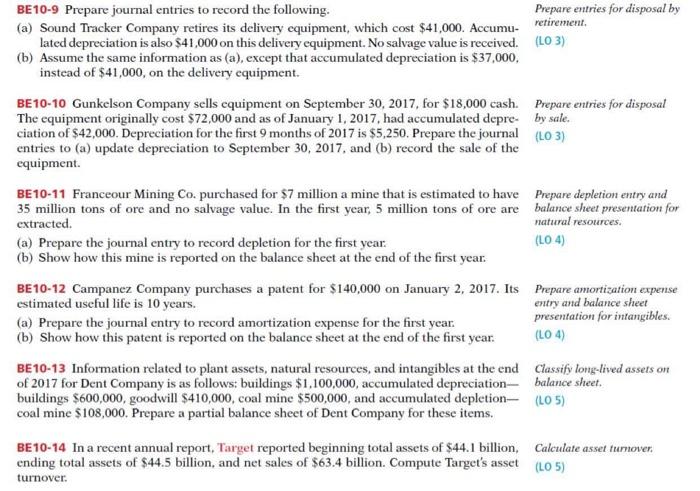

BE10-9 Prepare journal entries to record the following. Prepare entries for disposal by (a) Sound Tracker Company retires its delivery equipment, which cost $41,000. Accumu- retirement lated depreciation is also $41,000 on this delivery equipment. No salvage value is received. (L03) (b) Assume the same information as (a), except that accumulated depreciation is $37,000, instead of $41,000, on the delivery equipment. BE10-10 Gunkelson Company sells equipment on September 30, 2017, for $18,000 cash. Prepare entries for disposal The equipment originally cost $72,000 and as of January 1, 2017, had accumulated depreby sale. ciation of $42,000. Depreciation for the first 9 months of 2017 is $5,250. Prepare the journal (LO 3) entries to (a) update depreciation to September 30, 2017, and (b) record the sale of the equipment. BE10-11 Franceour Mining Co. purchased for $7 million a mine that is estimated to have Prepare depletion entry and 35 million tons of ore and no salvage value. In the first year, 5 million tons of ore are balance sheet presentation for extracted. natural resources. (a) Prepare the journal entry to record depletion for the first year (LO 4) (b) Show how this mine is reported on the balance sheet at the end of the first year BE10-12 Campanez Company purchases a patent for $140,000 on January 2, 2017. Its Prepare amortization expense estimated useful life is 10 years. entry and balance sheet (a) Prepare the journal entry to record amortization expense for the first year. presentation for intangibles. (b) Show how this patent is reported on the balance sheet at the end of the first year. (LO 4) BE10-13 Information related to plant assets, natural resources, and intangibles at the end Classify long-lived assets or of 2017 for Dent Company is as follows: buildings $1,100,000, accumulated depreciation, balance sheet. buildings $600,000, goodwill $410,000, coal mine $500,000, and accumulated depletion- (LO 5) coal mine $108,000. Prepare a partial balance sheet of Dent Company for these items. BE10-14 In a recent annual report, Target reported beginning total assets of $44.1 billion. Calculate asset turnover. ending total assets of $44.5 billion, and net sales of $63.4 billion. Compute Target's asset (LO 5) turnover