BE5-2

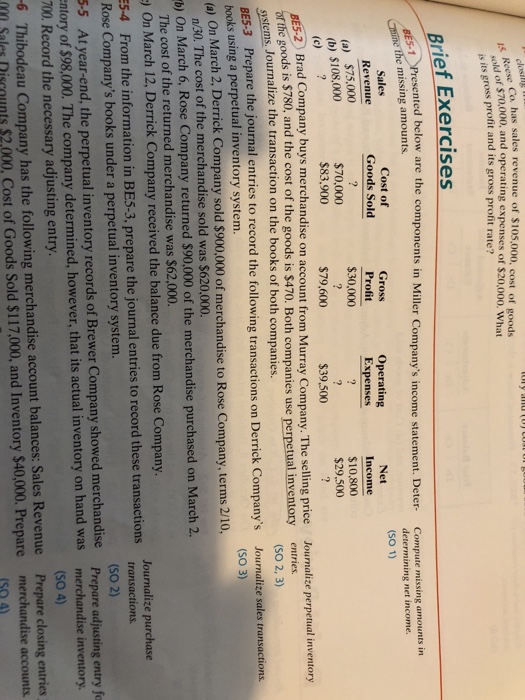

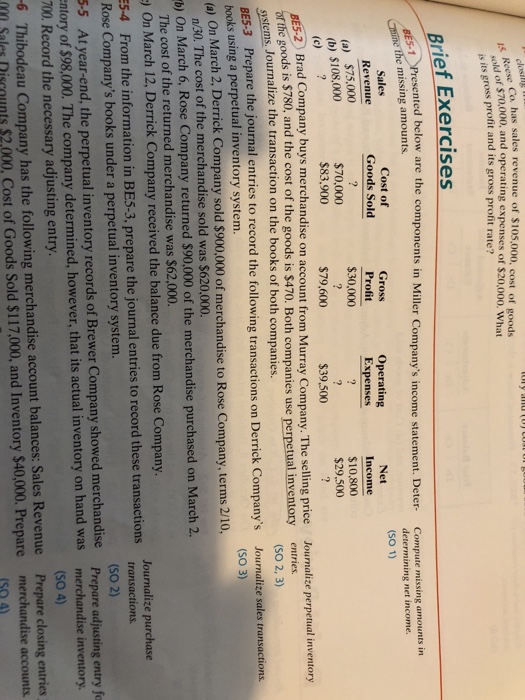

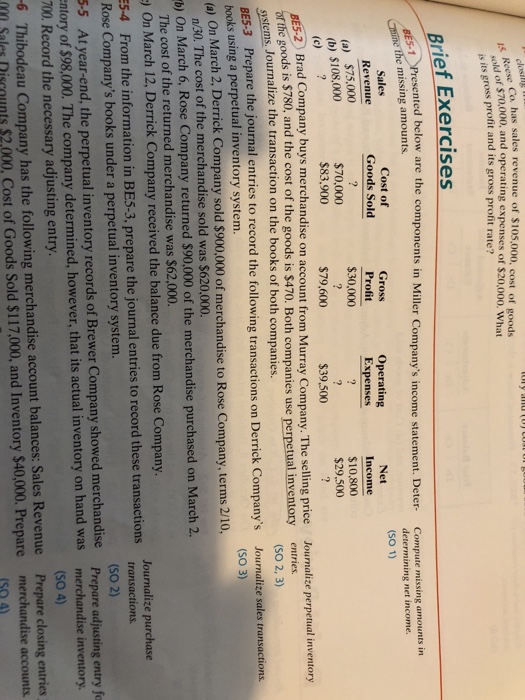

osih Co has sales revenue of $105.000, cost of goods 5 of $70,000, and operating expenses of $20,000. What gross profit and its gross profit rate? is its Brief Exercises ,?presented below are the components in Miller Company's income statement Deter- the missing amounts. Compute missing amounts in determining net income. (SO 1) Cost of Gross Profit Operating Expenses RevenueGoods Sold (a) $75,000 (b) $108,000 Income $10,800 $29,500 $70,000 $83.900 $79,600 39.500 y buys merchandise on account from Murray Company. The selling price of the goods is $780, and the cost of the goods is $470. Both companies use perpetual inventory Journalize perpetual inventory enthes. (SO 2, 3) Journa (SO 3) s. Journalize the transaction on the books of both companies BES-3 Prepare the journal entries to record the following transactions on Derrick Company's books using a perpetual inventory system. )On March 2, Derrick Company sold $900,000 of merchandise to Rose Company, terms 2/10 actions on Derrick Company's Journalize sales transactions (a n/30. The cost of the merchandise sold was $620,000 b) On March 6, Rose Company returned $90,000 of the merchandise purchased on March 2. The cost of the returned merchandise was $62,000 On March 12, Derrick Company received the balance due from Rose Company From the information in BES-3, prepare the journal entries to record these transactions toe Rose Company's books under a perpetual inventory system. 5-5 At year-end, the perpetual inventory records of Brewer Company showed merchandise Prepare adjusting entry fo entory of $98,000. The company determined, however, that its actual inventory on hand was merchandise invento 700. Record the necessary adjusting entry transactions (SO 2) (SO 4) 6 Thibodeau Company has the following merchandise account balances: Sales Revenue Prepare closing entries (00 Sales Riscounts $2,000, Cost of Goods Sold $117,000, and Inventory $40,000. Prepare merchandise accounts osih Co has sales revenue of $105.000, cost of goods 5 of $70,000, and operating expenses of $20,000. What gross profit and its gross profit rate? is its Brief Exercises ,?presented below are the components in Miller Company's income statement Deter- the missing amounts. Compute missing amounts in determining net income. (SO 1) Cost of Gross Profit Operating Expenses RevenueGoods Sold (a) $75,000 (b) $108,000 Income $10,800 $29,500 $70,000 $83.900 $79,600 39.500 y buys merchandise on account from Murray Company. The selling price of the goods is $780, and the cost of the goods is $470. Both companies use perpetual inventory Journalize perpetual inventory enthes. (SO 2, 3) Journa (SO 3) s. Journalize the transaction on the books of both companies BES-3 Prepare the journal entries to record the following transactions on Derrick Company's books using a perpetual inventory system. )On March 2, Derrick Company sold $900,000 of merchandise to Rose Company, terms 2/10 actions on Derrick Company's Journalize sales transactions (a n/30. The cost of the merchandise sold was $620,000 b) On March 6, Rose Company returned $90,000 of the merchandise purchased on March 2. The cost of the returned merchandise was $62,000 On March 12, Derrick Company received the balance due from Rose Company From the information in BES-3, prepare the journal entries to record these transactions toe Rose Company's books under a perpetual inventory system. 5-5 At year-end, the perpetual inventory records of Brewer Company showed merchandise Prepare adjusting entry fo entory of $98,000. The company determined, however, that its actual inventory on hand was merchandise invento 700. Record the necessary adjusting entry transactions (SO 2) (SO 4) 6 Thibodeau Company has the following merchandise account balances: Sales Revenue Prepare closing entries (00 Sales Riscounts $2,000, Cost of Goods Sold $117,000, and Inventory $40,000. Prepare merchandise accounts