\

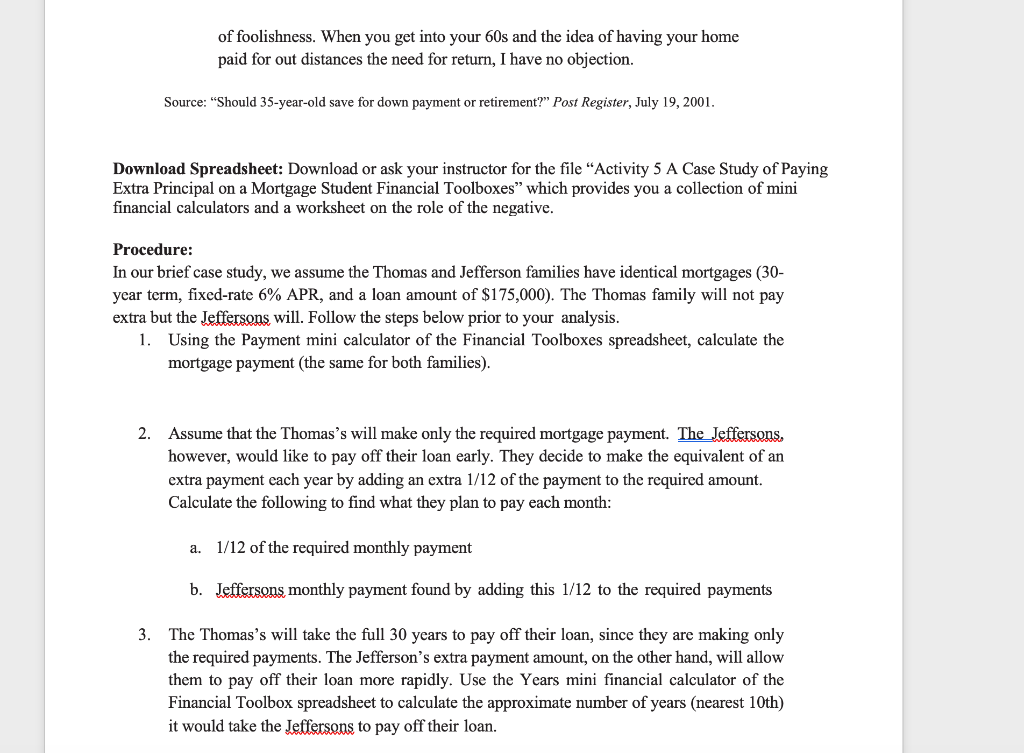

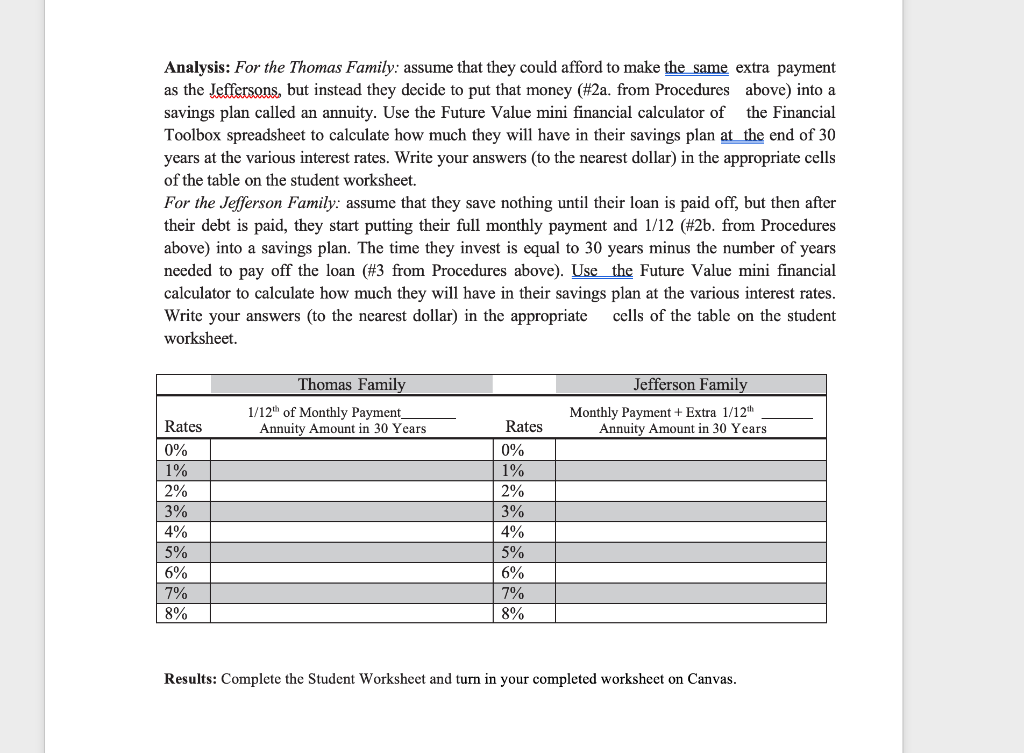

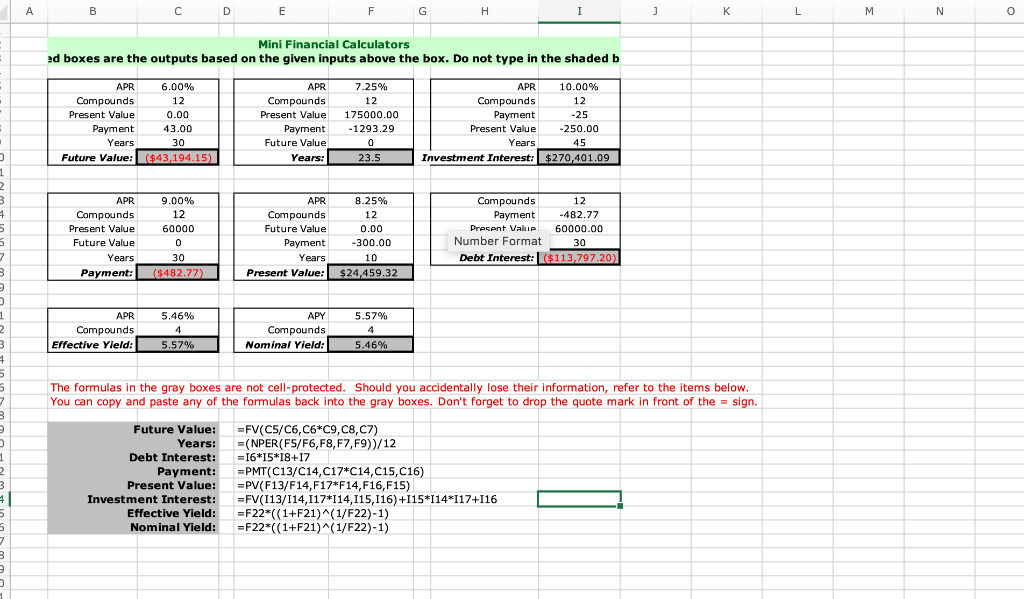

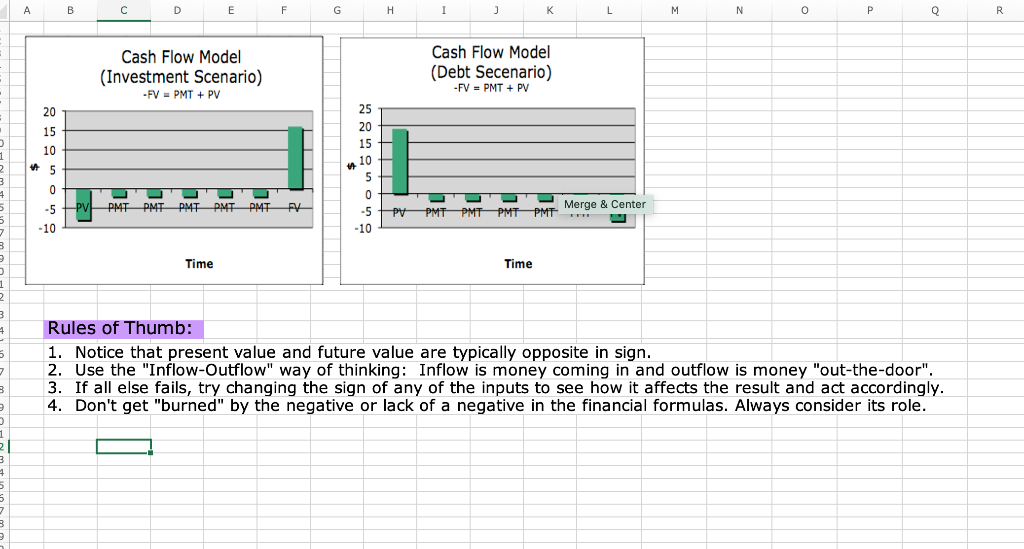

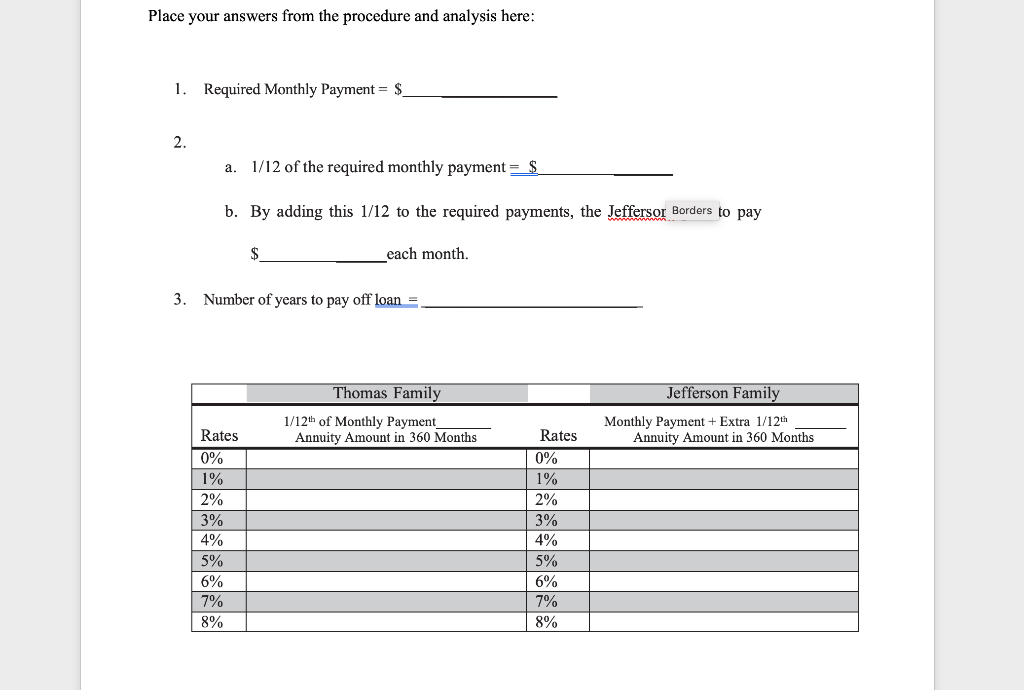

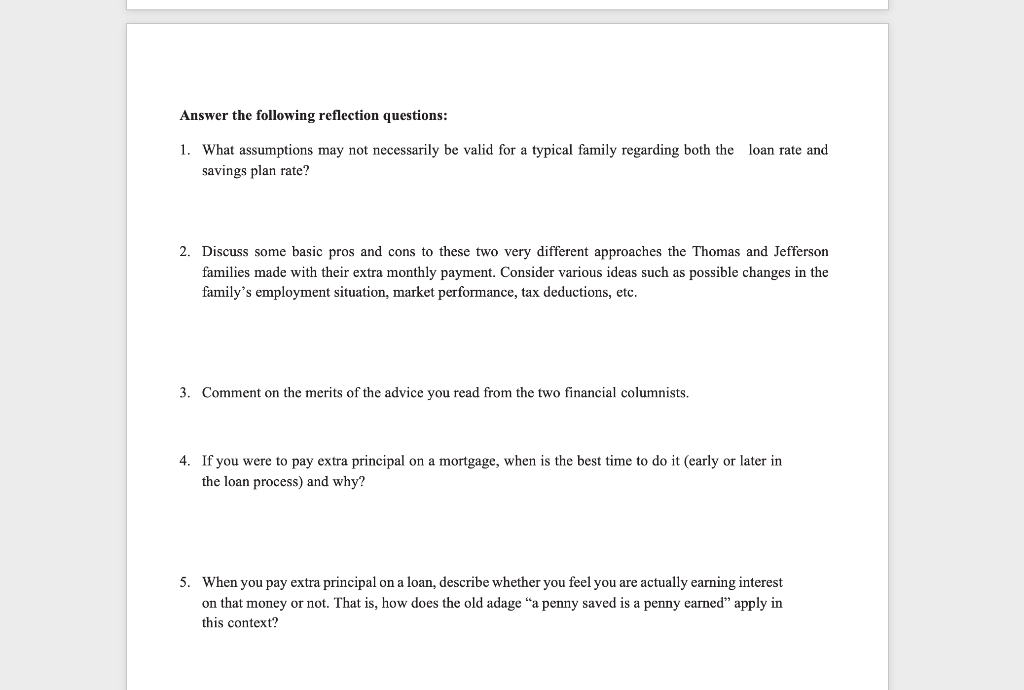

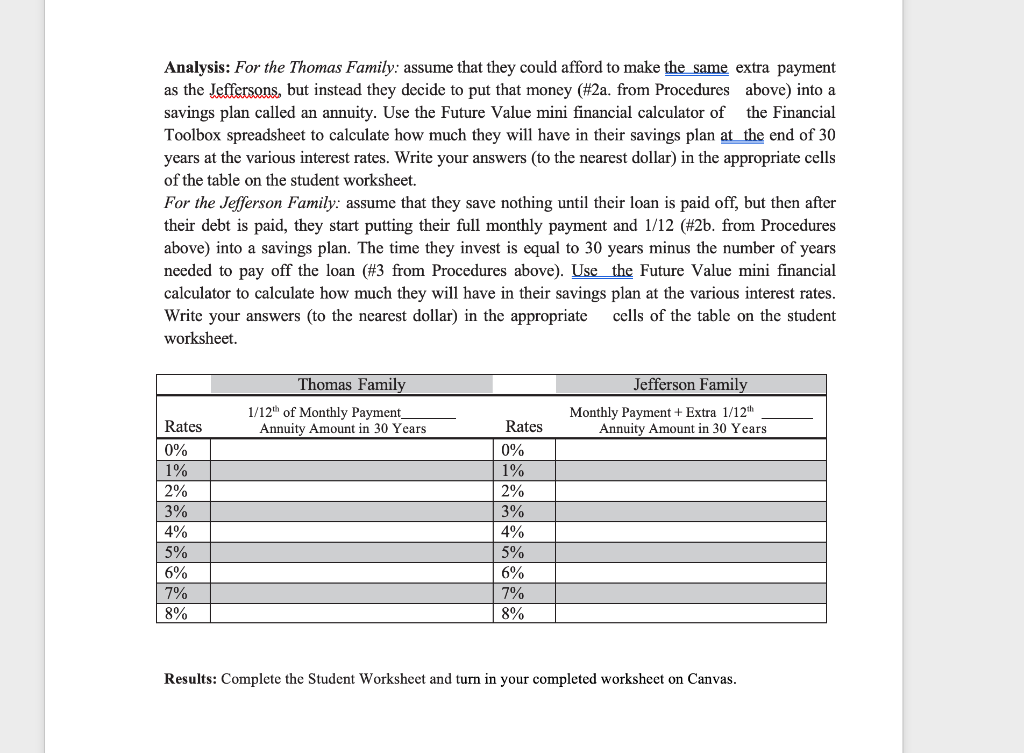

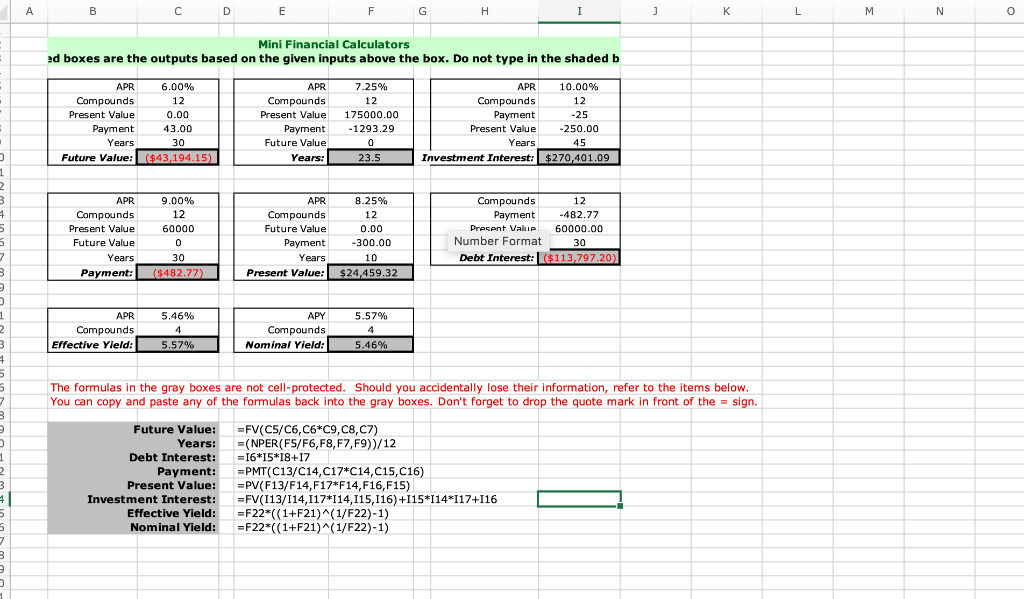

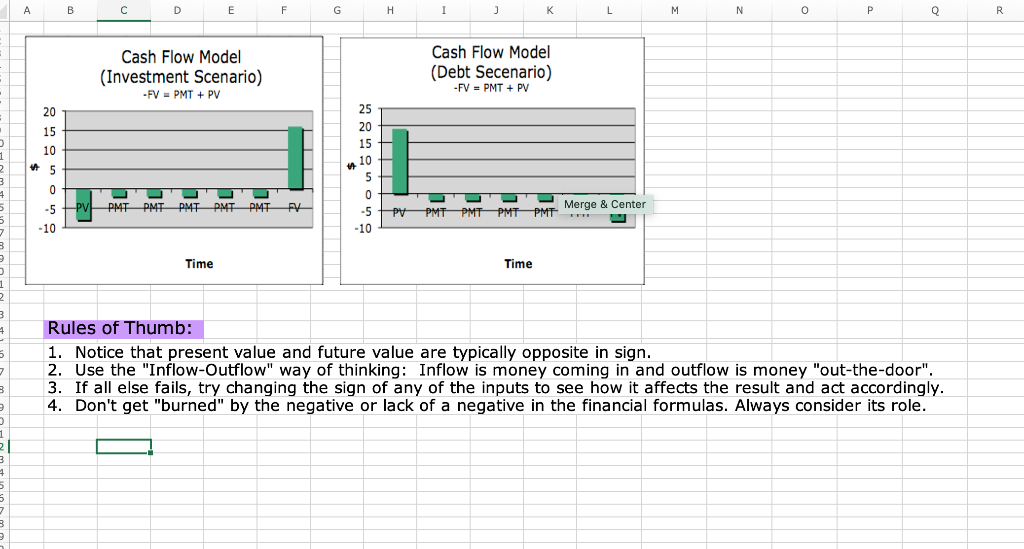

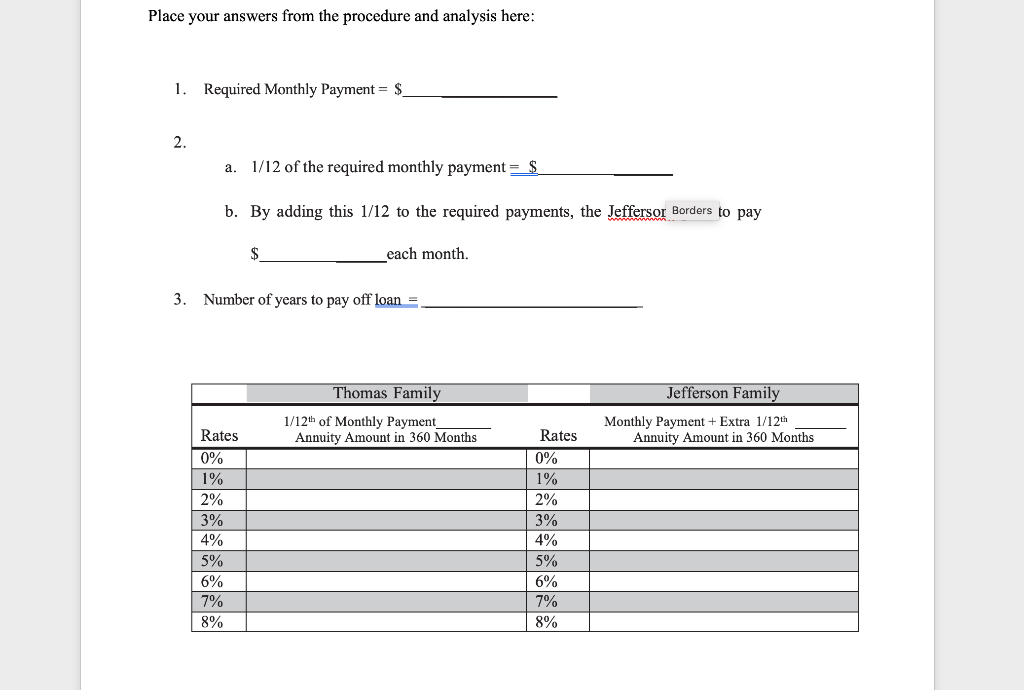

Before you begin: Review the loan basics in unit 4D of your textbook regarding the payment formula and the roles that interest and principal play in an amortization. Then carefully read the following pieces of advice written by two different nationally syndicated financial columnists (Sharon Epperson and Bruce Williams) regarding paying extra principal on a mortgage: Sharon Epperson from Money Smart of USAWeekend.com Shading Pay mortgage early? Q: My husband and I are 49 and 48 and are paying extra on our mortgage to have it paid off by the time we're 56. My friend says that will hurt us on our taxes; my husband says it's better to save the money in interest now than to worry about a mortgage tax deduction later. What's your take? S.R. Sheboygan, Wis. A: You married a smart man. Paying off your mortgage early will save thousands of dollars, and you'll get a reliable rate of return on your investment (you save the interest you would have paid on your mortgage). Yes, you'll lose the mortgage interest tax deduction when that happens. But if you're in the 25% tax bracket, for example, you'd only get back a quarter for each $1 in interest you pay --not such a big break. If you're debt-free and maxing out your 401(k) and IRAs, which offer tax breaks, paying up early isn't a bad idea. Source: http://www.usaweekend.com/08 issues/080511/080511 thinksmart-mortgage-broadwaytickets.html (Posted May 11, 2008). Bruce Williams from Smart Money . Bruce Williams from Smart Money DEAR BRUCE: I have a friend who says that you often advise that it is not wise to pay off a mortgage in advance. Could you tell me in one paragraph why this is a bad idea? It seems to me that being debt-free is a goal worth working toward. - L.H. Syracuse, N.Y. DEAR L.H.: In a nutshell, the cheapest money that you can borrow is against a first mortgage on your primary residence. Generally speaking, it's in a sub-7 percent range today. It