Question

Beautee Foo is Ms Leong Hohos 26-year-old niece. After working with her aunt at BBC since graduation, Beautee recognised an increasing popularity for diet health

Beautee Foo is Ms Leong Hoho’s 26-year-old niece. After working with her aunt at BBC since graduation, Beautee recognised an increasing popularity for diet health foods and drinks with the growing influencer culture in Thailand and the region. In view of this business opportunity, Beautee started her first business, producing healthy diet drinks and foods called ShrinkUp Pte Ltd (SPL) in July 2021, selling health bars and drink subscriptions online.

SPL is 85% owned by Beautee, while her aunt contributed the remaining capital. As the majority shareholder of the company, Beautee is the sole decision maker for SPL. In order to reduce the initial start-up costs, SPL is only offering two products (to test the market) – the Pina Colada Shake (PCS) and the Cookies & Cream Diet Bar (CDB), and will expand its product line as demand increases.

Beautee rents a small space in BBB’s factory for SPL’s production operations. 90% of the space is used in the production of the bars and shakes and the remaining space is converted into a small administrative office. One of her aunt’s staff, Aunty Lee, has an interest in health foods and has been seconded from BBB to help Beautee with the making of the bars and shakes, whenever orders are placed. An administrative clerk, Gigi Ho, has been hired to handle all administrative work. SPL engaged MaMa Move, a delivery service provider to deliver its orders to its customers.

The website will accept orders as well as advertise product offerings. Only the costs of the computer equipment and software are accounted for as fixed assets and will be depreciated over 3 years. The rest of the costs of setting up the online website were expensed off in the company’s profit and loss accounts for the first month.

The website publicises the PCS and CDB with pictures and stated prices from which customers can select and drop into a virtual shopping cart. PCS and CDB are sold in batches of 30 and an order comprises 1 batch of either PCS or 1 batch of CDB only. Once the order is confirmed, the customers can then make payment online through PayFriend, a payment service provider. PayFriend charges SPL a processing fee of 8% on the sales amount, capped at a maximum charge of $10 per order.

Upon receiving a confirmed order, Gigi will inform Aunty Lee to start working on the order. Once the bars or shakes are ready for delivery, Gigi will then contact MaMa Move for delivery of the order to the customer. MaMa Move charges a flat rate of $15 per order of PCS and $8 per order of CDB.

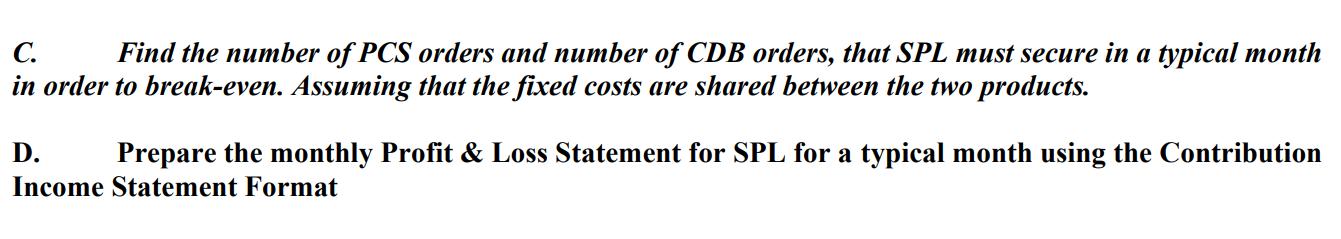

For the first year of operation, the business is expected to handle an estimated 1,600 orders a month of which, 480 are likely to be for PCS and 1,120 for CDB. This sales mix is expected to remain constant throughout the year. PCS and CDB are sold at $150 and $50 per batch respectively and customers enjoy free delivery.

