Answered step by step

Verified Expert Solution

Question

1 Approved Answer

begin{tabular}{|c|c|c|c|c|c|} hline Ratios & Value & Correct/Incorrect & Ratios & Value & Correct/Incorrect hline Profitability ratios & & & Asset management & &

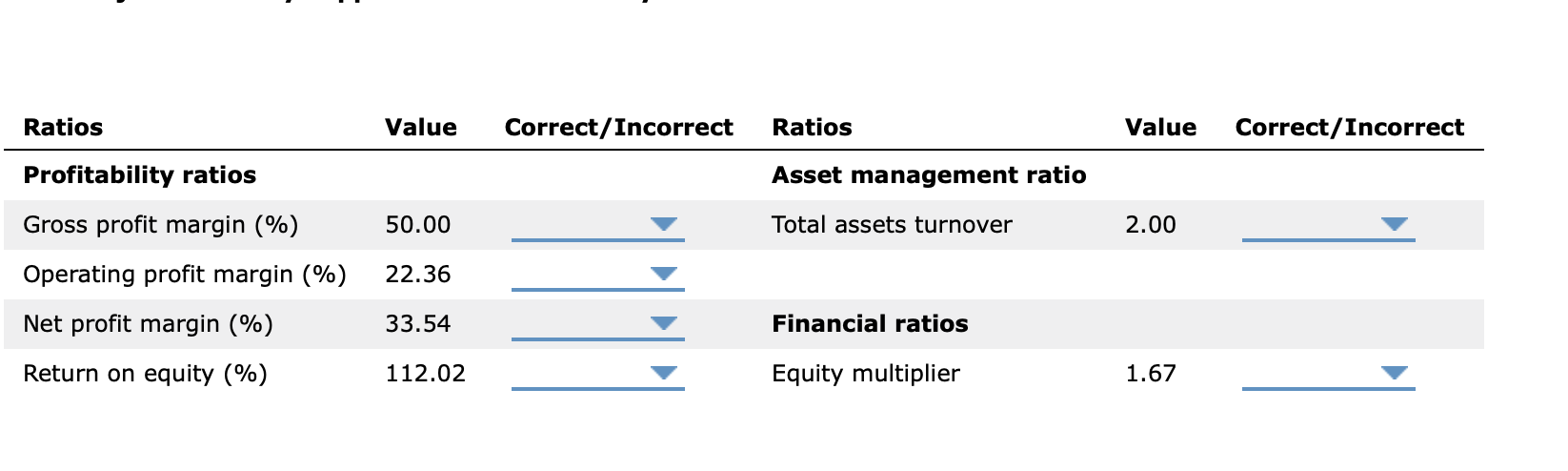

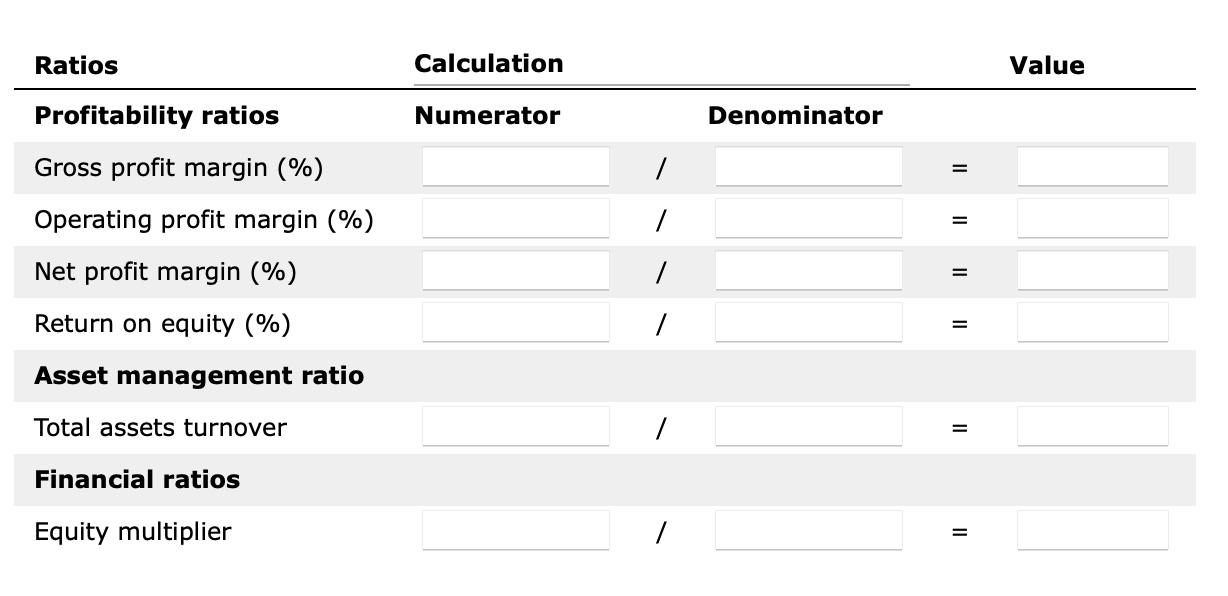

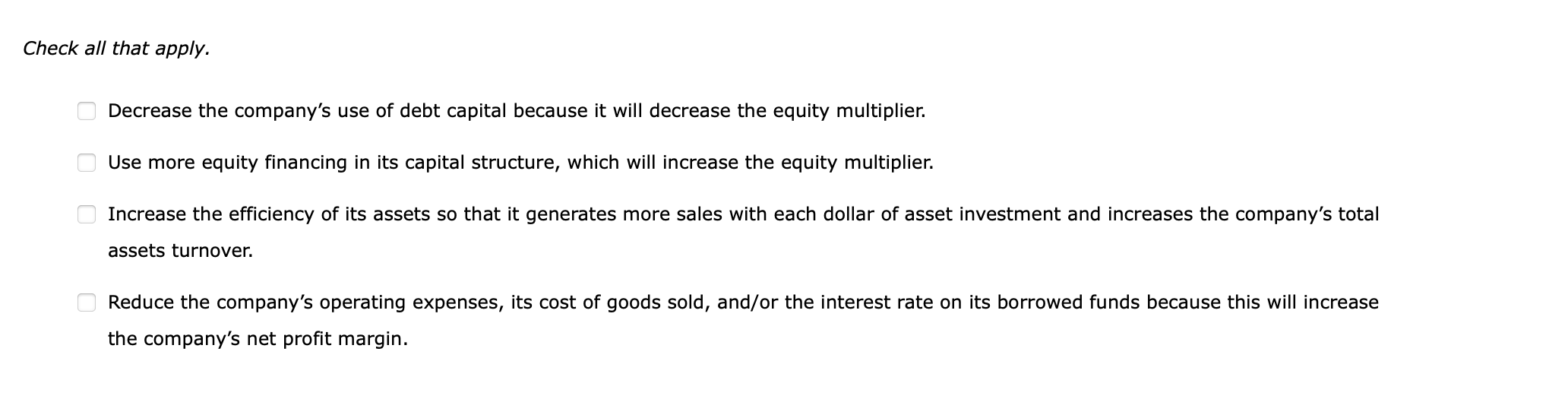

\begin{tabular}{|c|c|c|c|c|c|} \hline Ratios & Value & Correct/Incorrect & Ratios & Value & Correct/Incorrect \\ \hline Profitability ratios & & & Asset management & & \\ \hline Gross profit margin (\%) & 50.00 & & Total assets turnover & 2.00 & \\ \hline Operating profit margin (\%) & 22.36 & & & & \\ \hline Net profit margin (\%) & 33.54 & & Financial ratios & & \\ \hline Return on equity (\%) & 112.02 & & Equity multiplier & 1.67 & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline Ratios & Calculation & & & \\ \hline Profitability ratios & Numerator & & Denominator & \\ \hline Gross profit margin (\%) & & / & & = \\ \hline Operating profit margin (\%) & & / & & = \\ \hline Net profit margin (\%) & & / & & = \\ \hline Return on equity (\%) & & / & & = \\ \hline \multicolumn{5}{|l|}{ Asset management ratio } \\ \hline Total assets turnover & & / & & = \\ \hline \multicolumn{5}{|l|}{ Financial ratios } \\ \hline Equity multiplier & & / & & = \\ \hline \end{tabular} Check all that apply. Decrease the company's use of debt capital because it will decrease the equity multiplier. Use more equity financing in its capital structure, which will increase the equity multiplier. Increase the efficiency of its assets so that it generates more sales with each dollar of asset investment and increases the company's total assets