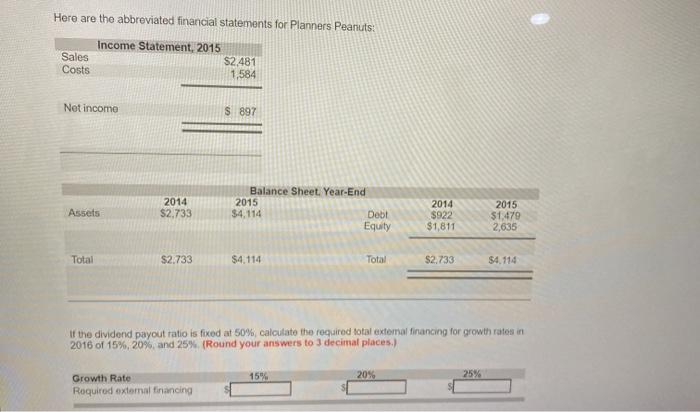

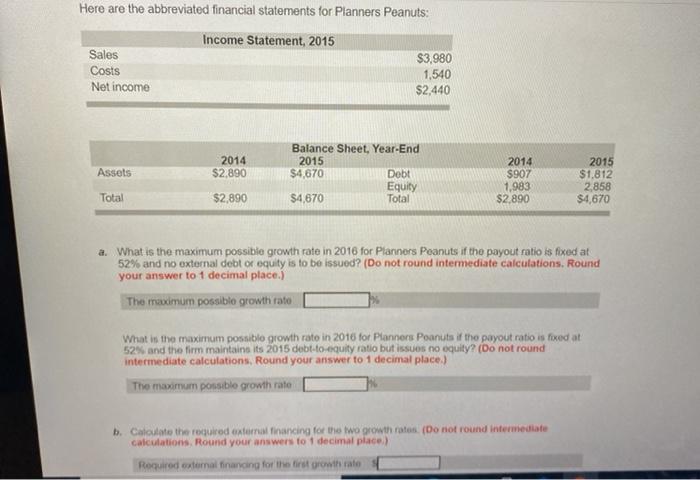

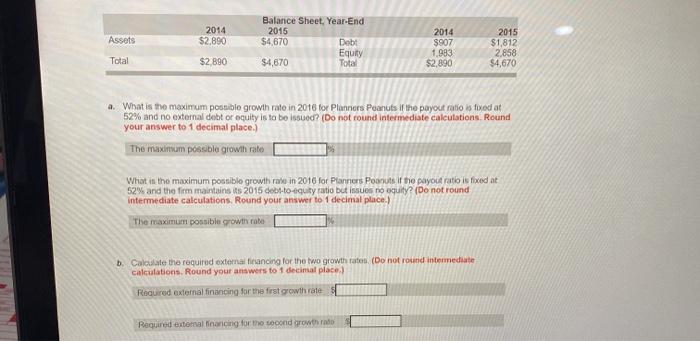

Here are the abbreviated financial statements for Planners Peanuts: Sales Costs Income Statement, 2015 S2,481 1,584 Net income $ 897 Assets 2014 $2.733 Balance Sheets Year-End 2015 $4, 114 Debt Equity 2014 $922 $1,811 2015 $1.479 2,635 Total $2.733 $4,114 Total S2,733 $4,114 If the dividend payout ratio is fixed at 50%, calculate the required total extema financing for growth ratos in 2016 of 15%, 20%, and 25% (Round your answers to 3 decimal places.) 15% 20% 25% Growth Rate Required external financing Here are the abbreviated financial statements for Planners Peanuts: Income Statement, 2015 Sales $3.980 Costs 1,540 Net income $2,440 Assets 2014 $2.890 Balance Sheet, Year-End 2015 $4,670 Debt Equity $4,670 Total 2014 $907 1,983 $2.890 2015 $1.812 2,858 $4,670 Total $2,890 a. What is the maximum possible growth rate in 2016 for Planners Peanuts if the payout ratio is fixed at 52% and no external debt or equity is to be issued? (Do not round intermediate calculations. Round your answer to 1 decimal place.) The maximum possible growth rato What in the maximum possible growth rate in 2016 for Planners Poanuts if the payout ratio is fixed at 52% and the firm maintains its 2015 debt-to-equity ratio but issues no equity? (Do not round intermediate calculations, Round your answer to 1 decimal place.) The maximum possible growth rate b. Calculate the required external financing for the two growth rates (Do not round intermediate calculations, Round your answers to 1 decimal place) Required external financing for the first growth rate Assets 2014 $2.890 Balance Sheet, Year-End 2015 $4,670 Debt Equity $4,670 Total 2014 S907 1.983 $2.890 2015 $1,812 2858 $4,670 Total $2,890 a. What is the maximum possible growth rate in 2016 for Planners Peanuts if the payout ratio is fixed at 52% and no external debt or equity is to be issued? (Do not round intermediate calculations. Round your answer to 1 decimal place.) The maximum possible growth rate What is the maximum possible growth rate in 2016 for Planners Peanuts if the payout ratio is foed at 52% and the firm maintains its 2015 db-to-equity ratio but issues no equity? (Do not round intermediate calculations. Round your answer to 1 decimal place.) The maximum possible growth rate b. Calculate the required extema financing for the two growth rates (Do not round intermediate calculations. Round your answers to 1 decimal place) Required external financing for the first