Answered step by step

Verified Expert Solution

Question

1 Approved Answer

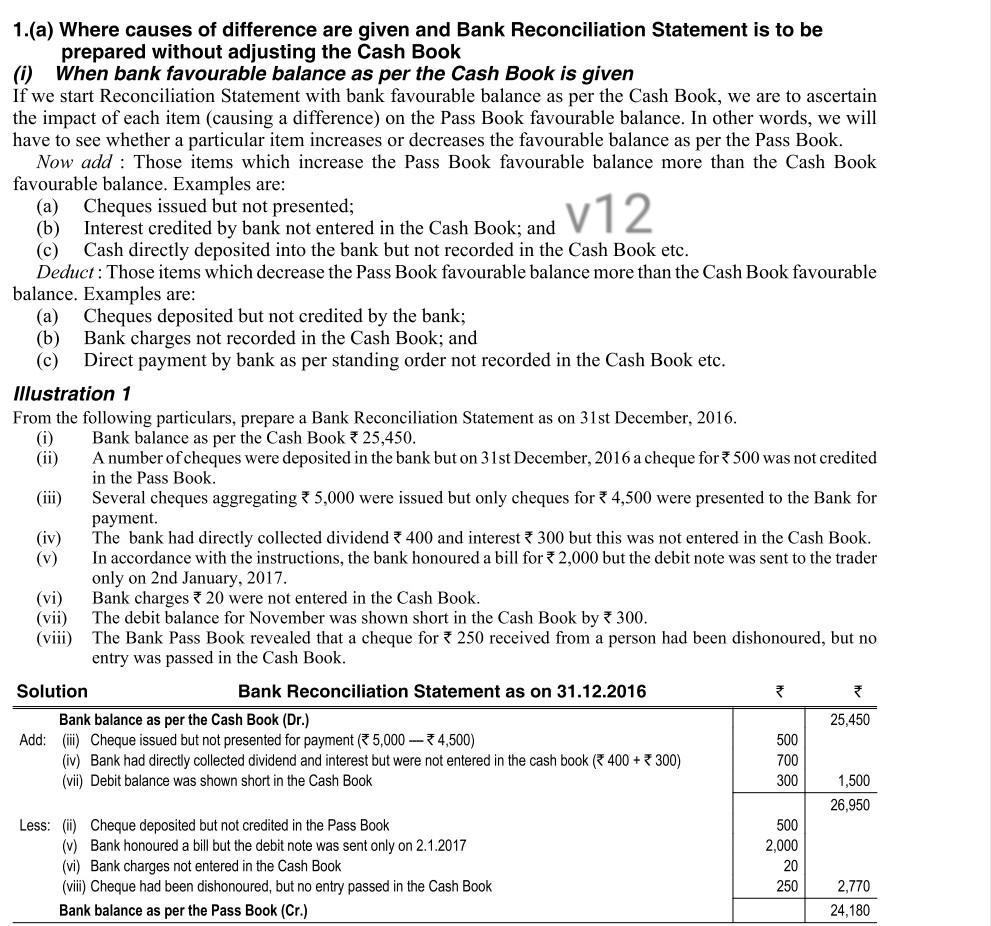

bb Interest credited by bank restentered in the Cash Book: and V12 1.(a) Where causes of difference are given and Bank Reconciliation Statement is to

bb

Interest credited by bank restentered in the Cash Book: and V12 1.(a) Where causes of difference are given and Bank Reconciliation Statement is to be prepared without adjusting the Cash Book (i) When bank favourable balance as per the Cash Book is given If we start Reconciliation Statement with bank favourable balance as per the Cash Book, we are to ascertain the impact of each item (causing a difference) on the Pass Book favourable balance. In other words, we will have to see whether a particular item increases or decreases the favourable balance as per the Pass Book. Now add : Those items which increase the Pass Book favourable balance more than the Cash Book favourable balance. Examples are: (a) presented; (b) (C) Cash directly deposited into the bank but not recorded in the Cash Book etc. Deduct: Those items which decrease the Pass Book favourable balance more than the Cash Book favourable balance. Examples are: (a) Cheques deposited but not credited by the bank; (b) Bank charges not recorded in the Cash Book; and (C) Direct payment by bank as per standing order not recorded in the Cash Book etc. Illustration 1 From the following particulars, prepare a Bank Reconciliation Statement as on 31st December, 2016. (i) Bank balance as per the Cash Book 25,450. (11) A number of cheques were deposited in the bank but on 31st December, 2016 a cheque for 500 was not credited in the Pass Book. (iii) Several cheques aggregating 5,000 were issued but only cheques for 4,500 were presented to the Bank for payment. (iv) The bank had directly collected dividend 400 and interest 300 but this was not entered in the Cash Book. (v) In accordance with the instructions, the bank honoured a bill for 2,000 but the debit note was sent to the trader only on 2nd January, 2017. (vi) Bank charges 320 were not entered in the Cash Book. (vii) The debit balance for November was shown short in the Cash Book by 300. (viii) The Bank Pass Book revealed that a cheque for 250 received from a person had been dishonoured, but no entry was passed in the Cash Book. Solution Bank Reconciliation Statement as on 31.12.2016 Bank balance as per the Cash Book (Dr.) 25,450 Add: (i) Cheque issued but not presented for payment (5,000 --- 4,500) 500 (iv) Bank had directly collected dividend and interest but were not entered in the cash book ( 400 + 300) 700 (vii) Debit balance was shown short in the Cash Book 300 1,500 26,950 Less: (i) Cheque deposited but not credited in the Pass Book 500 (v) Bank honoured a bill but the debit note was sent only on 2.1.2017 2,000 (vi) Bank charges not entered in the Cash Book 20 (vii) Cheque had been dishonoured, but no entry passed in the Cash Book 250 2,770 Bank balance as per the Pass Book (Cr.) 24,180Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started