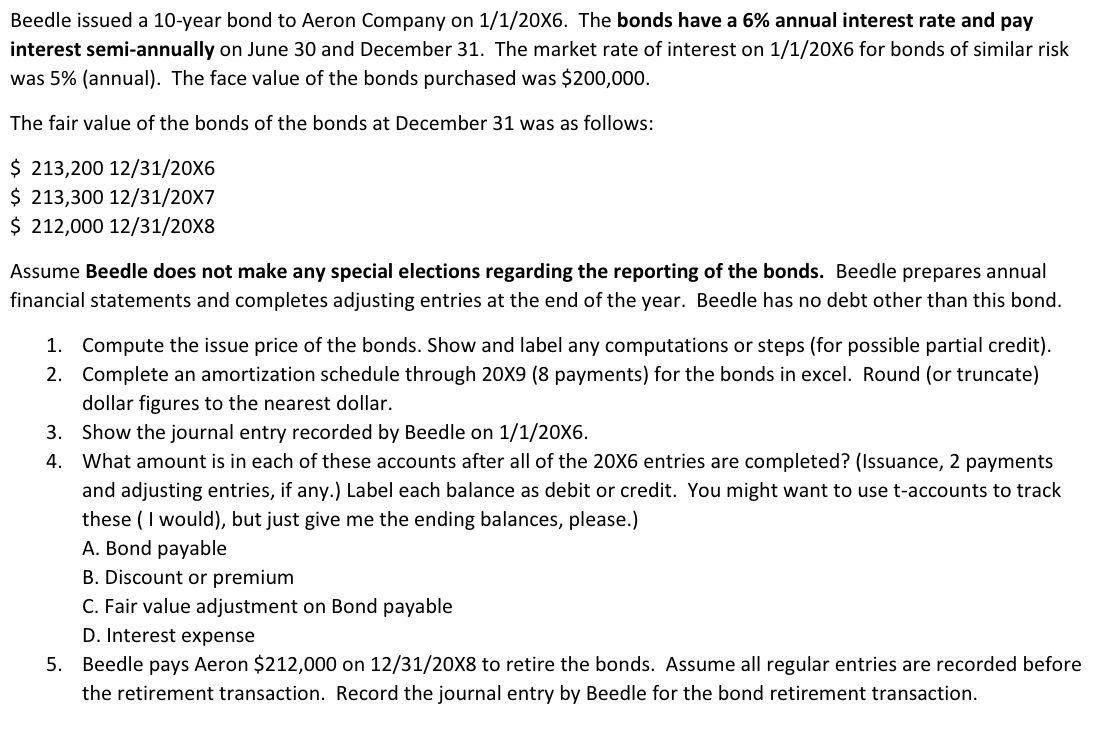

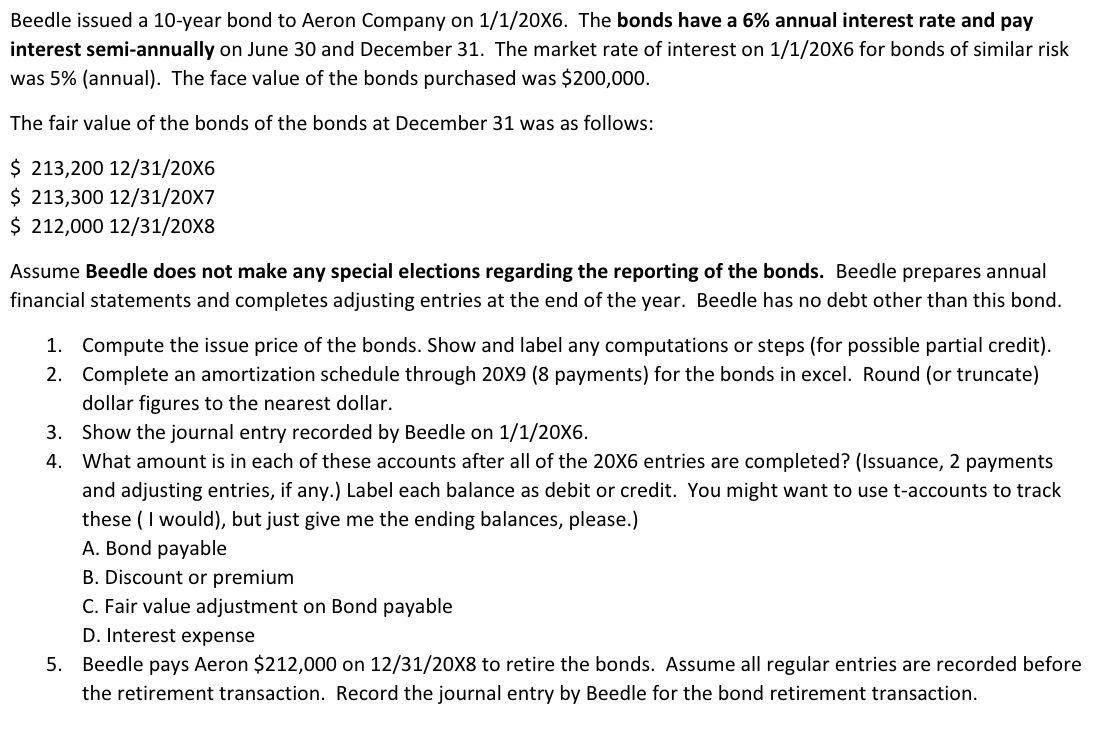

Beedle issued a 10-year bond to Aeron Company on 1/1/20X6. The bonds have a 6% annual interest rate and pay interest semi-annually on June 30 and December 31. The market rate of interest on 1/1/206 for bonds of similar risk was 5% (annual). The face value of the bonds purchased was $200,000. The fair value of the bonds of the bonds at December 31 was as follows: $213,20012/31/206$213,30012/31/207$212,00012/31/208 Assume Beedle does not make any special elections regarding the reporting of the bonds. Beedle prepares annual financial statements and completes adjusting entries at the end of the year. Beedle has no debt other than this bond. 1. Compute the issue price of the bonds. Show and label any computations or steps (for possible partial credit). 2. Complete an amortization schedule through 20X9 (8 payments) for the bonds in excel. Round (or truncate) dollar figures to the nearest dollar. 3. Show the journal entry recorded by Beedle on 1/1/206. 4. What amount is in each of these accounts after all of the 206 entries are completed? (Issuance, 2 payments and adjusting entries, if any.) Label each balance as debit or credit. You might want to use t-accounts to track these (I would), but just give me the ending balances, please.) A. Bond payable B. Discount or premium C. Fair value adjustment on Bond payable D. Interest expense 5. Beedle pays Aeron $212,000 on 12/31/20X8 to retire the bonds. Assume all regular entries are recorded before the retirement transaction. Record the journal entry by