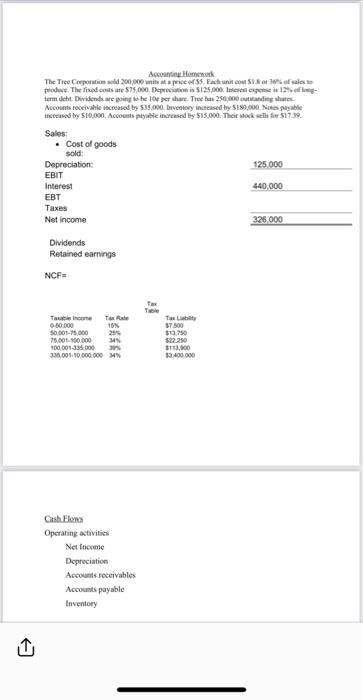

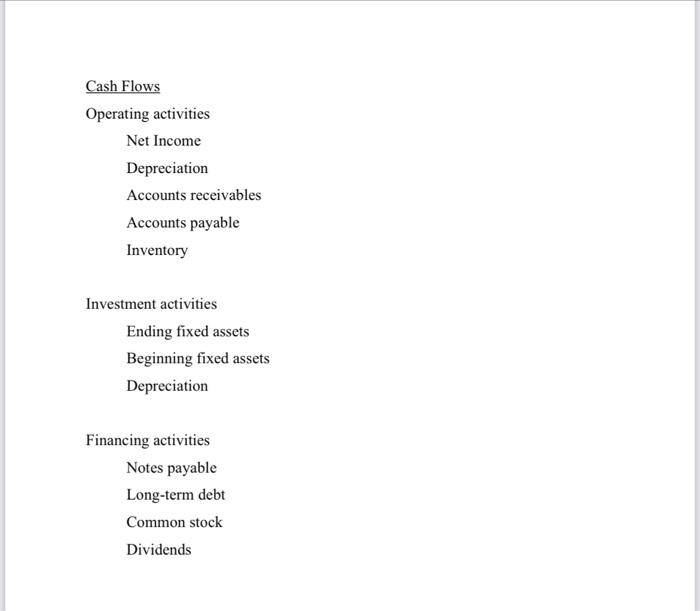

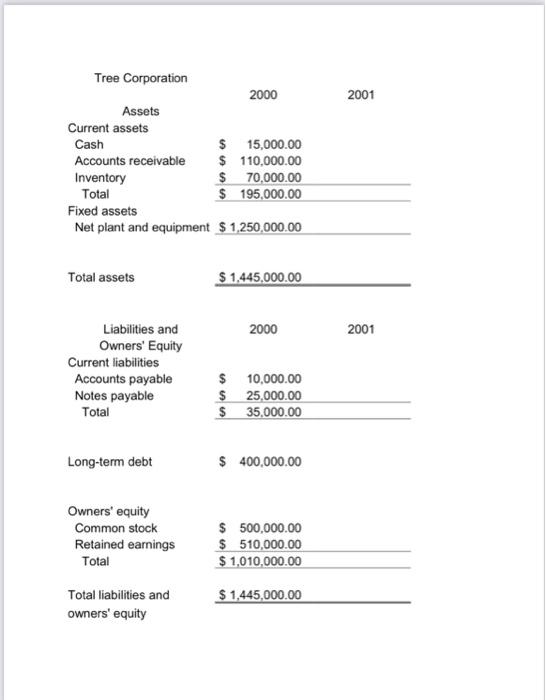

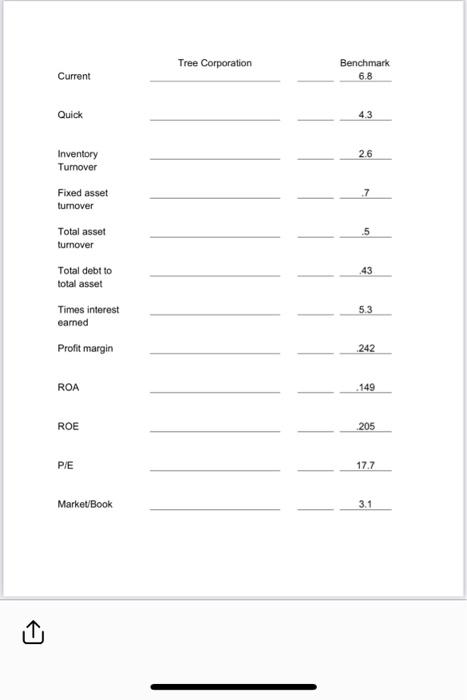

Bccointine Homswerk tern den. Dividendeare going to he 19e per ahare. Tree hat 250,400 inticandieg ahate. Accounts receivale iscoeased by 535,000 tnventory inscased by $182,000. Nito peable incteasd by $10,000. Accounts payalle incoresed by $15,000. Their wack velh fir $17.39. Sales: - Cost of gocds. sold: Depreciabion: ERIT Interest EBT Taxes Net income Dividends Retained earnings NCF= Cashtlons Operating activitions Net fnceeme Depreciation Actounts roteivables Accounts payable lnventery Cash Flows Operating activities Net Income Depreciation Accounts receivables Accounts payable Inventory Investment activities Ending fixed assets Beginning fixed assets Depreciation Financing activities Notes payable Long-term debt Common stock Dividends Tree Corporation Assets Current assets CashAccountsreceivableInventoryTotalFixedassetsNetplantandequipment$$$$$1,250,000.0015,000.00110,000.0070,000.00195,000.00 Total assets $1.445.000.00 Liabilities and 20002001 Owners' Equity Current liabilities Accounts payable Notes payable \begin{tabular}{cr} $ & 10,000.00 \\ $ & 25,000.00 \\ \hline$ & 35.000.00 \\ \hline \end{tabular} Long-term debt $400,000.00 Owners' equity Common stock Retained earnings Total $500,000.00$510,000.00 Total liabilities and $1,445,000.00 owners' equity \begin{tabular}{llc} & Tree Corporation Benchmark \\ Current & 6.8 \\ \hline \end{tabular} Quick 4.3 Inventory Tumover Fixed asset turnover Total asset turnover Total debt to total asset