Answered step by step

Verified Expert Solution

Question

1 Approved Answer

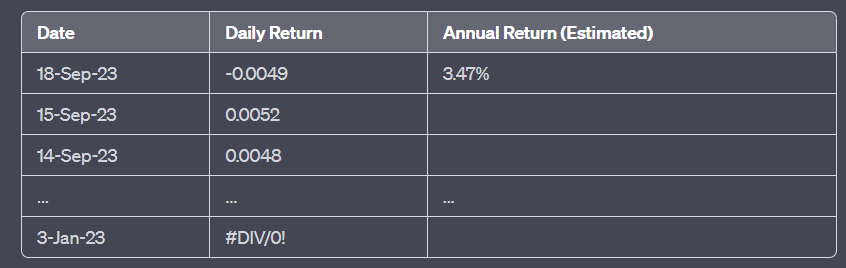

begin{tabular}{|l|l|l|} hline Date & Daily Return & Annual Return (Estimated) hline 18 Sep-23 & -0.0049 & 3.47% hline 15 Sep-23 & 0.0052 &

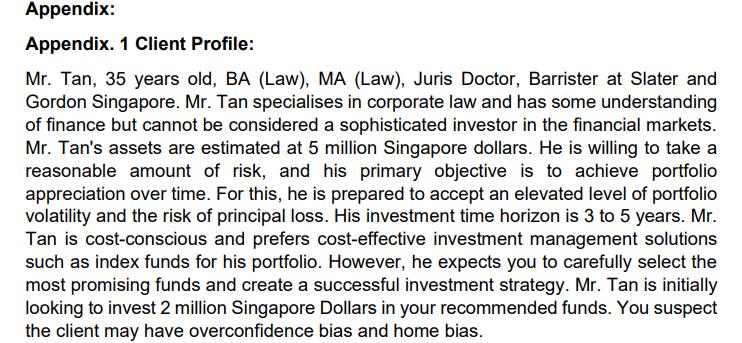

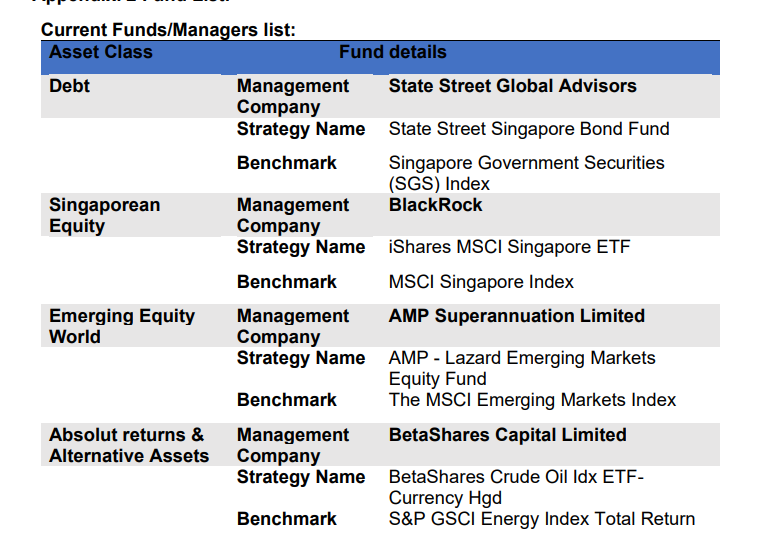

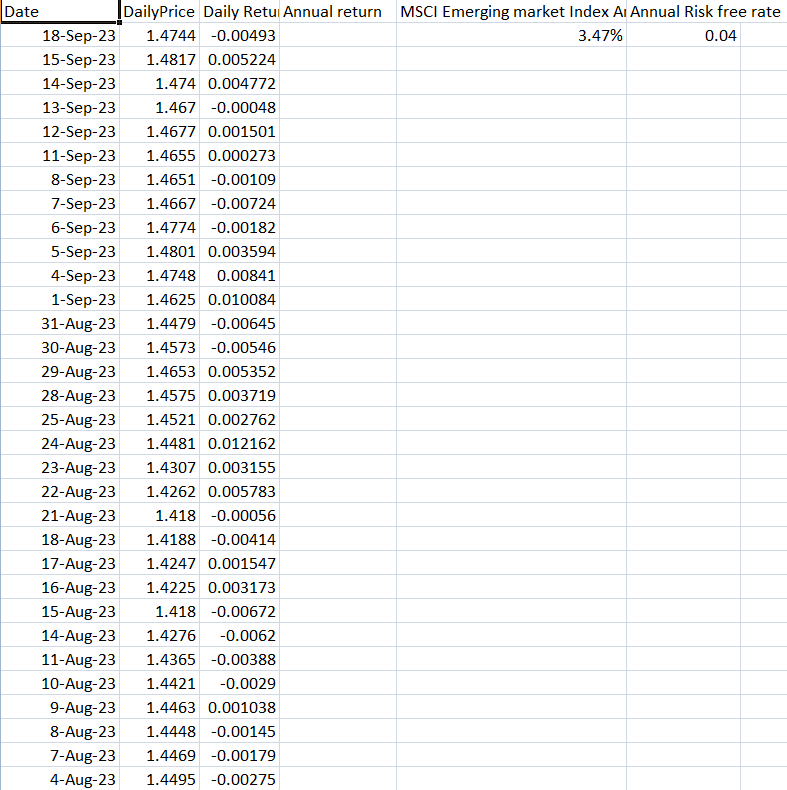

\begin{tabular}{|l|l|l|} \hline Date & Daily Return & Annual Return (Estimated) \\ \hline 18 Sep-23 & -0.0049 & 3.47% \\ \hline 15 Sep-23 & 0.0052 & \\ \hline 14 Sep-23 & 0.0048 & \\ \hline & & \\ \hline 3-Jan-23 & \#DIV/0! & \\ \hline \end{tabular} Appendix. 1 Client Profile: Mr. Tan, 35 years old, BA (Law), MA (Law), Juris Doctor, Barrister at Slater and Gordon Singapore. Mr. Tan specialises in corporate law and has some understanding of finance but cannot be considered a sophisticated investor in the financial markets. Mr. Tan's assets are estimated at 5 million Singapore dollars. He is willing to take a reasonable amount of risk, and his primary objective is to achieve portfolio appreciation over time. For this, he is prepared to accept an elevated level of portfolio volatility and the risk of principal loss. His investment time horizon is 3 to 5 years. Mr. Tan is cost-conscious and prefers cost-effective investment management solutions such as index funds for his portfolio. However, he expects you to carefully select the most promising funds and create a successful investment strategy. Mr. Tan is initially looking to invest 2 million Singapore Dollars in your recommended funds. You suspect the client may have overconfidence bias and home bias. \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{ Asset Class } \\ \hline \multirow[t]{3}{*}{ Debt } & ManagementCompany & State Street Global Advisors \\ \hline & Strategy Name & State Street Singapore Bond Fund \\ \hline & Benchmark & SingaporeGovernmentSecurities(SGS)Index \\ \hline \multirow[t]{3}{*}{SingaporeanEquity} & ManagementCompany & BlackRock \\ \hline & Strategy Name & iShares MSCI Singapore ETF \\ \hline & Benchmark & MSCI Singapore Index \\ \hline \multirow[t]{3}{*}{EmergingEquityWorld} & ManagementCompany & AMP Superannuation Limited \\ \hline & Strategy Name & AMP-LazardEmergingMarketsEquityFund \\ \hline & Benchmark & The MSCI Emerging Markets Index \\ \hline \multirow[t]{2}{*}{Absolutreturns&AlternativeAssets} & ManagementCompany & BetaShares Capital Limited \\ \hline & StrategyNameBenchmark & BetaSharesCrudeOilIdxETF-CurrencyHgdS&PGSClEnergyIndexTotalReturn \\ \hline \end{tabular} * Section 1: Market conditions and Monetary Policy - Discuss current market conditions in Singapore and globally that may impact investment decisions. - Discussion differences in the Monetary Policy Implementation Process in Singapore compared to Australia. - Explain the intermediate target for monetary policy set by the MAS and highlight the objectives and tools that the MAS employs to achieve this target. - Offer examples of economic indicators that provide insights into future stages of the business cycle. - Explain how changes in key economic indicators influence the Singapore Economy, referencing the brief of recent Economic Development in Singapore published in August. Date DailyPrice Daily Retul Annual return MSCl Emerging market Index AI Annual Risk free rate \begin{tabular}{l|l|l|} \hline 18-Sep-23 & 1.4744 & -0.00493 \\ \hline \end{tabular} 3.47% 0.04 \begin{tabular}{|r|r|r|} \hline 15Sep23 & 1.4817 & 0.005224 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline 14-Sep-23 & 1.474 & 0.004772 \\ \hline \end{tabular} \begin{tabular}{|l|r|r|r|} \hline 13Sep23 & 1.467 & -0.00048 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline 12Sep23 & 1.4677 & 0.001501 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline 11Sep23 & 1.4655 & 0.000273 \\ \hline \end{tabular} \begin{tabular}{|r|r|r|} \hline 8-Sep-23 & 1.4651 & -0.00109 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} 7-Sep-23 & 1.4667 & -0.00724 \\ \hline \end{tabular} \begin{tabular}{|r|r|r|r|} \hline 