Answered step by step

Verified Expert Solution

Question

1 Approved Answer

begin{tabular}{|l|r|r|} multicolumn{3}{c}{ Balance Sheet } multicolumn{1}{|c}{ ($ millions) } & multicolumn{1}{c|}{ actual } hline Assets & 2013 Est. hline Cash and equivalents

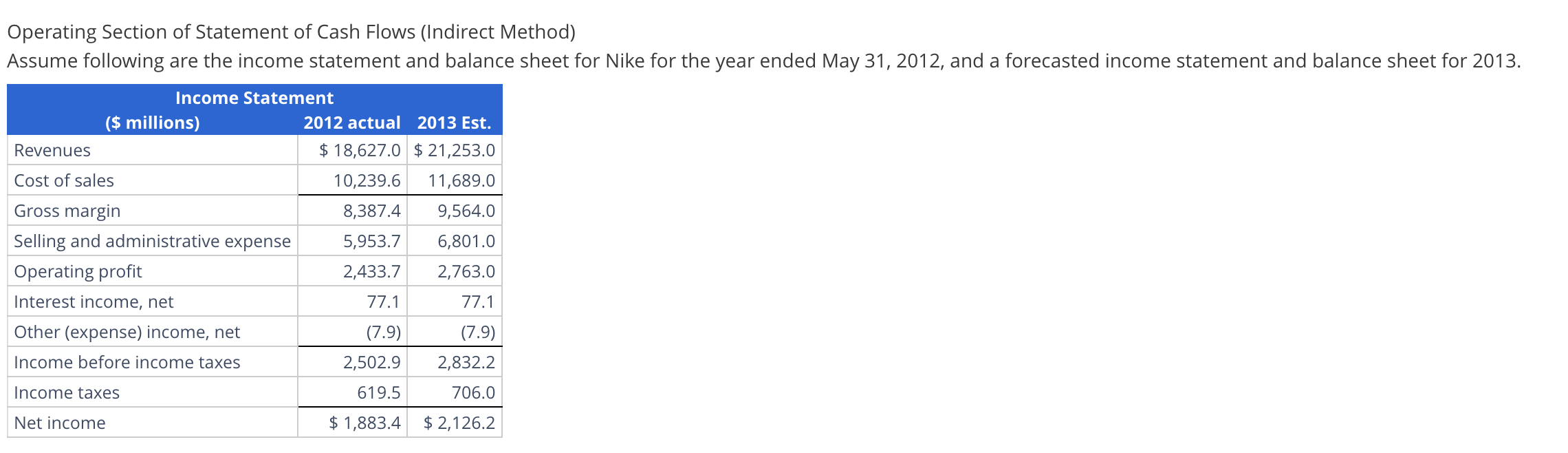

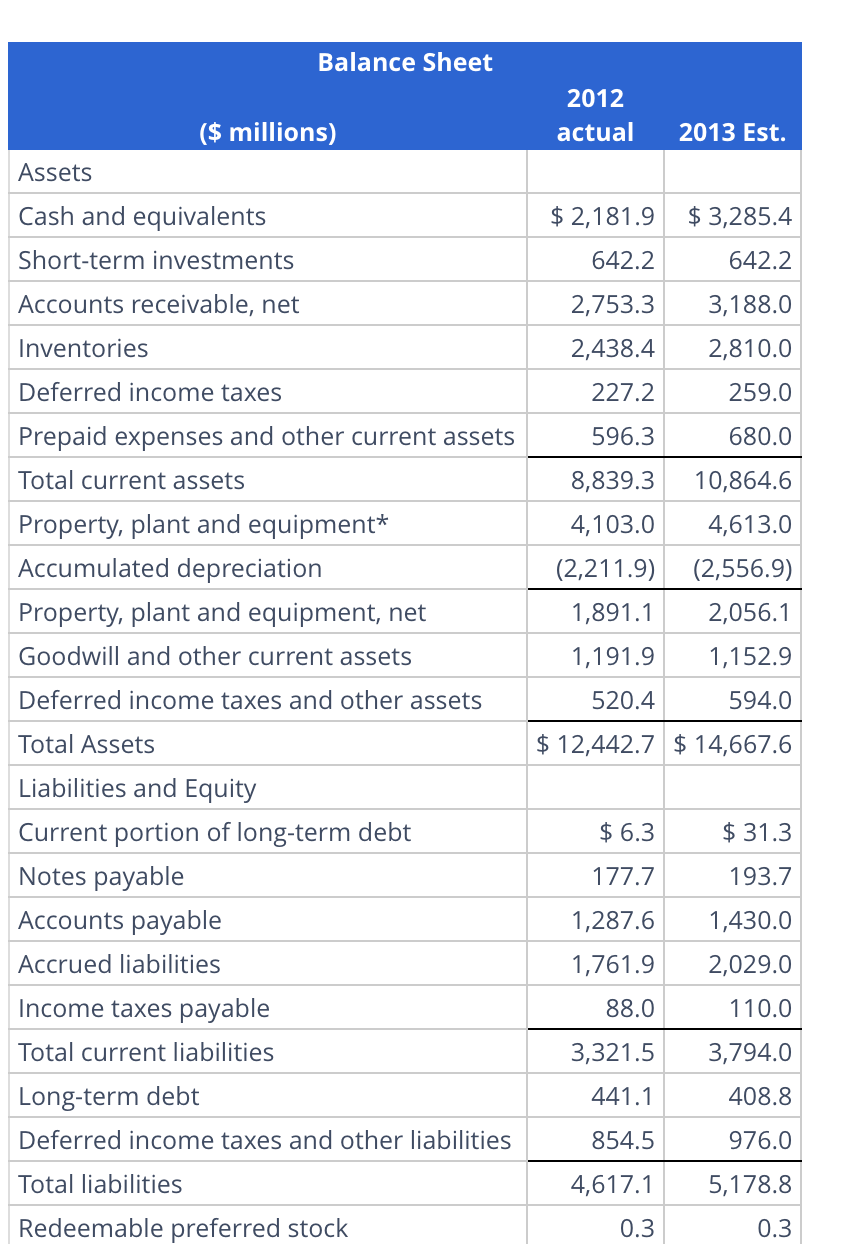

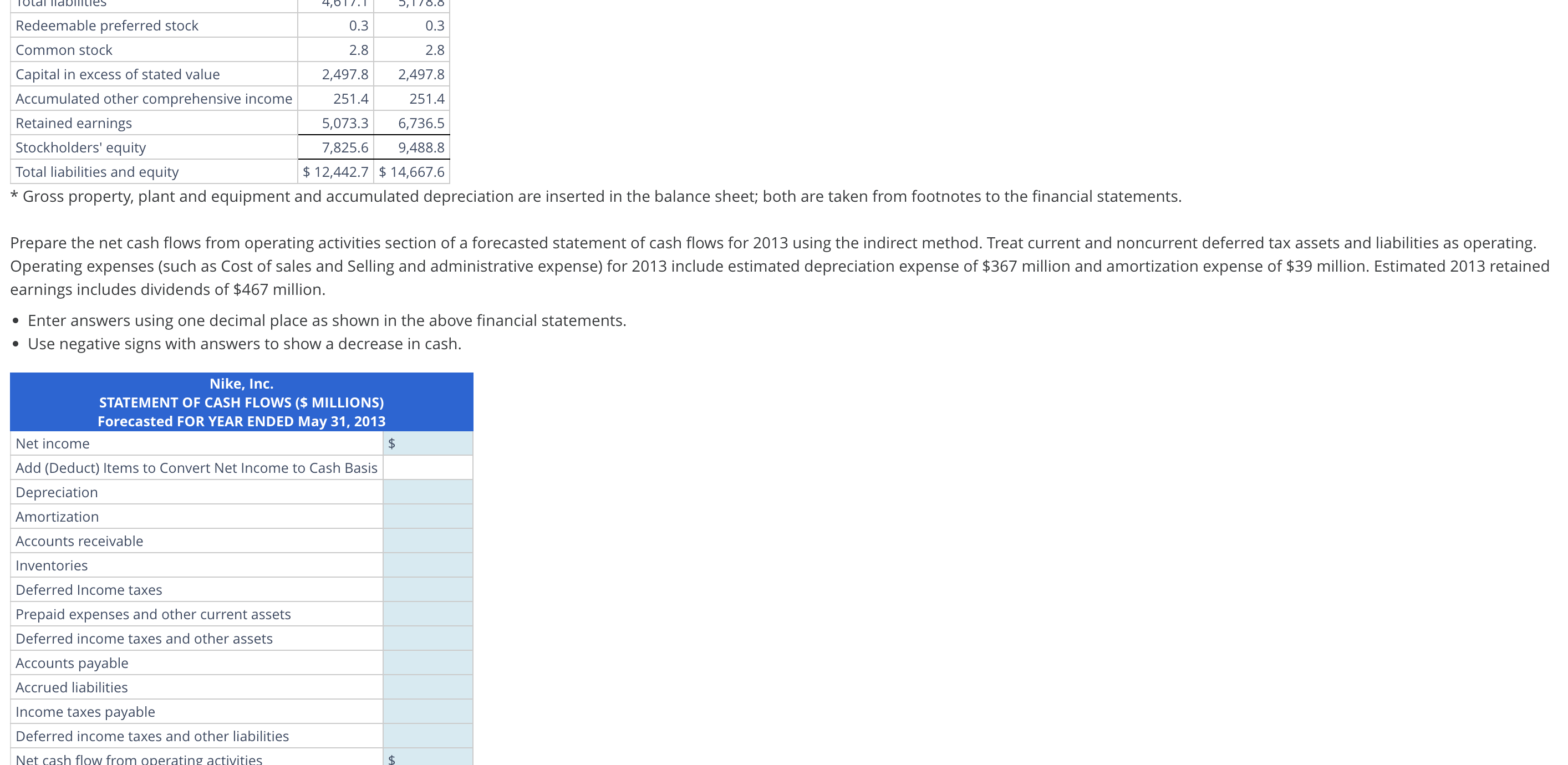

\begin{tabular}{|l|r|r|} \multicolumn{3}{c}{ Balance Sheet } \\ \multicolumn{1}{|c}{ (\$ millions) } & \multicolumn{1}{c|}{ actual } \\ \hline Assets & 2013 Est. \\ \hline Cash and equivalents & $2,181.9 & $3,285.4 \\ \hline Short-term investments & 642.2 & 642.2 \\ \hline Accounts receivable, net & 2,753.3 & 3,188.0 \\ \hline Inventories & 2,438.4 & 2,810.0 \\ \hline Deferred income taxes & 227.2 & 259.0 \\ \hline Prepaid expenses and other current assets & 596.3 & 680.0 \\ \hline Total current assets & 8,839.3 & 10,864.6 \\ \hline Property, plant and equipment* & 4,103.0 & 4,613.0 \\ \hline Accumulated depreciation & (2,211.9) & (2,556.9) \\ \hline Property, plant and equipment, net & 1,891.1 & 2,056.1 \\ \hline Goodwill