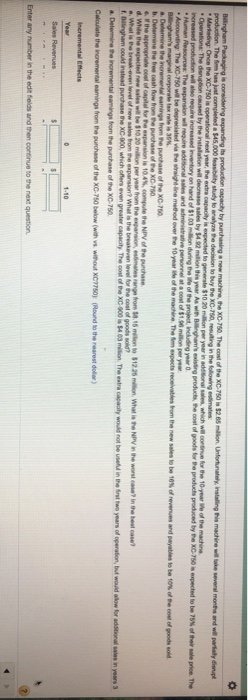

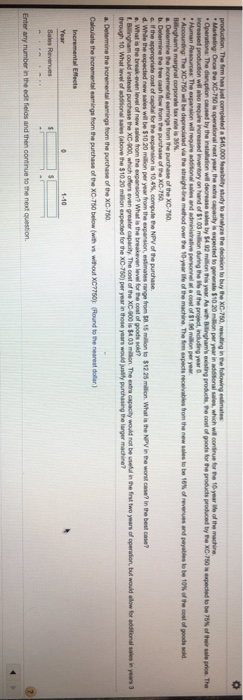

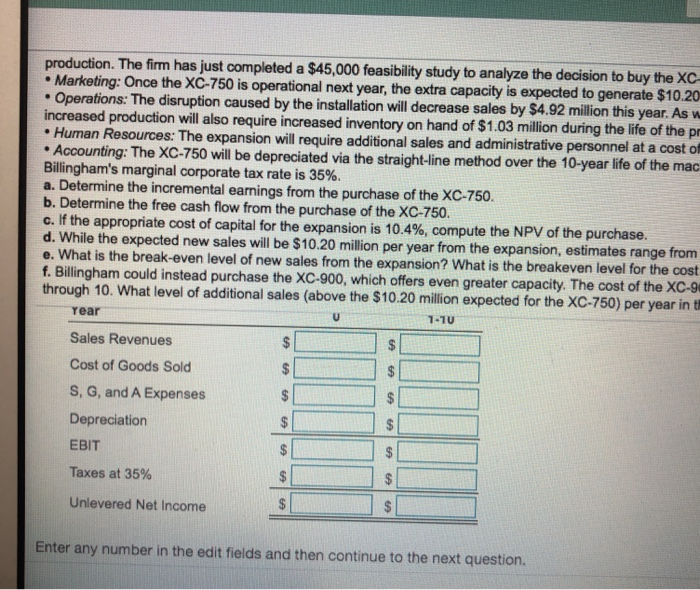

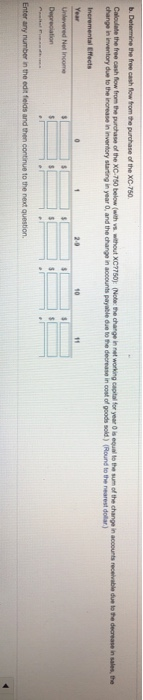

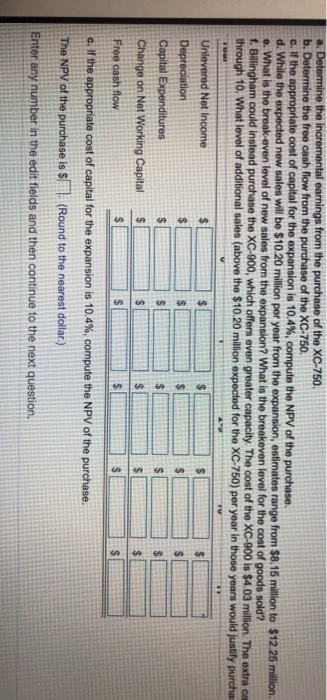

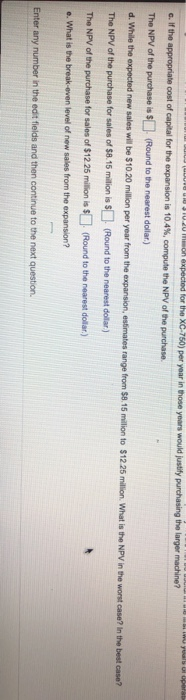

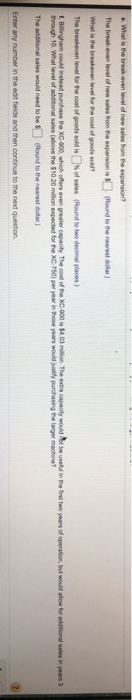

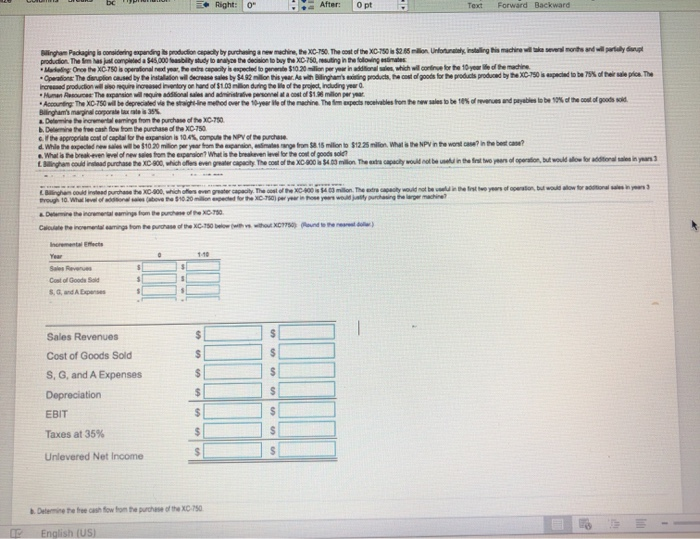

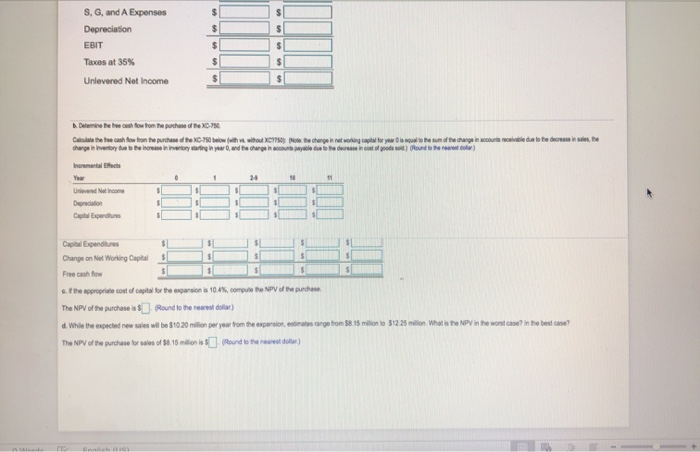

Bellingham Packaging is considering expanding production capacity by purchasing a new machine, the XC750. The cost of the XC-750 1265 million. Unfortunately, installing is machine w e several months and we party drupt production. The firm has completed a $45.000 fees b y suy to analyse the decision to buy the XC 750. ting in the following mates Marketing Once the XC-750 is operational neatyna, the capacity is expected to general $10 20 million per year in additional which will come for the 10 year of the machine Operations. The disruption caused by the Installation will decreased by 14.2 milion this year. As wit h produce cost of goods for the products produced by exc 750 is expected to be 75% of the price. The increased production will also require increased invertory on hand of 100 m.Bon during the of the project, including your * Human Resources. The expansion will regi o nal sales and administrative personnel a con $1.6 million per year * Accounting The XC-750 will be depreciated with w i ne method over the 10 years of the machine. The expects receivable to the new sales to be 10% of revenue and payable to be of the could goods sold Bingham's marginal corporate tax rates Determine the incremental earings from the purchase of the XC-750 b. Determine the free cash flow from the purchase of XC-700 the appropriate cool of capital for expansion is 10.45, compute the NIV the purchase d. While the speed w sales will be 1020 on per year from the p r ange from 10.16 on 512 25 on What is the NPV in the worst in the case .. What is the break-even level of sales from the expansion? What is the brave love for the cool of goods 1. Banghamountad purchase the X-900, which ens even greater capacity. The cost of the XC 600 4.03 on Theatre capacity would not be in the first two years of operation, but would allow for a n al ses in years 3 a. Determine the incremental coming from the purchase of the XC-750 Calculate the incremental amings from the purchase of the XC-750 below (with without XC7750 Pound to the nearest door Incremental Effects Sales Revenues Enter any number in the edit fields and then continue to the next question production. The firm has completed a $45.000 ability wody to analyze the decision to buy the XC-710,odding in re following estimates Marketing. Once the XC-750 is operational rest year, theatre capacity s pected to general $10 20 million per year in on e which will continue for 10 year of the machine * Operations. The deruption caused by the installation will decrease sale by $492 million this year. As with Bilingham's existing products. The cost of goods for the products produced by the XC-750 is expected to be 70% of the sale price. The Increased production will require increased Inventory on and of 100 milion during the W of the project including year * Human Resources The expansion will gradonales and a r tive persone a cost of 1.5 million per year. Accounting: The XC-750 will be deprecated via the straighline method over the 10 yerlife of the machine. The firm expects receivable from the new sales to be 10% of revenues and payable to be 10% of the cost of goods sold Bilingham's marginal corporate tax rates 35% Determine the incremental aring from the purchase of the XC-750 b. Determine per cash flow from the purchase of the XC-750 c. If the appropriate cost of capital for the expansion is 10.4%, compute the NPV of the