is not too difficult to earn substantially more than that in the marketplace, so why pay off the loan early and settle for an effective return of below 7 percent? You could invest this money elsewhere at a far better return. In addition, if you itemize the interest that you are paying on the home loan, it becomes a deductible item. To me, it's a no-brainer. For younger people to pay off a mortgage early is, in my opinion, the height of foolishness. When you get into your 60s and the idea of having your home paid for out distances the need for return, I have no objection. of foolishness. When you get into your 60s and the idea of having your home paid for out distances the need for return, I have no objection. Source: "Should 35-year-old save for down payment or retirement?" Post Register, July 19, 2001. Download Spreadsheet: Download or ask your instructor for the file "Activity 5 A Case Study of Paying Extra Principal on a Mortgage Student Financial Toolboxes which provides you a collection of mini financial calculators and a worksheet on the role of the negative. Procedure: In our brief case study, we assume the Thomas and Jefferson families have identical mortgages (30- year term, fixed-rate 6% APR, and a loan amount of $175,000). The Thomas family will not pay extra but the Jeffersons will. Follow the steps below prior to your analysis. 1. Using the Payment mini calculator of the Financial Toolboxes spreadsheet, calculate the mortgage payment (the same for both families). 2. Assume that the Thomas's will make only the required mortgage payment. The Jeffersons, however, would like to pay off their loan early. They decide to make the equivalent of an extra payment cach year by adding an extra 1/12 of the payment to the required amount. Calculate the following to find what they plan to pay each month: a. 1/12 of the required monthly payment b. Jeffersons monthly payment found by adding this 1/12 the required payments 3. The Thomas's will take the full 30 years to pay off their loan, since they are making only the required payments. The Jefferson's extra payment amount, on the other hand, will allow them to pay off their loan more rapidly. Use the Years mini financial calculator of the Financial Toolbox spreadsheet to calculate the approximate number of years (nearest 10th) it would take the Jeffersons to