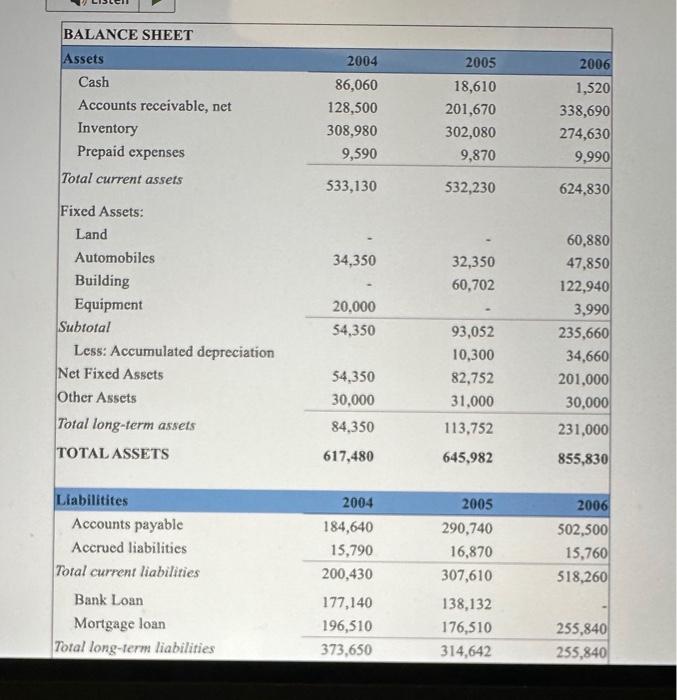

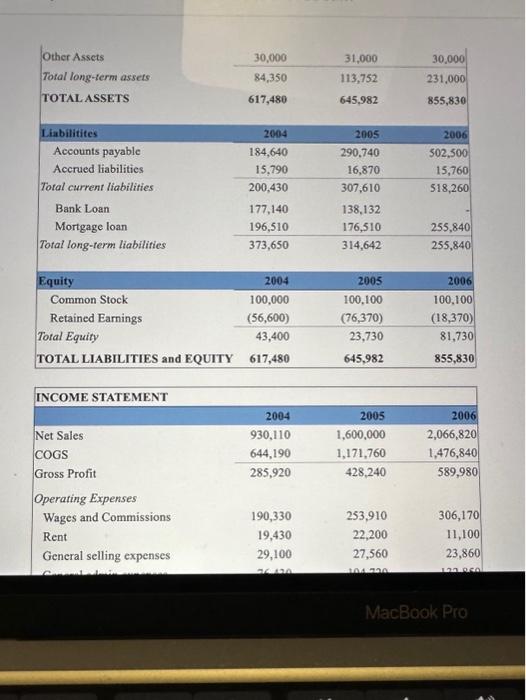

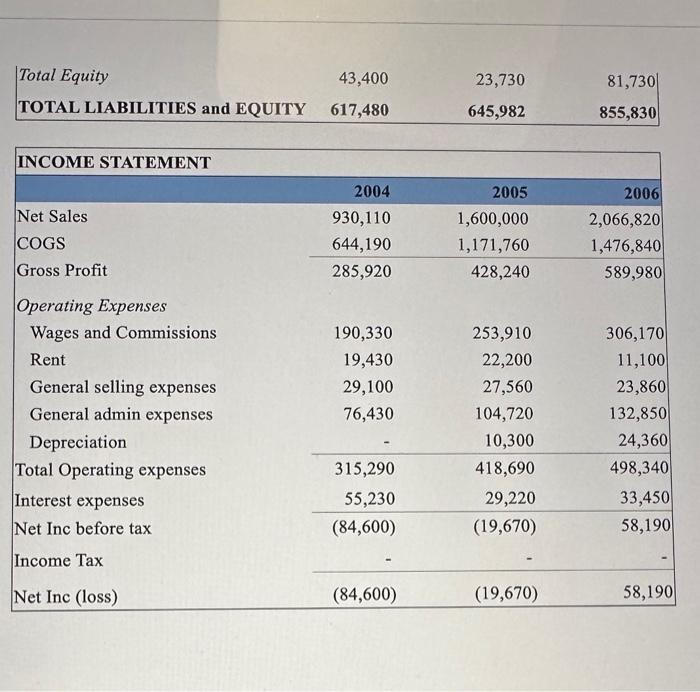

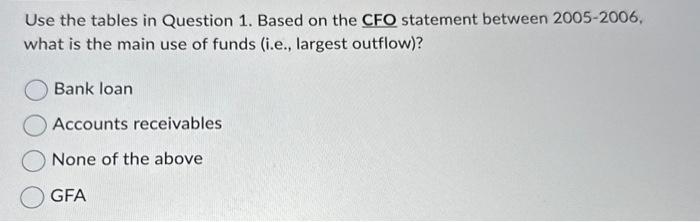

\begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|l|}{ BALANCE SHEET } \\ \hline Assets & 2004 & 2005 & 2006 \\ \hline Cash & 86,060 & 18,610 & 1,520 \\ \hline Accounts receivable, net & 128,500 & 201,670 & 338,690 \\ \hline Inventory & 308,980 & 302,080 & 274,630 \\ \hline Prepaid expenses & 9,590 & 9,870 & 9,990 \\ \hline Total current assets & 533,130 & 532,230 & 624,830 \\ \hline \multicolumn{4}{|l|}{ Fixed Assets: } \\ \hline Land & - & - & 60,880 \\ \hline Automobiles & 34,350 & 32,350 & 47,850 \\ \hline Building & - & 60,702 & 122,940 \\ \hline Equipment & 20,000 & - & 3,990 \\ \hline Subtotal & 54,350 & 93,052 & 235,660 \\ \hline Less: Accumulated depreciation & & 10,300 & 34,660 \\ \hline Net Fixed Assets & 54,350 & 82,752 & 201,000 \\ \hline Other Assets & 30,000 & 31,000 & 30,000 \\ \hline Total long-term assets & 84,350 & 113,752 & 231,000 \\ \hline TOTAL ASSETS & 617,480 & 645,982 & 855,830 \\ \hline Liabilitites & 2004 & 2005 & 2006 \\ \hline Accounts payable & 184,640 & 290,740 & 502,500 \\ \hline Accrued liabilities & 15,790 & 16,870 & 15,760 \\ \hline Total current liabilities & 200,430 & 307,610 & 518,260 \\ \hline Bank Loan & 177,140 & 138,132 & \\ \hline Mortgage loan & 196,510 & 176,510 & 255,840 \\ \hline Total long-term liabilities & 373,650 & 314,642 & 255,840 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Other Assets & 30,000 & 31,000 & 30.000 \\ \hline Total long-term assets & 84,350 & 113,752 & 231,000 \\ \hline TOTALASSETS & 617,480 & 645,982 & 855,830 \\ \hline Liabilitites & 2004 & 2005 & 2006 \\ \hline Accounts payable & 184,640 & 290.740 & 502,500 \\ \hline Accrued liabilities & 15,790 & 16,870 & 15,760 \\ \hline Total current liabilities & 200,430 & 307,610 & 518,260 \\ \hline Bank Loan & 177,140 & 138,132 & \\ \hline Mortgage loan & 196,510 & 176,510 & 255,840 \\ \hline Total long-term liabilities & 373,650 & 314,642 & 255,840 \\ \hline Equity & 2004 & 2005 & 2006 \\ \hline Common Stock & 100,000 & 100,100 & 100,100 \\ \hline Retained Earnings & (56,600) & (76,370) & (18,370) \\ \hline Total Equity & 43,400 & 23,730 & 81,730 \\ \hline TOTAL LIABILITIES and EQUITY & 617,480 & 645,982 & 855,830 \\ \hline \end{tabular} \begin{tabular}{|lrrr|} \hline INCOME STATEMENT & \multicolumn{3}{r|}{} \\ \hline Net Sales & 2004 & 2005 & 2006 \\ COGS & 930,110 & 1,600,000 & 2,066,820 \\ Gross Profit & 644,190 & 1,171,760 & 1,476,840 \\ \cline { 2 - 4 } & 285,920 & 428,240 & 589,980 \\ Operating Expenses & & \\ Wages and Commissions & 190,330 & 253,910 & 306,170 \\ Rent & 19,430 & 22,200 & 11,100 \\ General selling expenses & 29,100 & 27,560 & 23,860 \\ & & & \\ \hline \end{tabular} \begin{tabular}{|lrrr|} Total Equity & 43,400 & 23,730 & 81,730 \\ TOTAL LIABILITIES and EQUITY & 617,480 & 645,982 & 855,830 \\ \hline \end{tabular} \begin{tabular}{|lrrr|} \hline INCOME STATEMENT & & & \\ \hline & 2004 & 2005 & 2006 \\ Net Sales & 930,110 & 1,600,000 & 2,066,820 \\ COGS & 644,190 & 1,171,760 & 1,476,840 \\ Gross Profit & 285,920 & 428,240 & 589,980 \\ Operating Expenses & & & \\ Wages and Commissions & 190,330 & 253,910 & 306,170 \\ Rent & 19,430 & 22,200 & 11,100 \\ General selling expenses & 29,100 & 27,560 & 23,860 \\ General admin expenses & 76,430 & 104,720 & 132,850 \\ Depreciation & - & 10,300 & 24,360 \\ Total Operating expenses & 315,290 & 418,690 & 498,340 \\ Interest expenses & 55,230 & 29,220 & 33,450 \\ Net Inc before tax & (84,600) & (19,670) & 58,190 \\ Income Tax & - & & - \\ Net Inc (loss) & - & (19,670) & 58,190 \\ \hline \end{tabular} Use the tables in Question 1. Based on the CFO statement between 2005-2006. what is the main use of funds (i.e., largest outflow)? Bank loan Accounts receivables None of the above GFA