

BB (2/1) BB (2/1) 189,500 Labor Partially completed T-accounts and additional information for Pine Ridge Corporation for the month of February follow. Materials Inventory

BB (2/1) BB (2/1) 189,500 Labor Partially completed T-accounts and additional information for Pine Ridge Corporation for the month of February follow. Materials Inventory 57,300 228,600 Work-In-Process Inventory Finished Goods Inventory 100,300 187,100 BB (2/1) 201,900 346,900 250,400 Cost of Goods Sold Manufacturing Overhead Control Applied Manufacturing Overhead 155,400 140,325 Additional information for February follows: Labor wage rate was $27 per hour. During the month, sales revenue was $601,100, and selling and administrative costs were $103,200. This company has no indirect materials or supplies. The company applies manufacturing overhead on the basis of direct labor costs. Required: a. What was the cost of direct materials issued to production during February? b. What was the over- or underapplied manufacturing overhead for February? c. What was the manufacturing overhead application rate in February? d. What was the cost of products completed during February? e. What was the balance of the Work-in-Process Inventory account at the end of February? f. What was the operating profit for February? Any over- or underapplied overhead is written off to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E Required F What was the cost of direct materials issued to production during February? Direct materials < Required A Required B > Partially completed T-accounts and additional information for Pine Ridge Corporation for the month of February follow. Materials Inventory Work-In-Process Inventory Finished Goods Inventory BB (2/1) 57,300 228,600 BB (2/1) 189,500 Labor 100,300 187,100 BB (2/1) 201,900 346,900 250,400 Cost of Goods Sold Manufacturing Overhead Control Applied Manufacturing Overhead 155,400 140,325 Additional information for February follows: Labor wage rate was $27 per hour. During the month, sales revenue was $601,100, and selling and administrative costs were $103,200. This company has no indirect materials or supplies. The company applies manufacturing overhead on the basis of direct labor costs. Required: a. What was the cost of direct materials issued to production during February? b. What was the over- or underapplied manufacturing overhead for February? c. What was the manufacturing overhead application rate in February? d. What was the cost of products completed during February? e. What was the balance of the Work-in-Process Inventory account at the end of February? f. What was the operating profit for February? Any over- or underapplied overhead is written off to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E Required F What was the over- or underapplied manufacturing overhead for February? manufacturing overhead < Required A Required C > BB (2/1) BB (2/1) 189,500 Labor Partially completed T-accounts and additional information for Pine Ridge Corporation for the month of February follow. Materials Inventory 57,300 228,600 187,100 Work-In-Process Inventory Finished Goods Inventory 100,300 BB (2/1) 201,900 346,900 250,400 Cost of Goods Sold Manufacturing Overhead Control Applied Manufacturing Overhead 155,400 140,325 Additional information for February follows: Labor wage rate was $27 per hour. During the month, sales revenue was $601,100, and selling and administrative costs were $103,200. This company has no indirect materials or supplies. The company applies manufacturing overhead on the basis of direct labor costs. Required: a. What was the cost of direct materials issued to production during February? b. What was the over- or underapplied manufacturing overhead for February? c. What was the manufacturing overhead application rate in February? d. What was the cost of products completed during February? e. What was the balance of the Work-in-Process Inventory account at the end of February? f. What was the operating profit for February? Any over- or underapplied overhead is written off to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E Required F What was the manufacturing overhead application rate in February? Manufacturing overhead % < Required B Required D > BB (2/1) BB (2/1) 189,500 Labor Partially completed T-accounts and additional information for Pine Ridge Corporation for the month of February follow. Materials Inventory 57,300 228,600 Work-In-Process Inventory Finished Goods Inventory 100,300 187,100 BB (2/1) 201,900 346,900 250,400 Cost of Goods Sold Manufacturing Overhead Control Applied Manufacturing Overhead 155,400 140,325 Additional information for February follows: Labor wage rate was $27 per hour. During the month, sales revenue was $601,100, and selling and administrative costs were $103,200. This company has no indirect materials or supplies. The company applies manufacturing overhead on the basis of direct labor costs. Required: a. What was the cost of direct materials issued to production during February? b. What was the over- or underapplied manufacturing overhead for February? c. What was the manufacturing overhead application rate in February? d. What was the cost of products completed during February? e. What was the balance of the Work-in-Process Inventory account at the end of February? f. What was the operating profit for February? Any over- or underapplied overhead is written off to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E Required F What was the cost of products completed during February? Cost of products completed < Required C Required E > Partially completed T-accounts and additional information for Pine Ridge Corporation for the month of February follow. Materials Inventory Work-In-Process Inventory Finished Goods Inventory BB (2/1) 57,300 228,600 BB (2/1) 189,500 Labor 100,300 187,100 BB (2/1) 201,900 346,900 250,400 Cost of Goods Sold Manufacturing Overhead Control Applied Manufacturing Overhead 155,400 140,325 Additional information for February follows: Labor wage rate was $27 per hour. During the month, sales revenue was $601,100, and selling and administrative costs were $103,200. This company has no indirect materials or supplies. The company applies manufacturing overhead on the basis of direct labor costs. Required: a. What was the cost of direct materials issued to production during February? b. What was the over- or underapplied manufacturing overhead for February? c. What was the manufacturing overhead application rate in February? d. What was the cost of products completed during February? e. What was the balance of the Work-in-Process Inventory account at the end of February? f. What was the operating profit for February? Any over- or underapplied overhead is written off to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E Required F What was the balance of the Work-in-Process Inventory account at the end of February? Ending balance < Required D Required F > BB (2/1) BB (2/1) 189,500 Labor Partially completed T-accounts and additional information for Pine Ridge Corporation for the month of February follow. Materials Inventory 57,300 228,600 Work-In-Process Inventory Finished Goods Inventory 100,300 187,100 BB (2/1) 201,900 346,900 250,400 Cost of Goods Sold Manufacturing Overhead Control Applied Manufacturing Overhead 155,400 140,325 Additional information for February follows: Labor wage rate was $27 per hour. During the month, sales revenue was $601,100, and selling and administrative costs were $103,200. This company has no indirect materials or supplies. The company applies manufacturing overhead on the basis of direct labor costs. Required: a. What was the cost of direct materials issued to production during February? b. What was the over- or underapplied manufacturing overhead for February? c. What was the manufacturing overhead application rate in February? d. What was the cost of products completed during February? e. What was the balance of the Work-in-Process Inventory account at the end of February? f. What was the operating profit for February? Any over- or underapplied overhead is written off to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E Required F What was the operating profit for February? Any over- or underapplied overhead is written off to Cost of Goods Sold. (Loss amounts should be indicated with a minus sign.) Operating profit (loss) < Required E Required F >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started