pay off their loan. Analysis: For the Thomas Family: assume that they could afford to make the same extra payment as the Jeffersons, but instead they decide to put that money (#2a. from Procedures above) into a savings plan called an annuity. Use the Future Value mini financial calculator of the Financial Toolbox spreadsheet to calculate how much they will have in their savings plan at the end of 30 years at the various interest rates. Write your answers to the nearest dollar) in the appropriate cells of the table on the student worksheet. For the Jefferson Family: assume that they save nothing until their loan is paid off, but then after their debt is paid, they start putting their full monthly payment and 1/12 (#2b. from Procedures above) into a savings plan. The time they invest is equal to 30 years minus the number of years needed to pay off the loan (#3 from Procedures above). Use the Future Value mini financial calculator to calculate how much they will have in their savings plan at the various interest rates. Write your answers to the nearest dollar) in the appropriate cells of the table on the student worksheet. Thomas Family 1/12th of Monthly Payment Annuity Amount in 30 Years Jefferson Family Monthly Payment + Extra 1/12th Annuity Amount in 30 Years Rates 0% 1% 2% 3% 4% 5% 6% 7% 8% Rates 0% 1% 2% 3% 4% 5% 6% 7% 8% Results: Complete the Student Worksheet and turn in your completed worksheet on Canvas. A B D E F G H J K L M. N 0 Mini Financial Calculators ad boxes are the outputs based on the given inputs above the box. Do not type in the shaded b . APR 6.00% Compounds 12 Present Value 0.00 Payment 43.00 Years 30 Future Value: $43,194.15) APR Compounds Present Value Payment Future Value Years: 7.25% 12 175000.00 - 1293.29 0 23.5 APR 10.00% Compounds 12 Payment -25 Present Value -250.00 Years 45 Investment Interest: $270,401.09 : 1 2 3 4 5 5 7 2 3 APR Compounds Present Value Future Value Years Payment: 9.00% 12 60000 0 30 $482.77) APR Compounds Future Value Payment Years Present Value: 8.25% 12 0.00 -300.00 10 $24,459,32 Compounds 12 Payment -482.77 Present Valle 60000.00 Number Format 30 Debt Interest: $113,797.20) APR Compounds Effective Yield: 5.46% 4 4 5.57% APY Compounds Nominal Yield: 5.57% 4 5.46% 1 1 2 3 4 5 5 7 3 1 2 3 21 5 5 The formulas in the gray boxes are not cell-protected. Should you