Beedle for the bond retirement transaction. Beedle issued a 10-year bond to Aeron Company on 1/1/20X6. The bonds have a 6% annual interest rate and pay interest semi-annually on June 30 and December 31. The market rate of interest on 1/1/206 for bonds of similar risk was 5% (annual). The face value of the bonds purchased was $200,000. The fair value of the bonds of the bonds at December 31 was as follows: $213,20012/31/206$213,30012/31/207$212,00012/31/208 Assume Beedle does not make any special elections regarding the reporting of the bonds. Beedle prepares annual financial statements and completes adjusting entries at the end of the year. Beedle has no debt other than this bond. 1. Compute the issue price of the bonds. Show and label any computations or steps (for possible partial credit). 2. Complete an amortization schedule through 20X9 (8 payments) for the bonds in excel. Round (or truncate) dollar figures to the nearest dollar. 3. Show the journal entry recorded by Beedle on 1/1/206. 4. What amount is in each of these accounts after all of the 206 entries are completed? (Issuance, 2 payments and adjusting entries, if any.) Label each balance as debit or credit. You might want to use t-accounts to track these (I would), but just give me the ending balances, please.) A. Bond payable B. Discount or premium C. Fair value adjustment on Bond payable D. Interest expense 5. Beedle pays Aeron $212,000 on 12/31/20X8 to retire the bonds. Assume all regular entries are recorded before the retirement transaction. Record the journal entry by Beedle for the bond retirement transaction