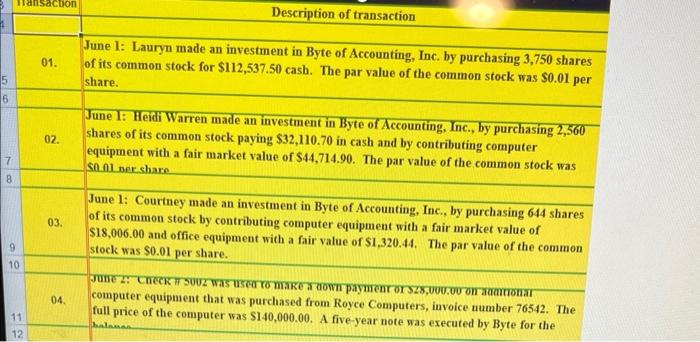

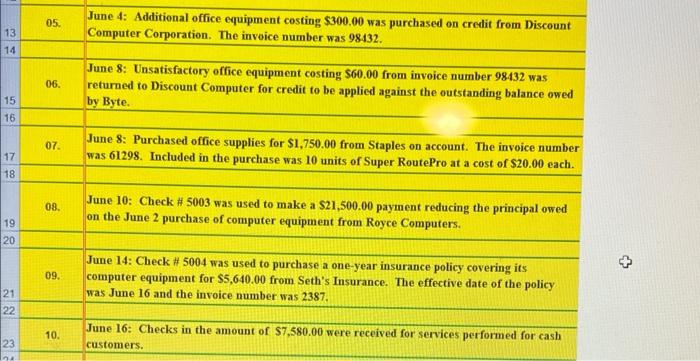

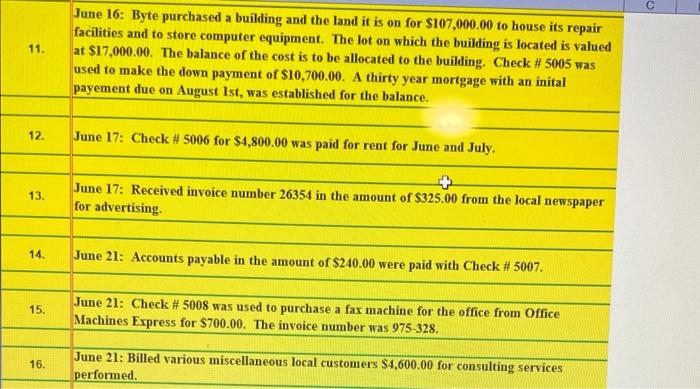

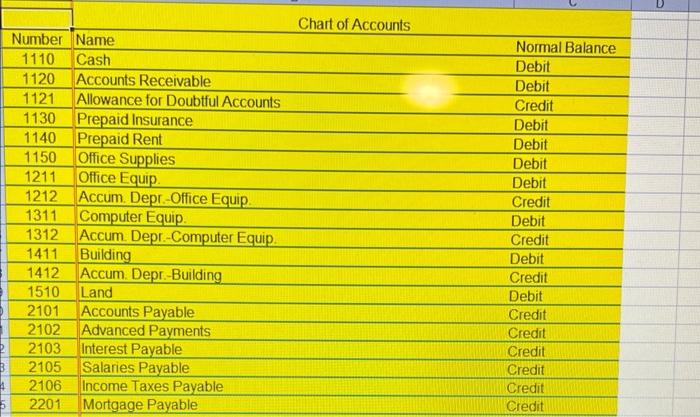

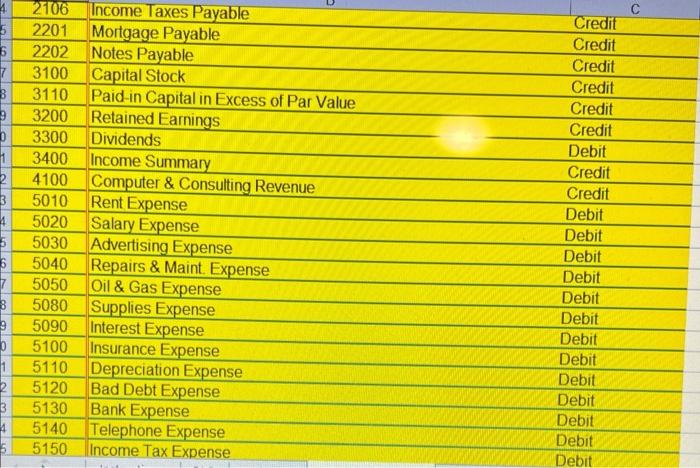

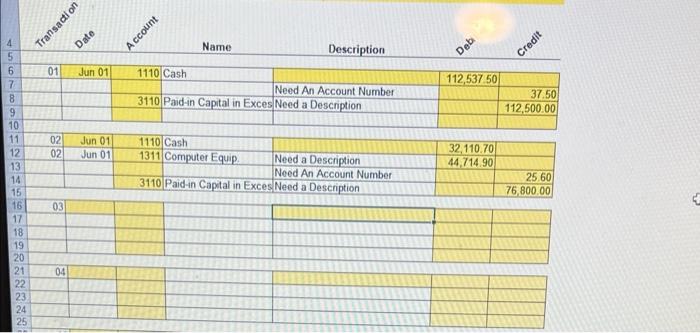

\begin{tabular}{|l|l|} \hline & Description of transaction \\ 01. June 1: Lauryn made an investment in Byte of Accounting, Inc. by purchasing 3,750 shares \end{tabular} share. June I: Heidi Warren made an investment in Byte of Accounting, Inc., by purchasing 2,560 shares of its common stock paying $32,110.70 in cash and by contributing computer equipment with a fair market value of $44,714.90. The par value of the common stock was si flu ner share June 1: Courtney made an investment in Byte of Accounting, Inc., by purchasing 644 shares of its common stock by contributing computer equipment with a fair market value of $18,006.00 and office equipment with a fair value of $1,320.44. The par value of the common stock was $0.01 per share. 05. June 4: Additional office equipment costing $$300.00 was purchased on credit from Discount Computer Corporation. The invoice number was 98432 . June 16: Byte purchased a building and the land it is on for $107,000.00 to house its repair facilities and to store computer equipment. The lot on which the building is located is valued at $17,000.00. The balance of the cost is to be allocated to the building. Check # 5005 was used to make the down payment of $10,700.00. A thirty year mortgage with an inital payement due on August 1st, was established for the balance. \begin{tabular}{|l} \hline payement due on August Ist, was established for the balance. \\ \hline June 17: Check # 5006 for $4,800.00 was paid for rent for June and July. \end{tabular} \begin{tabular}{|c|ll|l|} \hline & & Chart of Accounts & \\ \hline Number & Name & Normal Balance \\ \hline 1110 & Cash & Debit \\ \hline 1120 & Accounts Receivable & Debit \\ \hline 1121 & Allowance for Doubtful Accounts & Credit \\ \hline 1130 & Prepaid Insurance & Debit \\ \hline 1140 & Prepaid Rent & Debit \\ \hline 1150 & Office Supplies & Debit \\ \hline 1211 & Office Equip. & Debit \\ \hline 1212 & Accum. Depr-Office Equip. & Credit \\ \hline 1311 & Computer Equip. & Debit \\ \hline 1312 & Accum. Depr-Computer Equip. & Credit \\ \hline 1411 & Building & Debit \\ \hline 1412 & Accum. Depr.