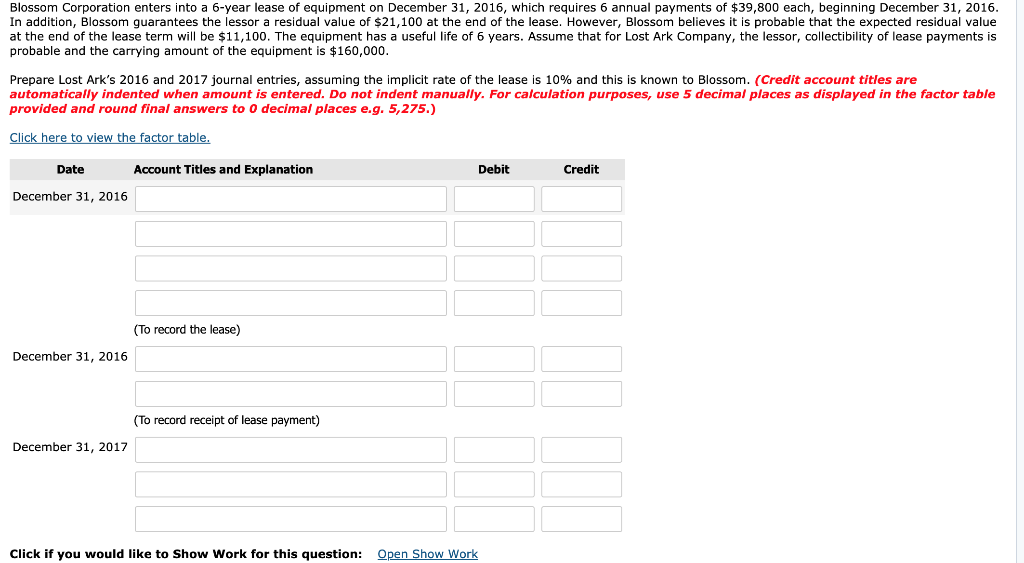

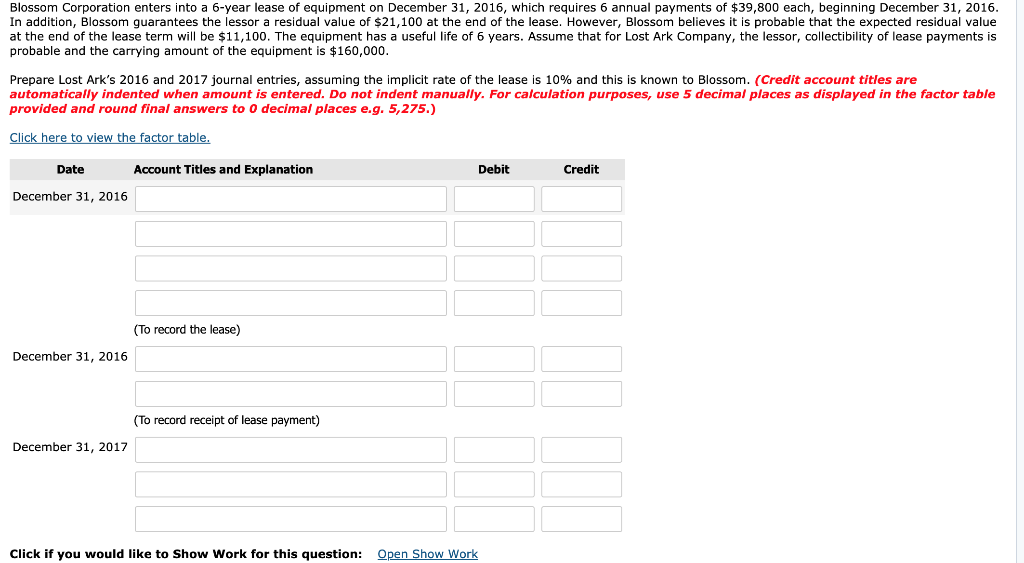

Blossom Corporation enters into a 6-year lease of equipment on December 31, 2016, which requires 6 annual payments of $39,800 each, beginning December 31, 2016 In addition, Blossom guarantees the lessor a residual value of $21,100 at the end of the lease. However, Blossom believes it is probable that the expected residual value at the end of the lease term will be $11,100. The equipment has a useful life of 6 years. Assume that for Lost Ark Company, the lessor, collectibility of lease payments is probable and the carrying amount of the equipment is $160,000 Prepare Lost Ark's 2016 and 2017 journal entries, assuming the implicit rate of the lease is 10% and this is known to Blossom. (Credit account titles are automatically indented when amount is entered. Do not indent manually. For calculation purposes, use 5 decimal places as displayed in the factor table provided and round final answers to O decimal places e.g. 5,275.) Date Debit Account Titles and Explanation Credit December 31, 2016 (To record the lease) December 31, 2016 To record receipt of lease payment) December 31, 2017 Click if you would like to Show Work for this question: Open Show Work Blossom Corporation enters into a 6-year lease of equipment on December 31, 2016, which requires 6 annual payments of $39,800 each, beginning December 31, 2016 In addition, Blossom guarantees the lessor a residual value of $21,100 at the end of the lease. However, Blossom believes it is probable that the expected residual value at the end of the lease term will be $11,100. The equipment has a useful life of 6 years. Assume that for Lost Ark Company, the lessor, collectibility of lease payments is probable and the carrying amount of the equipment is $160,000 Prepare Lost Ark's 2016 and 2017 journal entries, assuming the implicit rate of the lease is 10% and this is known to Blossom. (Credit account titles are automatically indented when amount is entered. Do not indent manually. For calculation purposes, use 5 decimal places as displayed in the factor table provided and round final answers to O decimal places e.g. 5,275.) Date Debit Account Titles and Explanation Credit December 31, 2016 (To record the lease) December 31, 2016 To record receipt of lease payment) December 31, 2017 Click if you would like to Show Work for this question: Open Show Work