purchase d. While the expected now we will be $10 20 million per year from the expansion estimates range from $8.15 million to $12.5 milion What is the NPV in the worst case in the best case? What is the break even level of new sales from the expansion? What is the breakeven love for the cost of goods sold 1. Bingham could instead purchase the XC 600, which offers even greater capacity. The cost of the XC 900 is $403 million. The extra capacity would not be in the first two years of operwtion, but would allow for additional sales in years 3 tough 10. What level of a n al sales above the $10.20 milion expected for the XC-7500 per year in the years would purchasing the larger machine? a. Determine the incrementalange from the purchase of the XC-750 Calculate the incremental aming from the purchase of the XC 750 below with without XC7750) Round to the nearest dolar) Incremental Eects Enter any number in the edition and then continue to the need Question production. The firm has just completed a $45,000 feasibility study to analyze the decision to buy the XC Marketing: Once the XC-750 is operational next year, the extra capacity is expected to generate $10.20 Operations: The disruption caused by the installation will decrease sales by $4.92 million this year. As w increased production will also require increased inventory on hand of $1.03 million during the life of the pi Human Resources: The expansion will require additional sales and administrative personnel at a cost of Accounting: The XC-750 will be depreciated via the straight-line method over the 10-year life of the mac Billingham's marginal corporate tax rate is 35%. a. Determine the incremental earnings from the purchase of the XC-750. b. Determine the free cash flow from the purchase of the XC-750. c. If the appropriate cost of capital for the expansion is 10.4%, compute the NPV of the purchase. d. While the expected new sales will be $10.20 million per year from the expansion, estimates range from e. What is the break-even level of new sales from the expansion? What is the breakeven level for the cost f. Billingham could instead purchase the XC-900, which offers even greater capacity. The cost of the XC-9 through 10. What level of additional sales (above the $10.20 million expected for the XC-750) per year in ti Year 1-10 Sales Revenues Cost of Goods Sold S, G, and A Expenses Depreciation EBIT Taxes at 35% Unlevered Net Income Enter any number in the edit fields and then continue to the next question. b. Determine the free cash flow from the purchase of the XC-750 Calculate the free cash flow from the purchase of the XC-750 below (with y without XC7780) (Note: the change in networking for your soul to the sum of the change in accounts receivable due to the decrease in sales, the change in inventory due to the increase in invertory starting in year, and the change in accounts payable due to the decrease in cost of goods sold) (Round to the nearest dollar) Incremental Effects Depreciation Enter any number in the editfelds and then continue to the next question a. Determine the incremental earnings from the purchase of the XC-750. b. Determine the free cash flow from the purchase of the XC-750. c. If the appropriate cost of capital for the expansion is 10.4%, compute the NPV of the purchase. d. While the expected new sales will be $10.20 million per year from the expansion, estimates range from $8.15 million to $12.25 million. e. What is the break-even level of new sales from the expansion? What is the breakeven level for the cost of goods sold? 1. Billingham could instead purchase the XC-900, which offers even greater capacity. The cost of the XC-900 is $4.03 million. The extra ca through 10. What level of additional sales (above the $10.20 million