Question: Before you begin, print out all the pages in this workbook. The unadjusted trial balance of Morgan Manufacturing Corp. at December 31, 2019 is

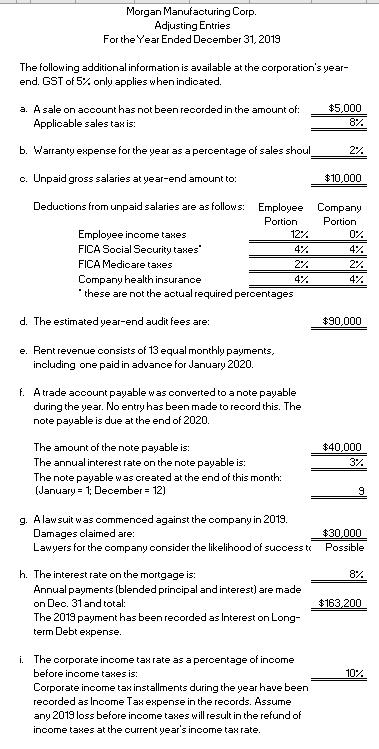

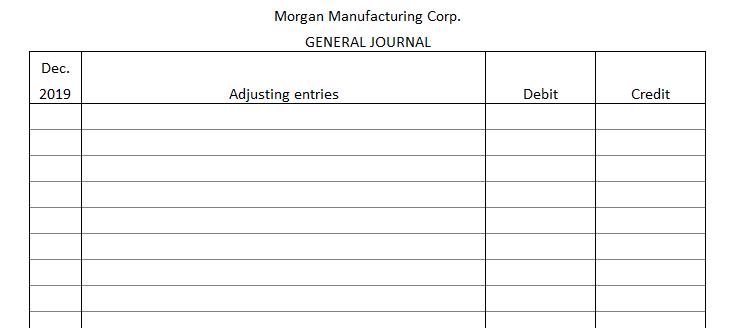

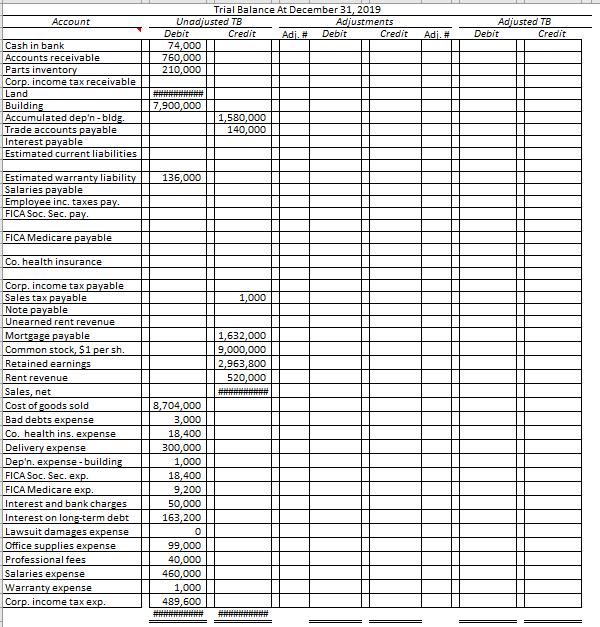

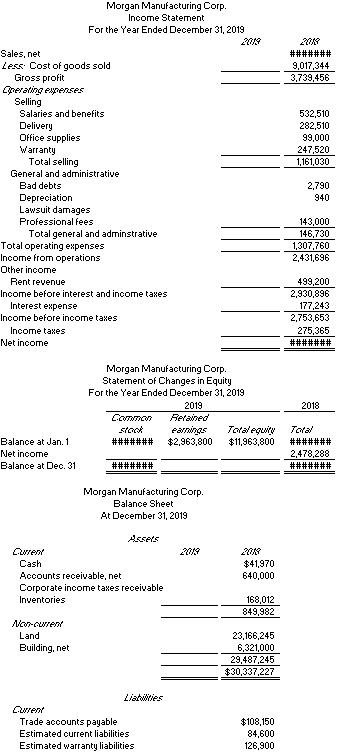

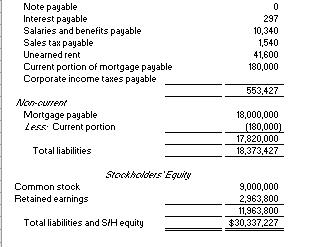

Before you begin, print out all the pages in this workbook. The unadjusted trial balance of Morgan Manufacturing Corp. at December 31, 2019 is shown on the "Trial Bal" page (see tab below). Refer also to the additional year- end information for the company shown on the "Adjusting Entries" page (see tab below). Required: 1 Prepare year-end adjusting entries. General ledger account numbers are not necessary. Show your calculations below each adjusting entry. 2 Post the adjusting entries to the trial balance and prepare an adjusted trial balance. 3 Using the amounts from the adjusted trial balance, complete the financial statements for the year ended December 31, 2019. Morgan Manufacturing Corp. Adjusting Entries For the Year Ended December 31, 2019 The following additional information is available at the corporation's year- end. GST of 5% only applies when indicated. a. Asale on account has not been recorded in the amount of: Applicable sales tax is: $5,000 8% b. Warranty expense for the year as a percentage of sales shoul 2% c. Unpaid gross salaries at year-end amount to: $10,000 Deductions from unpaid salaries are as follows: Employee Company Portion Portion Employee income taxes FICA Social Security taxes 12% 0% 4% 4% FICA Medicare taxes 2% 2% Company health insurance these are not the actual required percentages 4% 4% d. The estimated year-end audit fees are: $90,000 e. Rent revenue consists of 13 equal monthly payments, including one paid in advance for January 2020. f. Atrade account payable was converted to a note payable during the year. No entry has been made to record this. The note payable is due at the end of 2020. The amount of the note payable is: The annual interest rate on the note payable is: $40,000 3% The note payable was created at the end of this month: (January- 1: December = 12) g. Alawsuit was commenced against the company in 2019. Damages claimed are: Lawyers for the company consider the likelihood of success to $30,000 Possible h. The interest rate on the mortgage is: 8% Annual payments (blended principal and interest) are made on Dec. 31 and total: The 2019 payment has been recorded as Interest on Long- term Debt expense. $163.200 i. The corporate income tax rate as a percentage of income before income taxes is: 10% Corporate income tax installments during the year have been recorded as Income Tax expense in the records. Assume any 2019 loss before income taxes will result in the refund of income taxes at the current year's income tax rate. Morgan Manufacturing Corp. GENERAL JOURNAL Dec. 2019 Adjusting entries Debit Credit Trial Balance At December 31, 2019 Adjustments Credit Unadjusted TB Debit 74,000 760,000 210,000 Adjusted TB Debit Account Credit Adj. # Debit