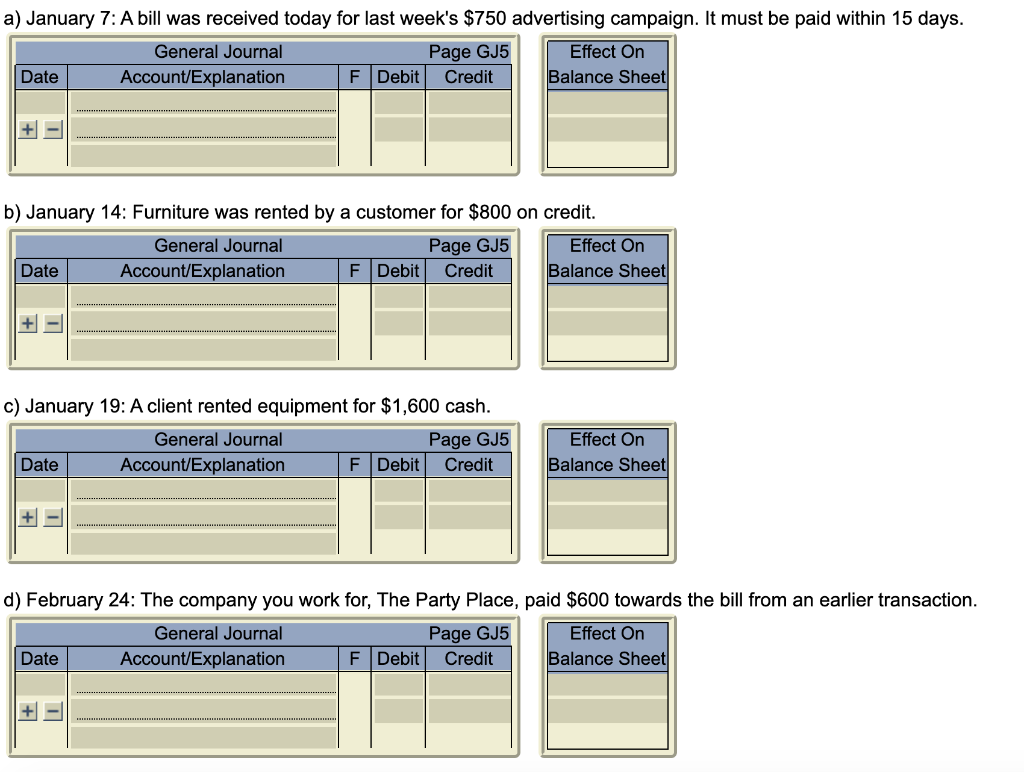

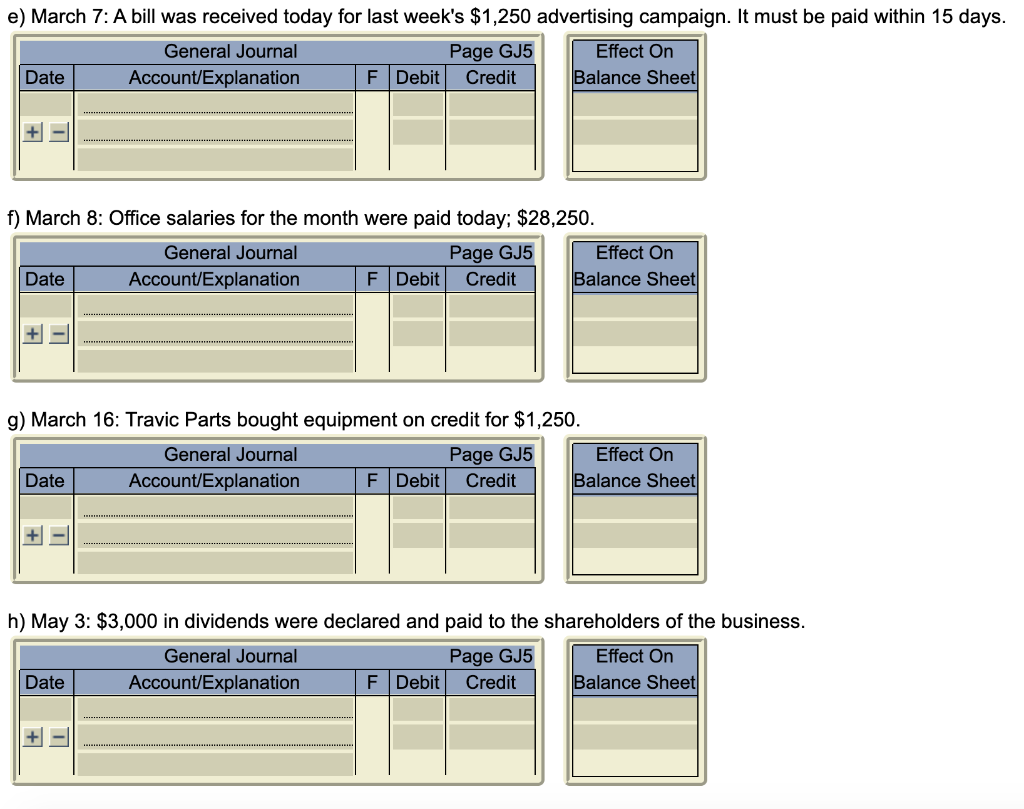

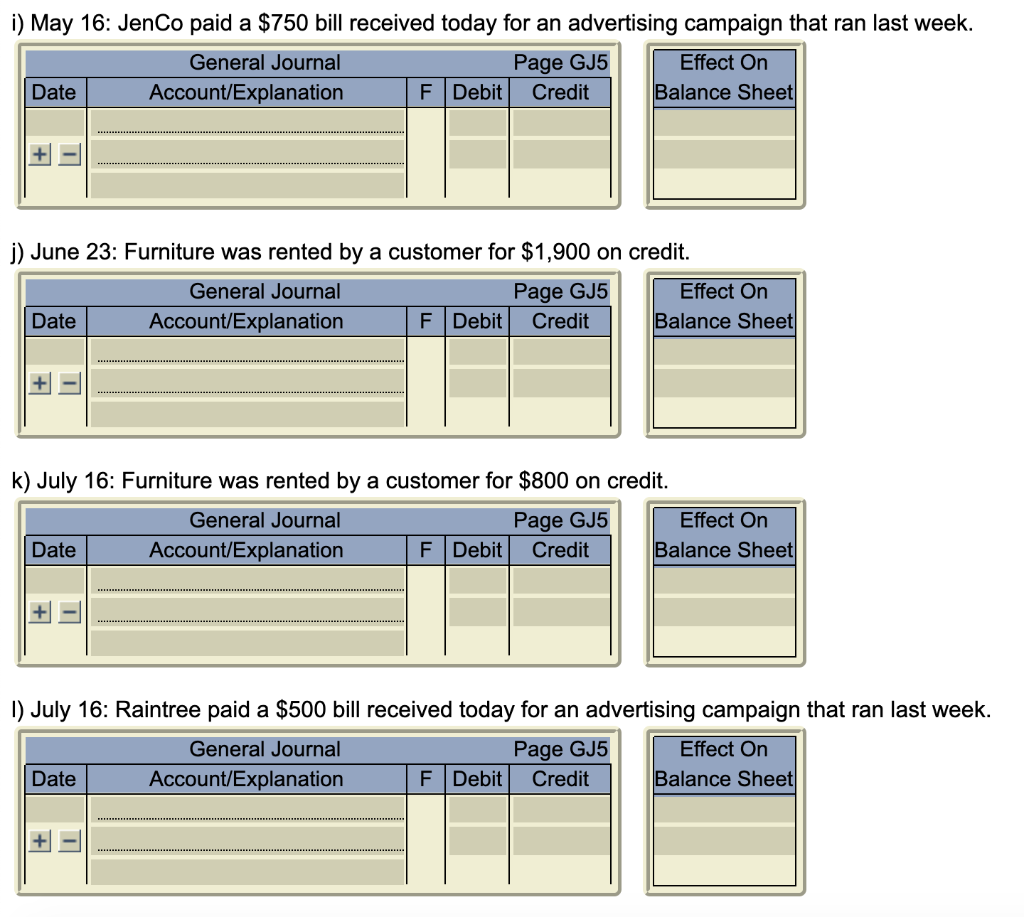