expected for the XC-750) per year in those years would justify purchas 60 $ Unlevered Net Income Depreciation Capital Expenditures Change on Net Working Capital Free cash flow c. If the appropriate cost of capital for the expansion is 10.4%, compute the NPV of the purchase. The NPV of the purchase is $ (Round to the nearest dollar.) Enter any number in the edit fields and then continue to the next question. we also operat (UTDUD 10.20mmon expected for the XC-750) per year in those years would justify purchasing the larger machine? c. If the appropriate cost of capital for the expansion is 10.4%, compute the NPV of the purchase The NPV of the purchase is (Round to the nearest dollar) d. While the expected new sales will be $10.20 million per year from the expansion, estimates range from $8.15 million to $1225 million What is the NPV in the worst case? In the best case? The NPV of the purchase for sales of $8.15 milionis (Round to the nearest dollar) The NPV of the purchase for sales of $12 25 milionis $ (Round to the nearest dollar) e. What is the break-even level of new sales from the expansion? Enter any number in the edit fields and then continue to the next question What is the break-even level of news from the expansion The break even level of news from the pasion Found to the nearest ) What is the breakeven level for the cost of goods sold? The breakeven level for the cost of goods sold is of sales Round to two decimal places) Billingham could instead purchase the XC-900, which offers even greater capacity. The cost of the x 900 i 140mmon. The extra capacity would be useful in the first two years of operation, but would allow for additional sales in years 3 through 10. What level of additional sales (above the $10 20 million expected for the XC-750) per year in those years would justly purchasing the larger machine? The additional sales would need to be found to the nearest dollar) Enter any number in the edities and then continue to the next question Right: 0 . After: 0pt Text Forward Backward ingen Pada g pending production padly by purcha sed the XC-750. The otheXC-5025 U n ghii ya production. The m ore you the th i ng the longe W ing Orce the C70 per her e cted to do with the 10 of the machine Operation The di d by the nation by the Min d e r hedsproduced by the XC-750 do bet ter the nar d production Invertory hand of $1.00 during of the induding your Human Resources The wor l d where a cost of $1 million pery Accounting The XC-750 will be depreciated the str e ngthed over you the ne Thermexper t s to be und be the goods Bilinghammar corporal Determine the onl ine from the purchase of the XC-790 Determine the free cash flow from the purchase of the XC-750 the appropriate cost of a ll the expansion is 10.4%, compute the NPV of the purchase d. While the expected n ew 10 20 miliony for the a g e from win $12 . What the NPV in the word in the best ? What's the brave news on the expansion? What is the brave ever the cooledo Minghen could n e ws Theoftheo They would be the two of Moderna Long An Nam H a y - - - - - Cethe ame the NC- 50 N C no Cost of Good Solid S., and AB Sales Revenues Cost of Goods Sold S. G and A Expenses Depreciation EBIT Taxes at 35% Unlevered Net Income English (US) S, G, and A Expenses Depreciation EBIT Taxes at 35% Unlevered Net Income C Determine the fresh flow from the purchase of the XC-750 e the cashow on the phase of the wh o change in voor e en very grader l e the w a y s of change in info on the roa) due to the door Inormal Efecte Depreciation Capital Expenditures Capital Expenditures Change on Net Working Capital s Freshow c. the appropriate cost of capital for the expansion is 100% compute NPV the purchase The NPV of the purchases Round to the newest dollar) d. While