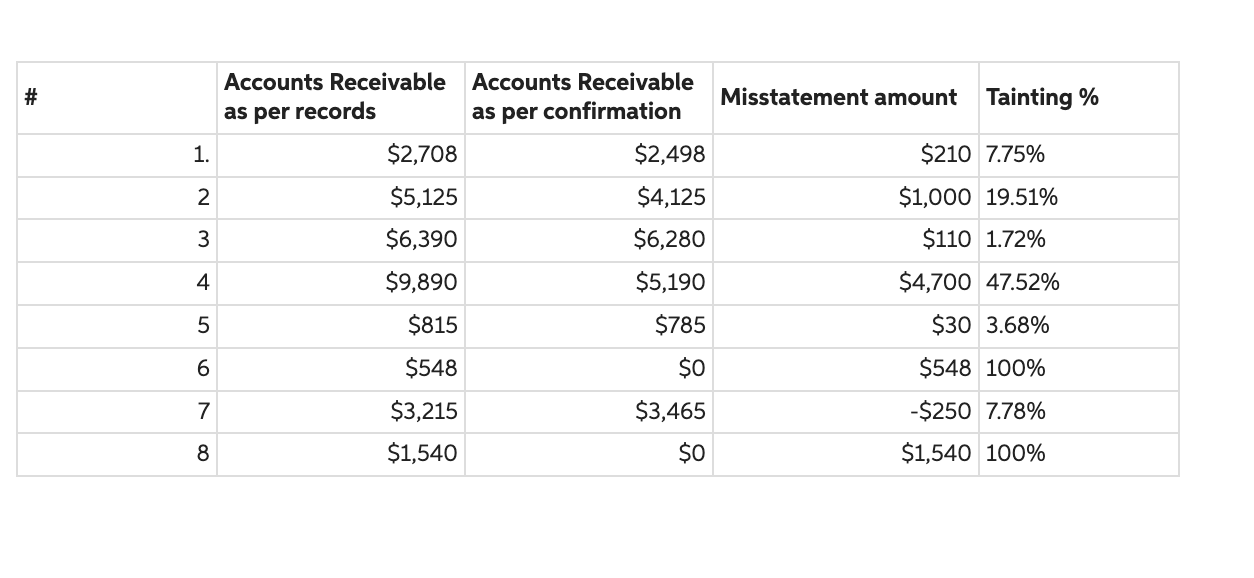

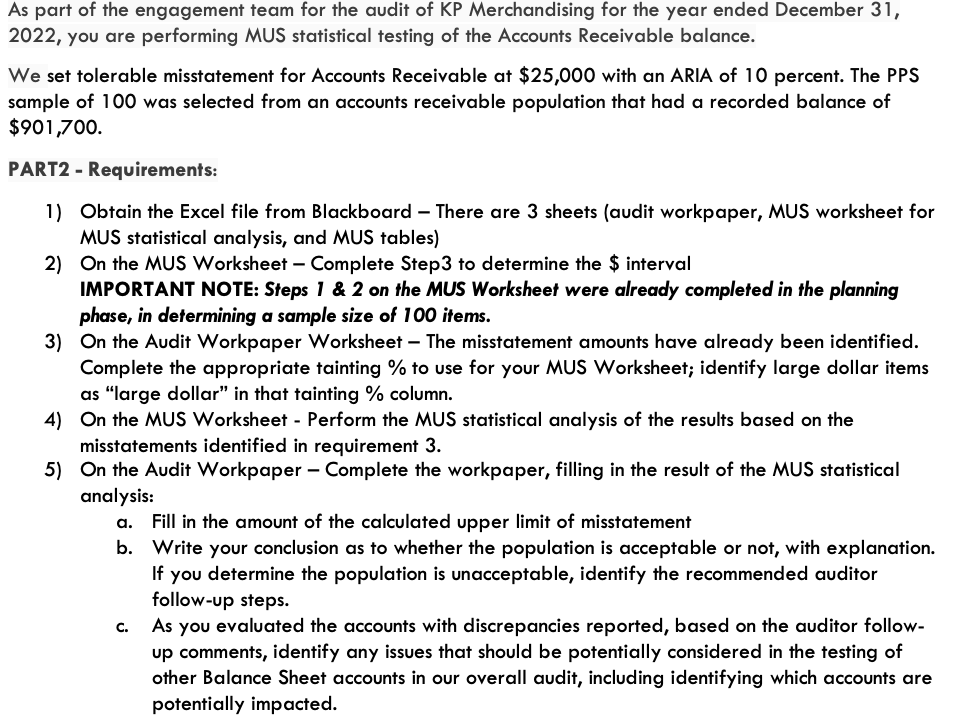

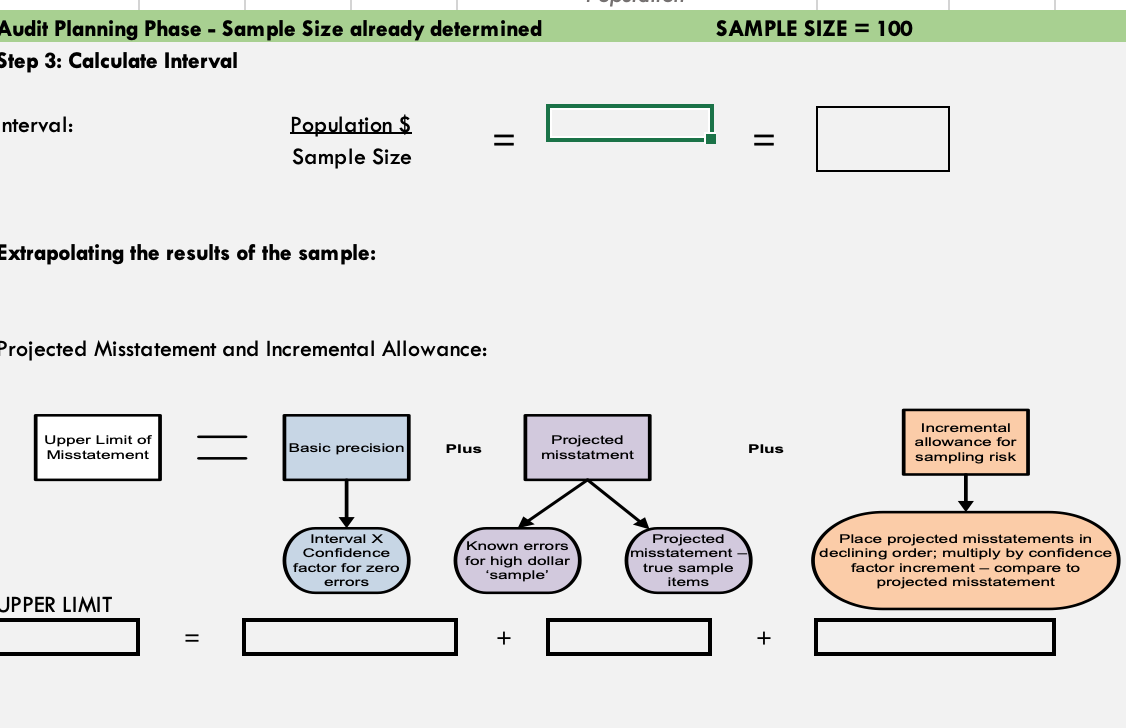

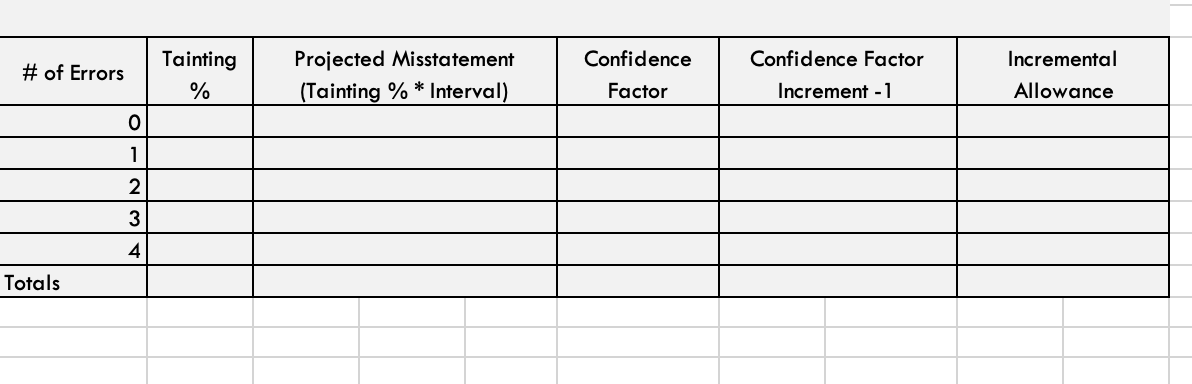

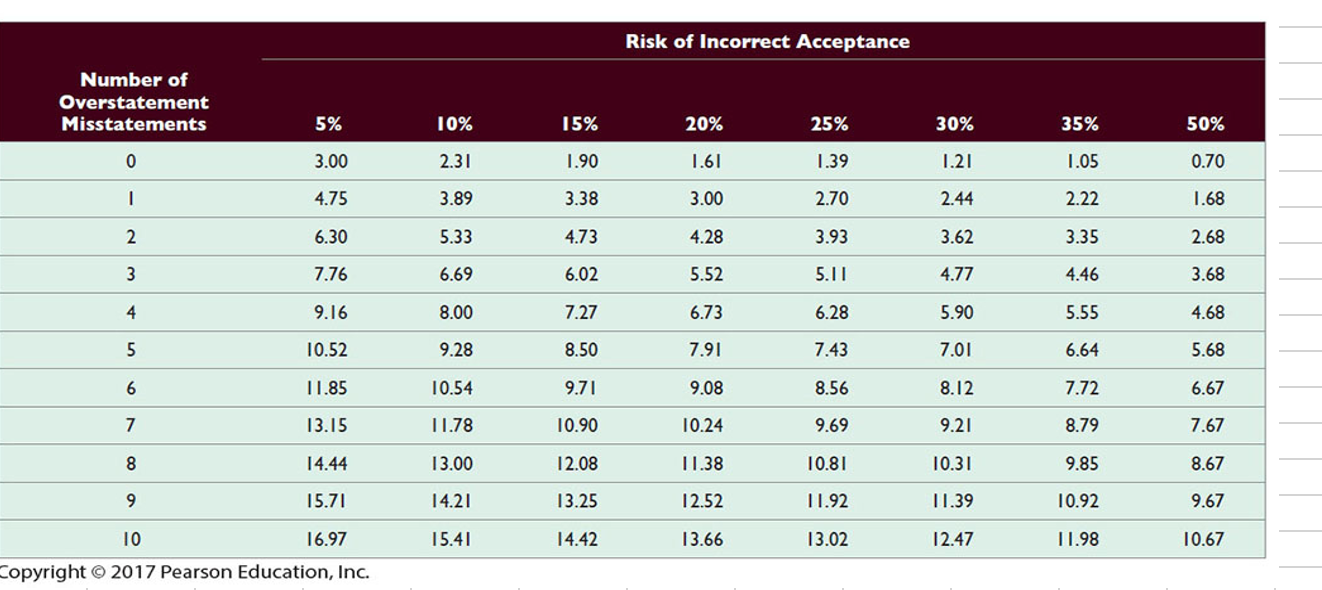

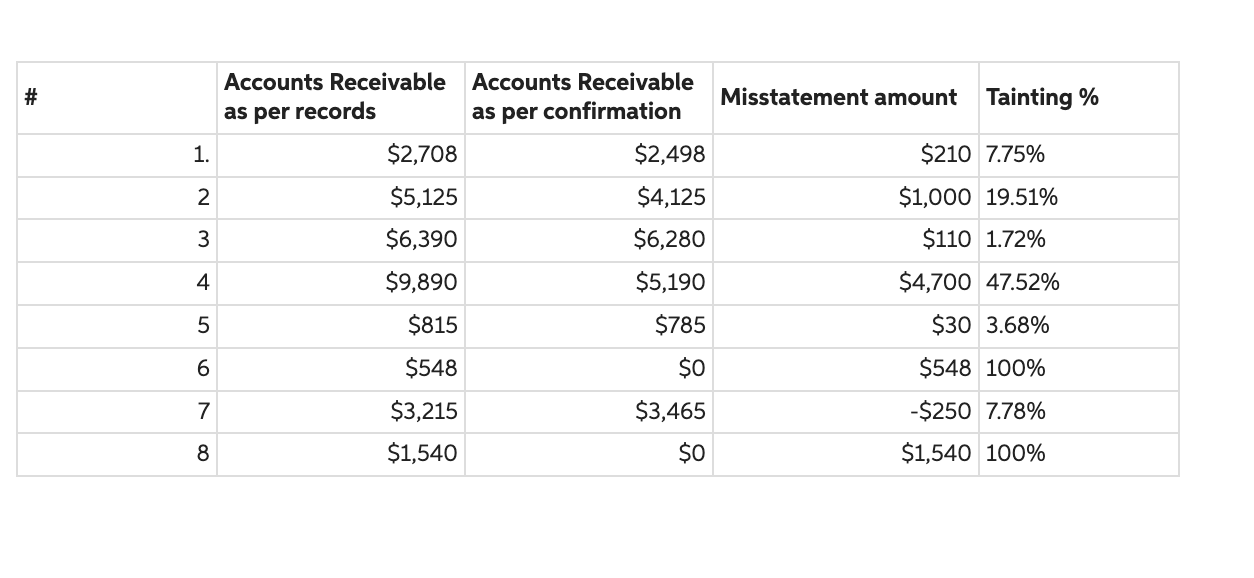

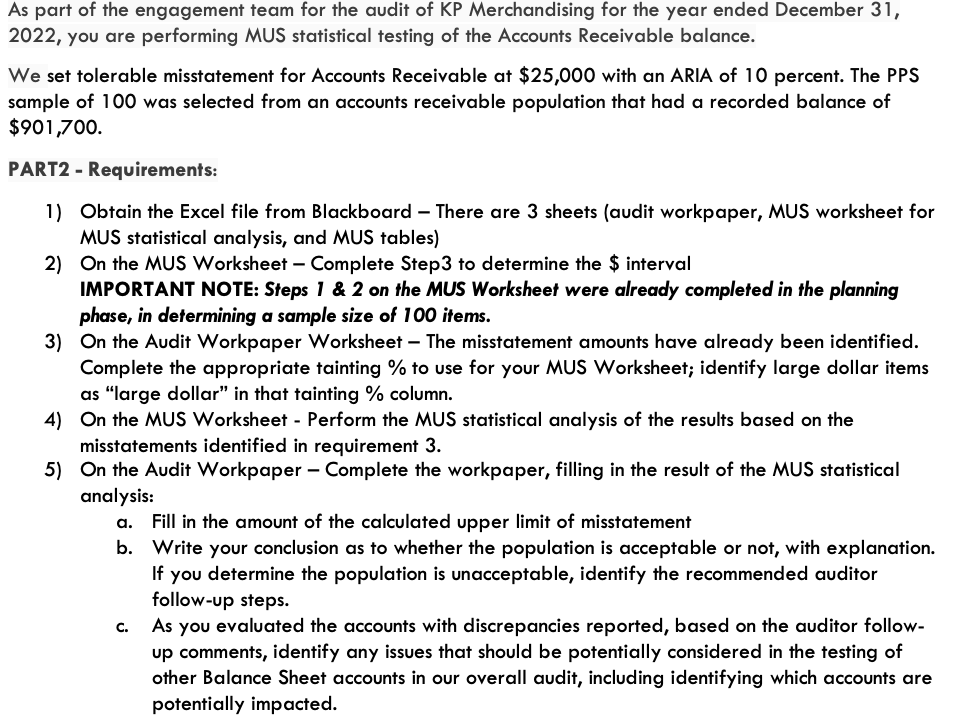

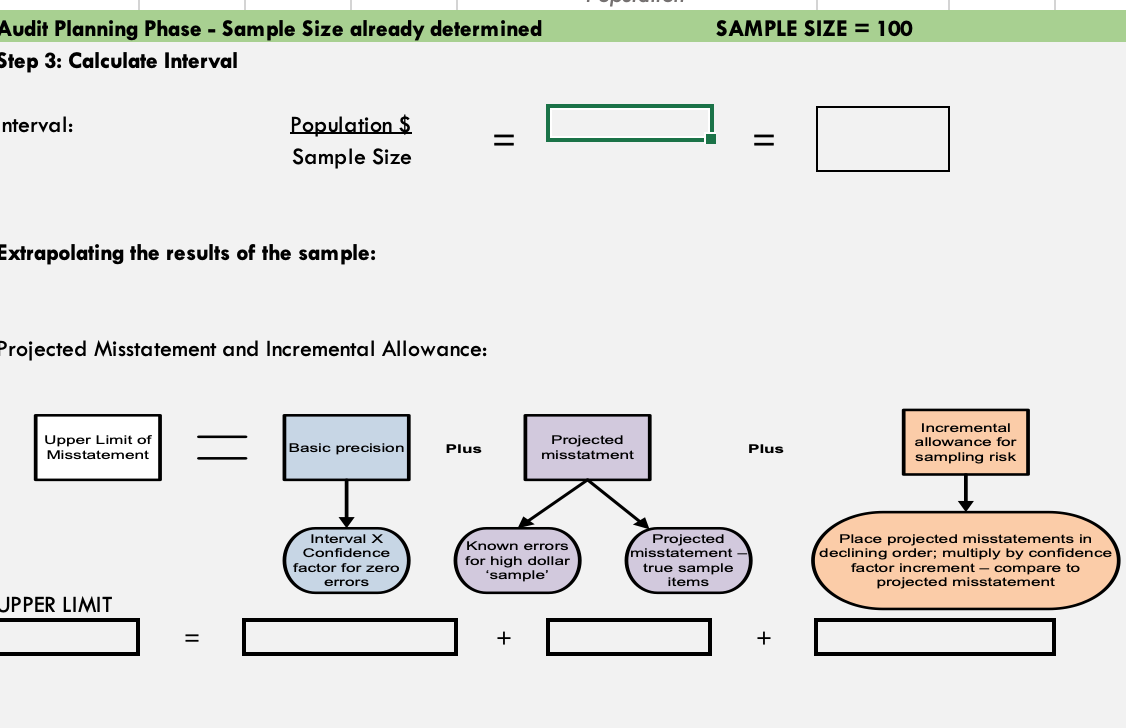

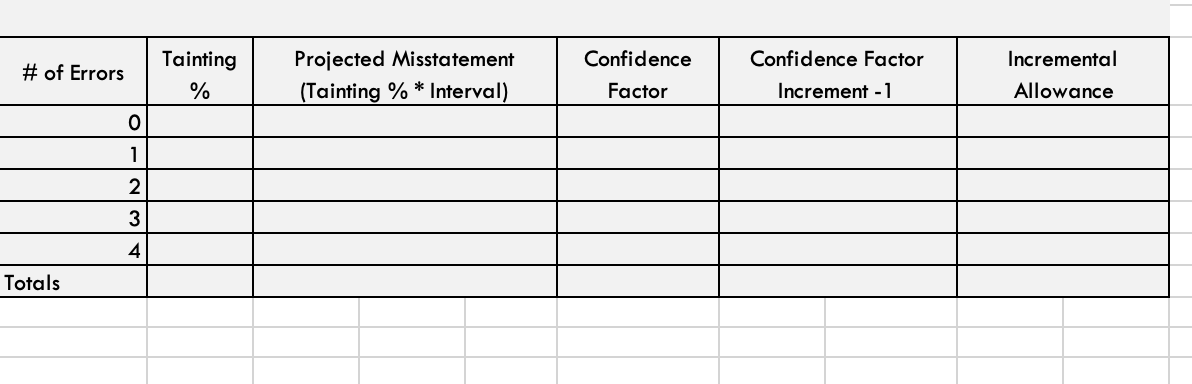

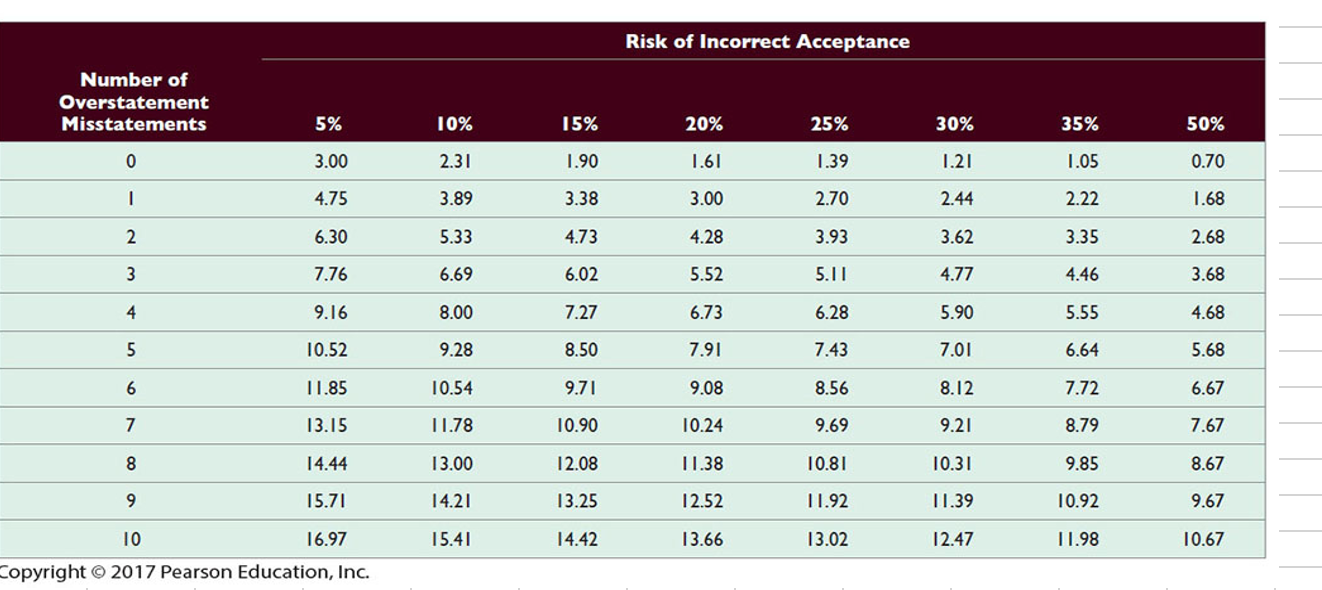

\begin{tabular}{|r|r|r|r|l|} \hline \# & AccountsReceivableasperrecords & AccountsReceivableasperconfirmation & Misstatement amount & Tainting \% \\ \hline 1. & $2,708 & $2,498 & $210 & 7.75% \\ \hline 2 & $5,125 & $4,125 & $1,000 & 19.51% \\ \hline 3 & $6,390 & $6,280 & $110 & 1.72% \\ \hline 4 & $9,890 & $5,190 & $4,700 & 47.52% \\ \hline 5 & $815 & $548 & $30 & 3.68% \\ \hline 6 & $3,215 & $548 & 100% \\ \hline 7 & $1,540 & $0 & $250 & 7.78% \\ \hline 8 & & $1,540 & 100% \\ \hline \end{tabular} As part of the engagement team for the audit of KP Merchandising for the year ended December 31 , 2022, you are performing MUS statistical testing of the Accounts Receivable balance. We set tolerable misstatement for Accounts Receivable at $25,000 with an ARIA of 10 percent. The PPS sample of 100 was selected from an accounts receivable population that had a recorded balance of $901,700. PART2 - Requirements: 1) Obtain the Excel file from Blackboard - There are 3 sheets (audit workpaper, MUS worksheet for MUS statistical analysis, and MUS tables) 2) On the MUS Worksheet - Complete Step3 to determine the $ interval IMPORTANT NOTE: Steps 1&2 on the MUS Worksheet were already completed in the planning phase, in defermining a sample size of 100 items. 3) On the Audit Workpaper Worksheet - The misstatement amounts have already been identified. Complete the appropriate tainting \% to use for your MUS Worksheet; identify large dollar items as "large dollar" in that tainting \% column. 4) On the MUS Worksheet - Perform the MUS statistical analysis of the results based on the misstatements identified in requirement 3. 5) On the Audit Workpaper - Complete the workpaper, filling in the result of the MUS statistical analysis: a. Fill in the amount of the calculated upper limit of misstatement b. Write your conclusion as