Answered step by step

Verified Expert Solution

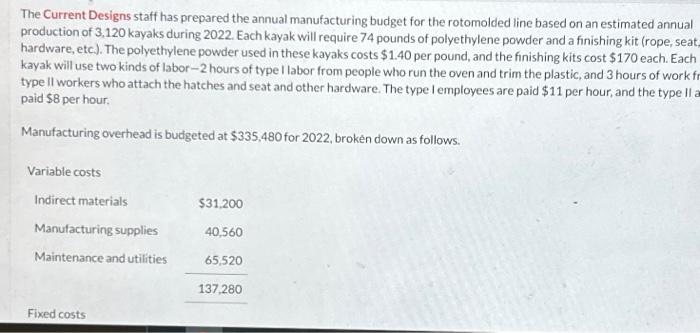

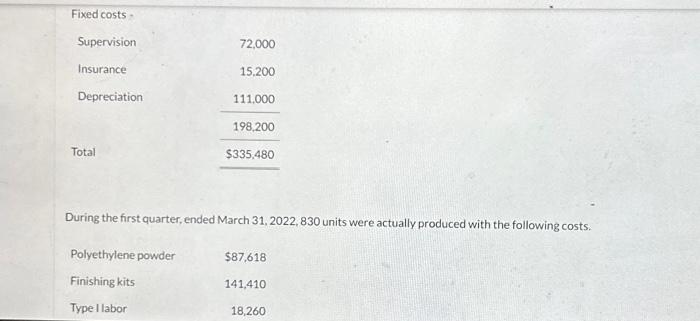

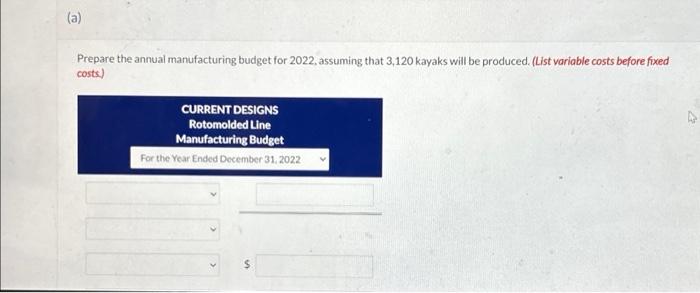

Question

1 Approved Answer

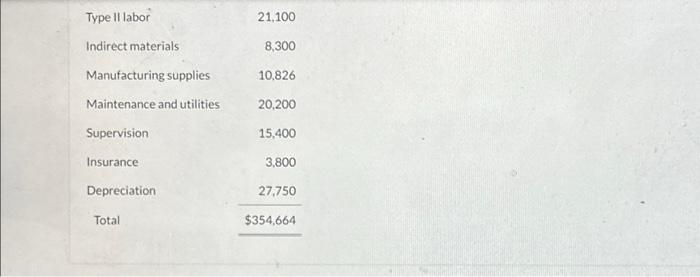

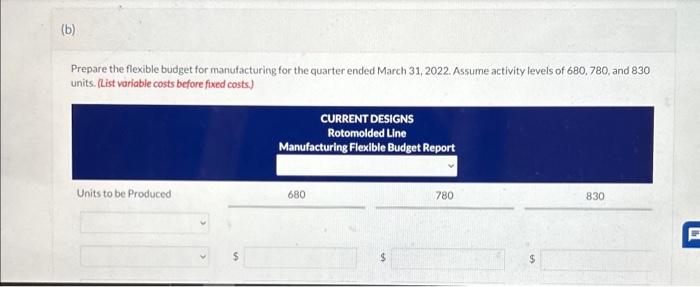

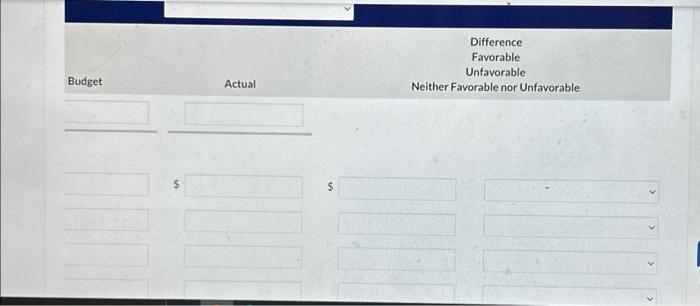

begin{tabular}{lr} hline Type Il labor & 21,100 hline Indirect materials & 8,300 hline Manufacturing supplies & 10,826 hline Maintenance and utilities &

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started