the expected new sales will be $10 20 milion per year from the person e s arge The NPV of the purchase or of 8.15 milioni Round herewet dollar) 15 milioni 51225 What is a NPV wonte in -- Bellingham Packaging is considering expanding production capacity by purchasing a new machine, the XC750. The cost of the XC-750 1265 million. Unfortunately, installing is machine w e several months and we party drupt production. The firm has completed a $45.000 fees b y suy to analyse the decision to buy the XC 750. ting in the following mates Marketing Once the XC-750 is operational neatyna, the capacity is expected to general $10 20 million per year in additional which will come for the 10 year of the machine Operations. The disruption caused by the Installation will decreased by 14.2 milion this year. As wit h produce cost of goods for the products produced by exc 750 is expected to be 75% of the price. The increased production will also require increased invertory on hand of 100 m.Bon during the of the project, including your * Human Resources. The expansion will regi o nal sales and administrative personnel a con $1.6 million per year * Accounting The XC-750 will be depreciated with w i ne method over the 10 years of the machine. The expects receivable to the new sales to be 10% of revenue and payable to be of the could goods sold Bingham's marginal corporate tax rates Determine the incremental earings from the purchase of the XC-750 b. Determine the free cash flow from the purchase of XC-700 the appropriate cool of capital for expansion is 10.45, compute the NIV the purchase d. While the speed w sales will be 1020 on per year from the p r ange from 10.16 on 512 25 on What is the NPV in the worst in the case .. What is the break-even level of sales from the expansion? What is the brave love for the cool of goods 1. Banghamountad purchase the X-900, which ens even greater capacity. The cost of the XC 600 4.03 on Theatre capacity would not be in the first two years of operation, but would allow for a n al ses in years 3 a. Determine the incremental coming from the purchase of the XC-750 Calculate the incremental amings from the purchase of the XC-750 below (with without XC7750 Pound to the nearest door Incremental Effects Sales Revenues Enter any number in the edit fields and then continue to the next question production. The firm has completed a $45.000 ability wody to analyze the decision to buy the XC-710,odding in re following estimates Marketing. Once the XC-750 is operational rest year, theatre capacity s pected to general $10 20 million per year in on e which will continue for 10 year of the machine * Operations. The deruption caused by the installation will decrease sale by $492 million this year. As with Bilingham's existing products. The cost of goods for the products produced by the XC-750 is expected to be 70% of the sale price. The Increased production will require increased Inventory on and of 100 milion during the W of the project including year * Human Resources The expansion will gradonales and a r tive persone a cost of 1.5 million per year. Accounting: The XC-750 will be deprecated via the straighline method over the 10 yerlife of the machine. The firm expects receivable from the new sales to be 10% of revenues and payable to be 10% of the cost of goods sold Bilingham's marginal corporate tax rates 35% Determine the incremental aring from the purchase of the XC-750 b. Determine per cash flow from the purchase of the XC-750 c. If the appropriate cost of capital for the expansion is 10.4%, compute the NPV of the purchase d. While the expected now we will be $10 20 million per year from the expansion estimates range from $8.15 million to $12.5 milion What is the NPV in the worst case in the best