to whether the population is acceptable or not, with explanation. If you determine the population is unacceptable, identify the recommended auditor follow-up steps. c. As you evaluated the accounts with discrepancies reported, based on the auditor followup comments, identify any issues that should be potentially considered in the testing of other Balance Sheet accounts in our overall audit, including identifying which accounts are potentially impacted. Extrapolating the results of the sample: Projected Misstatement and Incremental Allowance: Copyright 2017 Pearson Education, Inc. \begin{tabular}{|r|r|r|r|l|} \hline \# & AccountsReceivableasperrecords & AccountsReceivableasperconfirmation & Misstatement amount & Tainting \% \\ \hline 1. & $2,708 & $2,498 & $210 & 7.75% \\ \hline 2 & $5,125 & $4,125 & $1,000 & 19.51% \\ \hline 3 & $6,390 & $6,280 & $110 & 1.72% \\ \hline 4 & $9,890 & $5,190 & $4,700 & 47.52% \\ \hline 5 & $815 & $548 & $30 & 3.68% \\ \hline 6 & $3,215 & $548 & 100% \\ \hline 7 & $1,540 & $0 & $250 & 7.78% \\ \hline 8 & & $1,540 & 100% \\ \hline \end{tabular} As part of the engagement team for the audit of KP Merchandising for the year ended December 31 , 2022, you are performing MUS statistical testing of the Accounts Receivable balance. We set tolerable misstatement for Accounts Receivable at $25,000 with an ARIA of 10 percent. The PPS sample of 100 was selected from an accounts receivable population that had a recorded balance of $901,700. PART2 - Requirements: 