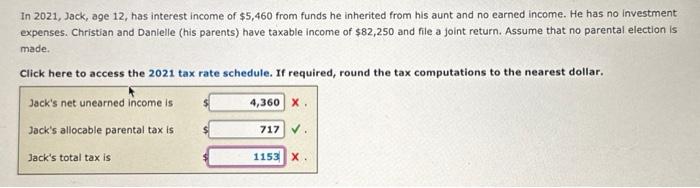

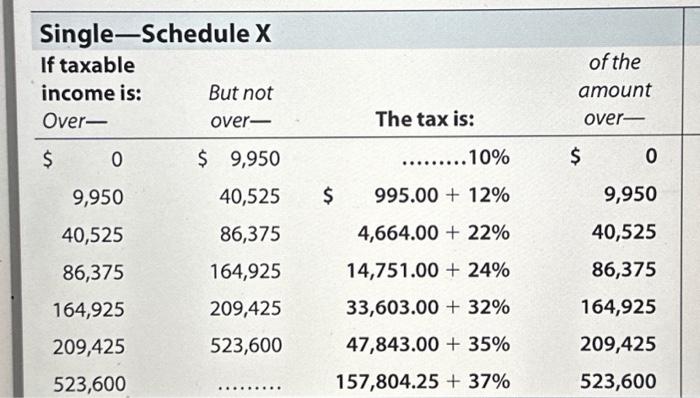

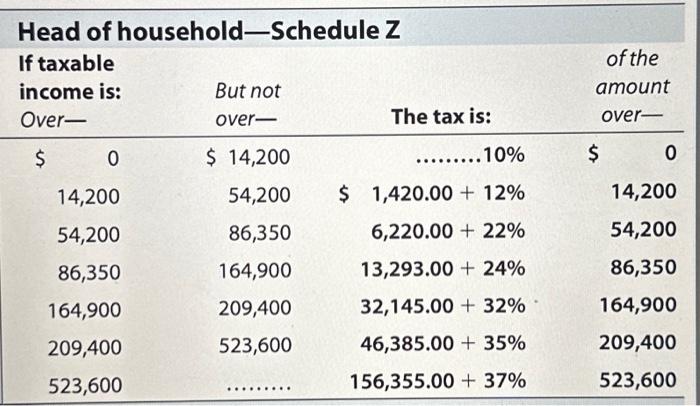

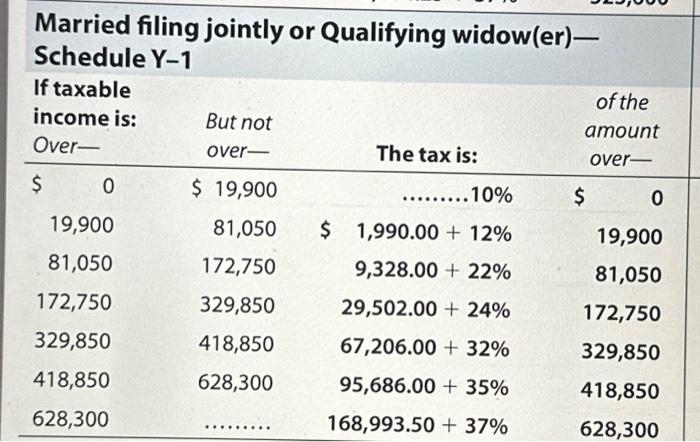

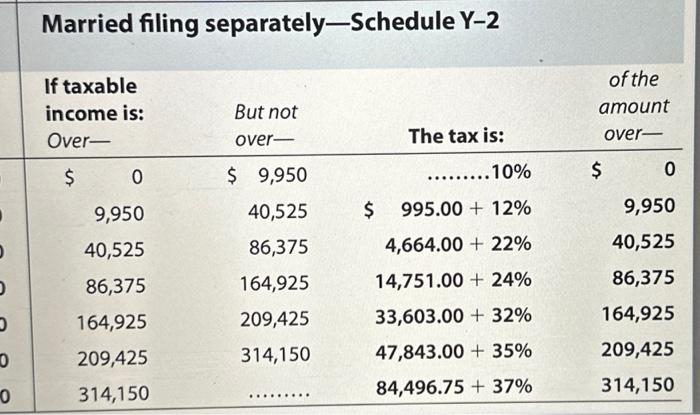

\begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Head of household-Schedule Z } \\ \hline \begin{tabular}{l} If taxable \\ income is: \\ Over- \end{tabular} & \begin{tabular}{l} But not \\ over- \end{tabular} & The tax is: & \begin{tabular}{c} of the \\ amount \\ over- \end{tabular} \\ \hline 0 & $14,200 & .........10\% & $ \\ \hline 14,200 & 54,200 & $1,420.00+12% & 14,200 \\ \hline 54,200 & 86,350 & 6,220.00+22% & 54,200 \\ \hline 86,350 & 164,900 & 13,293.00+24% & 86,350 \\ \hline 164,900 & 209,400 & 32,145.00+32% & 164,900 \\ \hline 209,400 & 523,600 & 46,385.00+35% & 209,400 \\ \hline 523,600 & ......... & 156,355.00+37% & 523,600 \\ \hline \end{tabular} In 2021, Jack, age 12, has interest income of $5,460 from funds he inherited from his aunt and no earned income. He has no investment expenses. Christian and Danielle (his parents) have taxable income of $82,250 and file a joint return. Assume that no parental election is made. Click here to access the 2021 tax rate schedule. If required, round the tax computations to the nearest dollar. \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Married filing separately-Schedule Y-2 } \\ \hline \begin{tabular}{l} If taxable \\ income is: \\ Over- \end{tabular} & \begin{tabular}{l} But not \\ over- \end{tabular} & The tax is: & \begin{tabular}{l} of the \\ amount \\ over- \end{tabular} \\ \hline 0 & $9,950 & .........10\% & $ \\ \hline 9,950 & 40,525 & $995.00+12% & 9,950 \\ \hline 40,525 & 86,375 & 4,664.00+22% & 40,525 \\ \hline 86,375 & 164,925 & 14,751.00+24% & 86,375 \\ \hline 164,925 & 209,425 & 33,603.00+32% & 164,925 \\ \hline 209,425 & 314,150 & 47,843.00+35% & 209,425 \\ \hline 314,150 & & 84,496.75+37% & 314,150 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Single-Schedule X } \\ \hline \begin{tabular}{l} If taxable \\ income is: \\ Over- \end{tabular} & \begin{tabular}{l} But not \\ over- \end{tabular} & The tax is: & \begin{tabular}{l} of the \\ amount \\ over- \end{tabular} \\ \hline 0 & $9,950 & 10% & $ \\ \hline 9,950 & 40,525 & 995.00+12% & 9,950 \\ \hline 40,525 & 86,375 & 4,664.00+22% & 40,525 \\ \hline 86,375 & 164,925 & 14,751.00+24% & 86,375 \\ \hline 164,925 & 209,425 & 33,603.00+32% & 164,925 \\ \hline 209,425 & 523,600 & 47,843.00+35% & 209,425 \\ \hline 523,600 & & 157,804.25+37% & 523,600 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{\begin{tabular}{l} Married filing jointly or Qualifying widow(er) - \\ Schedule Y-1 \end{tabular}} \\ \hline \begin{tabular}{l} If taxable \\ income is: \\ Over- \end{tabular} & \begin{tabular}{l} But not \\ over- \end{tabular} & The tax is: & \begin{tabular}{l} of the \\ amount \\ over- \end{tabular} \\ \hline 0 & $19,900 & ..........10\% & $ \\ \hline 19,900 & 81,050 & $1,990.00+12% & 19,900 \\ \hline 81,050 & 172,750 & 9,328.00+22% & 81,050 \\ \hline 172,750 & 329,850 & 29,502.00+24% & 172,750 \\ \hline 329,850 & 418,850 & 67,206.00+32% & 329,850 \\ \hline 418,850 & 628,300 & 95,686.00+35% & 418,850 \\ \hline 628,300 & & 168,993.50+37% & 628,300 \\ \hline \end{tabular}