6-Sep-23 & 1.4774 & -0.00182 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline 5-Sep-23 & 1.4801 & 0.003594 \\ \hline \end{tabular} \begin{tabular}{l|l|l|} \hline 4-Sep-23 & 1.4748 & 0.00841 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} \hline 1-Sep-23 & 1.4625 & 0.010084 \\ \hline \end{tabular} \begin{tabular}{|r|r|r|r|} \hline 31-Aug-23 & 1.4479 & -0.00645 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline 30-Aug-23 & 1.4573 & -0.00546 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline 29-Aug-23 & 1.4653 & 0.005352 \\ \hline \end{tabular} \begin{tabular}{|l|r|r|r|} \hline 28Aug23 & 1.4575 & 0.003719 \\ \hline \end{tabular} \begin{tabular}{|l|r|r|} \hline 25Aug23 & 1.4521 & 0.002762 \\ \hline \end{tabular} \begin{tabular}{|l|r|r|r|} \hline 24-Aug-23 & 1.4481 & 0.012162 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline 23-Aug-23 & 1.4307 & 0.003155 \\ \hline \end{tabular} \begin{tabular}{|l|r|r|r|} \hline 22Aug23 & 1.4262 & 0.005783 \\ \hline \end{tabular} \begin{tabular}{|r|r|r|} \hline 21Aug23 & 1.418 & -0.00056 \\ \hline \end{tabular} \begin{tabular}{|l|r|r|} \hline 18Aug23 & 1.4188 & -0.00414 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline 17-Aug-23 & 1.4247 & 0.001547 \\ \hline \end{tabular} \begin{tabular}{|r|r|r|r|} \hline 16Aug23 & 1.4225 & 0.003173 \\ \hline \end{tabular} \begin{tabular}{|r|r|r|r|} \hline 15Aug23 & 1.418 & -0.00672 \\ \hline \end{tabular} \begin{tabular}{|r|r|r|} \hline 14-Aug-23 & 1.4276 & -0.0062 \\ \hline \end{tabular} \begin{tabular}{|l|r|r|} \hline 11Aug23 & 1.4365 & -0.00388 \\ \hline \end{tabular} \begin{tabular}{|r|r|r|} \hline 10Aug23 & 1.4421 & -0.0029 \\ \hline \end{tabular} \begin{tabular}{l|l|l|} \hline 9-Aug-23 & 1.4463 & 0.001038 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline 8-Aug-23 & 1.4448 & -0.00145 \\ \hline \end{tabular} \begin{tabular}{|r|r|r|} \hline 7-Aug-23 & 1.4469 & -0.00179 \\ \hline \end{tabular} \begin{tabular}{lr|r} 4-Aug-23 & 1.4495 & -0.00275 \end{tabular}