and other current assets & 1,191.9 & 1,152.9 \\ \hline Deferred income taxes and other assets & 520.4 & 594.0 \\ \hline Total Assets & $12,442.7 & $14,667.6 \\ \hline Liabilities and Equity & & \\ \hline Current portion of long-term debt & $6.3 & $31.3 \\ \hline Notes payable & 177.7 & 193.7 \\ \hline Accounts payable & 1,287.6 & 1,430.0 \\ \hline Accrued liabilities & 1,761.9 & 2,029.0 \\ \hline Income taxes payable & 88.0 & 110.0 \\ \hline Total current liabilities & 3,321.5 & 3,794.0 \\ \hline Long-term debt & 441.1 & 408.8 \\ \hline Deferred income taxes and other liabilities & 854.5 & 976.0 \\ \hline Total liabilities & 4,617.1 & 5,178.8 \\ \hline Redeemable preferred stock & 0.3 & 0.3 \\ \hline \end{tabular} Operating Section of Statement of Cash Flows (Indirect Method) Assume following are the income statement and balance sheet for Nike for the year ended May 31, 2012, and a forecasted income statement and balance sheet for 2013. * Gross property, plant and equipment and accumulated depreciation are inserted in the balance sheet; both are taken from footnotes to the financial statements. earnings