Question

Beckman Engineering and Associates (BEA) is considering a change in its capital structure. BEA currently has $20 million in debt carrying a rate of 8%,

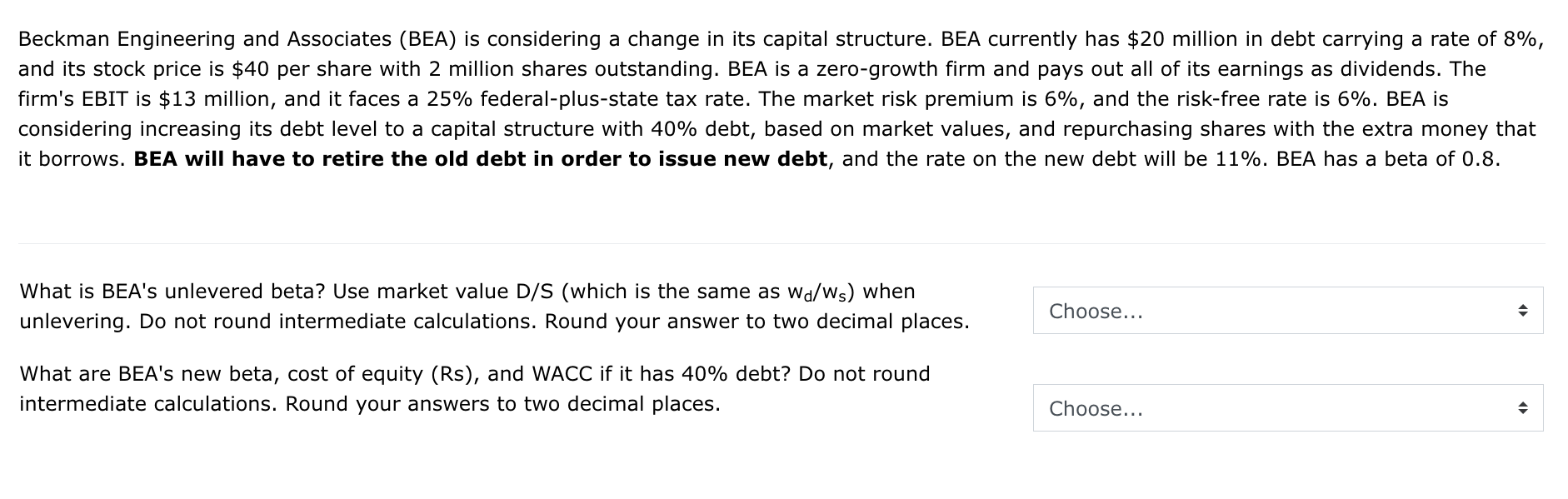

Beckman Engineering and Associates (BEA) is considering a change in its capital structure. BEA currently has $20 million in debt carrying a rate of 8%, and its stock price is $40 per share with 2 million shares outstanding. BEA is a zero-growth firm and pays out all of its earnings as dividends. The firm's EBIT is $13 million, and it faces a 25% federal-plus-state tax rate. The market risk premium is 6%, and the risk-free rate is 6%. BEA is considering increasing its debt level to a capital structure with 40% debt, based on market values, and repurchasing shares with the extra money that it borrows. BEA will have to retire the old debt in order to issue new debt, and the rate on the new debt will be 11%. BEA has a beta of 0.8.

Beckman Engineering and Associates (BEA) is considering a change in its capital structure. BEA currently has $20 million in debt carrying a rate of 8%, and its stock price is $40 per share with 2 million shares outstanding. BEA is a zero-growth firm and pays out all of its earnings as dividends. The firm's EBIT is $13 million, and it faces a 25% federal-plus-state tax rate. The market risk premium is 6%, and the risk-free rate is 6%. BEA is considering increasing its debt level to a capital structure with 40% debt, based on market values, and repurchasing shares with the extra money that it borrows. BEA will have to retire the old debt in order to issue new debt, and the rate on the new debt will be 11%. BEA has a beta of 0.8.

What is BEA's unlevered beta? Use market value D/S (which is the same as wd/ws) when unlevering. Do not round intermediate calculations. Round your answer to two decimal places.

What are BEA's new beta, cost of equity (Rs), and WACC if it has 40% debt? Do not round intermediate calculations. Round your answers to two decimal places.

Beckman Engineering and Associates (BEA) is considering a change in its capital structure. BEA currently has $20 million in debt carrying a rate of 8%, and its stock price is $40 per share with 2 million shares outstanding. BEA is a zero-growth firm and pays out all of its earnings as dividends. The firm's EBIT is $13 million, and it faces a 25% federal-plus-state tax rate. The market risk premium is 6%, and the risk-free rate is 6%. BEA is considering increasing its debt level to a capital structure with 40% debt, based on market values, and repurchasing shares with the extra money that it borrows. BEA will have to retire the old debt in order to issue new debt, and the rate on the new debt will be 11%. BEA has a beta of What is BEA's unlevered beta? Use market value D/S (which is the same as wd/ws ) when unlevering. Do not round intermediate calculations. Round your answer to two decimal places. What are BEA's new beta, cost of equity (Rs), and WACC if it has 40% debt? Do not round intermediate calculations. Round your answers to two decimal placesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started