accidentally lose their information, refer to the items below. You can copy and paste any of the formulas back into the gray boxes. Don't forget to drop the quote mark in front of the = sign. Future Value: : =FV(C5/C6, C6*C9, C8, C7) Years: =(NPER(F5/F6, F8, F7, F9)/12 Debt Interest: =16*15*18+I7 Payment: =PMT(C13/C14, C17*C14, C15, C16) Present Value: =PV(F13/F14,F17*F14,F16,F15) Investment Interest: =FV(113/114,117*114,115,116) +115*114*117+116 Effective Yield: =F22*((1+F21)^(1/F22)-1) Nominal Yield: =F22*((1+F21)^(1/F22)-1) 3 1 A B D E F G H 1 M N O P Q R Cash Flow Model (Investment Scenario) -FV = PMT + PV Cash Flow Model (Debt Secenario) -FV = PMT + PV 20 15 10 # 5 25 20 15 10 5 0 -5 -10 0 -5 PMT DMT DMT DMT PMTFV PV PMTPMT PMT PMT Merge & Center 5 -10 3 Time Time Rules of Thumb: 1. Notice that present value and future value are typically opposite in sign. 2. Use the "Inflow-Outflow" way of thinking: Inflow is money coming in and outflow is money "out-the-door". 3. If all else fails, try changing the sign of any of the inputs to see how it affects the result and act accordingly. 4. Don't get "burned" by the negative or lack of a negative in the financial formulas. Always consider its role. 2 3 4 5 Place your answers from the procedure and analysis here: 1. Required Monthly Payment = $ 2. a. 1/12 of the required monthly payment $ b. By adding this 1/12 to the required payments, the Jeffersor Borders to pay $ each month. 3. Number of years to pay off loan = Thomas Family Jefferson Family 1/12th of Monthly Payment Annuity Amount in 360 Months Monthly Payment + Extra 1/12th Annuity Amount in 360 Months Rates 0% 1% 2% 3% 4% 5% 6% 7% 8% Rates 0% 1% 2% 3% 4% 5% 6% 7% 8% Answer the following reflection questions: 1. What assumptions may not necessarily be valid for a typical family regarding both the loan rate and savings plan rate? 2. Discuss some basic pros and cons to these two very different approaches the Thomas and Jefferson families made with their extra monthly payment. Consider various ideas such as possible changes in the family's employment situation, market performance, tax deductions, etc. 3. Comment on the merits of the advice you read from the two financial columnists. 