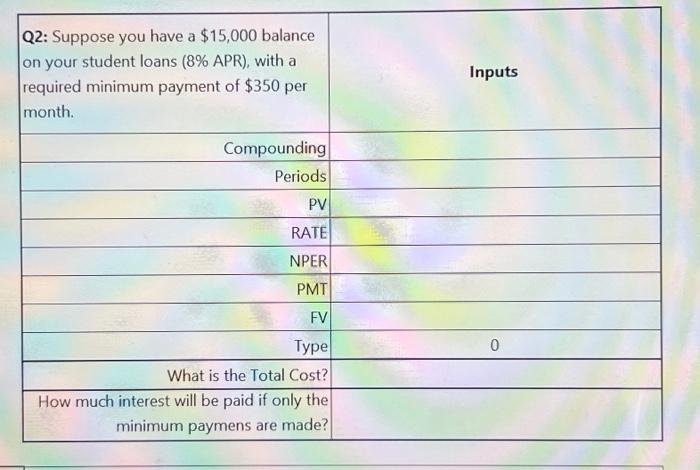

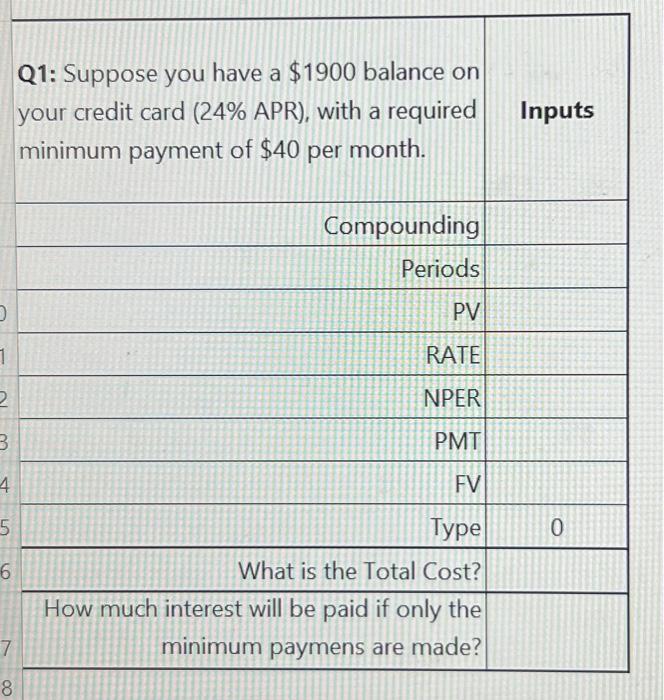

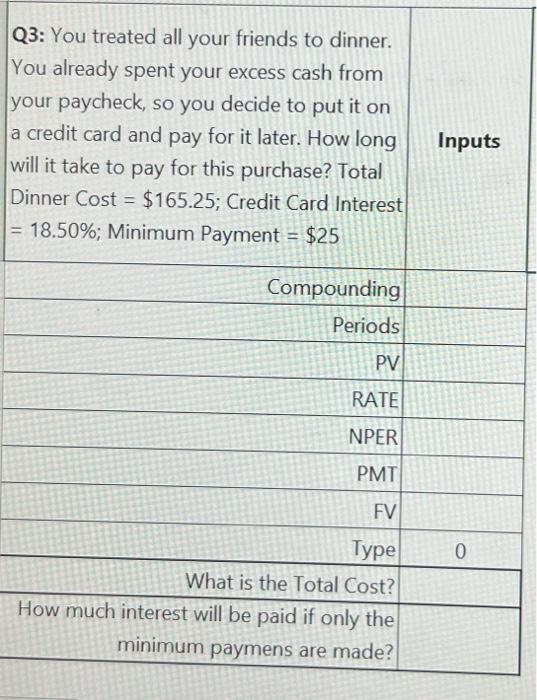

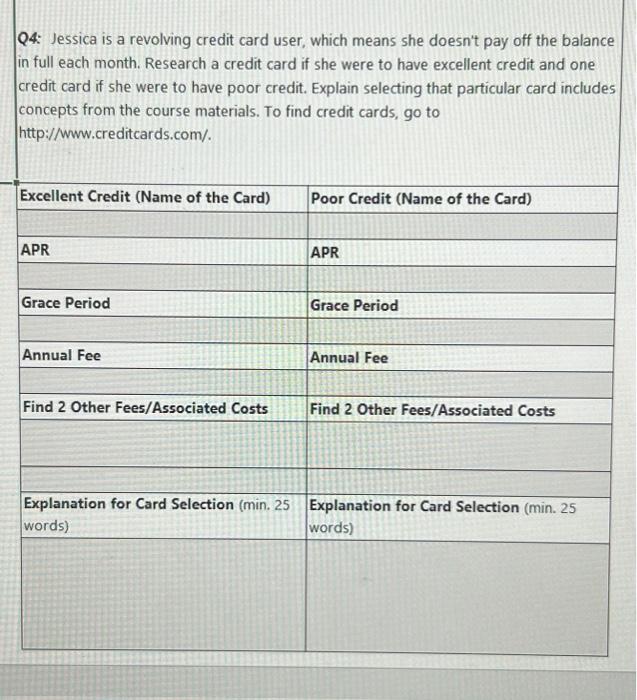

\begin{tabular}{|r|r|} \hline \begin{tabular}{l} Q2: Suppose you have a $15,000 balance \\ on your student loans ( 8% APR), with a \\ required minimum payment of $350 per \\ month. \end{tabular} & \\ \hline Compounding & \\ \hline Periods & \\ \hline PV & \\ \hline RATE & \\ \hline NPER & \\ \hline PMT & \\ \hline FV & \\ \hline Type & \\ \hline How much interest will be paid if only the & \\ \hline minimum paymens are made? & \\ \hline \end{tabular} Q4: Jessica is a revolving credit card user, which means she doesn't pay off the balance in full each month. Research a credit card if she were to have excellent credit and one credit card if she were to have poor credit. Explain selecting that particular card includes concepts from the course materials. To find credit cards, go to http://www.creditcards.com/. Q3: You treated all your friends to dinner. You already spent your excess cash from your paycheck, so you decide to put it on a credit card and pay for it later. How long will it take to pay for this purchase? Total Dinner Cost =$165.25; Credit Card Interest =18.50%; Minimum Payment =$25 \begin{tabular}{|r|r|} \hline Compounding & \\ \hline Periods & \\ \hline PV & \\ \hline RATE & \\ \hline NPER & \\ \hline PMT & \\ \hline FV & \\ \hline Type & 0 \\ \hline What is the Total Cost? & \\ \hline How much interest will be paid if only the & \\ \hline minimum paymens are made? & \\ \hline \end{tabular} Q1: Suppose you have a $1900 balance on