Answered step by step

Verified Expert Solution

Question

1 Approved Answer

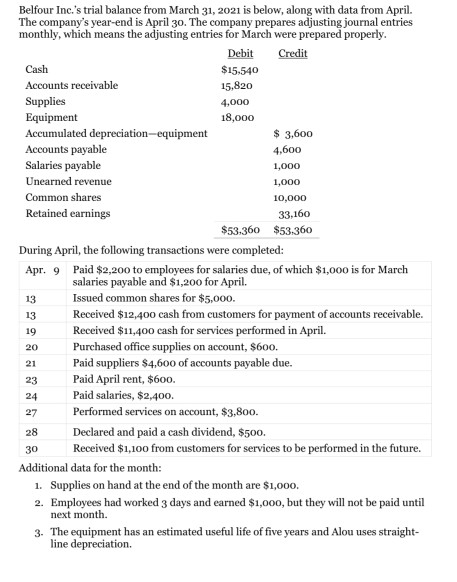

Belfour Inc.'s trial balance from March 31, 2021 is below, along with data from April. The company's year-end is April 30. The company prepares adjusting

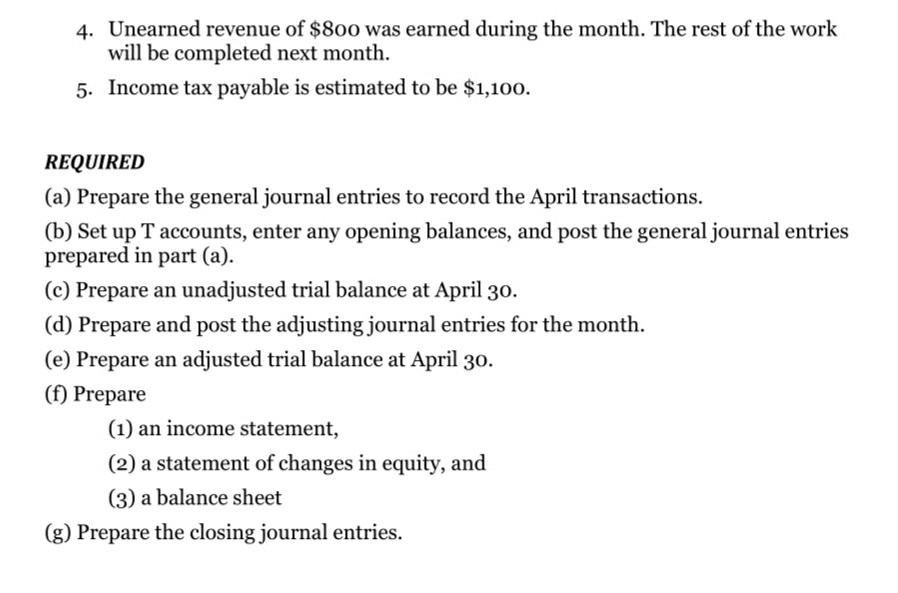

Belfour Inc.'s trial balance from March 31, 2021 is below, along with data from April. The company's year-end is April 30. The company prepares adjusting journal entries monthly, which means the adjusting entries for March were prepared properly. Debit Credit Cash $15.540 Accounts receivable 15.820 Supplies 4.000 Equipment 18,000 Accumulated depreciation-equipment $ 3,600 Accounts payable 4.600 Salaries payable 1,000 Unearned revenue 1,000 Common shares 10,000 Retained earnings 33.160 $53,360 $53,360 During April, the following transactions were completed: Apr. 9 Paid $2,200 to employees for salaries due, of which $1,000 is for March salaries payable and $1,200 for April. 13 Issued common shares for $5,000. 13 Received $12,400 cash from customers for payment of accounts receivable. 19 Received $11,400 cash for services performed in April. Purchased office supplies on account, $600. Paid suppliers $4,600 of accounts payable due. 23 Paid April rent, $600. 24 Paid salaries, $2,400. 27 Performed services on account, $3,800. Declared and paid a cash dividend, $500. 30 Received $1,100 from customers for services to be performed in the future. Additional data for the month: 1. Supplies on hand at the end of the month are $1,000. 2. Employees had worked 3 days and earned $1,000, but they will not be paid until next month. 3. The equipment has an estimated useful life of five years and Alou uses straight- line depreciation. 20 21 28 4. Unearned revenue of $800 was earned during the month. The rest of the work will be completed next month. 5. Income tax payable is estimated to be $1,100. REQUIRED (a) Prepare the general journal entries to record the April transactions. (b) Set up T accounts, enter any opening balances, and post the general journal entries prepared in part (a). (C) Prepare an unadjusted trial balance at April 30. (d) Prepare and post the adjusting journal entries for the month. (e) Prepare an adjusted trial balance at April 30. (f) Prepare (1) an income statement, (2) a statement of changes in equity, and (3) a balance sheet (g) Prepare the closing journal entries

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started