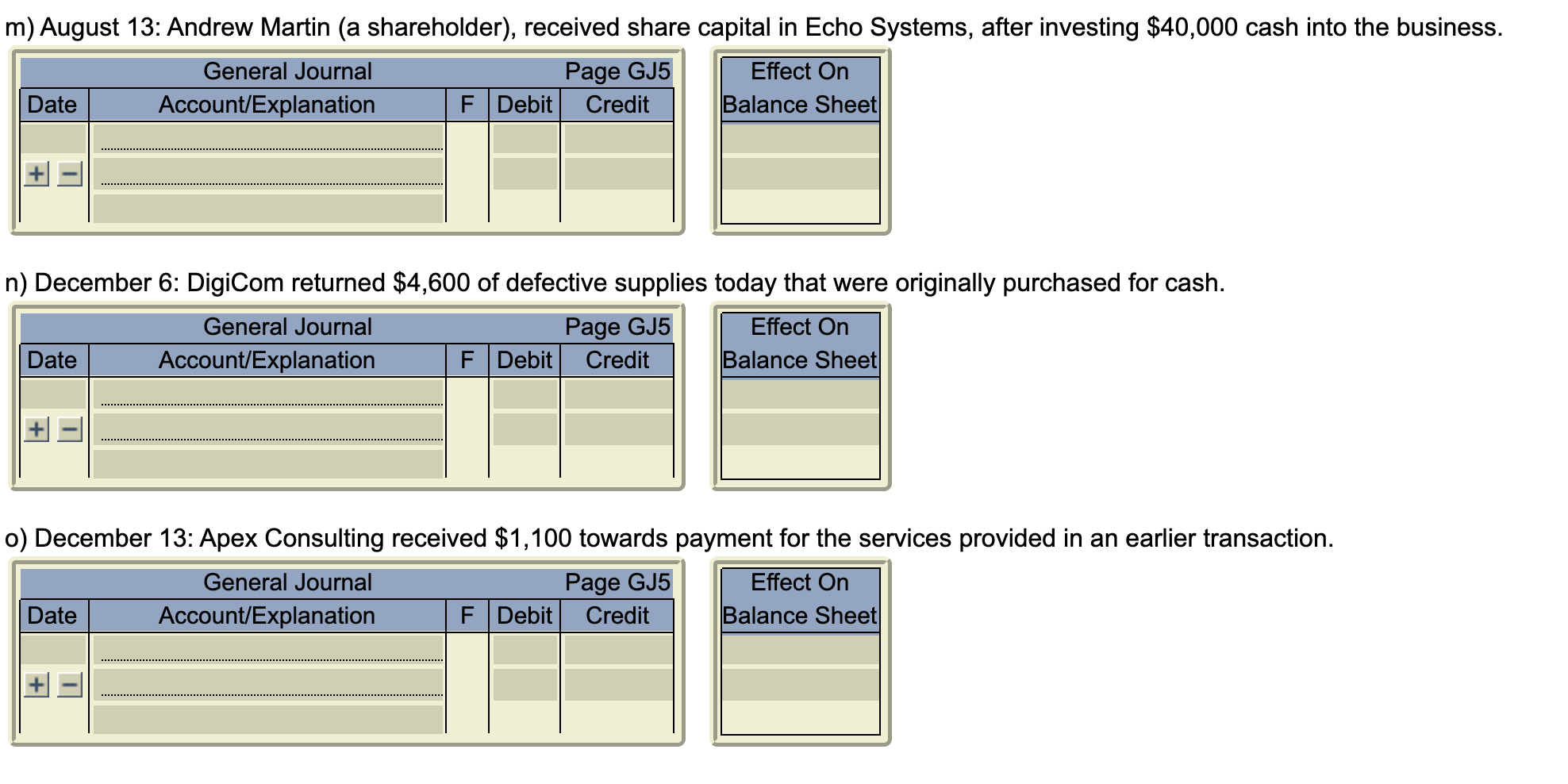

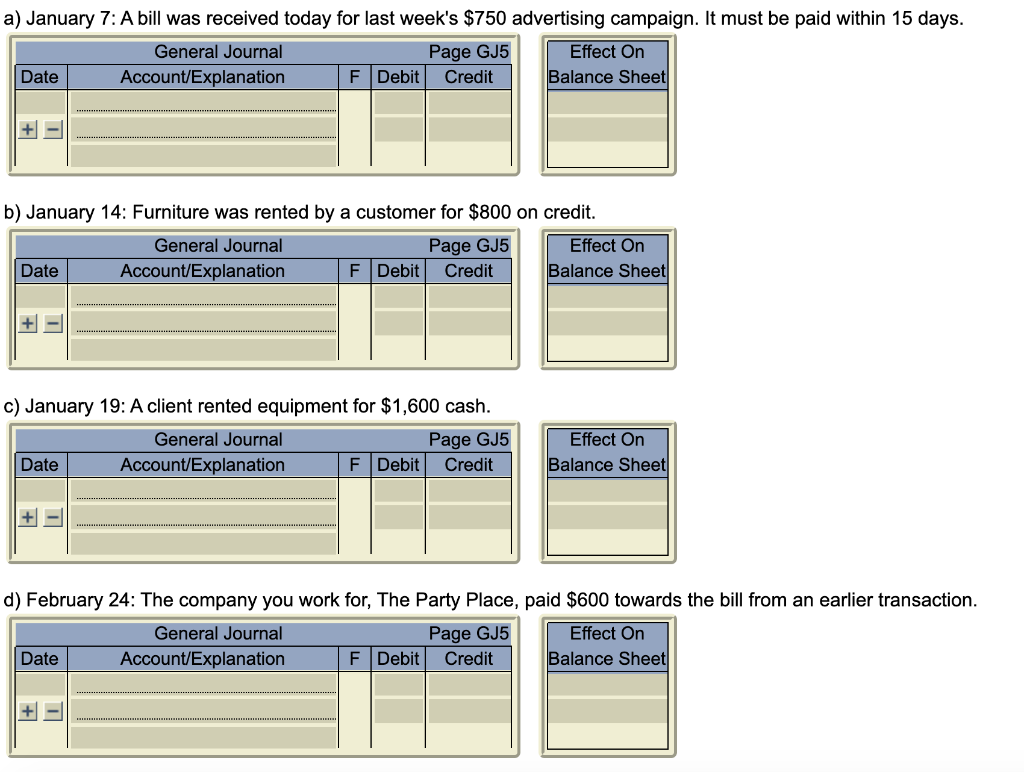

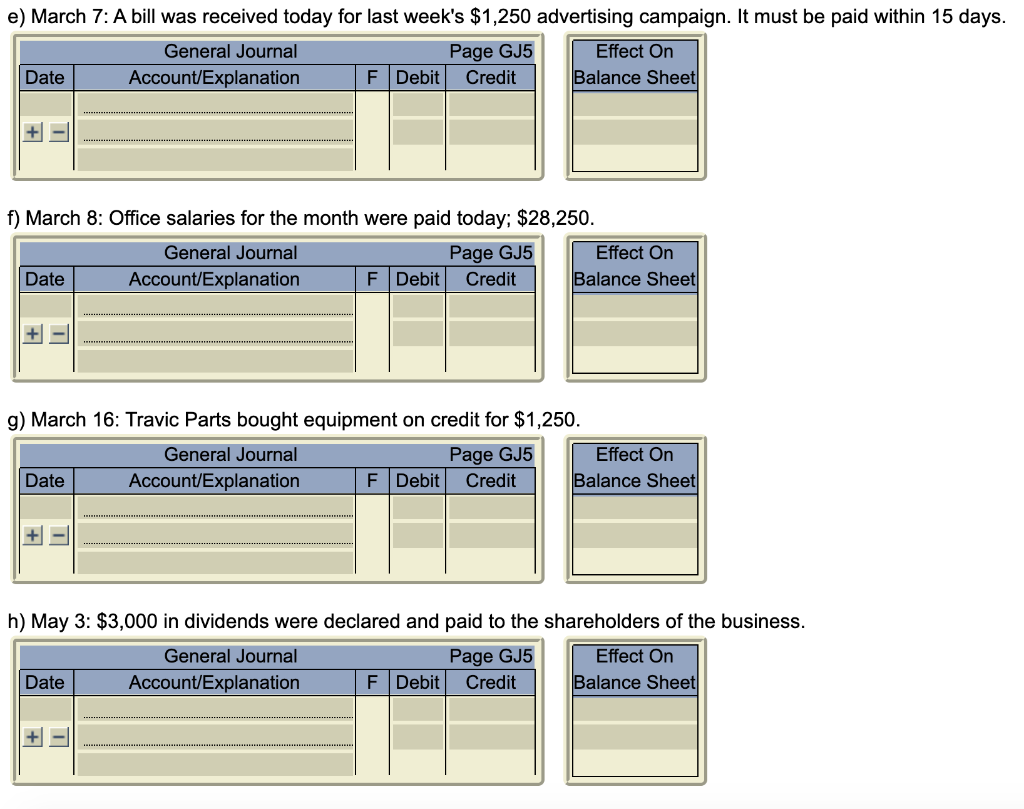