your credit card (24\% APR), with a required Inputs minimum payment of $40 per month. \begin{tabular}{|r|r|} \hline \begin{tabular}{l} Q2: Suppose you have a $15,000 balance \\ on your student loans ( 8% APR), with a \\ required minimum payment of $350 per \\ month. \end{tabular} & \\ \hline Compounding & \\ \hline Periods & \\ \hline PV & \\ \hline RATE & \\ \hline NPER & \\ \hline PMT & \\ \hline FV & \\ \hline Type & \\ \hline How much interest will be paid if only the & \\ \hline minimum paymens are made? & \\ \hline \end{tabular} Q4: Jessica is a revolving credit card user, which means she doesn't pay off the balance in full each month. Research a credit card if she were to have excellent credit and one credit card if she were to have poor credit. Explain selecting that particular card includes concepts from the course materials. To find credit cards, go to http://www.creditcards.com/. Q3: You treated all your friends to dinner. You already spent your excess cash from your paycheck, so you decide to put it on a credit card and pay for it later. How long will it take to pay for this purchase? Total Dinner Cost =$165.25; Credit Card Interest =18.50%; Minimum Payment =$25 \begin{tabular}{|r|r|} \hline Compounding & \\ \hline Periods & \\ \hline PV & \\ \hline RATE & \\ \hline NPER & \\ \hline PMT & \\ \hline FV & \\ \hline Type & 0 \\ \hline What is the Total Cost? & \\ \hline How much interest will be paid if only the & \\ \hline minimum paymens are made? & \\ \hline \end{tabular} Q1: Suppose you have a $1900 balance on your credit card (24\% APR), with a required Inputs minimum payment of $40 per month