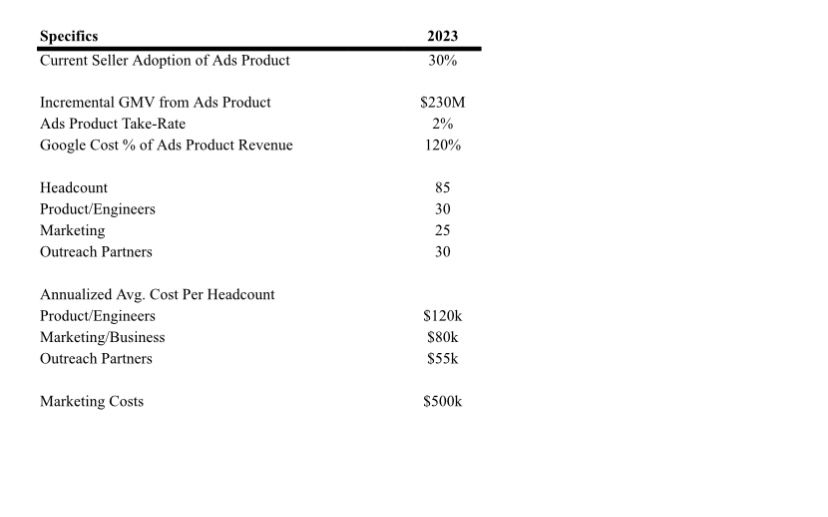

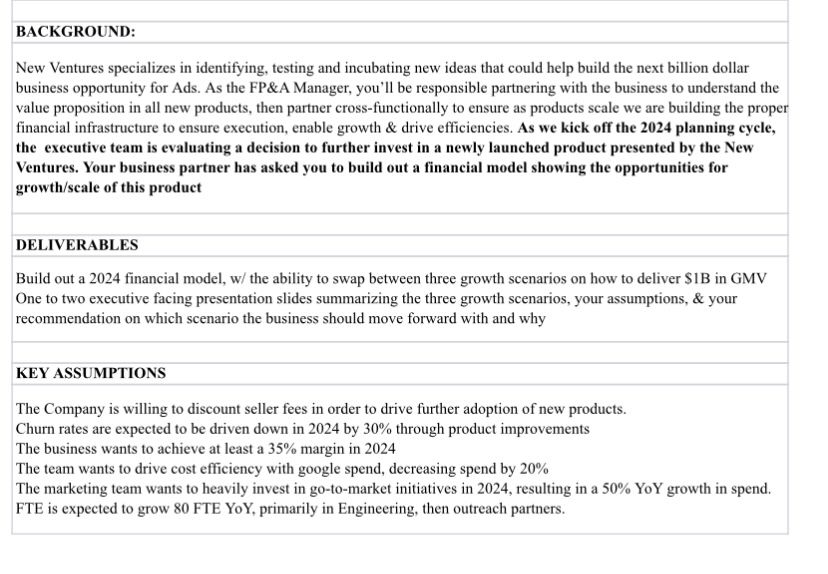

\begin{tabular}{lc} Specifics & 2023 \\ \hline Current Seller Adoption of Ads Product & 30% \\ Incremental GMV from Ads Product & $230M \\ Ads Product Take-Rate & 2% \\ Google Cost \% of Ads Product Revenue & 120% \\ Headcount & \\ Product/Engineers & 85 \\ Marketing & 30 \\ Outreach Partners & 25 \\ Annualized Avg. Cost Per Headcount & 30 \\ Product/Engineers & \\ Marketing/Business & $120k \\ Outreach Partners & $80k \\ Marketing Costs & $55k \\ \end{tabular} New Ventures specializes in identifying, testing and incubating new ideas that could help build the next billion dollar business opportunity for Ads. As the FP\&A Manager, you'll be responsible partnering with the business to understand the value proposition in all new products, then partner cross-functionally to ensure as products scale we are building the proper financial infrastructure to ensure execution, enable growth \& drive efficiencies. As we kick off the 2024 planning cycle, the executive team is evaluating a decision to further invest in a newly launched product presented by the New Ventures. Your business partner has asked you to build out a financial model showing the opportunities for growth/scale of this product DELIVERABLES Build out a 2024 financial model, w/ the ability to swap between three growth scenarios on how to deliver \$1B in GMV One to two executive facing presentation slides summarizing the three growth scenarios, your assumptions, \& your recommendation on which scenario the business should move forward with and why KEY ASSUMPTIONS The Company is willing to discount seller fees in order to drive further adoption of new products. Churn rates are expected to be driven down in 2024 by 30% through product improvements The business wants to achieve at least a 35% margin in 2024 The team wants to drive cost efficiency with google spend, decreasing spend by 20% The marketing team wants to heavily invest in go-to-market initiatives in 2024, resulting in a 50\% YoY growth in spend. FTE is expected to grow 80 FTE YoY, primarily in Engineering, then outreach partners