4. If you were to pay extra principal on a mortgage, when is the best time to do it (early or later in the loan process) and why? 5. When you pay extra principal on a loan, describe whether you feel you are actually earning interest on that money or not. That is, how does the old adage "a penny saved is a penny earned" apply in this context? Before you begin: Review the loan basics in unit 4D of your textbook regarding the payment formula and the roles that interest and principal play in an amortization. Then carefully read the following pieces of advice written by two different nationally syndicated financial columnists (Sharon Epperson and Bruce Williams) regarding paying extra principal on a mortgage: Sharon Epperson from Money Smart of USAWeekend.com Shading Pay mortgage early? Q: My husband and I are 49 and 48 and are paying extra on our mortgage to have it paid off by the time we're 56. My friend says that will hurt us on our taxes; my husband says it's better to save the money in interest now than to worry about a mortgage tax deduction later. What's your take? S.R. Sheboygan, Wis. A: You married a smart man. Paying off your mortgage early will save thousands of dollars, and you'll get a reliable rate of return on your investment (you save the interest you would have paid on your mortgage). Yes, you'll lose the mortgage interest tax deduction when that happens. But if you're in the 25% tax bracket, for example, you'd only get back a quarter for each $1 in interest you pay --not such a big break. If you're debt-free and maxing out your 401(k) and IRAs, which offer tax breaks, paying up early isn't a bad idea. Source: http://www.usaweekend.com/08 issues/080511/080511 thinksmart-mortgage-broadwaytickets.html (Posted May 11, 2008). Bruce Williams from Smart Money . Bruce Williams from Smart Money DEAR BRUCE: I have a friend who says that you often advise that it is not wise to pay off a mortgage in advance. Could you tell me in one paragraph why this is a bad idea? It seems to me that being debt-free is a goal worth working toward. - L.H. Syracuse, N.Y. DEAR L.H.: In a nutshell, the cheapest money that you can borrow is against a first mortgage on your primary residence. Generally speaking, it's in a sub-7 percent range today. It is not too difficult to earn substantially more than that in the marketplace, so why pay off the loan early and settle for an effective return of below 7 percent? You could invest this money elsewhere at a far