Answered step by step

Verified Expert Solution

Question

1 Approved Answer

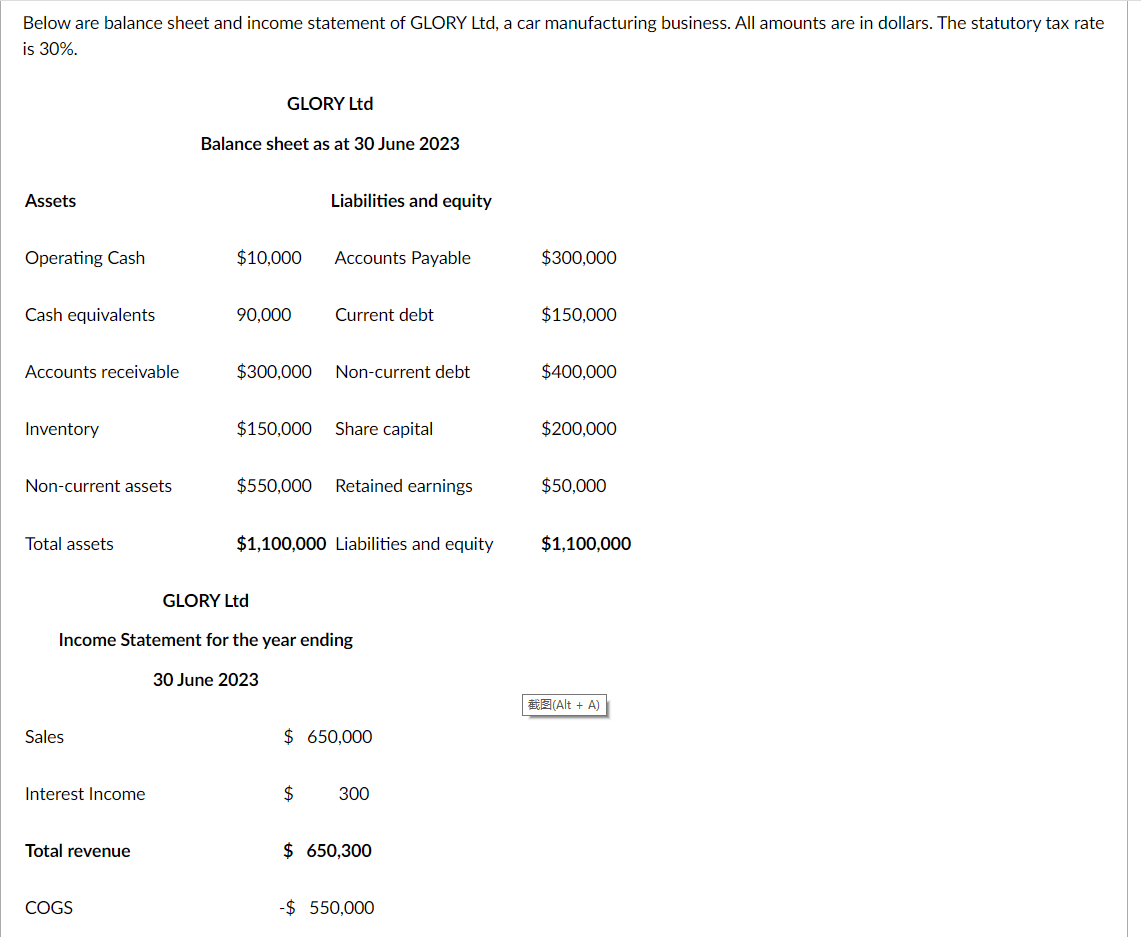

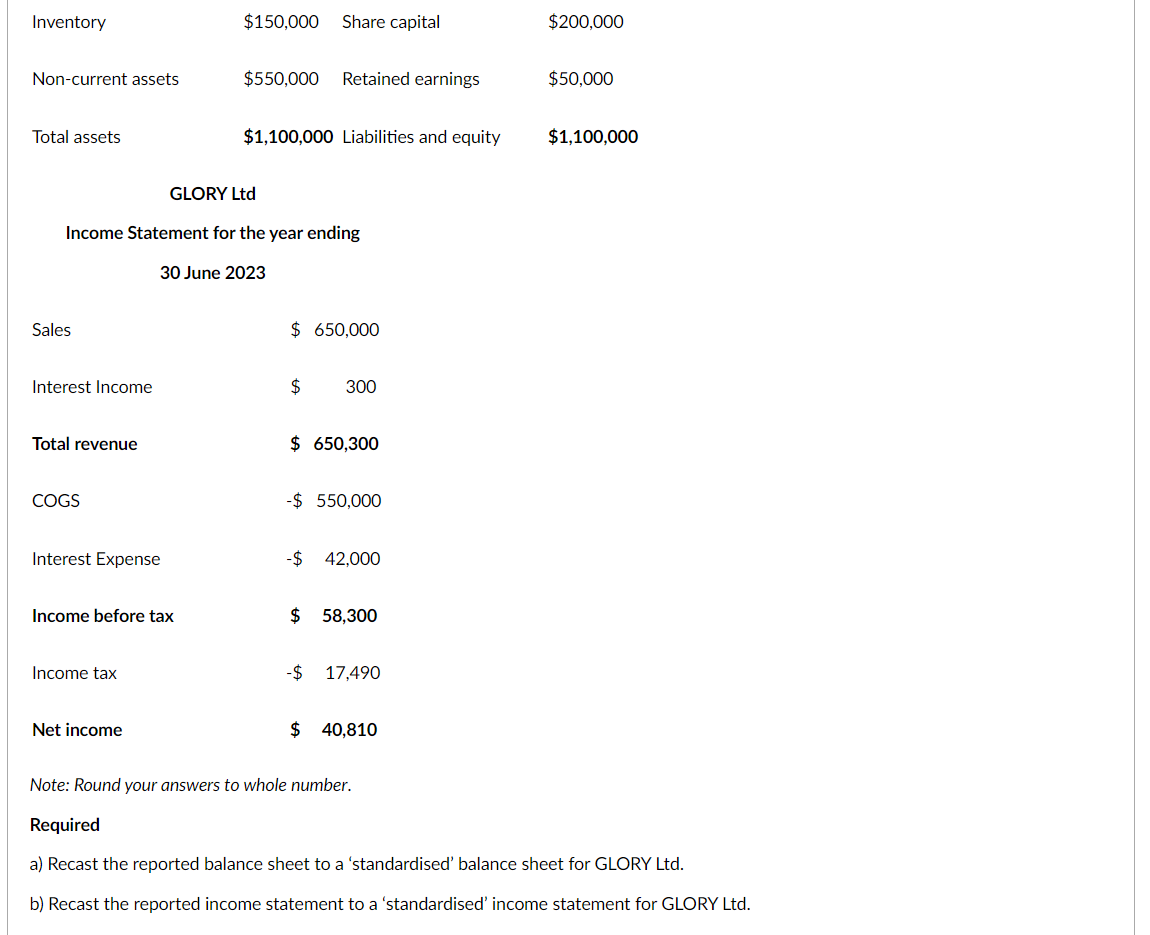

Below are balance sheet and income statement of GLORY Ltd, a car manufacturing business. All amounts are in dollars. The statutory tax rate is

Below are balance sheet and income statement of GLORY Ltd, a car manufacturing business. All amounts are in dollars. The statutory tax rate is 30%. Assets Operating Cash Cash equivalents Accounts receivable Inventory Non-current assets Total assets Sales Interest Income Total revenue GLORY Ltd COGS Balance sheet as at 30 June 2023 $10,000 90,000 $300,000 $150,000 $550,000 Liabilities and equity Accounts Payable Current debt Non-current debt GLORY Ltd Income Statement for the year ending 30 June 2023 Share capital Retained earnings $1,100,000 Liabilities and equity $ 650,000 $ 300 $ 650,300 -$ 550,000 $300,000 $150,000 $400,000 $200,000 $50,000 $1,100,000 (Alt + A) Inventory Non-current assets Total assets Sales Interest Income GLORY Ltd Income Statement for the year ending 30 June 2023 Total revenue COGS Interest Expense Income before tax Income tax $150,000 Share capital Net income $550,000 Retained earnings $1,100,000 Liabilities and equity $ 650,000 $ 300 $ 650,300 -$ 550,000 -$ 42,000 $ 58,300 -$ 17,490 $ 40,810 $200,000 $50,000 $1,100,000 Note: Round your answers to whole number. Required a) Recast the reported balance sheet to a 'standardised' balance sheet for GLORY Ltd. b) Recast the reported income statement to a 'standardised' income statement for GLORY Ltd.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Recast the reported balance sheet to a standardised balance sheet for GLORY Ltd The standardised b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started