Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In Australia, the Reserve Bank of Australia (RBA) is responsible for creating fiat money, in a number of forms that include coins and (plastic)

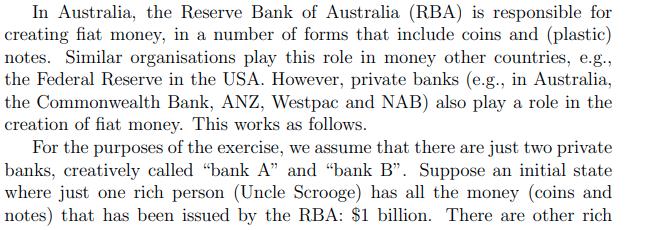

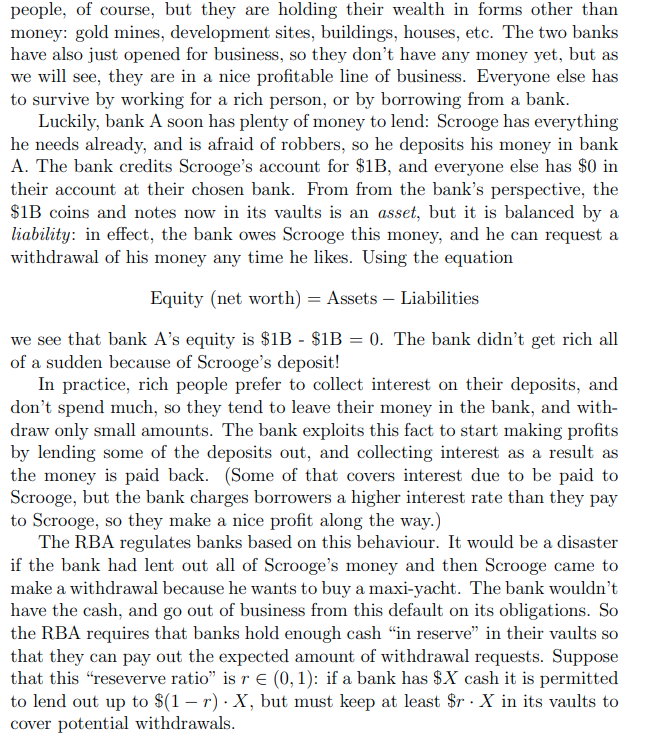

In Australia, the Reserve Bank of Australia (RBA) is responsible for creating fiat money, in a number of forms that include coins and (plastic) notes. Similar organisations play this role in money other countries, e.g., the Federal Reserve in the USA. However, private banks (e.g., in Australia, the Commonwealth Bank, ANZ, Westpac and NAB) also play a role in the creation of fiat money. This works as follows. For the purposes of the exercise, we assume that there are just two private banks, creatively called "bank A" and "bank B". Suppose an initial state where just one rich person (Uncle Scrooge) has all the money (coins and notes) that has been issued by the RBA: $1 billion. There are other rich people, of course, but they are holding their wealth in forms other than money: gold mines, development sites, buildings, houses, etc. The two banks have also just opened for business, so they don't have any money yet, but as we will see, they are in a nice profitable line of business. Everyone else has to survive by working for a rich person, or by borrowing from a bank. Luckily, bank A soon has plenty of money to lend: Scrooge has everything he needs already, and is afraid of robbers, so he deposits his money in bank A. The bank credits Scrooge's account for $1B, and everyone else has $0 in their account at their chosen bank. From from the bank's perspective, the $1B coins and notes now in its vaults is an asset, but it is balanced by a liability: in effect, the bank owes Scrooge this money, and he can request a withdrawal of his money any time he likes. Using the equation Equity (net worth) = Assets - Liabilities we see that bank A's equity is $1B - $1B = 0. The bank didn't get rich all of a sudden because of Scrooge's deposit! In practice, rich people prefer to collect interest on their deposits, and don't spend much, so they tend to leave their money in the bank, and with- draw only small amounts. The bank exploits this fact to start making profits by lending some of the deposits out, and collecting interest as a result as the money is paid back. (Some of that covers interest due to be paid to Scrooge, but the bank charges borrowers a higher interest rate than they pay to Scrooge, so they make a nice profit along the way.) The RBA regulates banks based on this behaviour. It would be a disaster if the bank had lent out all of Scrooge's money and then Scrooge came to make a withdrawal because he wants to buy a maxi-yacht. The bank wouldn't have the cash, and go out of business from this default on its obligations. So the RBA requires that banks hold enough cash in reserve" in their vaults so that they can pay out the expected amount of withdrawal requests. Suppose that this "reseverve ratio" is r (0, 1): if a bank has $X cash it is permitted to lend out up to $(1-r). X, but must keep at least $r. X in its vaults to cover potential withdrawals. Let's say that bank A lends out the $(1-r) 1B to Alice for her gold mining project, and Alice uses it to buy a gold mine and equipment from Bob, who deposits this money in bank B. How much "money" is there now in the economy? One way to answer this is to ask how much money people have in their bank accounts. Well, Scrooge has $1B in his account at bank A, 2 and Bob has (1-r). $1B in his at bank B, so there is now (1+(1-r)). $1B total in people's bank accounts. (Of course, some of them have to pay it back over time, but for the moment, this is money that could potentially be spent on goods and services.) The total amount of notes and coins in the economy is still the same. Bank A has $r 1B worth, and $(1 r) 1B has just been transferred to bank B, for a total of $1B. (a) Of course, the story does not end here. Bank B would like to make some money by collecting interest from loans as well, so it lends out some of the cash it now has in its vaults to Carol for her project to build student apartment towers. If it follows the RBA's rules about keeping money in reserve, what is the maximum it can lend to Carol? (b) Carol takes her maximum size loan and uses the money to buy a de- velopment site from Arthur, who deposits the money in bank A. What is the total amount of deposits now in the banking system? (c) After receiving Arthur's deposit, how much money is bank A able to issue in new loans? (Don't count the loan already made to Alice!) (d) Suppose this story is continued ad infinitum, with a bank making max- imum size loans at each step, and the money lent being deposited in the other bank. How much money in total is in people's accounts in the limit? Express this as simply as you can, and explain your answer. (Hint: there is an equation somewhere in the slides for weeks 1-2 that helps with this question.) (e) Suppose this story has been proceeding for a few years. What would happen if there was suddenly a pandemic, and Scrooge and the other rich people who had sold their gold mines and development sites and houses etc., started to worry that there would be mass unemployment and many of the people who had borrowed money would not be able to repay their loans? What might this have to do with the following diagram from the RBA?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Money Creation and the Banking System a Maximum loan to Carol Bank B can lend a maximum of 1r1r1B to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started