includes dividends of $467 million. - Enter answers using one decimal place as shown in the above financial statements. - Use negative signs with answers to show a decrease in cash. \begin{tabular}{|l|r|r|} \multicolumn{3}{c}{ Balance Sheet } \\ \multicolumn{1}{|c}{ (\$ millions) } & \multicolumn{1}{c|}{ actual } \\ \hline Assets & 2013 Est. \\ \hline Cash and equivalents & $2,181.9 & $3,285.4 \\ \hline Short-term investments & 642.2 & 642.2 \\ \hline Accounts receivable, net & 2,753.3 & 3,188.0 \\ \hline Inventories & 2,438.4 & 2,810.0 \\ \hline Deferred income taxes & 227.2 & 259.0 \\ \hline Prepaid expenses and other current assets & 596.3 & 680.0 \\ \hline Total current assets & 8,839.3 & 10,864.6 \\ \hline Property, plant and equipment* & 4,103.0 & 4,613.0 \\ \hline Accumulated depreciation & (2,211.9) & (2,556.9) \\ \hline Property, plant and equipment, net & 1,891.1 & 2,056.1 \\ \hline Goodwill and other current assets & 1,191.9 & 1,152.9 \\ \hline Deferred income taxes and other assets & 520.4 & 594.0 \\ \hline Total Assets & $12,442.7 & $14,667.6 \\ \hline Liabilities and Equity & & \\ \hline Current portion of long-term debt & $6.3 & $31.3 \\ \hline Notes payable & 177.7 & 193.7 \\ \hline Accounts payable & 1,287.6 & 1,430.0 \\ \hline Accrued liabilities & 1,761.9 & 2,029.0 \\ \hline Income taxes payable & 88.0 & 110.0 \\ \hline Total current liabilities & 3,321.5 & 3,794.0 \\ \hline Long-term debt & 441.1 & 408.8 \\ \hline Deferred income taxes and other liabilities & 854.5 & 976.0 \\ \hline Total liabilities & 4,617.1 & 5,178.8 \\ \hline Redeemable preferred stock & 0.3 & 0.3 \\ \hline \end{tabular} Operating Section of Statement of Cash Flows (Indirect Method) Assume following are the income statement and balance sheet for Nike for the year ended May 31, 2012, and a forecasted income statement and balance sheet for 2013. * Gross property, plant and equipment and accumulated depreciation are inserted in the balance sheet; both are taken from footnotes to the financial statements. earnings includes dividends of $467 million. - Enter answers using one decimal place as shown in the above financial statements. - Use negative signs with answers to show a decrease in cash

