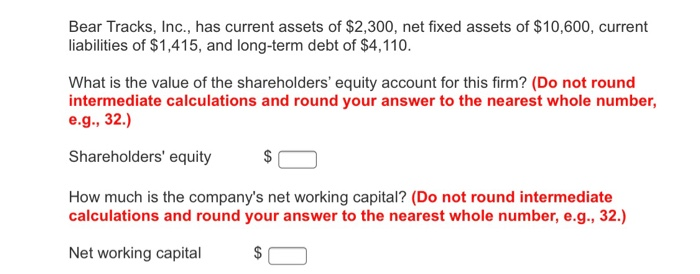

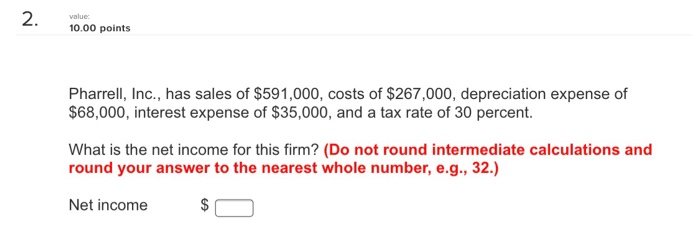

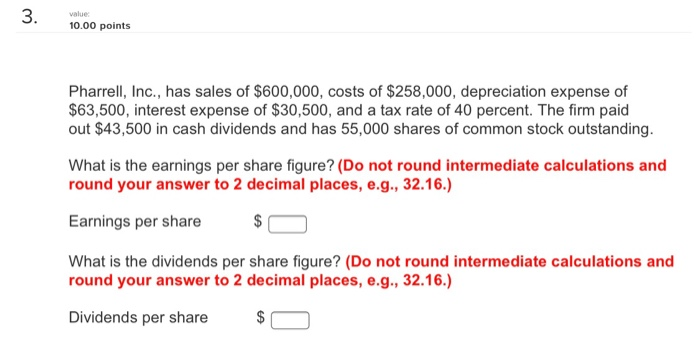

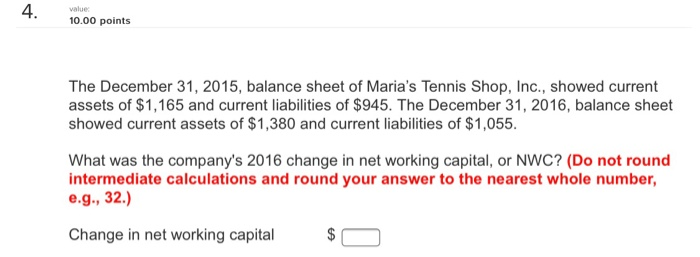

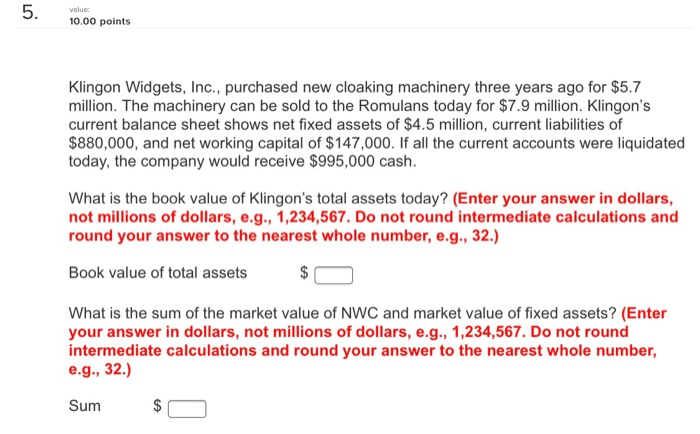

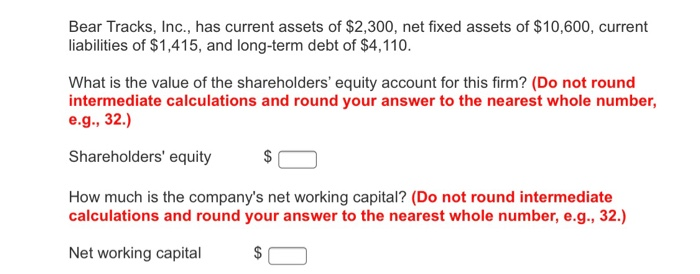

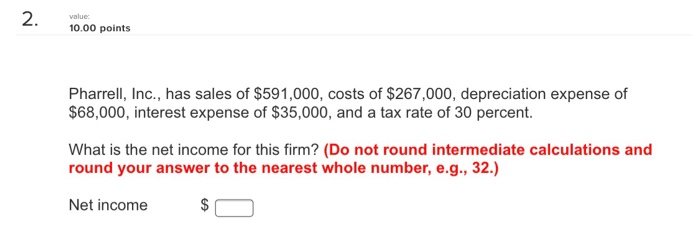

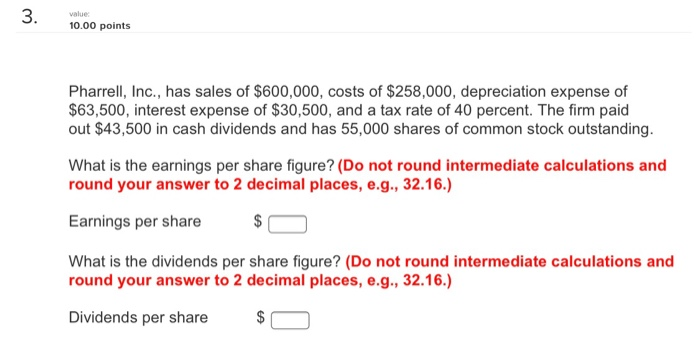

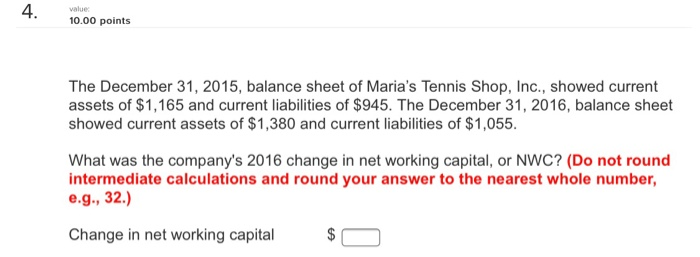

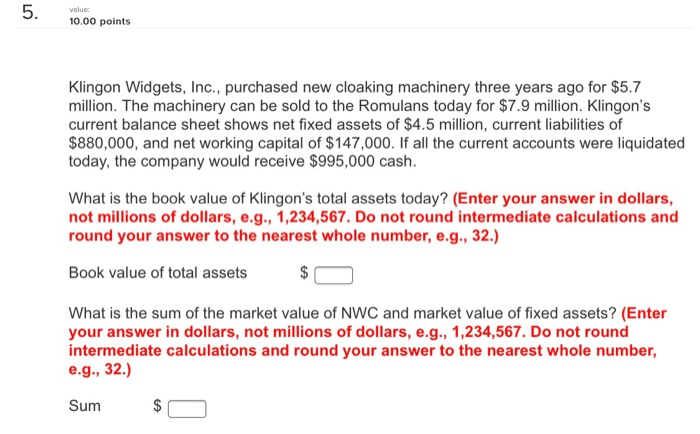

Bear Tracks, Inc., has current assets of $2,300, net fixed assets of $10,600, current liabilities of $1,415, and long-term debt of $4,110. What is the value of the shareholders' equity account for this firm? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) Shareholders' equity $ 0 How much is the company's net working capital? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) Net working capital 2. 10.00 points Pharrell, Inc., has sales of $591,000, costs of $267,000, depreciation expense of $68,000, interest expense of $35,000, and a tax rate of 30 percent. What is the net income for this firm? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) Net income $ 0 3. value 10.00 points Pharrell, Inc., has sales of $600,000, costs of $258,000, depreciation expense of $63,500, interest expense of $30,500, and a tax rate of 40 percent. The firm paid out $43,500 in cash dividends and has 55,000 shares of common stock outstanding. What is the earnings per share figure? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Earnings per share What is the dividends per share figure? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Dividends per share $ 10.00 points The December 31, 2015, balance sheet of Maria's Tennis Shop, Inc., showed current assets of $1,165 and current liabilities of $945. The December 31, 2016, balance sheet showed current assets of $1,380 and current liabilities of $1,055. What was the company's 2016 change in net working capital, or NWC? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) Change in net working capital $0 10.00 points Klingon Widgets, Inc., purchased new cloaking machinery three years ago for $5.7 million. The machinery can be sold to the Romulans today for $7.9 million. Klingon's current balance sheet shows net fixed assets of $4.5 million, current liabilities of $880,000, and net working capital of $147,000. If all the current accounts were liquidated today, the company would receive $995,000 cash. What is the book value of Klingon's total assets today? (Enter your answer in dollars, not millions of dollars, e.g., 1,234,567. Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) Book value of total assets $0 What is the sum of the market value of NWC and market value of fixed assets? (Enter your answer in dollars, not millions of dollars, e.g., 1,234,567. Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) Sum $