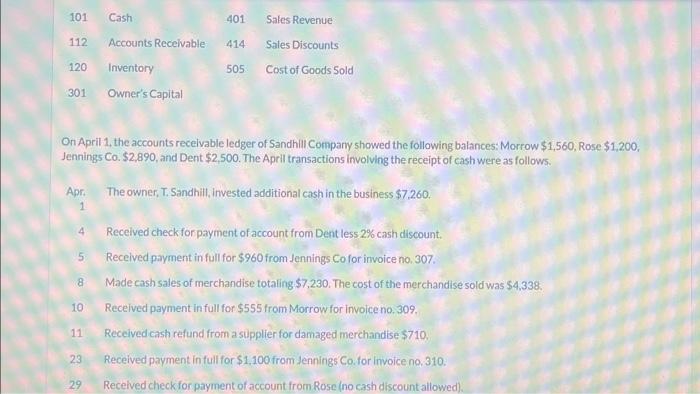

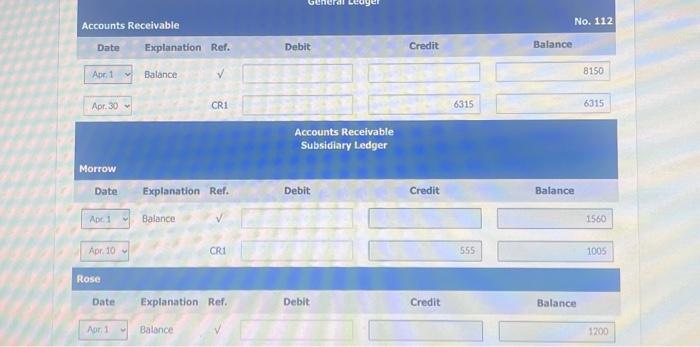

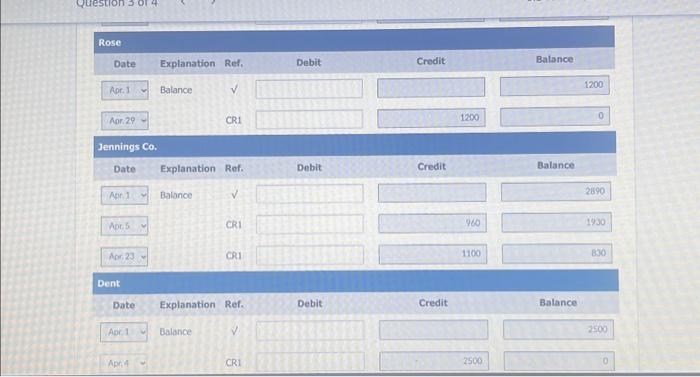

\begin{tabular}{|c|c|c|c|c|c|} \hline Date & Explanation & Ref. & Debit & Credit & Balance \\ \hline Aor 1 & Balance & & & & 1200 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{6}{|l|}{ Rose } \\ \hline Date & Explanation & Ref. & Debit & Crodit & Balance \\ \hline Apr. 1= & Balance & & & & 1200 \\ \hline+2 & & & & & \\ \hline Aor. 29 or & & CR1 & & 1200 & 0 \\ \hline \multicolumn{6}{|c|}{ Jennings Co. } \\ \hline Date & Explanation & Ref. & Debit & Credit & Balance \\ \hline Non1 & Balance & & & & 2690 \\ \hline Aor5v & & CR1 & & 960 & 1930 \\ \hline & & 1 & ing & & \\ \hline Aor23 v & & CR1 & 3 & 1100 & 830 \\ \hline \multicolumn{6}{|l|}{ Dent } \\ \hline Date & Explanation & Ref. & Debit & Credit & Balance \\ \hlineAbC1 & Balance & v & & & 2500 \\ \hline & & & & +2 & \\ \hline Apri 4 \% & & CR1 & & 2500 & 0 \\ \hline \end{tabular} On April 1, the accounts recelvable ledger of Sandhill Compary showed the following balances: Morrow $1,560, Rose $1,200, Jennings Co. $2,890, and Dent $2,500. The April transactions involving the receipt of eash were as follows. Apr. The owner, T. Sandhill, invested additional cash in the business $7.260. 4 Received check for payment of account from Dent less 2% cash discount. 5 Recelved payment in full for $960 from Jennings Co for invoice no, 307 . 8. Made cash sales of merchandise totaling $7,230. The cost of the merchandise sold was $4,338. 10 Received payment in full for $555 from Morrow for invoice no. 309 . 11 Received cash refund from a supplier for damaged merchandise $710. 29 Received payment in fulf for $1,100 from Jennings Co. for invoice no, 310 . 29 Recelved check for payment of account from Rosc (no cash discount allowed). \begin{tabular}{|c|c|c|c|c|c|} \hline Date & Explanation & Ref. & Debit & Credit & Balance \\ \hline Aor 1 & Balance & & & & 1200 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{6}{|l|}{ Rose } \\ \hline Date & Explanation & Ref. & Debit & Crodit & Balance \\ \hline Apr. 1= & Balance & & & & 1200 \\ \hline+2 & & & & & \\ \hline Aor. 29 or & & CR1 & & 1200 & 0 \\ \hline \multicolumn{6}{|c|}{ Jennings Co. } \\ \hline Date & Explanation & Ref. & Debit & Credit & Balance \\ \hline Non1 & Balance & & & & 2690 \\ \hline Aor5v & & CR1 & & 960 & 1930 \\ \hline & & 1 & ing & & \\ \hline Aor23 v & & CR1 & 3 & 1100 & 830 \\ \hline \multicolumn{6}{|l|}{ Dent } \\ \hline Date & Explanation & Ref. & Debit & Credit & Balance \\ \hlineAbC1 & Balance & v & & & 2500 \\ \hline & & & & +2 & \\ \hline Apri 4 \% & & CR1 & & 2500 & 0 \\ \hline \end{tabular} On April 1, the accounts recelvable ledger of Sandhill Compary showed the following balances: Morrow $1,560, Rose $1,200, Jennings Co. $2,890, and Dent $2,500. The April transactions involving the receipt of eash were as follows. Apr. The owner, T. Sandhill, invested additional cash in the business $7.260. 4 Received check for payment of account from Dent less 2% cash discount. 5 Recelved payment in full for $960 from Jennings Co for invoice no, 307 . 8. Made cash sales of merchandise totaling $7,230. The cost of the merchandise sold was $4,338. 10 Received payment in full for $555 from Morrow for invoice no. 309 . 11 Received cash refund from a supplier for damaged merchandise $710. 29 Received payment in fulf for $1,100 from Jennings Co. for invoice no, 310 . 29 Recelved check for payment of account from Rosc (no cash discount allowed)