1) Obtain the Excel file from Blackboard - There are 3 sheets (audit workpaper, MUS worksheet for MUS statistical analysis, and MUS tables) 2) On the MUS Worksheet - Complete Step3 to determine the $ interval IMPORTANT NOTE: Steps 1&2 on the MUS Worksheet were already completed in the planning phase, in defermining a sample size of 100 items. 3) On the Audit Workpaper Worksheet - The misstatement amounts have already been identified. Complete the appropriate tainting \% to use for your MUS Worksheet; identify large dollar items as "large dollar" in that tainting \% column. 4) On the MUS Worksheet - Perform the MUS statistical analysis of the results based on the misstatements identified in requirement 3. 5) On the Audit Workpaper - Complete the workpaper, filling in the result of the MUS statistical analysis: a. Fill in the amount of the calculated upper limit of misstatement b. Write your conclusion as to whether the population is acceptable or not, with explanation. If you determine the population is unacceptable, identify the recommended auditor follow-up steps. c. As you evaluated the accounts with discrepancies reported, based on the auditor followup comments, identify any issues that should be potentially considered in the testing of other Balance Sheet accounts in our overall audit, including identifying which accounts are potentially impacted. Extrapolating the results of the sample: Projected Misstatement and Incremental Allowance: Copyright 2017 Pearson Education, Inc