Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The accounts of 2,500 credit card customers out of a sample of 35,000 that were reviewed did not perform satisfactorily. The credit scores assigned

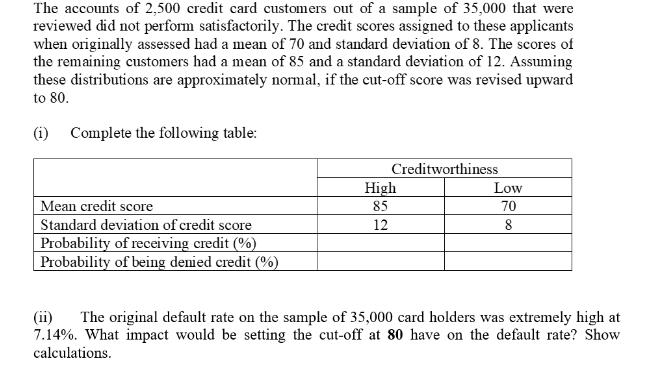

The accounts of 2,500 credit card customers out of a sample of 35,000 that were reviewed did not perform satisfactorily. The credit scores assigned to these applicants when originally assessed had a mean of 70 and standard deviation of 8. The scores of the remaining customers had a mean of 85 and a standard deviation of 12. Assuming these distributions are approximately normal, if the cut-off score was revised upward to 80. (1) Complete the following table: Mean credit score Standard deviation of credit score Probability of receiving credit (%) Probability of being denied credit (%) Creditworthiness High 85 12 Low 70 8 (ii) The original default rate on the sample of 35,000 card holders was extremely high at 7.14%. What impact would be setting the cut-off at 80 have on the default rate? Show calculations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Credit Card Default Rate Analysis i Completing the Table Creditworthiness Mean credit score Standard ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started