Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Before AUSING LTD approaches the bank for a loan the company has asked their internal credit department to see if the firm can generate

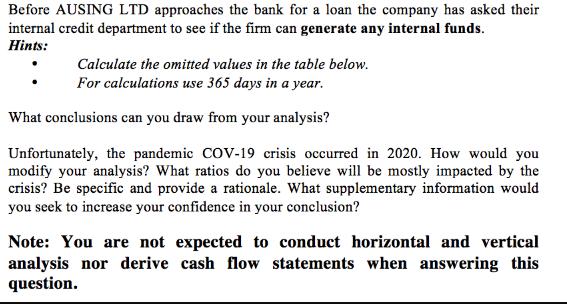

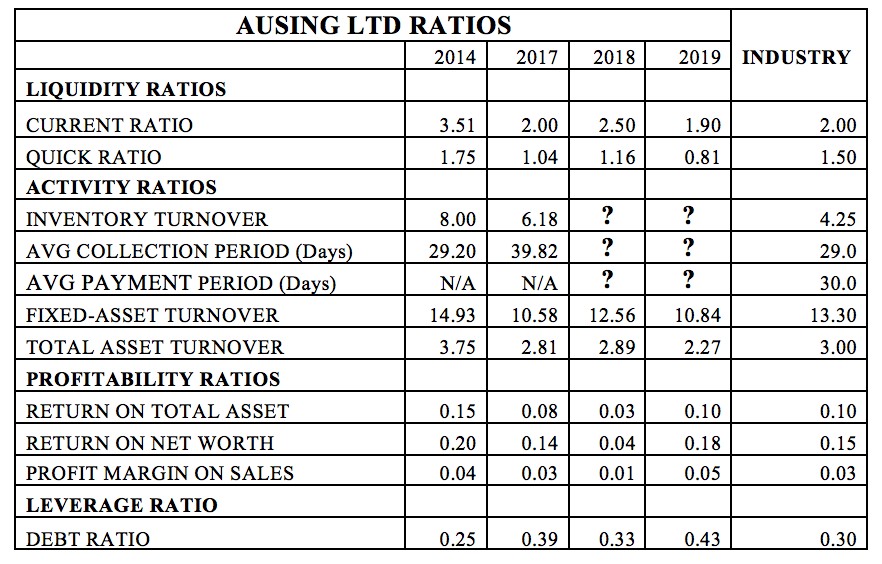

Before AUSING LTD approaches the bank for a loan the company has asked their internal credit department to see if the firm can generate any internal funds. Hints: Calculate the omitted values in the table below. For calculations use 365 days in a year. What conclusions can you draw from your analysis? Unfortunately, the pandemic COV-19 crisis occurred in 2020. How would you modify your analysis? What ratios do you believe will be mostly impacted by the crisis? Be specific and provide a rationale. What supplementary information would you seek to increase your confidence in your conclusion? Note: You are not expected to conduct horizontal and vertical analysis nor derive cash flow statements when answering this question. AUSING LTD RATIOS 2014 LIQUIDITY RATIOS CURRENT RATIO QUICK RATIO ACTIVITY RATIOS INVENTORY TURNOVER AVG COLLECTION PERIOD (Days) AVG PAYMENT PERIOD (Days) FIXED-ASSET TURNOVER TOTAL ASSET TURNOVER PROFITABILITY RATIOS RETURN ON TOTAL ASSET RETURN ON NET WORTH PROFIT MARGIN ON SALES LEVERAGE RATIO DEBT RATIO 3.51 1.75 8.00 29.20 N/A 14.93 3.75 0.15 0.20 0.04 0.25 2017 2018 2019 INDUSTRY 2.00 2.50 1.04 1.16 6.18 39.82 N/A 10.58 12.56 2.81 2.89 ? ? ? 0.08 0.03 0.14 0.04 0.03 0.01 0.39 0.33 1.90 0.81 ? ? ? 10.84 2.27 0.10 0.18 0.05 0.43 2.00 1.50 4.25 29.0 30.0 13.30 3.00 0.10 0.15 0.03 0.30 AUSING LTD INCOME STATEMENT AND BALANCE SHEET 2014 INCOME STATEMENT NET SALES COGS GROSS PROFIT ADMIN, SELLING & INTEREST DEPRECIATION MISCELLANEOUS NET INCOME BEFORE TAX TAXES @ 40% NET INCOME BALANCE SHEET CASH ACCOUNTS RECEIVABLE INVENTORY TOTAL CURRENT ASSETS LAND & BUILDING MACHINERY OTHER FIXED ASSETS TOTAL ASSETS BANK NOTES PAYABLE ACCOUNTS PAYABLE ACCRUALS TOTAL CURRENT LIABILITIES MORTGAGE COMMON STOCK RETAINED EARNINGS TOTAL LIABILITY & EQUITY $5,000,000 $4,000,200 $ 999,800 $ 521,467 $ 80,000 EA GA 2018 2019 2017 $4,400,000| $ 5,600,000| $ 4,500,000 $3,400,000 $ 4,500,000 | $ 3,500,000 $1,000,000 $1,100,000 $1,000,000 $ 849,667 $ 519,000 $ 72,000 $ 582,000 $ 105,000 $ 80,000 77,000 $ 71,500 93,333 $ 337,500 $ 135,000 $ 202,500 $ 65,000 $ 93,000 $333,333 $ 220,000 $ $ 133,333 $ 88,000 $ 37,333 $ 200,000 $ 132,000 $ 56,000 EA EA EA $ $ 285,000 $ 575,000 50,000 $ 40,000 $ 900,000 $ 900,000 $ 100,000 $ 51,000 $1,335,000 $1,566,000 $ EA GA 2014 2017 $ 2018 2019 90,000 $ 70,000 $ 600,000 100,000 $ 120,000 $ 400,000 $ 480,000 $ $ 550,000 $ $ 500,000 $ 1,000,000 $ 1,490,000 $ 600,000 $ 800,000 $ 900,000 $ 1,150,000 $ 1,570,000 $ 100,000 $ 90,000 $ 217,000 $ 221,000 150,000 $ 260,000 $ 202,000 $ 179,000 $ 85,000 $ 66,000 $ 27,000 $ 15,000 $ 1,335,000 $ 1,566,000 | $ 1,936,000| $ 1,985,000 $ 47,000 $ 53,000 $ 110,000 $ 473,000 $ 156,000 $ 171,500 $ 233,800 $319,000 $ 82,000 $ 350,500 $ 252,200 $ 34,300 $ 596,000 $ 826,300 $ 36,000 $ 33,000 $ 1,150,000 $ 867,000 $ 154,000 $ 258,700 $1,936,000 $1,985,000

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To analyze the given data and calculate the omitted values we will focus on the ratios provided in the table Lets start by calculating the missing val...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started