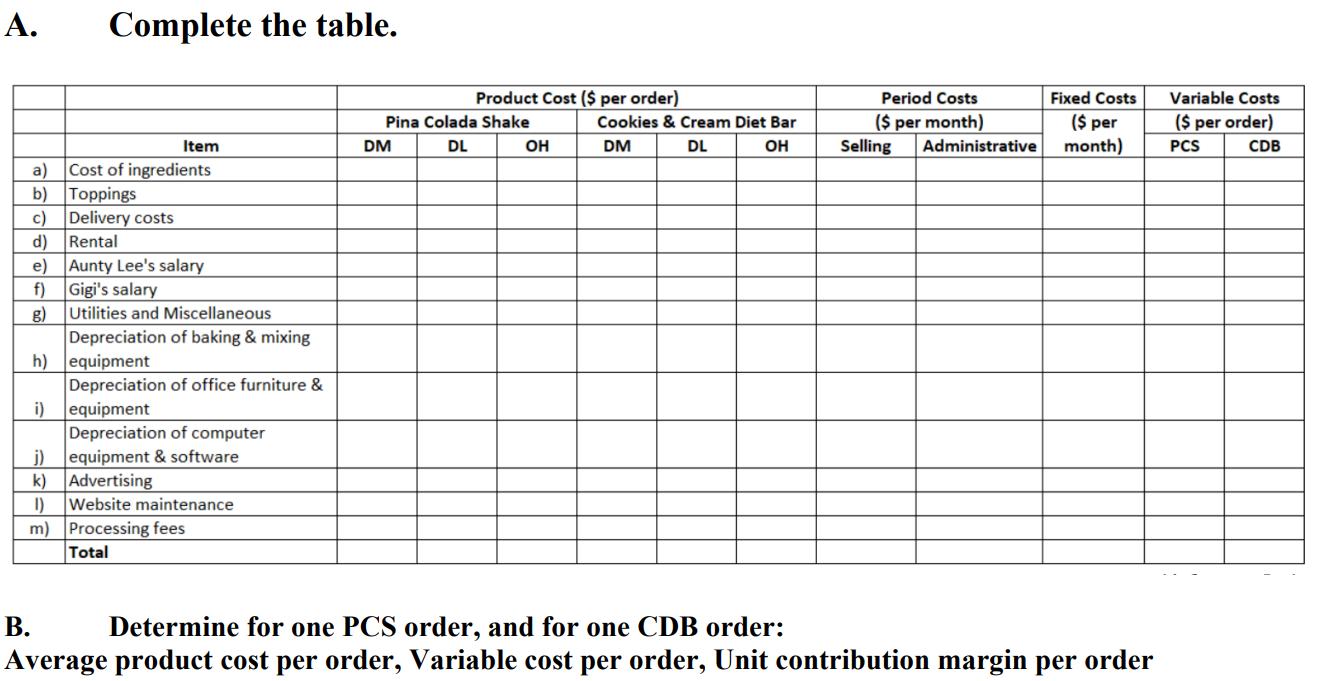

A listing of the costs incurred in a typical month to operate the business is as follows:

- Cost of ingredients amount to an average of $30 per order of PCS and $18 per order of CDB.

- Toppings and packaging for the bars and drinks are about $5 per order of PCS and $3 per order of CDB.

- Cost of delivering the order.

- The rent of the space in the BBB factory is $6,000 per month.

- Aunty Lee, who is in charge of all the production of PCS and CDB, is paid $3.10 per order of PCS and $1.60 per order of CDB that she helps to make. (Ignore employer/employee CPF contributions.)

- Gigi is paid a basic salary of $1,200 per month for administrative work. For every order processed, she will be paid a commission of $1 and $0.50 for PCS and CDB respectively, in addition to her basic salary. (Ignore employer/employee CPF contribution.)

- Utilities and miscellaneous production supplies amount to $5,000 per month.

- Depreciation of baking and mixing equipment, with a useful life of 6 years.

- Depreciation of office furniture and equipment, with a useful life of 5 years.

- Depreciation of computer equipment and software.

- Cost of advertising the business via food blogs and food delivery portals is estimated at $1,250 per month.

- Cost of website maintenance averages $245 per month. Website maintenance is outsourced to an external party who charges based on the number of web programming changes made.

- Processing fees paid to PayFriend.

Additional notes

- Assume there are no other expenses.

- SPL uses the traditional method of assigned fixed factory overhead costs by using the number

- of orders as the cost driver.

- Use the straight-line method to calculate depreciation.

REQUIREMENT

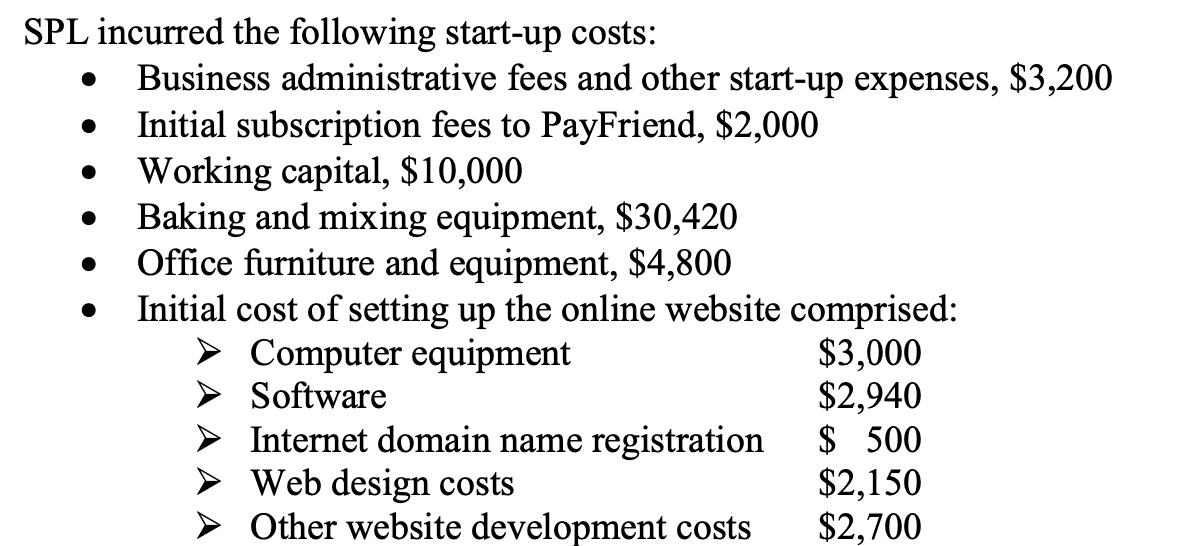

SPL incurred the following start-up costs: Business administrative fees and other start-up expenses, $3,200 Initial subscription fees to PayFriend, $2,000 Working capital, $10,000 Baking and mixing equipment, $30,420 Office furniture and equipment, $4,800 Initial cost of setting up the online website comprised: > Computer equipment $3,000 $2,940 $ 500 $2,150 $2,700 Software Internet domain name registration Web design costs Other website development costs

Step by Step Solution

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

ShrinkUp Pte Ltd SPL Fixed Costs Variable Costs Cookies Cream Diet Bar per month per ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started