Answered step by step

Verified Expert Solution

Question

1 Approved Answer

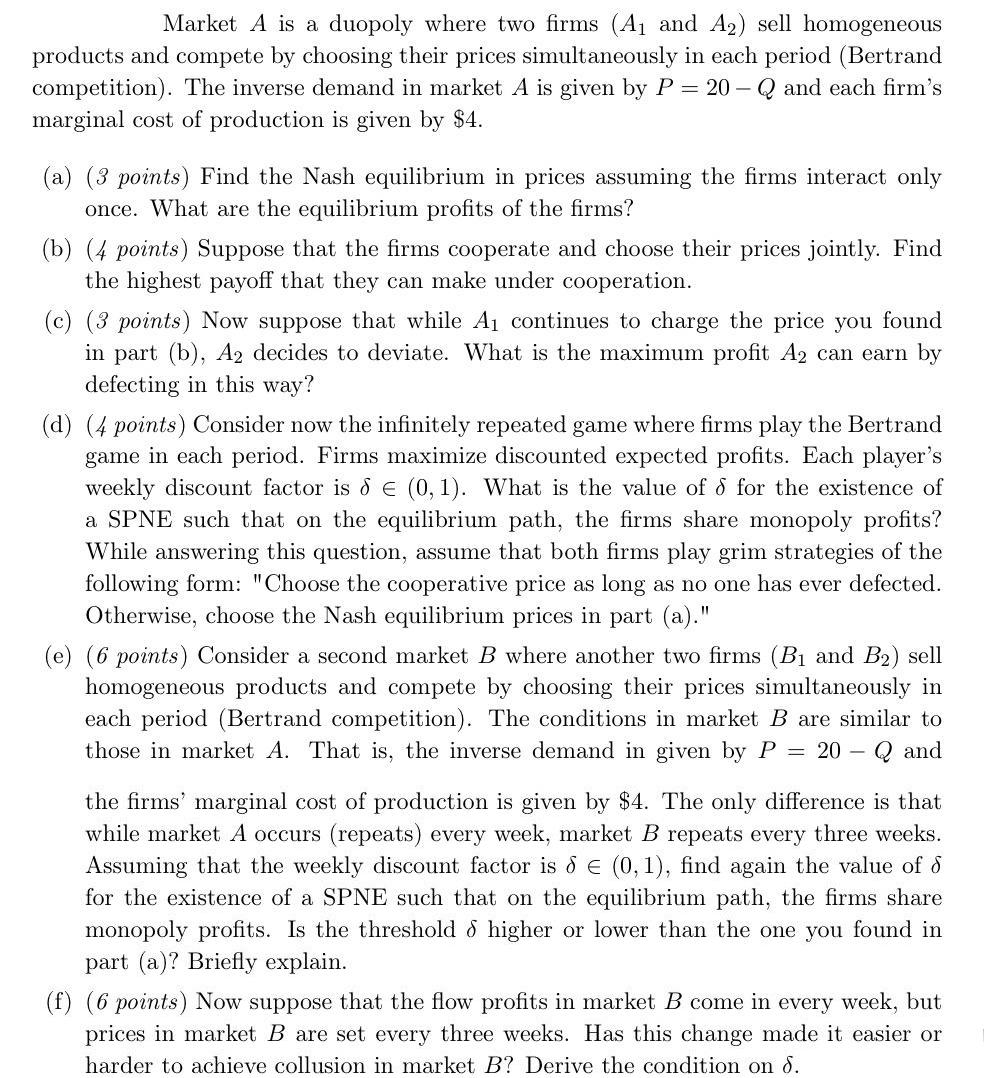

Market A is a duopoly where two firms (A and A) sell homogeneous products and compete by choosing their prices simultaneously in each period

Market A is a duopoly where two firms (A and A) sell homogeneous products and compete by choosing their prices simultaneously in each period (Bertrand competition). The inverse demand in market A is given by P = 20-Q and each firm's marginal cost of production is given by $4. (a) (3 points) Find the Nash equilibrium in prices assuming the firms interact only once. What are the equilibrium profits of the firms? (b) (4 points) Suppose that the firms cooperate and choose their prices jointly. Find the highest payoff that they can make under cooperation. (c) (3 points) Now suppose that while A continues to charge the price you found in part (b), A2 decides to deviate. What is the maximum profit A2 can earn by defecting in this way? (d) (4 points) Consider now the infinitely repeated game where firms play the Bertrand game in each period. Firms maximize discounted expected profits. Each player's weekly discount factor is 8 (0,1). What is the value of d for the existence of a SPNE such that on the equilibrium path, the firms share monopoly profits? While answering this question, assume that both firms play grim strategies of the following form: "Choose the cooperative price as long as no one has ever defected. Otherwise, choose the Nash equilibrium prices in part (a)." (e) (6 points) Consider a second market B where another two firms (B and B) sell homogeneous products and compete by choosing their prices simultaneously in each period (Bertrand competition). The conditions in market B are similar to those in market A. That is, the inverse demand in given by P = 20-Q and the firms' marginal cost of production is given by $4. The only difference is that while market A occurs (repeats) every week, market B repeats every three weeks. Assuming that the weekly discount factor is 8 (0,1), find again the value of d for the existence of a SPNE such that on the equilibrium path, the firms share monopoly profits. Is the threshold & higher or lower than the one you found in part (a)? Briefly explain. (f) (6 points) Now suppose that the flow profits in market B come in every week, but prices in market B are set every three weeks. Has this change made it easier or harder to achieve collusion in market B? Derive the condition on d.

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER a The Nash equilibrium in prices is P 10 and Q 10 The equilibrium profits of each firm are 30 b The highest payoff that the firms can make unde...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started