case? What is the break even level of new sales from the expansion? What is the breakeven love for the cost of goods sold 1. Bingham could instead purchase the XC 600, which offers even greater capacity. The cost of the XC 900 is $403 million. The extra capacity would not be in the first two years of operwtion, but would allow for additional sales in years 3 tough 10. What level of a n al sales above the $10.20 milion expected for the XC-7500 per year in the years would purchasing the larger machine? a. Determine the incrementalange from the purchase of the XC-750 Calculate the incremental aming from the purchase of the XC 750 below with without XC7750) Round to the nearest dolar) Incremental Eects Enter any number in the edition and then continue to the need Question production. The firm has just completed a $45,000 feasibility study to analyze the decision to buy the XC Marketing: Once the XC-750 is operational next year, the extra capacity is expected to generate $10.20 Operations: The disruption caused by the installation will decrease sales by $4.92 million this year. As w increased production will also require increased inventory on hand of $1.03 million during the life of the pi Human Resources: The expansion will require additional sales and administrative personnel at a cost of Accounting: The XC-750 will be depreciated via the straight-line method over the 10-year life of the mac Billingham's marginal corporate tax rate is 35%. a. Determine the incremental earnings from the purchase of the XC-750. b. Determine the free cash flow from the purchase of the XC-750. c. If the appropriate cost of capital for the expansion is 10.4%, compute the NPV of the purchase. d. While the expected new sales will be $10.20 million per year from the expansion, estimates range from e. What is the break-even level of new sales from the expansion? What is the breakeven level for the cost f. Billingham could instead purchase the XC-900, which offers even greater capacity. The cost of the XC-9 through 10. What level of additional sales (above the $10.20 million expected for the XC-750) per year in ti Year 1-10 Sales Revenues Cost of Goods Sold S, G, and A Expenses Depreciation EBIT Taxes at 35% Unlevered Net Income Enter any number in the edit fields and then continue to the next question. b. Determine the free cash flow from the purchase of the XC-750 Calculate the free cash flow from the purchase of the XC-750 below (with y without XC7780) (Note: the change in networking for your soul to the sum of the change in accounts receivable due to the decrease in sales, the change in inventory due to the increase in invertory starting in year, and the change in accounts payable due to the decrease in cost of goods sold) (Round to the nearest dollar) Incremental Effects Depreciation Enter any number in the editfelds and then continue to the next question a. Determine the incremental earnings from the purchase of the XC-750. b. Determine the free cash flow from the purchase of the XC-750. c. If the appropriate cost of capital for the expansion is 10.4%, compute the NPV of the purchase. d. While the expected new sales will be $10.20 million per year from the expansion, estimates range from $8.15 million to $12.25 million. e. What is the break-even level of new sales from the expansion? What is the breakeven level for the cost of goods sold? 1. Billingham could instead purchase the XC-900, which offers even greater capacity. The cost of the XC-900 is $4.03 million. The extra ca through 10. What level of additional sales (above the $10.20 million expected for the XC-750) per year in those years would justify purchas 60 $ Unlevered Net Income Depreciation Capital Expenditures Change on Net Working Capital Free cash flow c. If the