Adj. # Credit Cash in bank Accounts receivable Parts inventory Corp. income tax receivable Land Building Accumulated dep'n -bldg. Trade accounts payable Interest payable Estimated current liabilities 7,900,000 1,580,000 140,000 Estimated warranty liability Salaries payable Employee inc. taxes pay. FICA Soc. Sec. pay. 136,000 FICA Medicare payable Co. health insurance op. income tx ayable Sales tax payable Note payable 1,000 Unearned rent revenue Mortgage payable Common stock, $1 per sh. Retained earnings Rent revenue Sales, net Cost of goods sold Bad debts expense Co. health ins. expense Delivery expense Dep'n. expense -building FICA Soc. Sec. exp. FICA Medicare exp. Interest and bank charges Interest on long-term debt Lawsuit damages expense Office supplies expense 1,632,000 9,000,000 2,963,800 520,000 8,704,000 3,000 18,400 300,000 1,000 18,400 9,200 50,000 163,200 99,000 40,000 460,000 1,000 489,600 Professional fees Salaries expense Warranty expense Corp. income tax exp. Morgan Manufacturing Corp. Income Statement For the Year Ended December 31, 2019 2013 208 Sales, net Less: Cost of goods sold Gross profit Cperating espernses Selling ####### 9,017,344 3,739,456 Salaries and benefits 532,510 Delivery Office supplies Warranty Total selling 282,510 99,000 247,520 1,161,030 General and administrative Bad debts 2,790 Depreciation Lawsuit damages Professional fees Total general and adminstrative 940 143,000 Total operating expenses Income from operations 146,730 1,307,760 2,431,696 Other income Rent revenue Income before interest and income taxes Interest expense Income before income taxes 499,200 2,930,896 177,243 2,753,653 275,365 ####### Income taxes Net income Morgan Manufacturing Corp. Statement of Changes in Equity For the Year Ended December 31, 2019 2019 2018 Commen stock Retained earnings $2,963,800 Total eguity $11,963,800 Toral Balance at Jan. 1 ####### ####### Net income 2,478,288 ####### Balance at Dec. 31 ####### Morgan Manufacturing Corp. Balance Sheet At December 31, 2019 Assets Curent 2013 2018 Cash $41,970 640,000 Accounts receivable, net Corporate inoome taxes receivable Inventories 168,012 849,982 Non-curent Land 23,166,245 6,321,000 29,487,245 $30,337,227 Building, net Liatiies Curent Trade accounts payable $108,150 84,600 126,900 Estimated current liabilities Estimated warranty liabilities Note payable Interest payable Salaries and benefits payable Sales tax payable 297 10,340 1,540 41,600 180,000 Unearned rent Current portion of mortgage payable Corporate income taxes payable 553,427 Non-curent Mortgage payable Less: Current portion 18,000,000 (180,000) 17,820,000 Total liabilities 18,373,427 Stockhclders 'Equity Common stock 9,000,000 Retained earnings 2,963,800 11,963,800 $30,337,227 Total liabilities and SH equity

Step by Step Solution

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Answer Note The Balances of Unadjusted Trial Balance is not matching hence financial statements cannot be prepared the required adjusting entries and ... View full answer

Get step-by-step solutions from verified subject matter experts