beginning balances located below

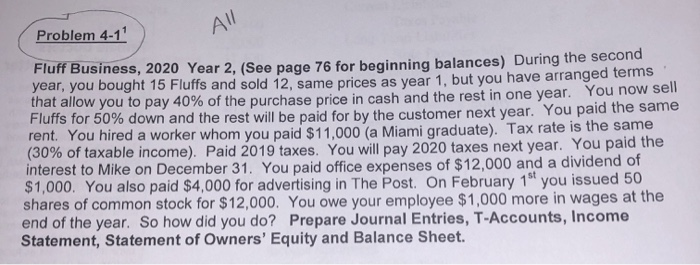

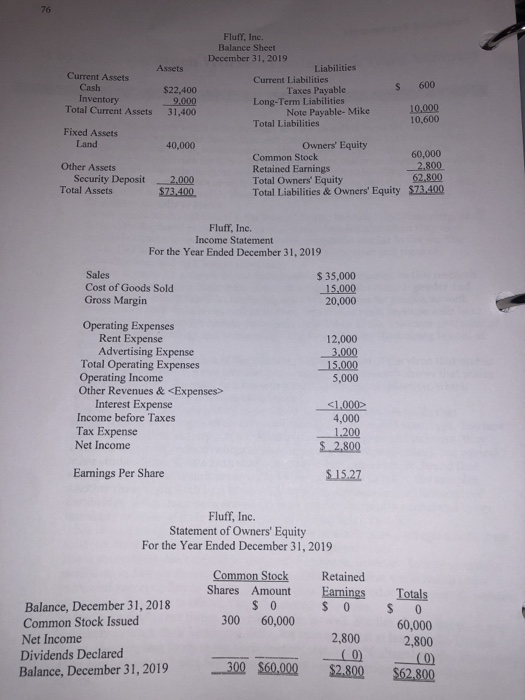

Problem 4-1 All Fluff Business, 2020 Year 2. (See page 76 for beginning balances) During the second year, you bought 15 Fluffs and sold 12, same prices as year 1. but you have arranged some that allow you to pay 40% of the purchase price in cash and the rest in one year. You now sen Fluffs for 50% down and the rest will be paid for by the customer next year. You paid the same rent. You hired a worker whom you paid $11,000 (a Miami graduate). Tax rate is the same (30% of taxable income). Paid 2019 taxes. You will pay 2020 taxes next year. You paid the interest to Mike on December 31. You paid office expenses of $12,000 and a dividend of $1,000. You also paid $4,000 for advertising in The Post. On February 1st you issued 50 shares of common stock for $12,000. You owe your employee $1,000 more in wages at the end of the year. So how did you do? Prepare Journal Entries, T-Accounts, Income Statement, Statement of Owners' Equity and Balance Sheet. Assets Current Assets Cash $22,400 Inventory 9.000 Total Current Assets 31,400 Flufy, Inc. Balance Sheet December 31, 2019 Liabilities Current Liabilities Taxes Payable Long-Term Liabilities Note Payable- Mike Total Liabilities $ 600 10.000 10,600 Fixed Assets Land 40,000 Other Assets Security Deposit Total Assets Owners' Equity Common Stock 60,000 Retained Earnings 2.800 Total Owners' Equity 62,800 Total Liabilities & Owners' Equity $73.400 2.000 $73.400 Fluff, Inc. Income Statement For the Year Ended December 31, 2019 Sales Cost of Goods Sold Gross Margin $ 35,000 15,000 20,000 12,000 3.000 15.000 5,000 Operating Expenses Rent Expense Advertising Expense Total Operating Expenses Operating Income Other Revenues &

4,000 1.200 $ 2.800 Eamings Per Share $ 15.27 Fluff, Inc. Statement of Owners' Equity For the Year Ended December 31, 2019 Common Stock Shares Amount $ 0 300 60,000 Retained Earings $ 0 Balance, December 31, 2018 Common Stock Issued Net Income Dividends Declared Balance, December 31, 2019 2,800 Totals $ 0 60,000 2,800 (0) $62.800 (0) 300 $60,000 $2.800 Problem 4-1 All Fluff Business, 2020 Year 2. (See page 76 for beginning balances) During the second year, you bought 15 Fluffs and sold 12, same prices as year 1. but you have arranged some that allow you to pay 40% of the purchase price in cash and the rest in one year. You now sen Fluffs for 50% down and the rest will be paid for by the customer next year. You paid the same rent. You hired a worker whom you paid $11,000 (a Miami graduate). Tax rate is the same (30% of taxable income). Paid 2019 taxes. You will pay 2020 taxes next year. You paid the interest to Mike on December 31. You paid office expenses of $12,000 and a dividend of $1,000. You also paid $4,000 for advertising in The Post. On February 1st you issued 50 shares of common stock for $12,000. You owe your employee $1,000 more in wages at the end of the year. So how did you do? Prepare Journal Entries, T-Accounts, Income Statement, Statement of Owners' Equity and Balance Sheet. Assets Current Assets Cash $22,400 Inventory 9.000 Total Current Assets 31,400 Flufy, Inc. Balance Sheet December 31, 2019 Liabilities Current Liabilities Taxes Payable Long-Term Liabilities Note Payable- Mike Total Liabilities $ 600 10.000 10,600 Fixed Assets Land 40,000 Other Assets Security Deposit Total Assets Owners' Equity Common Stock 60,000 Retained Earnings 2.800 Total Owners' Equity 62,800 Total Liabilities & Owners' Equity $73.400 2.000 $73.400 Fluff, Inc. Income Statement For the Year Ended December 31, 2019 Sales Cost of Goods Sold Gross Margin $ 35,000 15,000 20,000 12,000 3.000 15.000 5,000 Operating Expenses Rent Expense Advertising Expense Total Operating Expenses Operating Income Other Revenues & 4,000 1.200 $ 2.800 Eamings Per Share $ 15.27 Fluff, Inc. Statement of Owners' Equity For the Year Ended December 31, 2019 Common Stock Shares Amount $ 0 300 60,000 Retained Earings $ 0 Balance, December 31, 2018 Common Stock Issued Net Income Dividends Declared Balance, December 31, 2019 2,800 Totals $ 0 60,000 2,800 (0) $62.800 (0) 300 $60,000 $2.800