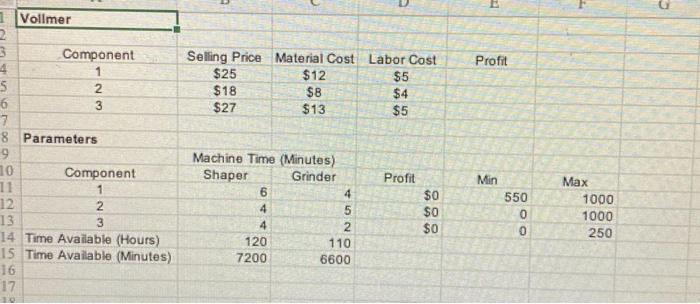

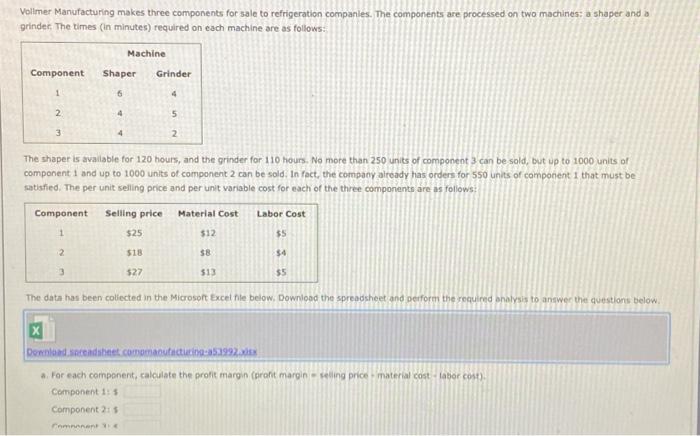

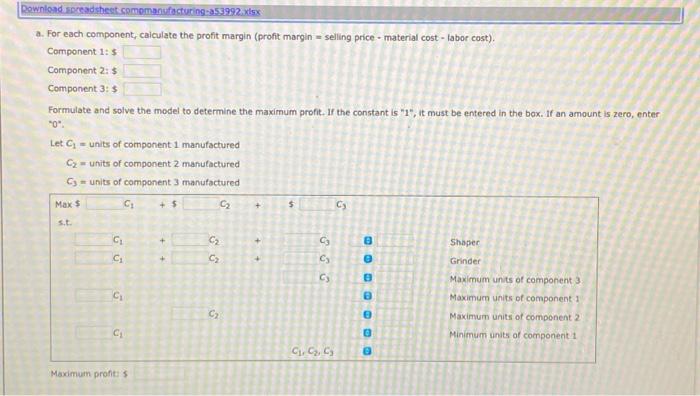

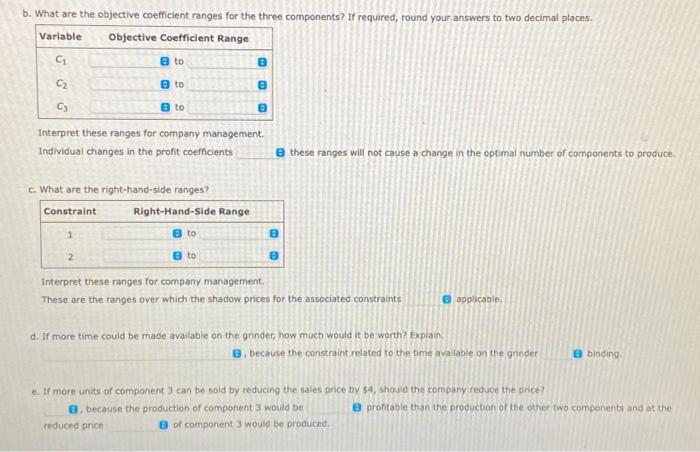

\begin{tabular}{|c|c|c|c|c|c|} \hline Vollmer & & & 23 & & \\ \hline & & & & & \\ \hline Component & Selling Price & Material Cost & Labor Cost & Profit & \\ \hline 1 & $25 & $12 & $5 & & \\ \hline 2 & $18 & $8 & $4 & & \\ \hline 3 & $27 & $13 & $5 & & \\ \hline & 54 & & & & \\ \hline \multicolumn{6}{|l|}{ Parameters } \\ \hline & \multicolumn{2}{|c|}{ Machine Time (Minutes) } & & & \\ \hline Component & Shaper & Grinder & Profit & Min & Max \\ \hline 1 & 6 & 4 & $0 & 550 & 1000 \\ \hline 2 & 4 & 5 & \$0 & 0 & 1000 \\ \hline 3 & 4 & 2 & $0 & 0 & 250 \\ \hline Time Avaliable (Hours) & 120 & 110 & & & \\ \hline Time Avallable (Minutes) & 7200 & 6600 & & & \\ \hline \end{tabular} a. For each component, caiculate the profit margin (profit margin = selling price - material cost - labor cost). Component i: 5 Component 2: $ Component 3:5 Formulate and solve the model to determine the maximum profit. If the constant is " 1 ", it must be entered in the box. If an amount is zero, enter "0". Let C1= units of component 1 manufactured C2 = units of component 2 manufactured C3= units of component 3 manufactured Interpret these ranges for company management. Individual changes in the profit coefficients these ranges will not cause a change in the optimal number of components to produce. c. What are the right-hand-side ranges? Interpret these ranges for company management. These are the ranges over which the shadow pnces for the associated constraints applicabie: d. If more time could be made available on the grinder, how much would it be worth? Explain. , because the constraint related to the time ava lable on the grinder binding. e. If more units of component, 3 can be sold by reducing the sales price by 54 , should thic company reduce the price? because the production of component 3 would be proftable than the productoon of the other two components and at the reduced price of component 3 would bet produced. Volimer Manufacturing makes three components for sale to refrigeration companies. The components are processed on two machines: a shaper and a grinder, The times (in minutes) required on each machine are as foltows: The shaper is avaliable for 120 hours, and the grinder for 110 hours. No more than 250 units of component 3 can be sold, but up to 1000 units of component 1 and up to 1000 units of component 2 can be sold. In fact, the company aiready has orders for 550 units of component 1 that must be satisfied. The per unit seling price and per unit variable cost for each of the three components are as follows: The data has been coliected in the Microsort Excel file below, Downlood the spreadsheet gnd perform the required