Question

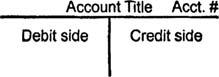

The simplest account structure is shaped like the letter T . The account title and account number appear above the T. Debits (abbreviated Dr.) always

The simplest account structure is shaped like the letter T. The account title and account number appear above the T. Debits (abbreviated Dr.) always go on the left side of the T, and credits (abbreviated Cr.) always go on the right.

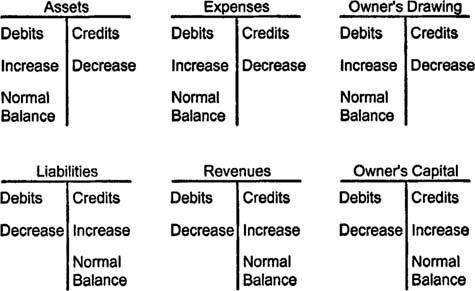

Accountants record increases in asset, expense, and owner's drawing accounts on the debit side, and they record increases in liability, revenue, and owner's capital accounts on the credit side. An account's assigned normal balance is on the side where increases go because the increases in any account are usually greater than the decreases. Therefore, asset, expense, and owner's drawing accounts normally have debit balances. Liability, revenue, and owner's capital accounts normally have credit balances. To determine the correct entry, identify the accounts affected by a transaction, which category each account falls into, and whether the transaction increases or decreases the account's balance. You may find the following chart helpful as a reference.

Occasionally, an account does not have a normal balance. For example, a company's checking account (an asset) has a credit balance if the account is overdrawn.

The way people often use the words debit and credit in everyday speech is not how accountants use these words. For example, the word credit generally has positive associations when used conversationally: in school you receive credit for completing a course, a great hockey player may be a credit to his or her team, and a hopeless romantic may at least deserve credit for trying. Someone who is familiar with these uses for credit but who is new to accounting may not immediately associate credits with decreases to asset, expense, and owner's drawing accounts. If a business owner loses $5,000 of the company's cash while gambling, the cash account, which is an asset, must be credited for $5,000. (The accountant who records this entry may also deserve credit for realizing that other job offers merit consideration.) For accounting purposes, think of debit and credit simply in terms of the left‐hand and right‐hand side of a T account.

Account Title Acct. # Debit side Credit side

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The Taccount structure serves as a foundational tool in accounting facilitating the organization and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started