turnover. Reduce the company's operating expenses, its cost of goods sold, and/or the interest rate on its borrowed funds because this will increase the company's net profit margin. \begin{tabular}{|c|c|c|c|c|c|} \hline Ratios & Value & Correct/Incorrect & Ratios & Value & Correct/Incorrect \\ \hline Profitability ratios & & & Asset management & & \\ \hline Gross profit margin (\%) & 50.00 & & Total assets turnover & 2.00 & \\ \hline Operating profit margin (\%) & 22.36 & & & & \\ \hline Net profit margin (\%) & 33.54 & & Financial ratios & & \\ \hline Return on equity (\%) & 112.02 & & Equity multiplier & 1.67 & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline Ratios & Calculation & & & \\ \hline Profitability ratios & Numerator & & Denominator & \\ \hline Gross profit margin (\%) & & / & & = \\ \hline Operating profit margin (\%) & & / & & = \\ \hline Net profit margin (\%) & & / & & = \\ \hline Return on equity (\%) & & / & & = \\ \hline \multicolumn{5}{|l|}{ Asset management ratio } \\ \hline Total assets turnover & & / & & = \\ \hline \multicolumn{5}{|l|}{ Financial ratios } \\ \hline Equity multiplier & & / & & = \\ \hline \end{tabular} Check all that apply. Decrease the company's use of debt capital because it will decrease the equity multiplier. Use more equity financing in its capital structure, which will increase the equity multiplier. Increase the efficiency of its assets so that it generates more sales with each dollar of asset investment and increases the company's total assets turnover. Reduce the company's operating expenses, its cost of goods sold, and/or the interest rate on its borrowed funds because this will increase the company's net profit margin