\begin{tabular}{|l|l|l|} \hline Date & Daily Return & Annual Return (Estimated) \\ \hline 18 Sep-23 & -0.0049 & 3.47% \\ \hline 15 Sep-23 & 0.0052 & \\ \hline 14 Sep-23 & 0.0048 & \\ \hline & & \\ \hline 3-Jan-23 & \#DIV/0! & \\ \hline \end{tabular} Appendix. 1 Client Profile: Mr. Tan, 35 years old, BA (Law), MA (Law), Juris Doctor, Barrister at Slater and Gordon Singapore. Mr. Tan specialises in corporate law and has some understanding of finance but cannot be considered a sophisticated investor in the financial markets. Mr. Tan's assets are estimated at 5 million Singapore dollars. He is willing to take a reasonable amount of risk, and his primary objective is to achieve portfolio appreciation over time. For this, he is prepared to accept an elevated level of portfolio volatility and the risk of principal loss. His investment time horizon is 3 to 5 years. Mr. Tan is cost-conscious and prefers cost-effective investment management solutions such as index funds for his portfolio. However, he expects you to carefully select the most promising funds and create a successful investment strategy. Mr. Tan is initially looking to invest 2 million Singapore Dollars in your recommended funds. You suspect the client may have overconfidence bias and home bias. \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{ Asset Class } \\ \hline \multirow[t]{3}{*}{ Debt } & ManagementCompany & State Street Global Advisors \\ \hline & Strategy Name & State Street Singapore Bond Fund \\ \hline & Benchmark & SingaporeGovernmentSecurities(SGS)Index \\ \hline \multirow[t]{3}{*}{SingaporeanEquity} & ManagementCompany & BlackRock \\ \hline & Strategy Name & iShares MSCI Singapore ETF \\ \hline & Benchmark & MSCI Singapore Index \\ \hline \multirow[t]{3}{*}{EmergingEquityWorld} & ManagementCompany & AMP Superannuation Limited \\ \hline & Strategy Name & AMP-LazardEmergingMarketsEquityFund \\ \hline & Benchmark & The MSCI Emerging Markets Index \\ \hline \multirow[t]{2}{*}{Absolutreturns&AlternativeAssets} & ManagementCompany & BetaShares Capital Limited \\ \hline & StrategyNameBenchmark & BetaSharesCrudeOilIdxETF-CurrencyHgdS&PGSClEnergyIndexTotalReturn \\ \hline \end{tabular} * Section 1: Market conditions and Monetary Policy - Discuss current market conditions in Singapore and globally that may impact investment decisions. - Discussion differences in the Monetary Policy Implementation Process in Singapore compared to Australia. - Explain the intermediate target for monetary policy set by the MAS and highlight the objectives and tools that the MAS employs to achieve this target. - Offer examples of economic indicators that provide insights into future stages of the business cycle. - Explain how changes in key economic indicators influence the Singapore Economy, referencing the brief of recent Economic Development in Singapore published in August. Date DailyPrice Daily Retul Annual return MSCl Emerging market Index AI Annual Risk free rate \begin{tabular}{l|l|l|} \hline 18-Sep-23 & 1.4744 & -0.00493 \\ \hline \end{tabular} 3.47% 0.04 \begin{tabular}{|r|r|r|} \hline 15Sep23 & 1.4817 & 0.005224 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline 14-Sep-23 & 1.474 & 0.004772 \\ \hline \end{tabular} \begin{tabular}{|l|r|r|r|} \hline 13Sep23 & 1.467 & -0.00048 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline 12Sep23 & 1.4677 & 0.001501 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline 11Sep23 & 1.4655 & 0.000273 \\ \hline \end{tabular} \begin{tabular}{|r|r|r|} \hline 8-Sep-23 & 1.4651 & -0.00109 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} 7-Sep-23 & 1.4667 & -0.00724 \\ \hline \end{tabular} \begin{tabular}{|r|r|r|r|} \hline 6-Sep-23 & 1.4774 & -0.00182 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline 5-Sep-23 & 1.4801 & 0.003594 \\ \hline \end{tabular} \begin{tabular}{l|l|l|} \hline 4-Sep-23 & 1.4748 & 0.00841 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} \hline 1-Sep-23 & 1.4625 & 0.010084 \\ \hline \end{tabular} \begin{tabular}{|r|r|r|r|} \hline 31-Aug-23 & 1.4479 & -0.00645 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline 30-Aug-23 & 1.4573 & -0.00546 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline 29-Aug-23 & 1.4653 & 0.005352 \\ \hline \end{tabular} \begin{tabular}{|l|r|r|r|} \hline 28Aug23 & 1.4575 & 0.003719 \\ \hline \end{tabular} \begin{tabular}{|l|r|r|} \hline 25Aug23 & 1.4521 & 0.002762 \\ \hline \end{tabular} \begin{tabular}{|l|r|r|r|} \hline 24-Aug-23 & 1.4481 & 0.012162 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline 23-Aug-23 & 1.4307 & 0.003155 \\ \hline \end{tabular} \begin{tabular}{|l|r|r|r|} \hline 22Aug23 & 1.4262 & 0.005783 \\ \hline \end{tabular} \begin{tabular}{|r|r|r|} \hline 21Aug23 & 1.418 & -0.00056 \\ \hline \end{tabular} \begin{tabular}{|l|r|r|} \hline 18Aug23 & 1.4188 & -0.00414 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline 17-Aug-23 & 1.4247 & 0.001547 \\ \hline \end{tabular} \begin{tabular}{|r|r|r|r|} \hline 16Aug23 & 1.4225 & 0.003173 \\ \hline \end{tabular} \begin{tabular}{|r|r|r|r|} \hline 15Aug23 & 1.418 & -0.00672 \\ \hline \end{tabular} \begin{tabular}{|r|r|r|} \hline 14-Aug-23 & 1.4276 & -0.0062 \\ \hline \end{tabular} \begin{tabular}{|l|r|r|} \hline 11Aug23 & 1.4365 & -0.00388 \\ \hline \end{tabular} \begin{tabular}{|r|r|r|} \hline 10Aug23 & 1.4421 & -0.0029 \\ \hline \end{tabular} \begin{tabular}{l|l|l|} \hline 9-Aug-23 & 1.4463 & 0.001038 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline 8-Aug-23 & 1.4448 & -0.00145 \\ \hline \end{tabular} \begin{tabular}{|r|r|r|} \hline 7-Aug-23 & 1.4469 & -0.00179 \\ \hline \end{tabular} \begin{tabular}{lr|r} 4-Aug-23 & 1.4495 & -0.00275 \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started