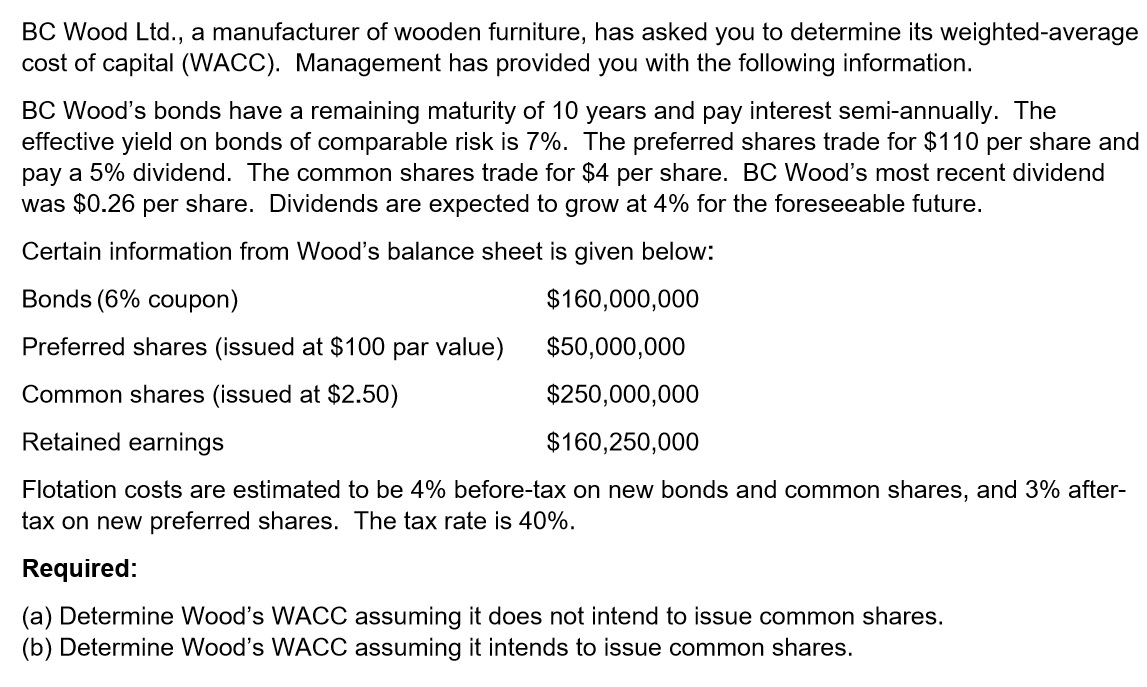

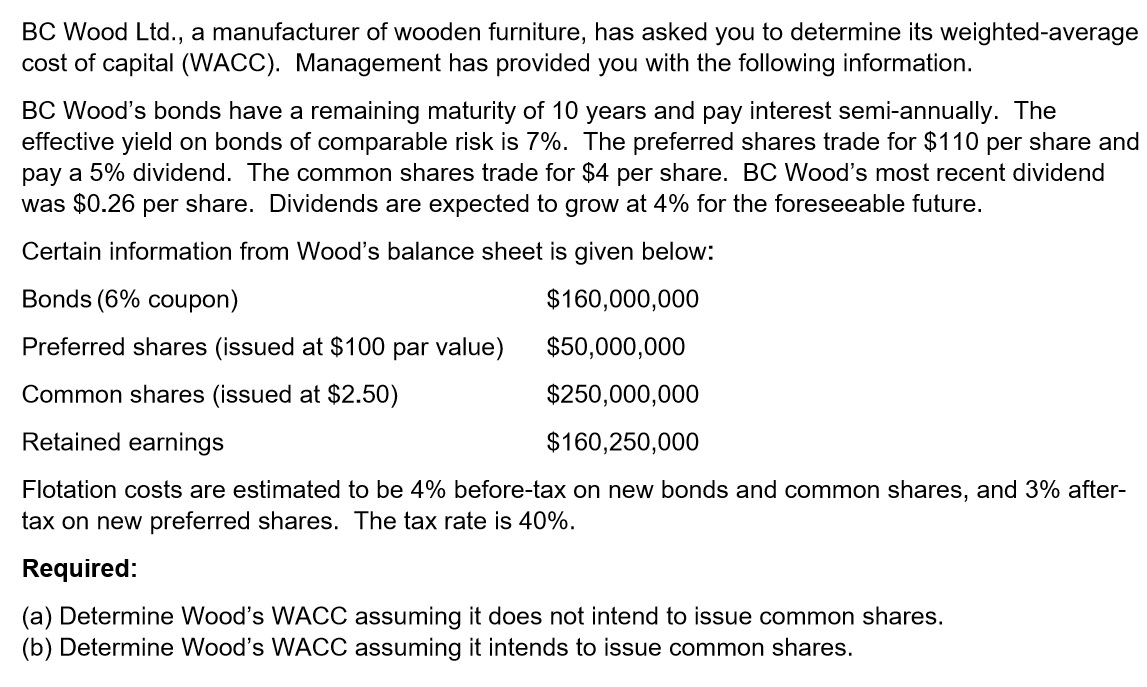

BC Wood Ltd., a manufacturer of wooden furniture, has asked you to determine its weighted average cost of capital (WACC). Management has provided you with the following information. BC Wood's bonds have a remaining maturity of 10 years and pay interest semi-annually. The effective yield on bonds of comparable risk is 7%. The preferred shares trade for $110 per share and pay a 5% dividend. The common shares trade for $4 per share. BC Wood's most recent dividend was $0.26 per share. Dividends are expected to grow at 4% for the foreseeable future. Certain information from Wood's balance sheet is given below: Bonds (6% coupon) $160,000,000 Preferred shares (issued at $100 par value) $50,000,000 Common shares (issued at $2.50) $250,000,000 Retained earnings $160,250,000 Flotation costs are estimated to be 4% before-tax on new bonds and common shares, and 3% after- tax on new preferred shares. The tax rate is 40%. Required: (a) Determine Wood's WACC assuming it does not intend to issue common shares. (b) Determine Wood's WACC assuming it intends to issue common shares. BC Wood Ltd., a manufacturer of wooden furniture, has asked you to determine its weighted average cost of capital (WACC). Management has provided you with the following information. BC Wood's bonds have a remaining maturity of 10 years and pay interest semi-annually. The effective yield on bonds of comparable risk is 7%. The preferred shares trade for $110 per share and pay a 5% dividend. The common shares trade for $4 per share. BC Wood's most recent dividend was $0.26 per share. Dividends are expected to grow at 4% for the foreseeable future. Certain information from Wood's balance sheet is given below: Bonds (6% coupon) $160,000,000 Preferred shares (issued at $100 par value) $50,000,000 Common shares (issued at $2.50) $250,000,000 Retained earnings $160,250,000 Flotation costs are estimated to be 4% before-tax on new bonds and common shares, and 3% after- tax on new preferred shares. The tax rate is 40%. Required: (a) Determine Wood's WACC assuming it does not intend to issue common shares. (b) Determine Wood's WACC assuming it intends to issue common shares