\begin{tabular}{|c|c|c|c|c|c|} \hline Ratios & Value & Correct/Incorrect & Ratios & Value & Correct/Incorrect \\ \hline Profitability ratios & & & Asset management & & \\ \hline Gross profit margin (\%) & 50.00 & & Total assets turnover & 2.00 & \\ \hline Operating profit margin (\%) & 22.36 & & & & \\ \hline Net profit margin (\%) & 33.54 & & Financial ratios & & \\ \hline Return on equity (\%) & 112.02 & & Equity multiplier & 1.67 & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline Ratios & Calculation & & & \\ \hline Profitability ratios & Numerator & & Denominator & \\ \hline Gross profit margin (\%) & & / & & = \\ \hline Operating profit margin (\%) & & / & & = \\ \hline Net profit margin (\%) & & / & & = \\ \hline Return on equity (\%) & & / & & = \\ \hline \multicolumn{5}{|l|}{ Asset management ratio } \\ \hline Total assets turnover & & / & & = \\ \hline \multicolumn{5}{|l|}{ Financial ratios } \\ \hline Equity multiplier & & / & & = \\ \hline \end{tabular} Check all that apply. Decrease the company's use of debt capital because it will decrease the equity multiplier. Use more equity financing in its capital structure, which will increase the equity multiplier. Increase the efficiency of its assets so that it generates more sales with each dollar of asset investment and increases the company's total assets turnover. Reduce the company's operating expenses, its cost of goods sold, and/or the interest rate on its borrowed funds because this will increase the company's net profit margin. \begin{tabular}{|c|c|c|c|c|c|} \hline Ratios & Value & Correct/Incorrect & Ratios & Value & Correct/Incorrect \\ \hline Profitability ratios & & & Asset management & & \\ \hline Gross profit margin (\%) & 50.00 & & Total assets turnover & 2.00 & \\ \hline Operating profit margin (\%) & 22.36 & & & & \\ \hline Net profit margin (\%) & 33.54 & & Financial ratios & & \\ \hline Return on equity (\%) & 112.02 & & Equity multiplier & 1.67 & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline Ratios & Calculation & & & \\ \hline Profitability ratios & Numerator & & Denominator & \\ \hline Gross profit margin (\%) & & / & & = \\ \hline Operating profit margin (\%) & & / & & = \\ \hline Net profit margin (\%) & & / & & = \\ \hline Return on equity (\%) & & / & & = \\ \hline \multicolumn{5}{|l|}{ Asset management ratio } \\ \hline Total assets turnover & & / & & = \\ \hline \multicolumn{5}{|l|}{ Financial ratios } \\ \hline Equity multiplier & & / & & = \\ \hline \end{tabular} Check all that apply. Decrease the company's use of debt capital because it will decrease the equity multiplier. Use more equity financing in its capital structure, which will increase the equity multiplier. Increase the efficiency of its assets so that it generates more sales with each dollar of asset investment and increases the company's total assets turnover. Reduce the company's operating expenses, its cost of goods sold, and/or the interest rate on its borrowed funds because this will increase the company's net profit margin Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started