Answered step by step

Verified Expert Solution

Question

1 Approved Answer

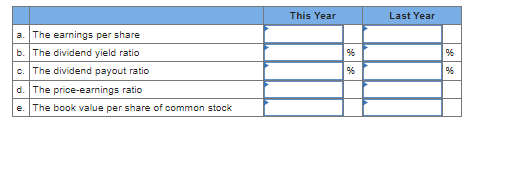

begin{tabular}{|c|l|c|c|c|c|} hline a. & The earnings per share & multicolumn{2}{c|}{ This Year } & multicolumn{2}{c|}{ Last Year } hline b. & The dividend yield

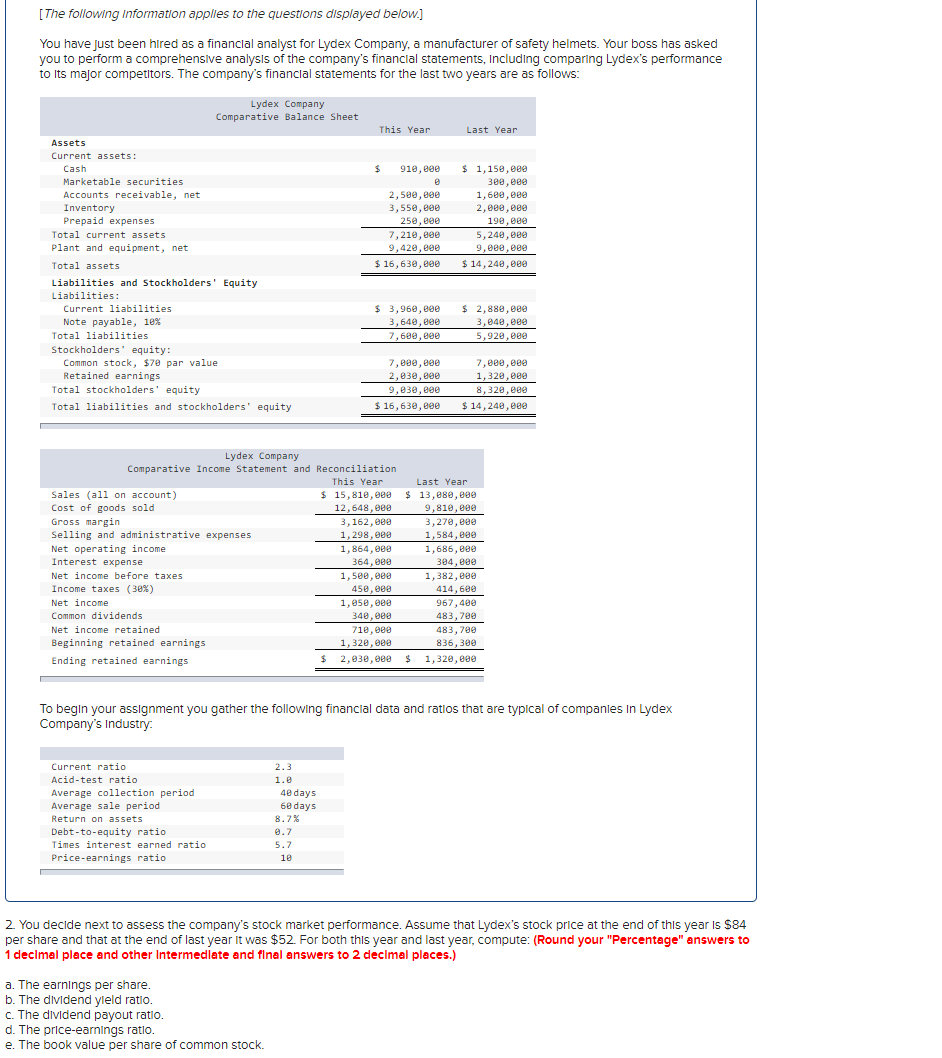

\begin{tabular}{|c|l|c|c|c|c|} \hline a. & The earnings per share & \multicolumn{2}{c|}{ This Year } & \multicolumn{2}{c|}{ Last Year } \\ \hline b. & The dividend yield ratio & & & & \\ \hline c. & The dividend payout ratio & & % & & % \\ \hline d. & The price-earnings ratio & & % & & % \\ \hline e. & The book value per share of common stock & & & & \\ \hline \end{tabular} [The following Information applies to the questions displayed below.] You have just been hired as a financlal analyst for Lydex Company, a manufacturer of safety helmets. Your boss has asked you to perform a comprehensive analysis of the company's financlal statements, Including comparing Lydex's performance to its major compettors. The company's financlal statements for the last two years are as follows: To begin your assignment you gather the following financlal data and ratios that are typical of companles in Lydex Company's Industry. 2. You decide next to assess the company's stock market performance. Assume that Lydex's stock price at the end of this year is $84 per share and that at the end of last year it was $52. For both this year and last year, compute: (Round your "Percentage" answers to 1 decimal place and other Intermedlate and final answers to 2 decimal places.) a. The earnings per share. b. The dividend yleld ratio. c. The dividend payout ratio. d. The price-earnings ratlo. e. The book value per share of common stock

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started