-Building & Credit \\ \hline 1510 & Land & Debit \\ \hline 2101 & Accounts Payable & Credit \\ \hline 2102 & Advanced Payments & Credit \\ \hline 2103 & Interest Payable & Credit \\ \hline 2105 & Salaries Payable & Credit \\ \hline 2106 & Income Taxes Payable & Credit \\ \hline 2201 & Mortgage Payable & Credit \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|l|l|l|} \hline \end{tabular} \begin{tabular}{|l|l|} \hline & Description of transaction \\ 01. June 1: Lauryn made an investment in Byte of Accounting, Inc. by purchasing 3,750 shares \end{tabular} share. June I: Heidi Warren made an investment in Byte of Accounting, Inc., by purchasing 2,560 shares of its common stock paying $32,110.70 in cash and by contributing computer equipment with a fair market value of $44,714.90. The par value of the common stock was si flu ner share June 1: Courtney made an investment in Byte of Accounting, Inc., by purchasing 644 shares of its common stock by contributing computer equipment with a fair market value of $18,006.00 and office equipment with a fair value of $1,320.44. The par value of the common stock was $0.01 per share. 05. June 4: Additional office equipment costing $$300.00 was purchased on credit from Discount Computer Corporation. The invoice number was 98432 . June 16: Byte purchased a building and the land it is on for $107,000.00 to house its repair facilities and to store computer equipment. The lot on which the building is located is valued at $17,000.00. The balance of the cost is to be allocated to the building. Check # 5005 was used to make the down payment of $10,700.00. A thirty year mortgage with an inital payement due on August 1st, was established for the balance. \begin{tabular}{|l} \hline payement due on August Ist, was established for the balance. \\ \hline June 17: Check # 5006 for $4,800.00 was paid for rent for June and July. \end{tabular} \begin{tabular}{|c|ll|l|} \hline & & Chart of Accounts & \\ \hline Number & Name & Normal Balance \\ \hline 1110 & Cash & Debit \\ \hline 1120 & Accounts Receivable & Debit \\ \hline 1121 & Allowance for Doubtful Accounts & Credit \\ \hline 1130 & Prepaid Insurance & Debit \\ \hline 1140 & Prepaid Rent & Debit \\ \hline 1150 & Office Supplies & Debit \\ \hline 1211 & Office Equip. & Debit \\ \hline 1212 & Accum. Depr-Office Equip. & Credit \\ \hline 1311 & Computer Equip. & Debit \\ \hline 1312 & Accum. Depr-Computer Equip. & Credit \\ \hline 1411 & Building & Debit \\ \hline 1412 & Accum. Depr.-Building & Credit \\ \hline 1510 & Land & Debit \\ \hline 2101 & Accounts Payable & Credit \\ \hline 2102 & Advanced Payments & Credit \\ \hline 2103 & Interest Payable & Credit \\ \hline 2105 & Salaries Payable & Credit \\ \hline 2106 & Income Taxes Payable & Credit \\ \hline 2201 & Mortgage Payable & Credit \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|l|l|l|} \hline \end{tabular}