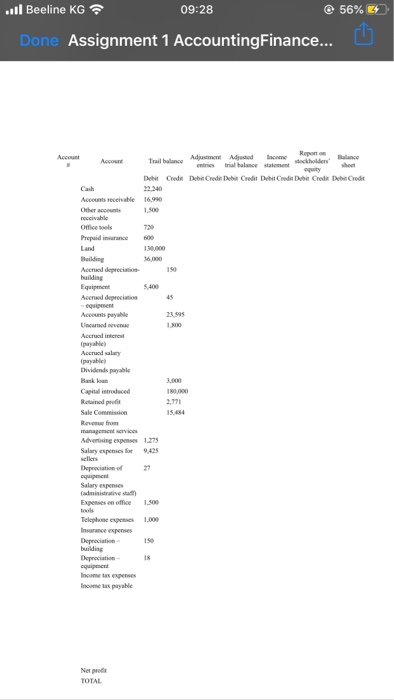

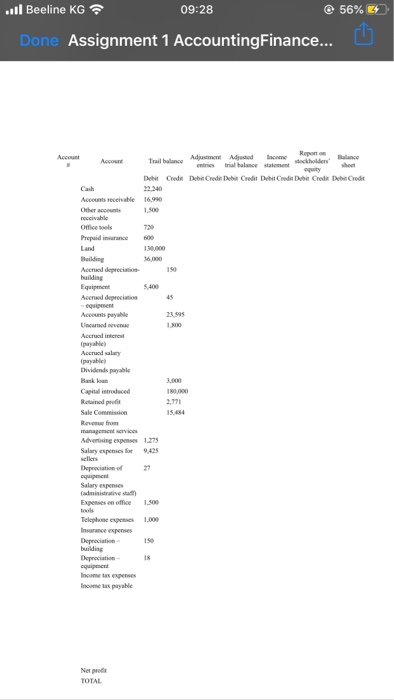

.. Beeline KG 09:28 55% Done Assignment 1 Accounting Finance... Economics, Inc. has started its operation in late 2016. At the beginning it was generating revenue from sales commission and after it expanded its operation by providing management services. By the end of 2017 the company has hired you as independent consultant to help with comprising final balance sheet and income statement. Required: 1. Provide ALL adjustments by the end of 2017. 2. Fill in the worksheet. 3. Prepare closing entries, income statement, statement of retained earnings, and balance sheet for 2017. The following information has been presented to you by the end of the year: 1. On November 01, 2017 the company paid USD 600 insurance fee for 1 year. At that time the company debited Prepaid rent account. 2. The beginning balance of office tools on December 01, 2017 were equaled to USD 720. All purchases of office tools were debited on account Expenses on office tools. The ending balance of office tools by the end of year was USD 319. 3. In January 01, 2017 the company purchased a building, The company has accrued depreciation only for first months of USD 150. The non-accrued balance of depreciation for 2017 is USD 1,650. 4. On January 01, 2017 the company also purchased an equipment for USD 5,400. The depreciation also was not recognized for 11 months of USD 495. 5. On September 2017 the company has signed contract with client for 6 month period. The client has paid this amount on September 30, 2017. 6. On November 21 the company obtained a loan from local bank of USD 3,000. The term is 3 years and interest rate 36.5%. Interest is paid every three months and accrued on 365 daily basis. 7. On December 20 the company hired a new accountant. She worked for 20 days at rate of USD 30 per day. The salary for December will be paid in January 5, 2018. 8. In December the company also hired a new employee. His salary is comprised form sales commissions. By the end of the year he did not sell anything. 9. On December 31 the company declared dividends of USD 900. ... Beeline KG 09:28 56% E Done Assignment 1 Accounting Finance... Date Code Darodie Credit Code de de A 16.99 o le Offices Prince Acord de Accued depreca equipe Acts payable Ungured 23.995 (payable) Accrud salary Dividend pale 10.000 Capital introduced Retained profit Sale Commission 2.971 Avg Salary expenses 1275 425 Depreciatio Tel .000 TOTAL