onalysis to answer the questions below Component is 5 Component 2 is Component at 4 \begin{tabular}{|c|c|c|c|c|c|} \hline Vollmer & & & 23 & & \\ \hline & & & & & \\ \hline Component & Selling Price & Material Cost & Labor Cost & Profit & \\ \hline 1 & $25 & $12 & $5 & & \\ \hline 2 & $18 & $8 & $4 & & \\ \hline 3 & $27 & $13 & $5 & & \\ \hline & 54 & & & & \\ \hline \multicolumn{6}{|l|}{ Parameters } \\ \hline & \multicolumn{2}{|c|}{ Machine Time (Minutes) } & & & \\ \hline Component & Shaper & Grinder & Profit & Min & Max \\ \hline 1 & 6 & 4 & $0 & 550 & 1000 \\ \hline 2 & 4 & 5 & \$0 & 0 & 1000 \\ \hline 3 & 4 & 2 & $0 & 0 & 250 \\ \hline Time Avaliable (Hours) & 120 & 110 & & & \\ \hline Time Avallable (Minutes) & 7200 & 6600 & & & \\ \hline \end{tabular} a. For each component, caiculate the profit margin (profit margin = selling price - material cost - labor cost). Component i: 5 Component 2: $ Component 3:5 Formulate and solve the model to determine the maximum profit. If the constant is " 1 ", it must be entered in the box. If an amount is zero, enter "0". Let C1= units of component 1 manufactured C2 = units of component 2 manufactured C3= units of component 3 manufactured Interpret these ranges for company management. Individual changes in the profit coefficients these ranges will not cause a change in the optimal number of components to produce. c. What are the right-hand-side ranges? Interpret these ranges for company management. These are the ranges over which the shadow pnces for the associated constraints applicabie: d. If more time could be made available on the grinder, how much would it be worth? Explain. , because the constraint related to the time ava lable on the grinder binding. e. If more units of component, 3 can be sold by reducing the sales price by 54 , should thic company reduce the price? because the production of component 3 would be proftable than the productoon of the other two components and at the reduced price of component 3 would bet produced. Volimer Manufacturing makes three components for sale to refrigeration companies. The components are processed on two machines: a shaper and a grinder, The times (in minutes) required on each machine are as foltows: The shaper is avaliable for 120 hours, and the grinder for 110 hours. No more than 250 units of component 3 can be sold, but up to 1000 units of component 1 and up to 1000 units of component 2 can be sold. In fact, the company aiready has orders for 550 units of component 1 that must be satisfied. The per unit seling price and per unit variable cost for each of the three components are as follows: The data has been coliected in the Microsort Excel file below, Downlood the spreadsheet gnd perform the required onalysis to answer the questions below Component is 5 Component 2 is Component at 4