Times interest 5.3 earned Profit margin .242 ROA ROE .205 PiE [17.7 MarketBook 3.1 Bccointine Homswerk tern den. Dividendeare going to he 19e per ahare. Tree hat 250,400 inticandieg ahate. Accounts receivale iscoeased by 535,000 tnventory inscased by $182,000. Nito peable incteasd by $10,000. Accounts payalle incoresed by $15,000. Their wack velh fir $17.39. Sales: - Cost of gocds. sold: Depreciabion: ERIT Interest EBT Taxes Net income Dividends Retained earnings NCF= Cashtlons Operating activitions Net fnceeme Depreciation Actounts roteivables Accounts payable lnventery Cash Flows Operating activities Net Income Depreciation Accounts receivables Accounts payable Inventory Investment activities Ending fixed assets Beginning fixed assets Depreciation Financing activities Notes payable Long-term debt Common stock Dividends Tree Corporation Assets Current assets CashAccountsreceivableInventoryTotalFixedassetsNetplantandequipment$$$$$1,250,000.0015,000.00110,000.0070,000.00195,000.00 Total assets $1.445.000.00 Liabilities and 20002001 Owners' Equity Current liabilities Accounts payable Notes payable \begin{tabular}{cr} $ & 10,000.00 \\ $ & 25,000.00 \\ \hline$ & 35.000.00 \\ \hline \end{tabular} Long-term debt $400,000.00 Owners' equity Common stock Retained earnings Total $500,000.00$510,000.00 Total liabilities and $1,445,000.00 owners' equity \begin{tabular}{llc} & Tree Corporation Benchmark \\ Current & 6.8 \\ \hline \end{tabular} Quick 4.3 Inventory Tumover Fixed asset turnover Total asset turnover Total debt to total asset Times interest 5.3 earned Profit margin .242 ROA ROE .205 PiE [17.7 MarketBook 3.1