Question

Below are cash transactions for Goldman Incorporated, which provides consulting services related to mining of precious metals. a. Cash used for purchase of office supplies,

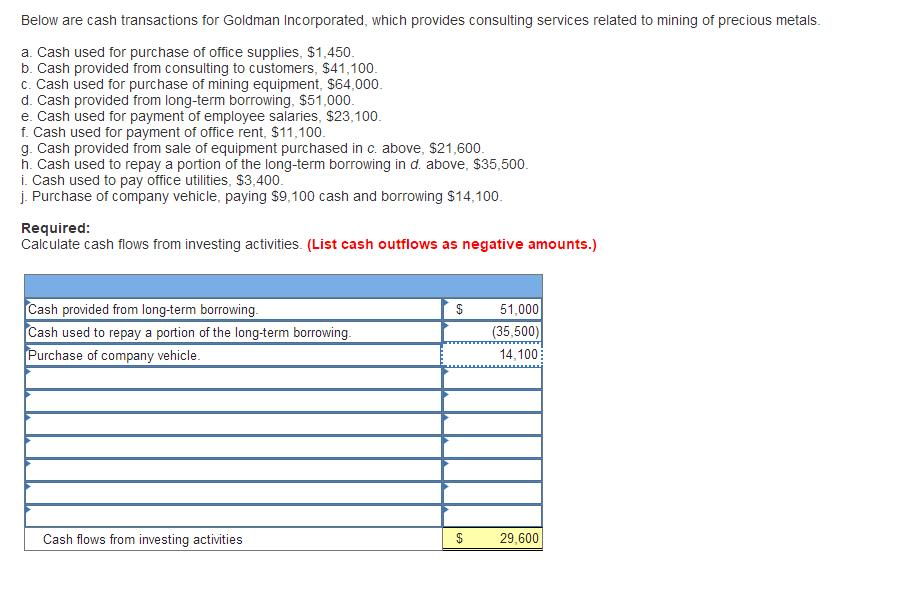

Below are cash transactions for Goldman Incorporated, which provides consulting services related to mining of precious metals.

a. Cash used for purchase of office supplies, $1,450. b. Cash provided from consulting to customers, $41,100. c. Cash used for purchase of mining equipment, $64,000. d. Cash provided from long-term borrowing, $51,000. e. Cash used for payment of employee salaries, $23,100. f. Cash used for payment of office rent, $11,100. g. Cash provided from sale of equipment purchased in c. above, $21,600. h. Cash used to repay a portion of the long-term borrowing in d. above, $35,500. i. Cash used to pay office utilities, $3,400. j. Purchase of company vehicle, paying $9,100 cash and borrowing $14,100

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started