\begin{tabular}{|l|r|r|} \multicolumn{3}{c}{ Balance Sheet } \\ \multicolumn{1}{|c}{ (\$ millions) } & \multicolumn{1}{c|}{ actual } \\ \hline Assets & 2013 Est. \\ \hline Cash and equivalents & $2,181.9 & $3,285.4 \\ \hline Short-term investments & 642.2 & 642.2 \\ \hline Accounts receivable, net & 2,753.3 & 3,188.0 \\ \hline Inventories & 2,438.4 & 2,810.0 \\ \hline Deferred income taxes & 227.2 & 259.0 \\ \hline Prepaid expenses and other current assets & 596.3 & 680.0 \\ \hline Total current assets & 8,839.3 & 10,864.6 \\ \hline Property, plant and equipment* & 4,103.0 & 4,613.0 \\ \hline Accumulated depreciation & (2,211.9) & (2,556.9) \\ \hline Property, plant and equipment, net & 1,891.1 & 2,056.1 \\ \hline Goodwill and other current assets & 1,191.9 & 1,152.9 \\ \hline Deferred income taxes and other assets & 520.4 & 594.0 \\ \hline Total Assets & $12,442.7 & $14,667.6 \\ \hline Liabilities and Equity & & \\ \hline Current portion of long-term debt & $6.3 & $31.3 \\ \hline Notes payable & 177.7 & 193.7 \\ \hline Accounts payable & 1,287.6 & 1,430.0 \\ \hline Accrued liabilities & 1,761.9 & 2,029.0 \\ \hline Income taxes payable & 88.0 & 110.0 \\ \hline Total current liabilities & 3,321.5 & 3,794.0 \\ \hline Long-term debt & 441.1 & 408.8 \\ \hline Deferred income taxes and other liabilities & 854.5 & 976.0 \\ \hline Total liabilities & 4,617.1 & 5,178.8 \\ \hline Redeemable preferred stock & 0.3 & 0.3 \\ \hline \end{tabular} Operating Section of Statement of Cash Flows (Indirect Method) Assume following are the income statement and balance sheet for Nike for the year ended May 31, 2012, and a forecasted income statement and balance sheet for 2013. * Gross property, plant and equipment and accumulated depreciation are inserted in the balance sheet; both are taken from footnotes to the financial statements. earnings includes dividends of $467 million. - Enter answers using one decimal place as shown in the above financial statements. - Use negative signs with answers to show a decrease in cash. \begin{tabular}{|l|r|r|} \multicolumn{3}{c}{ Balance Sheet } \\ \multicolumn{1}{|c}{ (\$ millions) } & \multicolumn{1}{c|}{ actual } \\ \hline Assets & 2013 Est. \\ \hline Cash and equivalents & $2,181.9 & $3,285.4 \\ \hline Short-term investments & 642.2 & 642.2 \\ \hline Accounts receivable, net & 2,753.3 & 3,188.0 \\ \hline Inventories & 2,438.4 & 2,810.0 \\ \hline Deferred income taxes & 227.2 & 259.0 \\ \hline Prepaid expenses and other current assets & 596.3 & 680.0 \\ \hline Total current assets & 8,839.3 & 10,864.6 \\ \hline Property, plant and equipment* & 4,103.0 & 4,613.0 \\ \hline Accumulated depreciation & (2,211.9) & (2,556.9) \\ \hline Property, plant and equipment, net & 1,891.1 & 2,056.1 \\ \hline Goodwill and other current assets & 1,191.9 & 1,152.9 \\ \hline Deferred income taxes and other assets & 520.4 & 594.0 \\ \hline Total Assets & $12,442.7 & $14,667.6 \\ \hline Liabilities and Equity & & \\ \hline Current portion of long-term debt & $6.3 & $31.3 \\ \hline Notes payable & 177.7 & 193.7 \\ \hline Accounts payable & 1,287.6 & 1,430.0 \\ \hline Accrued liabilities & 1,761.9 & 2,029.0 \\ \hline Income taxes payable & 88.0 & 110.0 \\ \hline Total current liabilities & 3,321.5 & 3,794.0 \\ \hline Long-term debt & 441.1 & 408.8 \\ \hline Deferred income taxes and other liabilities & 854.5 & 976.0 \\ \hline Total liabilities & 4,617.1 & 5,178.8 \\ \hline Redeemable preferred stock & 0.3 & 0.3 \\ \hline \end{tabular} Operating Section of Statement of Cash Flows (Indirect Method) Assume following are the income statement and balance sheet for Nike for the year ended May 31, 2012, and a forecasted income statement and balance sheet for 2013. * Gross property, plant and equipment and accumulated depreciation are inserted in the balance sheet; both are taken from footnotes to the financial statements. earnings includes dividends of $467 million. - Enter answers using one decimal place as shown in the above financial statements. - Use negative signs with answers to show a decrease in cash Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started