Answered step by step

Verified Expert Solution

Question

1 Approved Answer

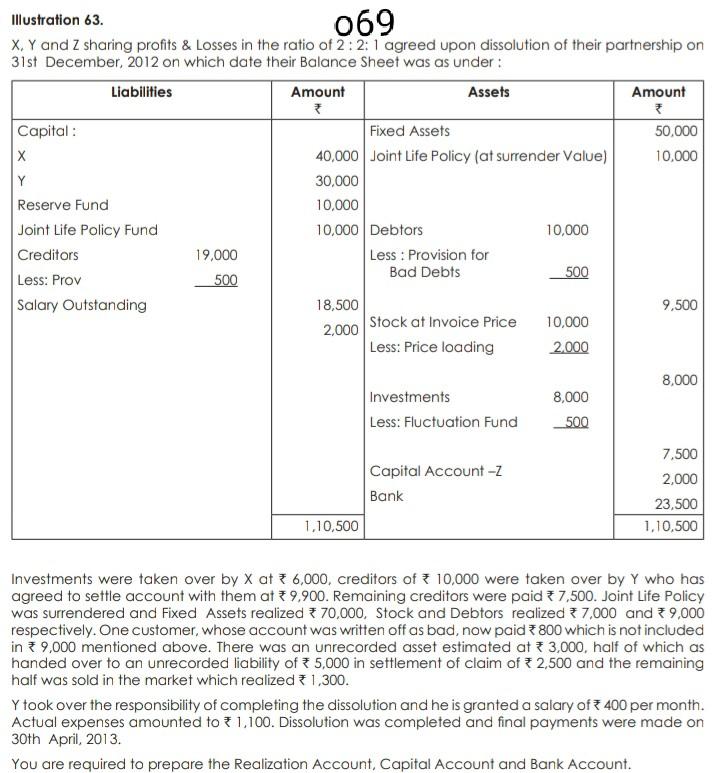

bb illustration 63. 069 X. Y and Z sharing profits & Losses in the ratio of 2:2:1 agreed upon dissolution of their partnership on 31st

bb

illustration 63. 069 X. Y and Z sharing profits & Losses in the ratio of 2:2:1 agreed upon dissolution of their partnership on 31st December, 2012 on which date their Balance Sheet was as under: Liabilities Amount Assets Amount Capital: Fixed Assets 50,000 40,000 Joint Life Policy (at surrender Value) 10,000 |Y 30,000 Reserve Fund 10,000 Joint Life Policy Fund 10,000 Debtors 10,000 Creditors 19,000 Less : Provision for Less: Prov 500 Bad Debts 500 Salary Outstanding 18,500 9.500 2,000 Stock at Invoice Price 10,000 Less: Price loading 2.000 8,000 Investments Less: Fluctuation Fund 8,000 500 7,500 Capital Account -2 Bank 2,000 23.500 1.10.500 1,10,500 Investments were taken over by X at 6,000, creditors of * 10,000 were taken over by Y who has agreed to settle account with them at 39,900. Remaining creditors were paid * 7,500. Joint Life Policy was surrendered and Fixed Assets realized * 70,000, Stock and Debtors realized 37,000 and 39,000 respectively. One customer, whose account was written off as bad, now paid * 800 which is not included in 9.000 mentioned above. There was an unrecorded asset estimated at 3,000, half of which as handed over to an unrecorded liability of 5,000 in settlement of claim of 2,500 and the remaining half was sold in the market which realized 1,300. Y took over the responsibility of completing the dissolution and he is granted a salary of 400 per month. Actual expenses amounted to * 1,100. Dissolution was completed and final payments were made on 30th April, 2013 You are required to prepare the realization Account, Capital Account and Bank AccountStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started