growth rate Required external linancing for the second growth rado Here are the abbreviated financial statements for Planners Peanuts: Sales Costs Income Statement, 2015 S2,481 1,584 Net income $ 897 Assets 2014 $2.733 Balance Sheets Year-End 2015 $4, 114 Debt Equity 2014 $922 $1,811 2015 $1.479 2,635 Total $2.733 $4,114 Total S2,733 $4,114 If the dividend payout ratio is fixed at 50%, calculate the required total extema financing for growth ratos in 2016 of 15%, 20%, and 25% (Round your answers to 3 decimal places.) 15% 20% 25% Growth Rate Required external financing Here are the abbreviated financial statements for Planners Peanuts: Income Statement, 2015 Sales $3.980 Costs 1,540 Net income $2,440 Assets 2014 $2.890 Balance Sheet, Year-End 2015 $4,670 Debt Equity $4,670 Total 2014 $907 1,983 $2.890 2015 $1.812 2,858 $4,670 Total $2,890 a. What is the maximum possible growth rate in 2016 for Planners Peanuts if the payout ratio is fixed at 52% and no external debt or equity is to be issued? (Do not round intermediate calculations. Round your answer to 1 decimal place.) The maximum possible growth rato What in the maximum possible growth rate in 2016 for Planners Poanuts if the payout ratio is fixed at 52% and the firm maintains its 2015 debt-to-equity ratio but issues no equity? (Do not round intermediate calculations, Round your answer to 1 decimal place.) The maximum possible growth rate b. Calculate the required external financing for the two growth rates (Do not round intermediate calculations, Round your answers to 1 decimal place) Required external financing for the first growth rate Assets 2014 $2.890 Balance Sheet, Year-End 2015 $4,670 Debt Equity $4,670 Total 2014 S907 1.983 $2.890 2015 $1,812 2858 $4,670 Total $2,890 a. What is the maximum possible growth rate in 2016 for Planners Peanuts if the payout ratio is fixed at 52% and no external debt or equity is to be issued? (Do not round intermediate calculations. Round your answer to 1 decimal place.) The maximum possible growth rate What is the maximum possible growth rate in 2016 for Planners Peanuts if the payout ratio is foed at 52% and the firm maintains its 2015 db-to-equity ratio but issues no equity? (Do not round intermediate calculations. Round your answer to 1 decimal place.) The maximum possible growth rate b. Calculate the required extema financing for the two growth rates (Do not round intermediate calculations. Round your answers to 1 decimal place) Required external financing for the first growth rate Required external linancing for the second growth rado