Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Beamy Corporation was organized in 2020 to operate financial consulting business. The chartet authorized 12,000 common shores, no par value. During the first year, the

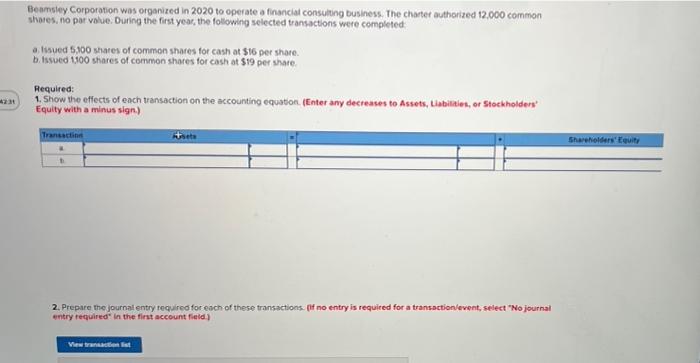

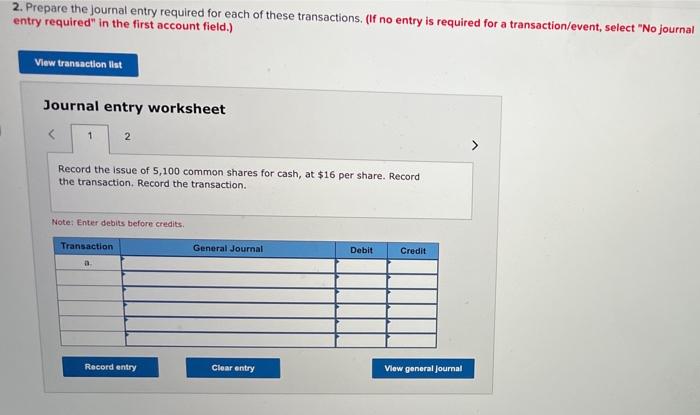

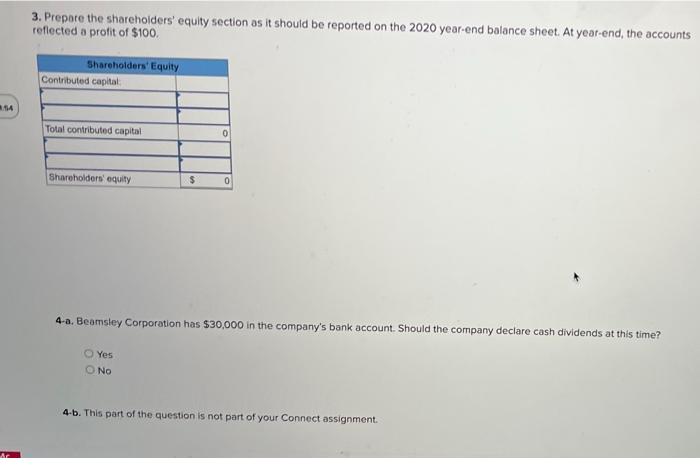

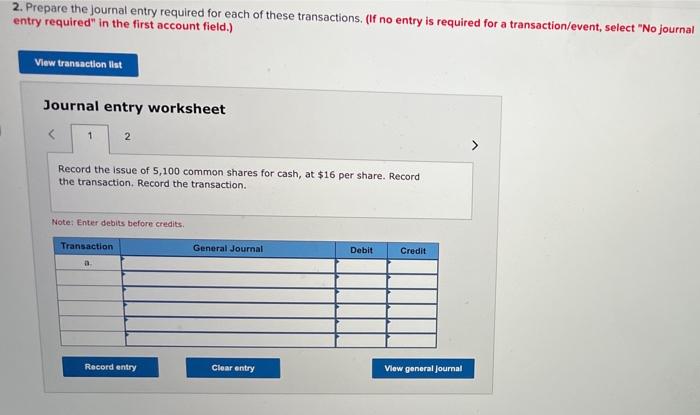

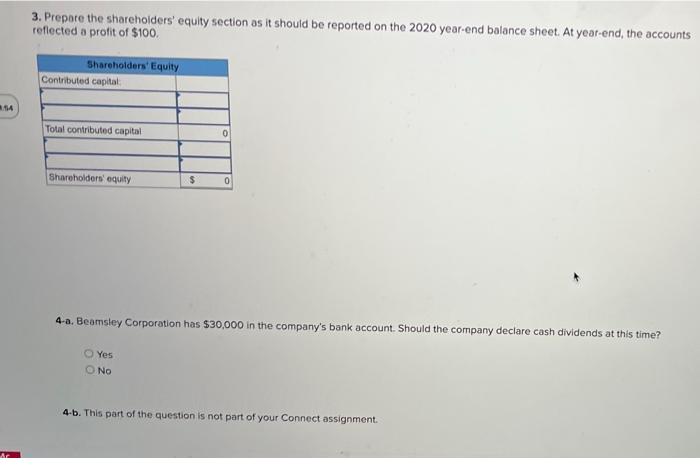

Beamy Corporation was organized in 2020 to operate financial consulting business. The chartet authorized 12,000 common shores, no par value. During the first year, the following selected transactions were completed a. Issued 5,100 shares of common shares for cash at $16 per share. b. Issued 1100 shares of common shares for cash at $19 per share Required: 1. Show the effects of each transaction on the accounting equation. (Enter any decreases to Assets, Liabilities, or Stockholders Equity with a minus sign.) Transaction itata Shareholders Equity 2. Prepare the journal entry required for each of these transactions of no entry is required for a transactionevent, select "No journal entry required in the first account field) Wews 2. Prepare the journal entry required for each of these transactions. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 Record the issue of 5,100 common shares for cash, at $16 per share. Record the transaction Record the transaction. Note: Enter debits before credits Transaction General Journal Debit Credit Record entry Clear entry View general Journal 3. Prepare the shareholders' equity section as it should be reported on the 2020 year-end balance sheet At year-end, the accounts reflected a profit of $100. Shareholders' Equity Contributed capital Total contributed capital 0 Shareholders equity $ 0 4-a. Beamsley Corporation has $30,000 in the company's bank account. Should the company declare cash dividends at this time? Yes No 4.b. This part of the question is not part of your Connect assignment. Ar

Beamy Corporation was organized in 2020 to operate financial consulting business. The chartet authorized 12,000 common shores, no par value. During the first year, the following selected transactions were completed a. Issued 5,100 shares of common shares for cash at $16 per share. b. Issued 1100 shares of common shares for cash at $19 per share Required: 1. Show the effects of each transaction on the accounting equation. (Enter any decreases to Assets, Liabilities, or Stockholders Equity with a minus sign.) Transaction itata Shareholders Equity 2. Prepare the journal entry required for each of these transactions of no entry is required for a transactionevent, select "No journal entry required in the first account field) Wews 2. Prepare the journal entry required for each of these transactions. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 Record the issue of 5,100 common shares for cash, at $16 per share. Record the transaction Record the transaction. Note: Enter debits before credits Transaction General Journal Debit Credit Record entry Clear entry View general Journal 3. Prepare the shareholders' equity section as it should be reported on the 2020 year-end balance sheet At year-end, the accounts reflected a profit of $100. Shareholders' Equity Contributed capital Total contributed capital 0 Shareholders equity $ 0 4-a. Beamsley Corporation has $30,000 in the company's bank account. Should the company declare cash dividends at this time? Yes No 4.b. This part of the question is not part of your Connect assignment. Ar

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started