Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bell Co. purchased a new building for $85,000. To do so, it borrowed $45,000 from Shapiro Limited and gave Shapiro a first mortgage on

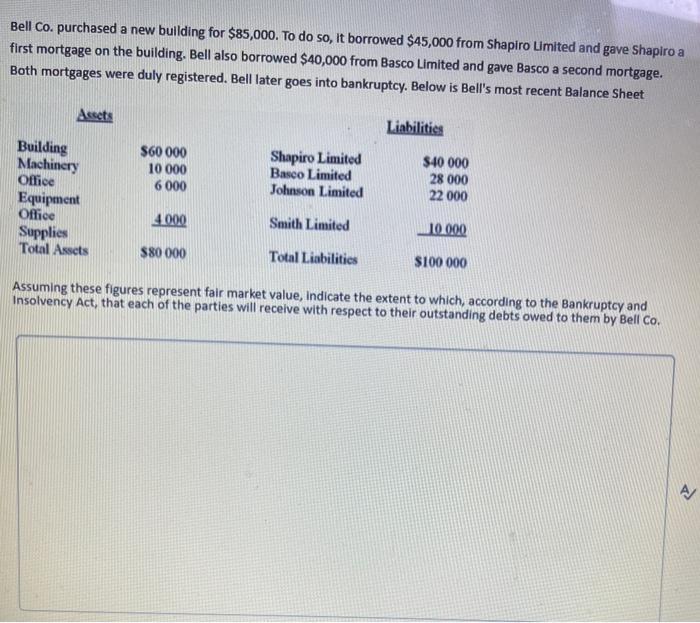

Bell Co. purchased a new building for $85,000. To do so, it borrowed $45,000 from Shapiro Limited and gave Shapiro a first mortgage on the building. Bell also borrowed $40,000 from Basco Limited and gave Basco a second mortgage. Both mortgages were duly registered. Bell later goes into bankruptcy. Below is Bell's most recent Balance Sheet Assets Building Machinery Office Equipment Office Supplies Total Assets $60 000 10 000 6 000 4.000 $80 000 Shapiro Limited Basco Limited Johnson Limited Smith Limited Total Liabilities Liabilities $40 000 28 000 22 000 10 000 $100 000 Assuming these figures represent fair market value, indicate the extent to which, according to the Bankruptcy and Insolvency Act, that each of the parties will receive with respect to their outstanding debts owed to them by Bell Co. A

Step by Step Solution

★★★★★

3.52 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Answer Each party will receive their outstanding debts in the ratio of thei...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started