better return. In addition, if you itemize the interest that you are paying on the home loan, it becomes a deductible item. To me, it's a no-brainer. For younger people to pay off a mortgage early is, in my opinion, the height of foolishness. When you get into your 60s and the idea of having your home paid for out distances the need for return, I have no objection. of foolishness. When you get into your 60s and the idea of having your home paid for out distances the need for return, I have no objection. Source: "Should 35-year-old save for down payment or retirement?" Post Register, July 19, 2001. Download Spreadsheet: Download or ask your instructor for the file "Activity 5 A Case Study of Paying Extra Principal on a Mortgage Student Financial Toolboxes which provides you a collection of mini financial calculators and a worksheet on the role of the negative. Procedure: In our brief case study, we assume the Thomas and Jefferson families have identical mortgages (30- year term, fixed-rate 6% APR, and a loan amount of $175,000). The Thomas family will not pay extra but the Jeffersons will. Follow the steps below prior to your analysis. 1. Using the Payment mini calculator of the Financial Toolboxes spreadsheet, calculate the mortgage payment (the same for both families). 2. Assume that the Thomas's will make only the required mortgage payment. The Jeffersons, however, would like to pay off their loan early. They decide to make the equivalent of an extra payment cach year by adding an extra 1/12 of the payment to the required amount. Calculate the following to find what they plan to pay each month: a. 1/12 of the required monthly payment b. Jeffersons monthly payment found by adding this 1/12 the required payments 3. The Thomas's will take the full 30 years to pay off their loan, since they are making only the required payments. The Jefferson's extra payment amount, on the other hand, will allow them to pay off their loan more rapidly. Use the Years mini financial calculator of the Financial Toolbox spreadsheet to calculate the approximate number of years (nearest 10th) it would take the Jeffersons to pay off their loan. Analysis: For the Thomas Family: assume that they could afford to make the same extra payment as the Jeffersons, but instead they decide to put that money (#2a. from Procedures above) into a