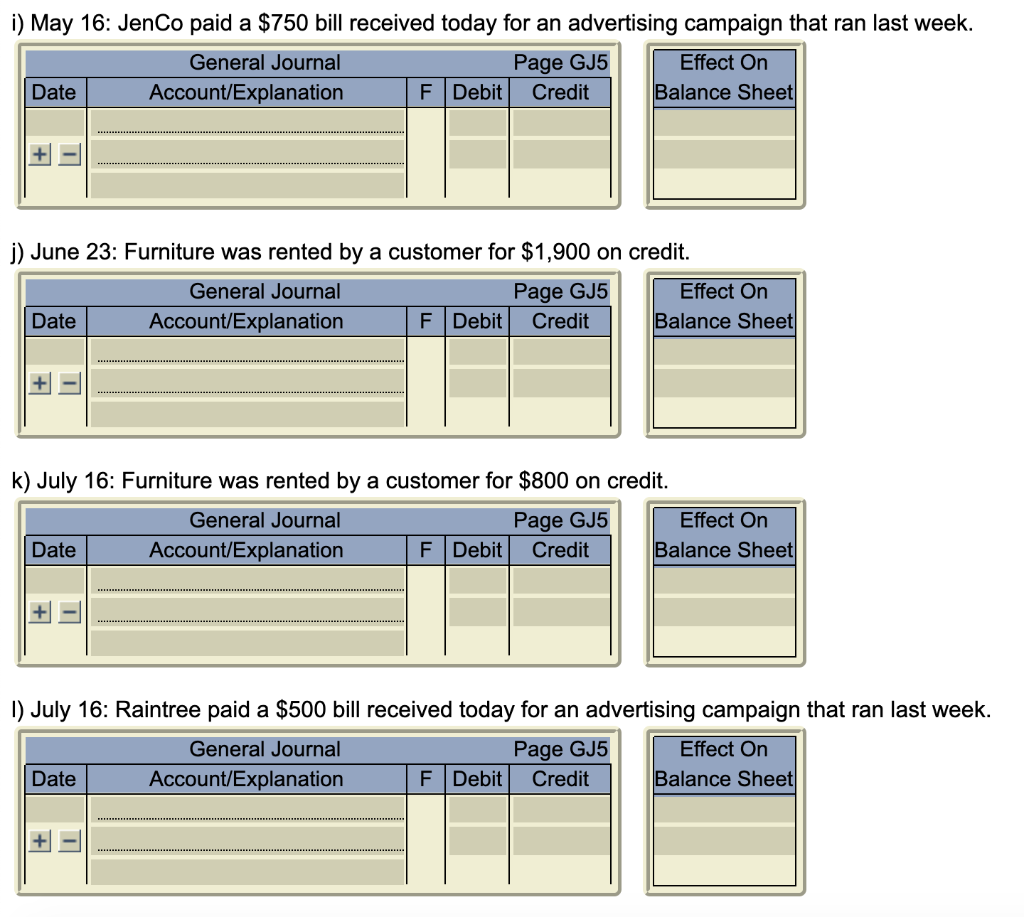

Below are individual unrelated transactions from various companies. Record each transaction in the General Journal directly below it. Enter the transaction letter as the description when entering the transactions in the journal. Dates must be entered in the format dd/mmm (i.e., January 15 would be 15/Jan).

