Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Following an audit of Mary Anderson's individual income tax return, the IRS revenue agent determined additional taxes were due. Mary disagreed. The IRS revenue agent

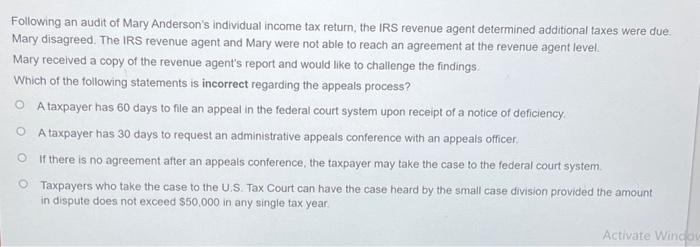

Following an audit of Mary Anderson's individual income tax return, the IRS revenue agent determined additional taxes were due. Mary disagreed. The IRS revenue agent and Mary were not able to reach an agreement at the revenue agent level. Mary received a copy of the revenue agent's report and would like to challenge the findings. Which of the following statements is incorrect regarding the appeals process? OA taxpayer has 60 days to file an appeal in the federal court system upon receipt of a notice of deficiency. O A taxpayer has 30 days to request an administrative appeals conference with an appeals officer. O If there is no agreement after an appeals conference, the taxpayer may take the case to the federal court system. Taxpayers who take the case to the U.S. Tax Court can have the case heard by the small case division provided the amount in dispute does not exceed $50,000 in any single tax year. Activate Window

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started