savings plan called an annuity. Use the Future Value mini financial calculator of the Financial Toolbox spreadsheet to calculate how much they will have in their savings plan at the end of 30 years at the various interest rates. Write your answers to the nearest dollar) in the appropriate cells of the table on the student worksheet. For the Jefferson Family: assume that they save nothing until their loan is paid off, but then after their debt is paid, they start putting their full monthly payment and 1/12 (#2b. from Procedures above) into a savings plan. The time they invest is equal to 30 years minus the number of years needed to pay off the loan (#3 from Procedures above). Use the Future Value mini financial calculator to calculate how much they will have in their savings plan at the various interest rates. Write your answers to the nearest dollar) in the appropriate cells of the table on the student worksheet. Thomas Family 1/12th of Monthly Payment Annuity Amount in 30 Years Jefferson Family Monthly Payment + Extra 1/12th Annuity Amount in 30 Years Rates 0% 1% 2% 3% 4% 5% 6% 7% 8% Rates 0% 1% 2% 3% 4% 5% 6% 7% 8% Results: Complete the Student Worksheet and turn in your completed worksheet on Canvas. A B D E F G H J K L M. N 0 Mini Financial Calculators ad boxes are the outputs based on the given inputs above the box. Do not type in the shaded b . APR 6.00% Compounds 12 Present Value 0.00 Payment 43.00 Years 30 Future Value: $43,194.15) APR Compounds Present Value Payment Future Value Years: 7.25% 12 175000.00 - 1293.29 0 23.5 APR 10.00% Compounds 12 Payment -25 Present Value -250.00 Years 45 Investment Interest: $270,401.09 : 1 2 3 4 5 5 7 2 3 APR Compounds Present Value Future Value Years Payment: 9.00% 12 60000 0 30 $482.77) APR Compounds Future Value Payment Years Present Value: 8.25% 12 0.00 -300.00 10 $24,459,32 Compounds 12 Payment -482.77 Present Valle 60000.00 Number Format 30 Debt Interest: $113,797.20) APR Compounds Effective Yield: 5.46% 4 4 5.57% APY Compounds Nominal Yield: 5.57% 4 5.46% 1 1 2 3 4 5 5 7 3 1 2 3 21 5 5 The formulas in the gray boxes are not cell-protected. Should you accidentally lose their information, refer to the items below. You can copy and paste any of the formulas back into the gray boxes. Don't forget to drop the quote mark in front of the = sign. Future Value: : =FV(C5/C6, C6*C9, C8, C7) Years: =(NPER(F5/F6, F8, F7, F9)/12 Debt Interest: =16*15*18+I7 Payment: =PMT(C13/C14, C17*C14, C15, C16) Present Value: =PV(F13/F14,F17*F14,F16,F15) Investment Interest: =FV(113/114,117*114,115,116) +115*114*117+116 Effective Yield: =F22*((1+F21)^(1/F22)-1) Nominal Yield: =F22*((1+F21)^(1/F22)-1) 3 1 A B D E F G H 1 M N O P Q R Cash Flow Model (Investment Scenario) -FV = PMT + PV Cash Flow Model (Debt Secenario) -FV = PMT + PV 20 15 10 # 5 25 20 15 10 5 0 -5 -10 0 -5 PMT DMT DMT DMT PMTFV PV PMTPMT PMT PMT Merge & Center 5 -10 3 Time Time Rules of Thumb: 1. Notice that present value and future value are typically opposite in sign. 2. Use the "Inflow-Outflow" way of thinking: Inflow is money coming in and outflow is money "out-the-door". 3. If all else fails, try changing the sign of any of the inputs to see how it affects the result and act accordingly. 4. Don't get "burned" by the negative or lack of a negative in the financial formulas. Always consider its role. 2 3 4 5 Place your answers from the procedure and analysis here: 1. Required Monthly Payment = $ 2. a. 1/12 of the required monthly payment $ b. By adding this 1/12 to the required payments, the Jeffersor Borders to pay $ each month. 3. Number of years to pay off loan = Thomas Family Jefferson Family 1/12th of Monthly Payment Annuity Amount in 360 Months Monthly Payment + Extra 1/12th Annuity Amount in 360 Months Rates 0% 1% 2% 3% 4% 5% 6% 7% 8% Rates 0% 1% 2% 3% 4% 5% 6% 7% 8% Answer the following reflection questions: 1. What assumptions may not necessarily be valid for a typical family regarding both the loan rate and savings plan rate? 2. Discuss some basic pros and cons to these two very different approaches the Thomas and Jefferson families made with their extra monthly payment. Consider various ideas such as possible changes in the family's employment situation, market performance, tax deductions, etc. 3. Comment on the merits of the advice you read from the two financial columnists. 4. If you were to pay extra principal on a mortgage, when is the best time to do it (early or later in the loan process) and why? 5. When you pay extra principal on a loan, describe whether you feel you are actually earning interest on that money or not. That is, how does the old adage "a penny saved is a penny earned" apply in this context