appropriate cost of capital for the expansion is 10.4%, compute the NPV of the purchase. The NPV of the purchase is $ (Round to the nearest dollar.) Enter any number in the edit fields and then continue to the next question. we also operat (UTDUD 10.20mmon expected for the XC-750) per year in those years would justify purchasing the larger machine? c. If the appropriate cost of capital for the expansion is 10.4%, compute the NPV of the purchase The NPV of the purchase is (Round to the nearest dollar) d. While the expected new sales will be $10.20 million per year from the expansion, estimates range from $8.15 million to $1225 million What is the NPV in the worst case? In the best case? The NPV of the purchase for sales of $8.15 milionis (Round to the nearest dollar) The NPV of the purchase for sales of $12 25 milionis $ (Round to the nearest dollar) e. What is the break-even level of new sales from the expansion? Enter any number in the edit fields and then continue to the next question What is the break-even level of news from the expansion The break even level of news from the pasion Found to the nearest ) What is the breakeven level for the cost of goods sold? The breakeven level for the cost of goods sold is of sales Round to two decimal places) Billingham could instead purchase the XC-900, which offers even greater capacity. The cost of the x 900 i 140mmon. The extra capacity would be useful in the first two years of operation, but would allow for additional sales in years 3 through 10. What level of additional sales (above the $10 20 million expected for the XC-750) per year in those years would justly purchasing the larger machine? The additional sales would need to be found to the nearest dollar) Enter any number in the edities and then continue to the next question Right: 0 . After: 0pt Text Forward Backward ingen Pada g pending production padly by purcha sed the XC-750. The otheXC-5025 U n ghii ya production. The m ore you the th i ng the longe W ing Orce the C70 per her e cted to do with the 10 of the machine Operation The di d by the nation by the Min d e r hedsproduced by the XC-750 do bet ter the nar d production Invertory hand of $1.00 during of the induding your Human Resources The wor l d where a cost of $1 million pery Accounting The XC-750 will be depreciated the str e ngthed over you the ne Thermexper t s to be und be the goods Bilinghammar corporal Determine the onl ine from the purchase of the XC-790 Determine the free cash flow from the purchase of the XC-750 the appropriate cost of a ll the expansion is 10.4%, compute the NPV of the purchase d. While the expected n ew 10 20 miliony for the a g e from win $12 . What the NPV in the word in the best ? What's the brave news on the expansion? What is the brave ever the cooledo Minghen could n e ws Theoftheo They would be the two of Moderna Long An Nam H a y - - - - - Cethe ame the NC- 50 N C no Cost of Good Solid S., and AB Sales Revenues Cost of Goods Sold S. G and A Expenses Depreciation EBIT Taxes at 35% Unlevered Net Income English (US) S, G, and A Expenses Depreciation EBIT Taxes at 35% Unlevered Net Income C Determine the fresh flow from the purchase of the XC-750 e the cashow on the phase of the wh o change in voor e en very grader l e the w a y s of change in info on the roa) due to the door Inormal Efecte Depreciation Capital Expenditures Capital Expenditures Change on Net Working Capital s Freshow c. the appropriate cost of capital for the expansion is 100% compute NPV the purchase The NPV of the purchases Round to the newest dollar) d. While the expected new sales will be $10 20 milion per year from the person e s arge The NPV of the purchase or of 8.15 milioni Round herewet dollar) 15 milioni 51225 What is a NPV wonte in