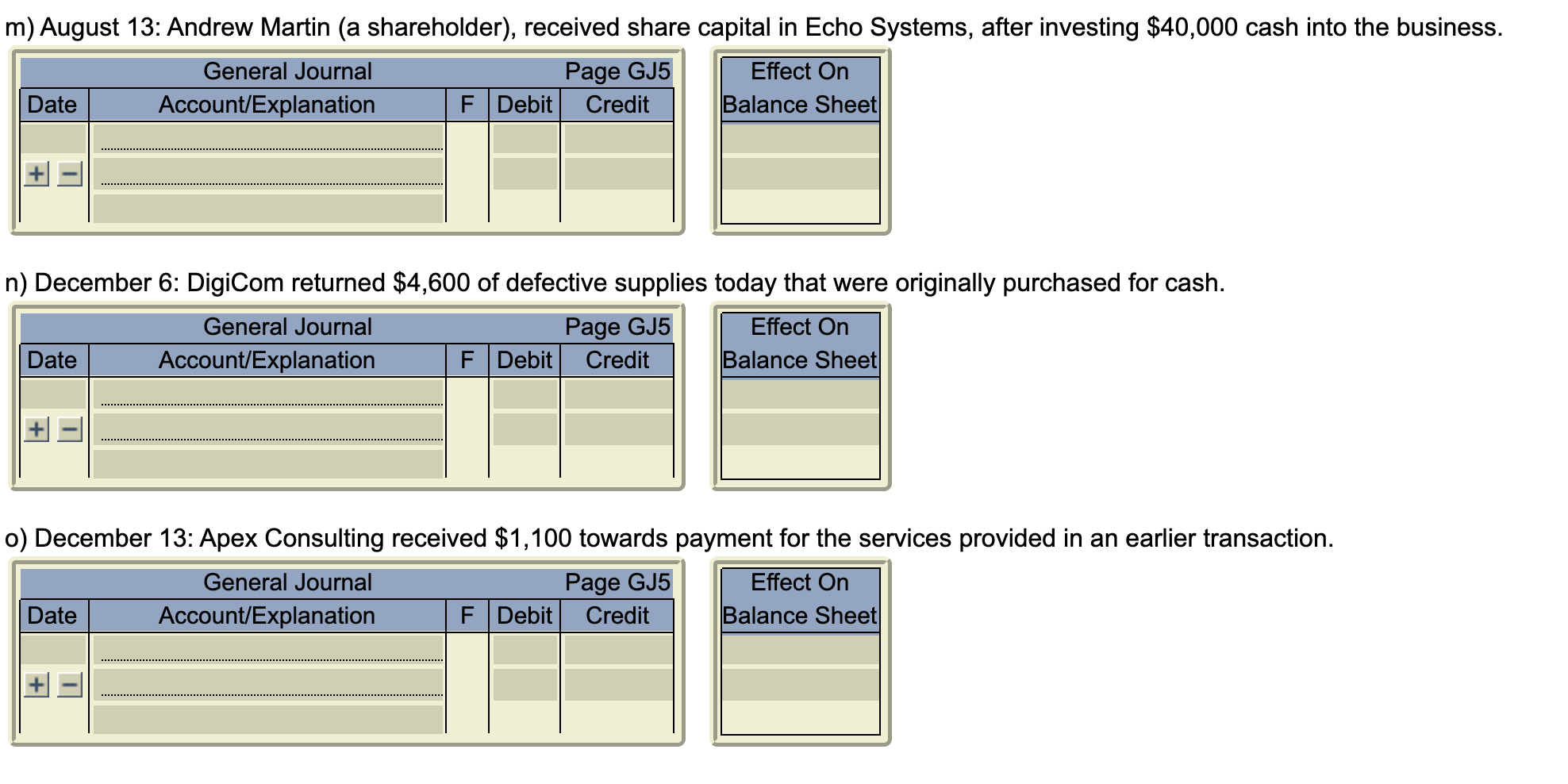

b) January 14: Furniture was rented by a customer for $800 on credit. c) January 19: A client rented equipment for $1,600 cash. f) March 8: Office salaries for the month were paid today; $28,250. g) March 16: Travic Parts bought equipment on credit for $1,250. j) June 23: Furniture was rented by a customer for $1,900 on credit. k) July 16: Furniture was rented by a customer for $800 on credit. l) July 16: Raintree paid a $500 bill received today for an advertising campaign the m) August 13: Andrew Martin (a shareholder), received share capital in Echo Systems, after investing $40,000 cash into the business. \begin{tabular}{|l|c|c|c|c|} \hline \multicolumn{3}{|c}{ General Journal } & \multicolumn{3}{r|}{ Page GJ5 } \\ \hline Date & Account/Explanation & F & Debit & Credit \\ \hline & & & & \\ \hline+ & & & & \\ \hline \end{tabular} \begin{tabular}{|c|} \hline Effect On \\ Balance Sheet \\ \hline \\ \hline \end{tabular} n) December 6: DigiCom returned $4,600 of defective supplies today that were originally purchased for cash. \begin{tabular}{|c|} \hline Effect On \\ Balance Sheet \\ \hline \\ \hline \end{tabular} o) December 13: Apex Consulting received $1,100 towards payment for the services provided in an earlier transaction. \begin{tabular}{|l|c|c|c|c|} \hline \multicolumn{3}{|c|}{ General Journal } & \multicolumn{3}{r|}{ Page GJ5 } \\ \hline Date & Account/Explanation & F & Debit & Credit \\ \hline & & & & \\ \hline+ & & & & \\ \hline \end{tabular} \begin{tabular}{|c|} \hline Effect On \\ Balance Sheet \\ \hline \\ \hline \end{tabular} b) January 14: Furniture was rented by a customer for $800 on credit. c) January 19: A client rented equipment for $1,600 cash. f) March 8: Office salaries for the month were paid today; $28,250. g) March 16: Travic Parts bought equipment on credit for $1,250. j) June 23: Furniture was rented by a customer for $1,900 on credit. k) July 16: Furniture was rented by a customer for $800 on credit. l) July 16: Raintree paid a $500 bill received today for an advertising campaign the m) August 13: Andrew Martin (a shareholder), received share capital in Echo Systems, after investing $40,000 cash into the business. \begin{tabular}{|l|c|c|c|c|} \hline \multicolumn{3}{|c}{ General Journal } & \multicolumn{3}{r|}{ Page GJ5 } \\ \hline Date & Account/Explanation & F & Debit & Credit \\ \hline & & & & \\ \hline+ & & & & \\ \hline \end{tabular} \begin{tabular}{|c|} \hline Effect On \\ Balance Sheet \\ \hline \\ \hline \end{tabular} n) December 6: DigiCom returned $4,600 of defective supplies today that were originally purchased for cash. \begin{tabular}{|c|} \hline Effect On \\ Balance Sheet \\ \hline \\ \hline \end{tabular} o) December 13: Apex Consulting received $1,100 towards payment for the services provided in an earlier transaction. \begin{tabular}{|l|c|c|c|c|} \hline \multicolumn{3}{|c|}{ General Journal } & \multicolumn{3}{r|}{ Page GJ5 } \\ \hline Date & Account/Explanation & F & Debit & Credit \\ \hline & & & & \\ \hline+ & & & & \\ \hline \end{tabular} \begin{tabular}{|c|} \hline Effect On \\ Balance Sheet \\ \hline \\ \hline \end{tabular}